A BETTER-THAN-EXPECTED CHRISTMAS FOR TESCO

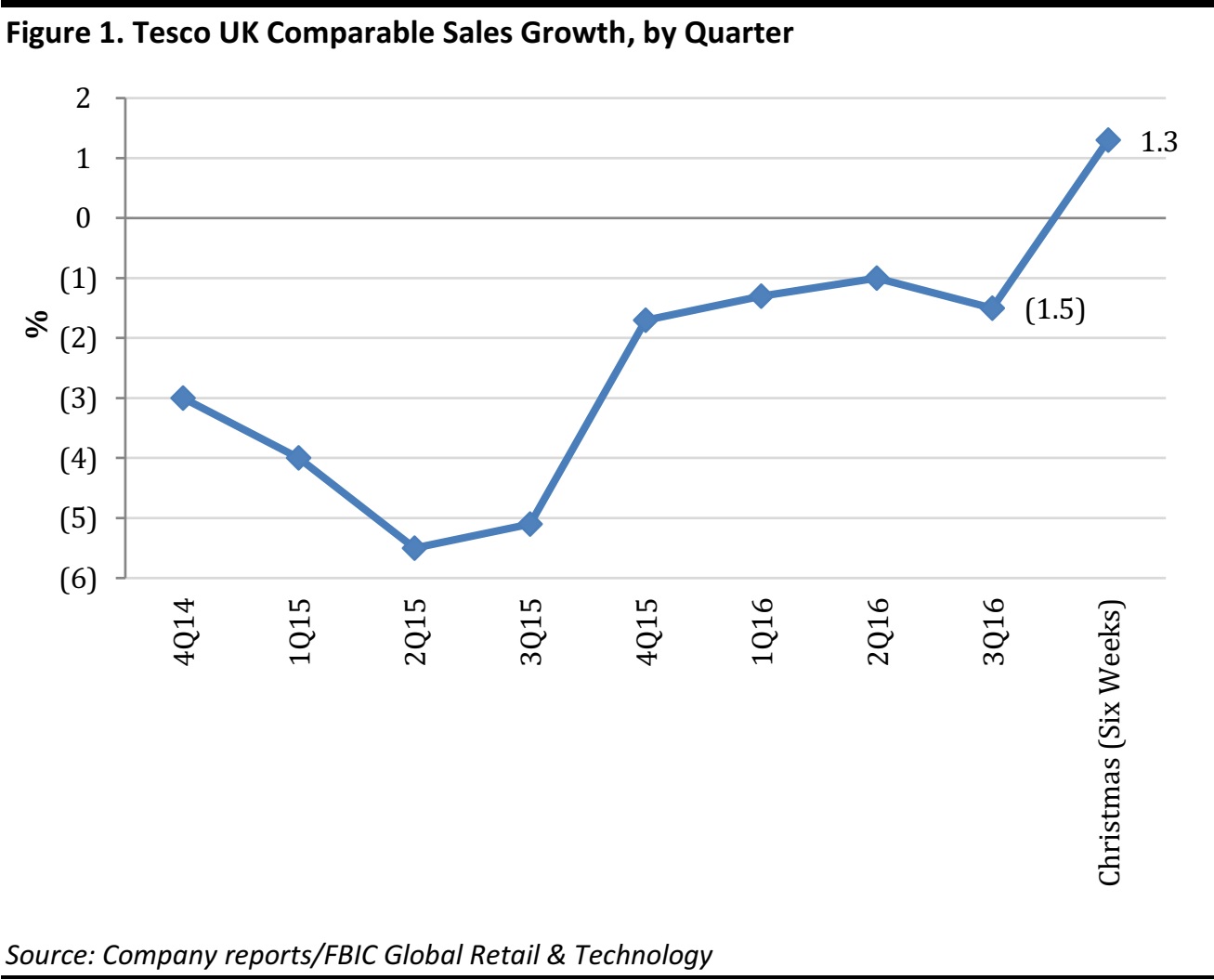

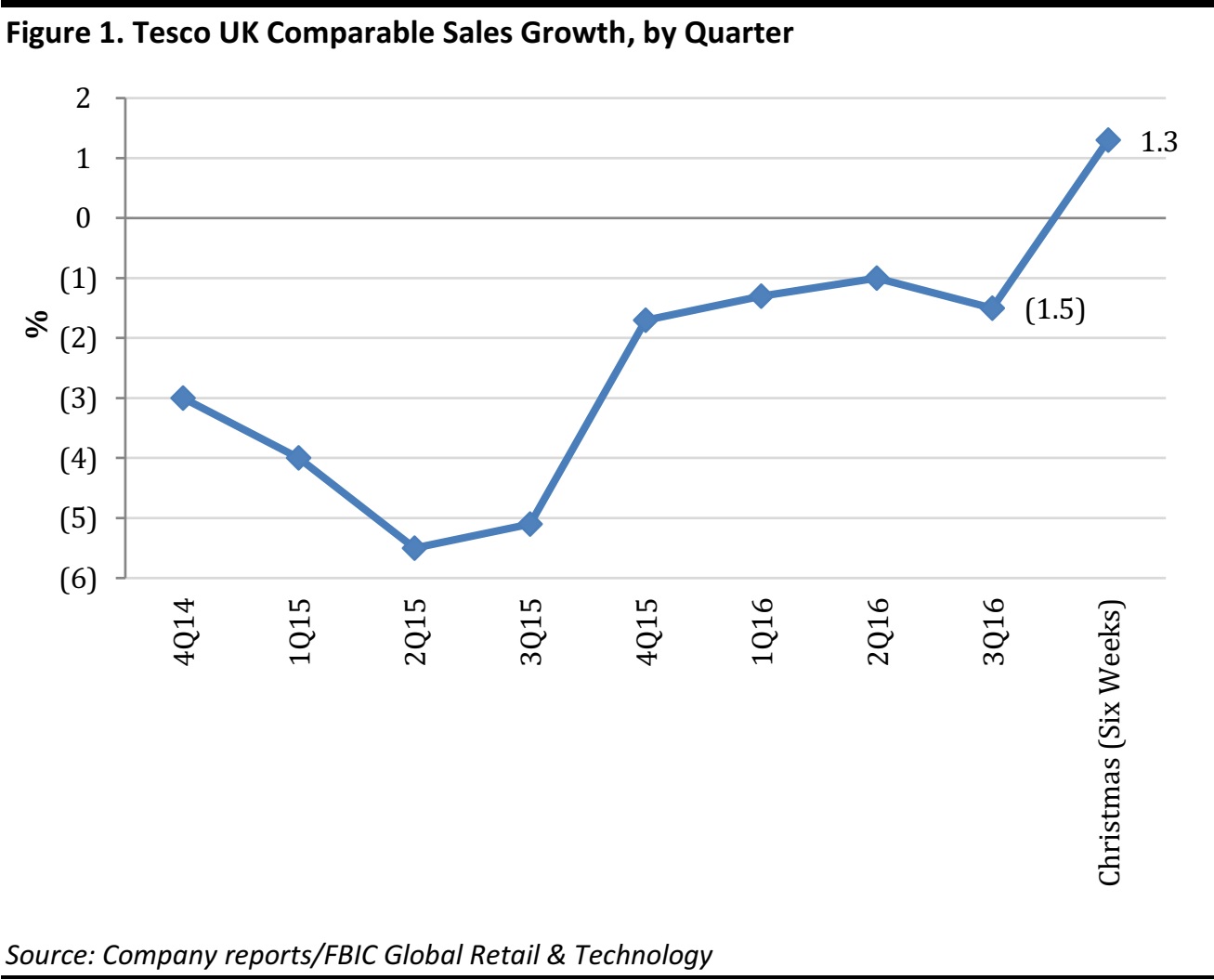

Tesco, Britain’s biggest grocery retailer, reported UK comps of (1.5)% and group comps of (0.5)% for its third fiscal quarter, the 13 weeks through November 28. Tesco’s total UK sales (excluding fuel) fell by 1.5% in the period and its total group sales fell by 2.9%. UK operations are core to Tesco, and they are the focus of its current turnaround plan.

For a six-week Christmas period ending January 9, UK comps were much improved, up 1.3%, and group comps were up 2.1%.

Beating the Competition with a Leap in Comps

Tesco’s Christmas-period comps were above the 0.2% comp increase reported by Morrisons and the (0.4)% comp decrease posted by Sainsbury’s earlier this week. (Morrisons’ results were for a nine-week Christmas trading period, rather than for a full quarter.)

The trend in comparable sales growth charted below suggests that Tesco UK is improving under CEO Dave Lewis. However, the 2.8-percentage-point leap in comps between the third quarter and the Christmas period casts some doubt on the sustainability of positive underlying growth in the coming quarters. After such entrenched negative growth, it is hard to see comps in the region of 1.3% or more being sustained in the near term.

Although third-quarter results were still down significantly, Tesco said this included a (1)% impact from reduced couponing versus last year.

The retailer enjoyed a much stronger Christmas period. Tesco said that UK sales volumes were up 3.5%, transaction numbers were up 3.4% and customer satisfaction was improved. The company emphasized that its large Extra superstores—often seen as a drag on Tesco’s performance—posted positive comps, with general merchandise and clothing underpinning growth at the stores.

Dave Lewis joined Tesco in September 2014, so Christmas 2015 was the first period in which his UK turnaround strategy had the chance to impact results fully. Lewis said that UK performance was driven by lower prices and improved customer service.

Key elements in Lewis’s turnaround plan for Tesco UK include:

- Selectively lowering prices. Lewis has not unleashed a price war, opting instead to cut prices more selectively. During Christmas 2015, we saw this reflected in lower prices on staples such as vegetables, where the retailer repeated its successful “39p” promotion introduced for Christmas 2014.

- More stable prices. In his presentation of Tesco’s interim results last October, Lewis said that ranges now see 21% fewer price changes per period on average, as Tesco has nudged a little closer to an everyday low price proposition.

- Simplifying ranges. By the time of the interims, 21 product categories had been reviewed, and reduced by an average of 15%.

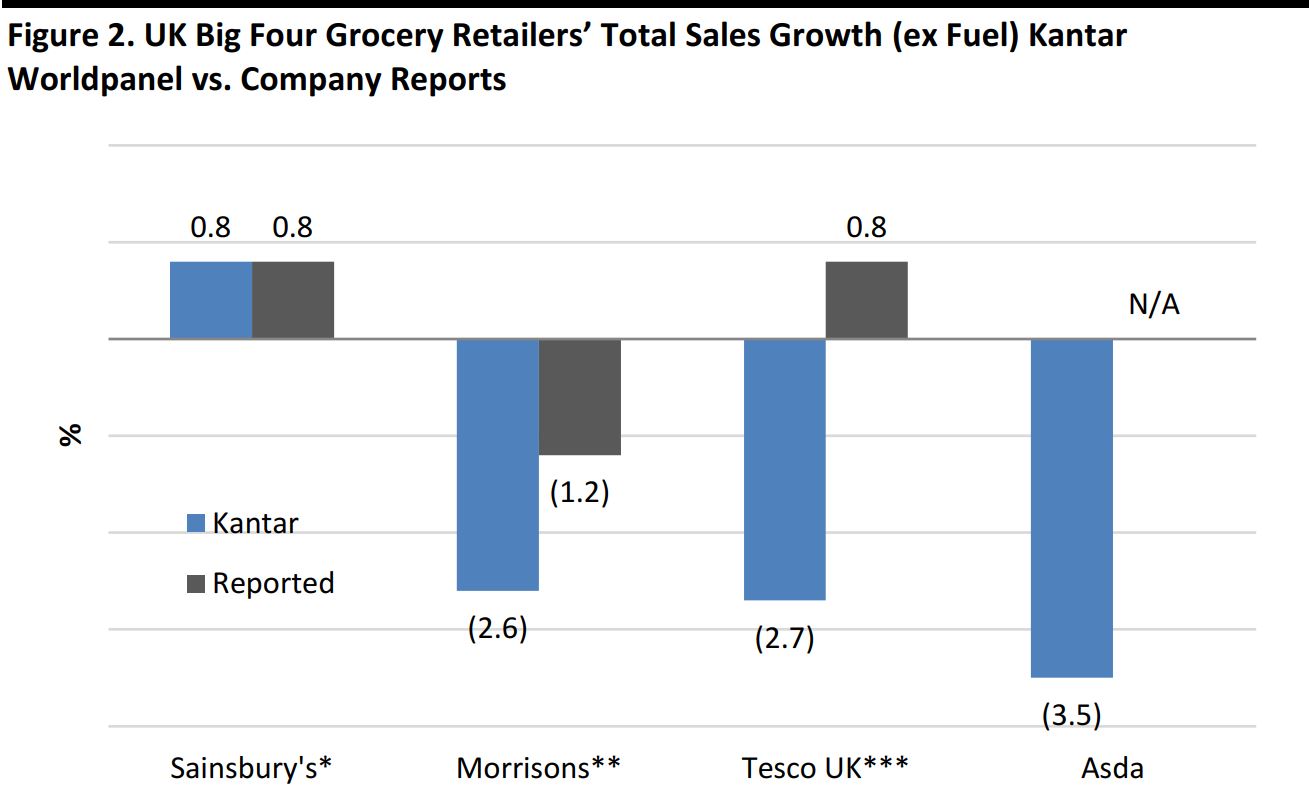

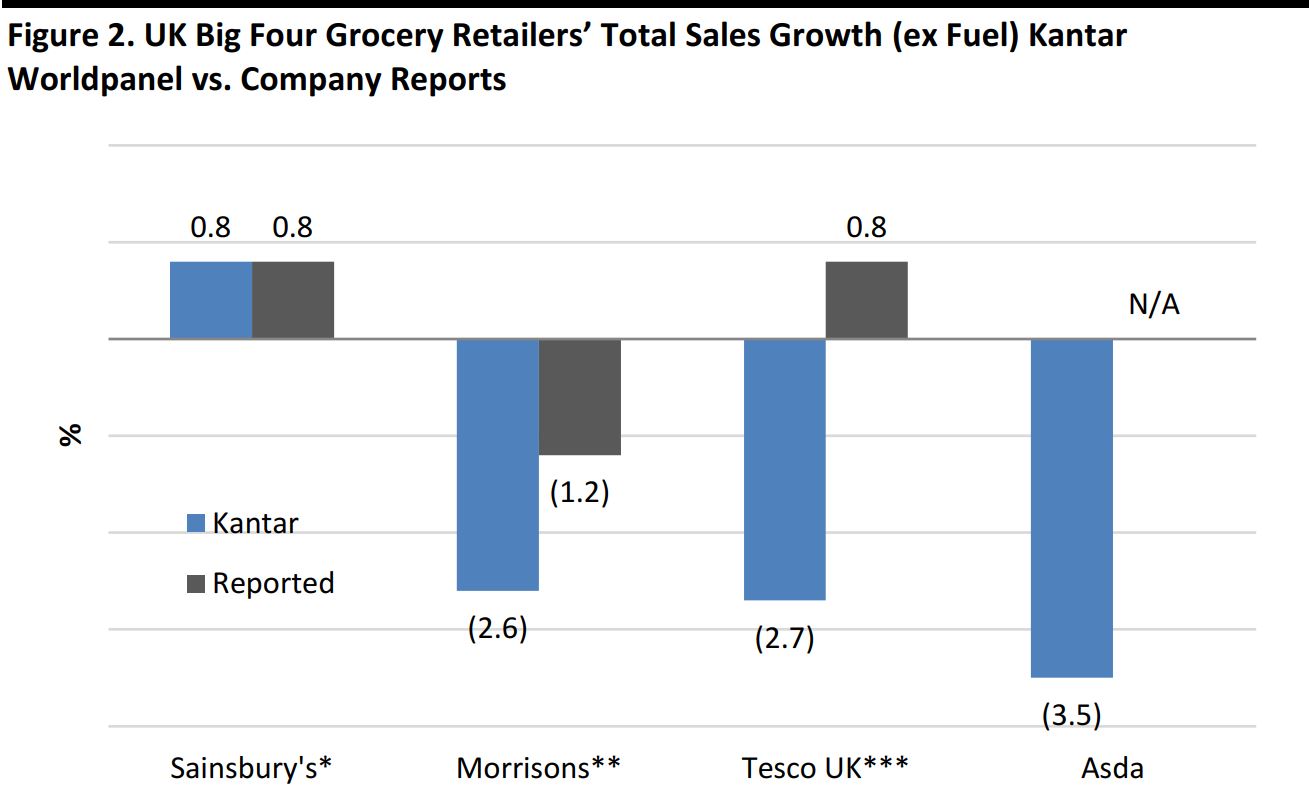

KANTAR WORLDPANEL VS. REPORTED

On January 12, we got the latest indication of the comparable performance of the big grocers from market-share measurement service Kantar Worldpanel. The survey provides a comparable snapshot of turnover at the major grocers, although the numbers often do not match those reported by the companies, in part because of differing reporting periods. The Kantar Worldpanel data charted below are for the 12 weeks through January 3.

The Kantar Worldpanel data are also the only indication we will have of Asda’s sales growth until February. But Asda has been the worst-performing major grocer in recent quarters, and it recently announced a further £500 million investment in lowering prices in order to stem loss of share to the discounters.

Privately owned Aldi and Lidl grew sales by 13.3% and 18.5%, respectively, in the 12-week holiday period, according to Kantar Worldpanel.

*Reported for the 15 weeks through January 9, 2016

**Reported for the nine weeks through January 3, 2016; this differs from the third-quarter trading period data charted in Figure 1, above.

***Reported for the six weeks through January 9, 2016

Source: Company reports/Kantar Worldpanel/FBIC Global Retail & Technology

Although third-quarter results were still down significantly, Tesco said this included a (1)% impact from reduced couponing versus last year.

The retailer enjoyed a much stronger Christmas period. Tesco said that UK sales volumes were up 3.5%, transaction numbers were up 3.4% and customer satisfaction was improved. The company emphasized that its large Extra superstores—often seen as a drag on Tesco’s performance—posted positive comps, with general merchandise and clothing underpinning growth at the stores.

Dave Lewis joined Tesco in September 2014, so Christmas 2015 was the first period in which his UK turnaround strategy had the chance to impact results fully. Lewis said that UK performance was driven by lower prices and improved customer service.

Key elements in Lewis’s turnaround plan for Tesco UK include:

Although third-quarter results were still down significantly, Tesco said this included a (1)% impact from reduced couponing versus last year.

The retailer enjoyed a much stronger Christmas period. Tesco said that UK sales volumes were up 3.5%, transaction numbers were up 3.4% and customer satisfaction was improved. The company emphasized that its large Extra superstores—often seen as a drag on Tesco’s performance—posted positive comps, with general merchandise and clothing underpinning growth at the stores.

Dave Lewis joined Tesco in September 2014, so Christmas 2015 was the first period in which his UK turnaround strategy had the chance to impact results fully. Lewis said that UK performance was driven by lower prices and improved customer service.

Key elements in Lewis’s turnaround plan for Tesco UK include: