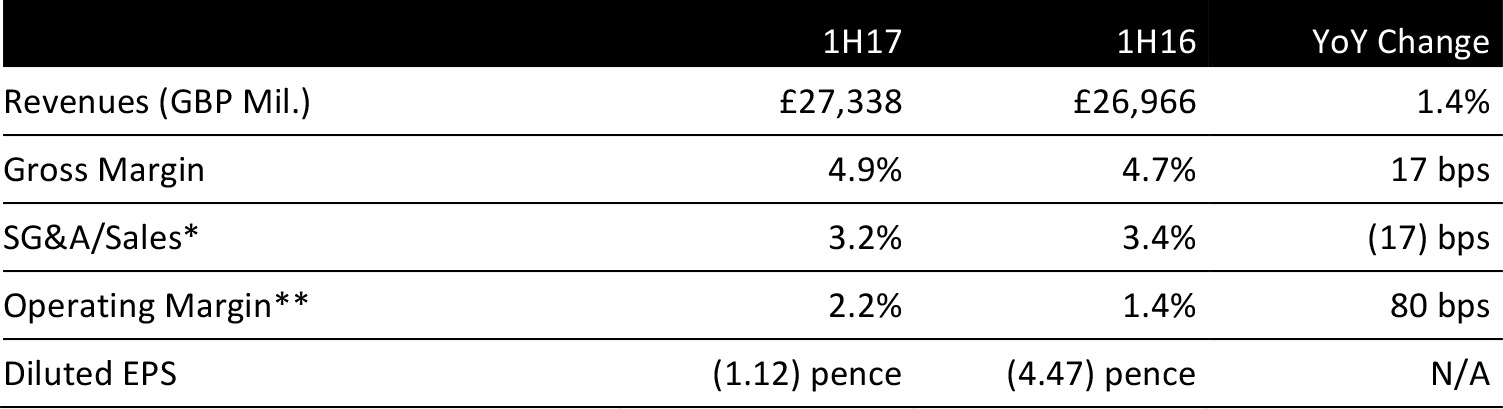

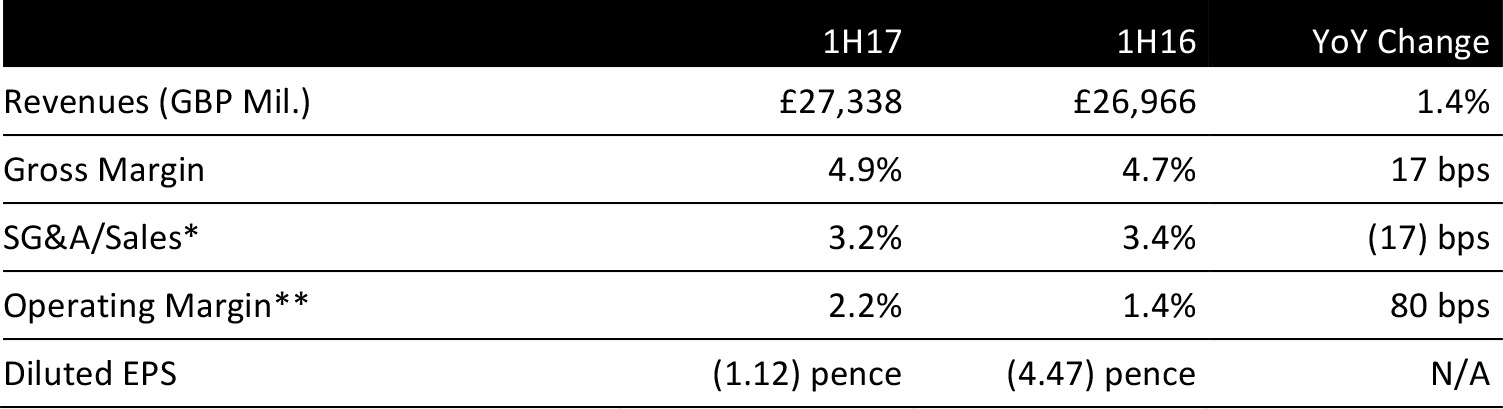

* Administrative expenses only.

** Before exceptionals.

Source: Company reports/Fung Global Retail & Technology

1H17 RESULTS

Tesco reported 1H17 revenue of £27.34 billion, up 1.4% year over year. At constant exchange rates, total revenue declined 0.4%. The top line missed consensus of £27.77 billion.

Group comparable sales growth strengthened to 1.0% in the first half, at constant exchange rates. The half year saw sequential improvement, with 1Q17 comps at 0.9% and 2Q17 comps at 1.1%.

UK comps came in at 0.6% for the first half, and also registered an improving trend, from 0.3% in 1Q17 to 0.9% in 2Q17. The 2Q17 comp beat consensus of 0.5% recorded by S&P Capital IQ.

The gross margin climbed by 17 basis points and the SG&A ratio fell by a similar magnitude. The operating margin, before exceptional items, jumped by 80 basis points to 2.2%. The company reported a net loss of £100 million versus a net loss of £368 million one year earlier.

The diluted loss per share improved to 1.1 pence versus a loss per share of 4.5 pence in 1H16. On a continuing-operations basis and before exceptional items and net pension finance costs, EPS was 3.74 pence, ahead of the consensus of three pence.

Discontinued operations include Tesco’s Turkish chain, Kipa, the sale of which was announced on June 10. The sale of the Harris + Hoole coffee-shop chain, Dobbies garden centers and the Giraffe restaurant group were completed in the first half, and the sale of the Euphorium bakery was agreed, as Tesco refocuses on its core operations.

The market rewarded Tesco with an 11.45% increase in its share price by midday UK time on October 5.

ADDITIONAL METRICS

Tesco noted the following positive metrics:

- UK volumes climbed 2.1% and UK transactions were up 1.6%. This was the seventh consecutive quarter of positive numbers for these metrics.

- International volumes rose 3.3% and transactions nudged up 0.3%.

- In the second quarter, UK food sales climbed in value for the first time since 2013. Tesco claimed to have outperformed the market on volume growth in all food categories.

- All UK store formats saw an improving trend in comparable sales growth. Tesco noted that this included its large Extra stores, which had been hit by trends for shopping online and more locally.

BY SEGMENT

The company reported the following:

- UK and Ireland revenues fell 0.6% to £21.34 billion. The operating margin before exceptionals was 1.8%.

- International sales rose 9.8% at actual exchange rates, or 2.1% at constant exchange rates, to £5.39 billion, on a continuing operations basis. The operating margin before exceptionals was 2.2%.

- Tesco bank revenues climbed 5.2%.

OUTLOOK

The company announced plans to deliver a group operating margin of between 3.5% and 4.0% by FY20. A further £1.5 billion of identified cost savings over the next three years is one element underpinning this. The company identified five further levers to help grow margins: differentiating its brand, focusing on strong cash generation, maximizing the margin mix from sales, maximizing the value of its property portfolio and continuing to innovate in how it operates and in its offering to customers.

Tesco said some initiatives require investment and it expects total capital expenditure to average £1.4 billion per year in the period to FY20. It expects the benefits of these levers to “become evident” over the coming months, but margin improvement to be weighted toward the end of the period to FY20.

For the year ended February 2017, analysts expect Tesco to grow revenues by 2.0% to £55.51 billion. EBIT is forecast to climb 26.6% to £1.19 billion and pre-tax profit to jump 322% to £683 million. Analysts expect GAAP EPS to come in at six pence for the year, versus two pence in FY16.

�