What the Company Said

In their presentation to analysts, CEO Dave Lewis and CFO Alan Stewart were at pains to emphasize that this year’s first half would best be compared to last year’s second half, in order to take into account the reset of the business. Lewis said that in the first half of fiscal year 2015, Tesco was running an “unsustainable model,” with customer numbers and sales volumes falling.

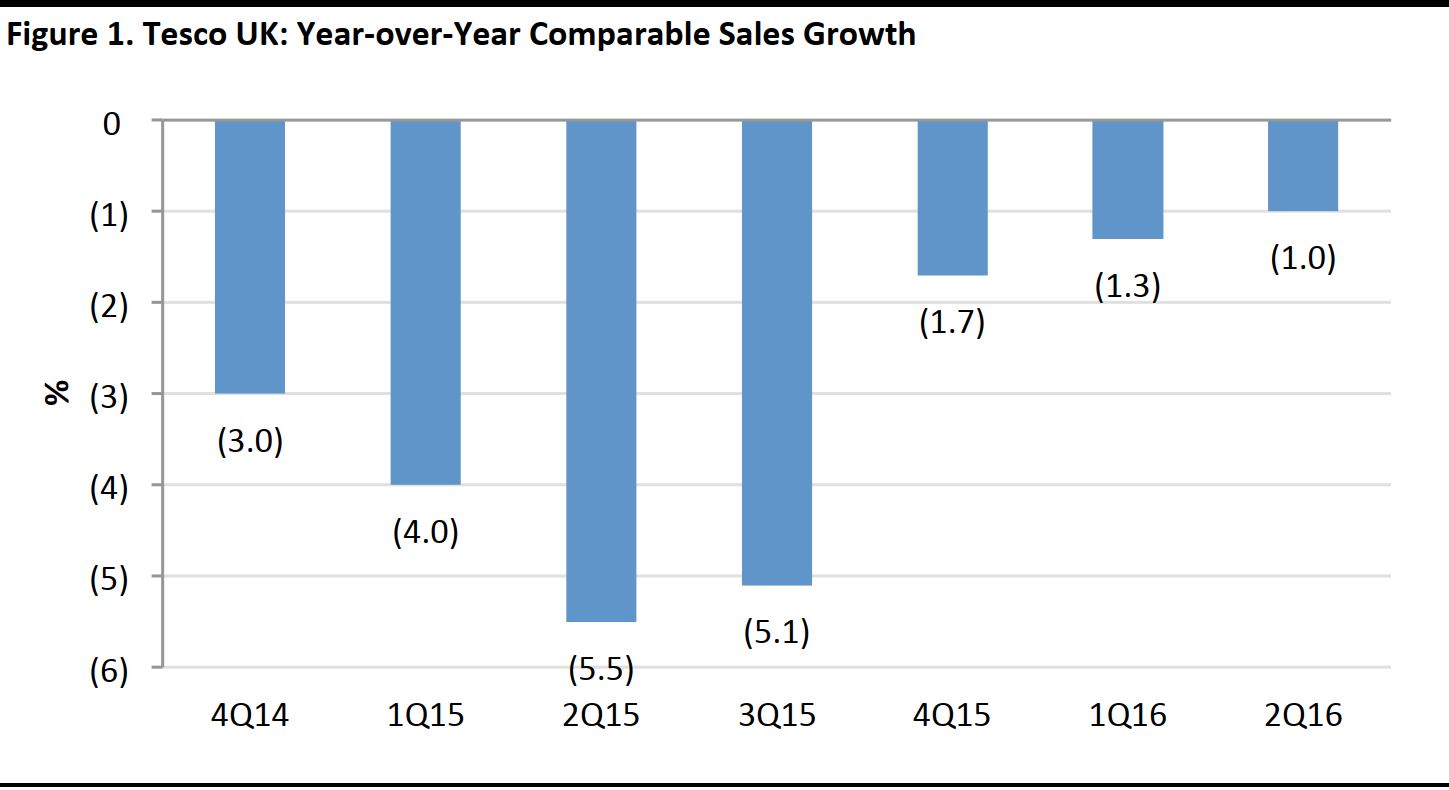

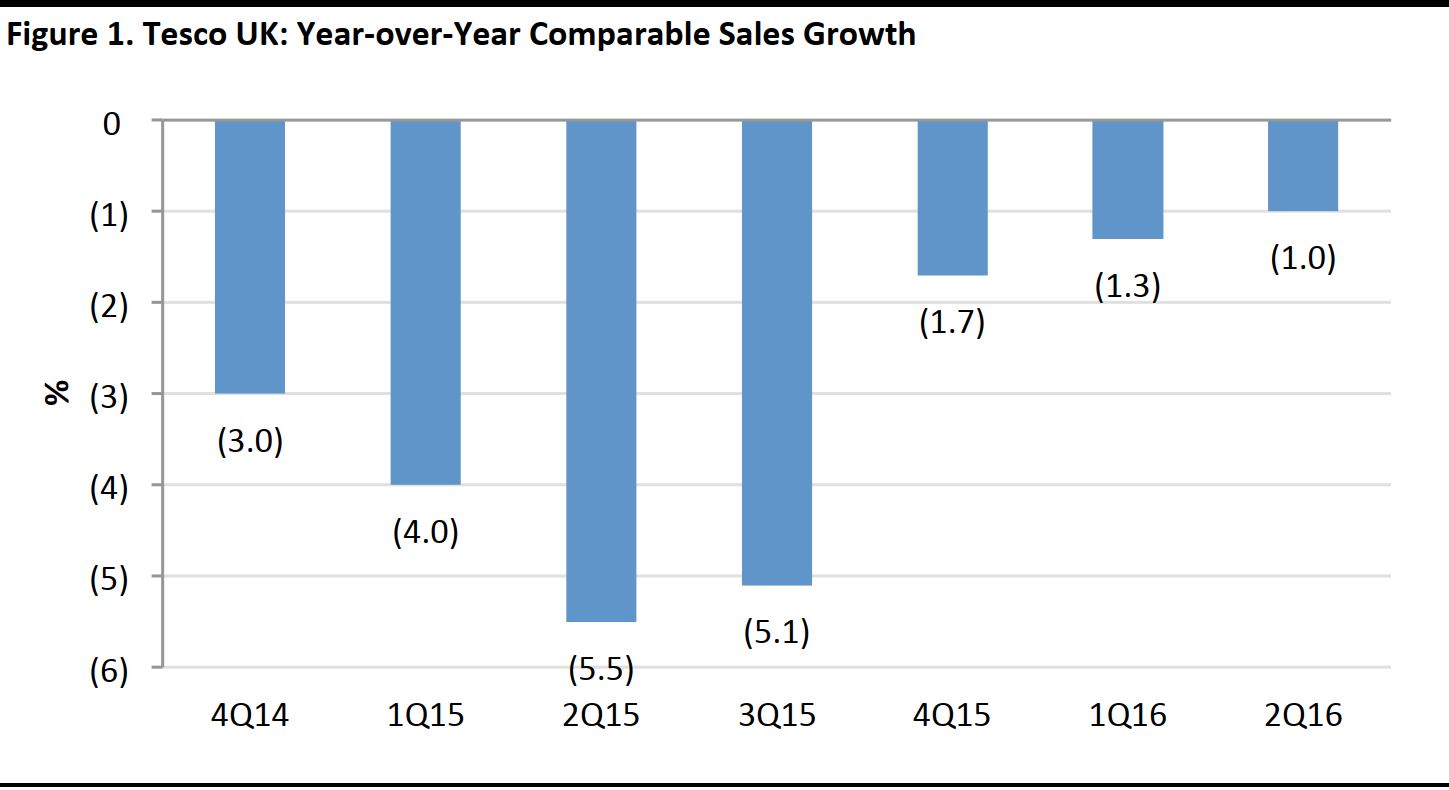

The UK remains the core of Tesco’s operations, and the headline story was the continued improvement in UK comps. However, this metric remained negative in a deflationary UK grocery market.

Source: Tesco

Lewis and Stewart pointed to a steady improvement in other UK metrics:

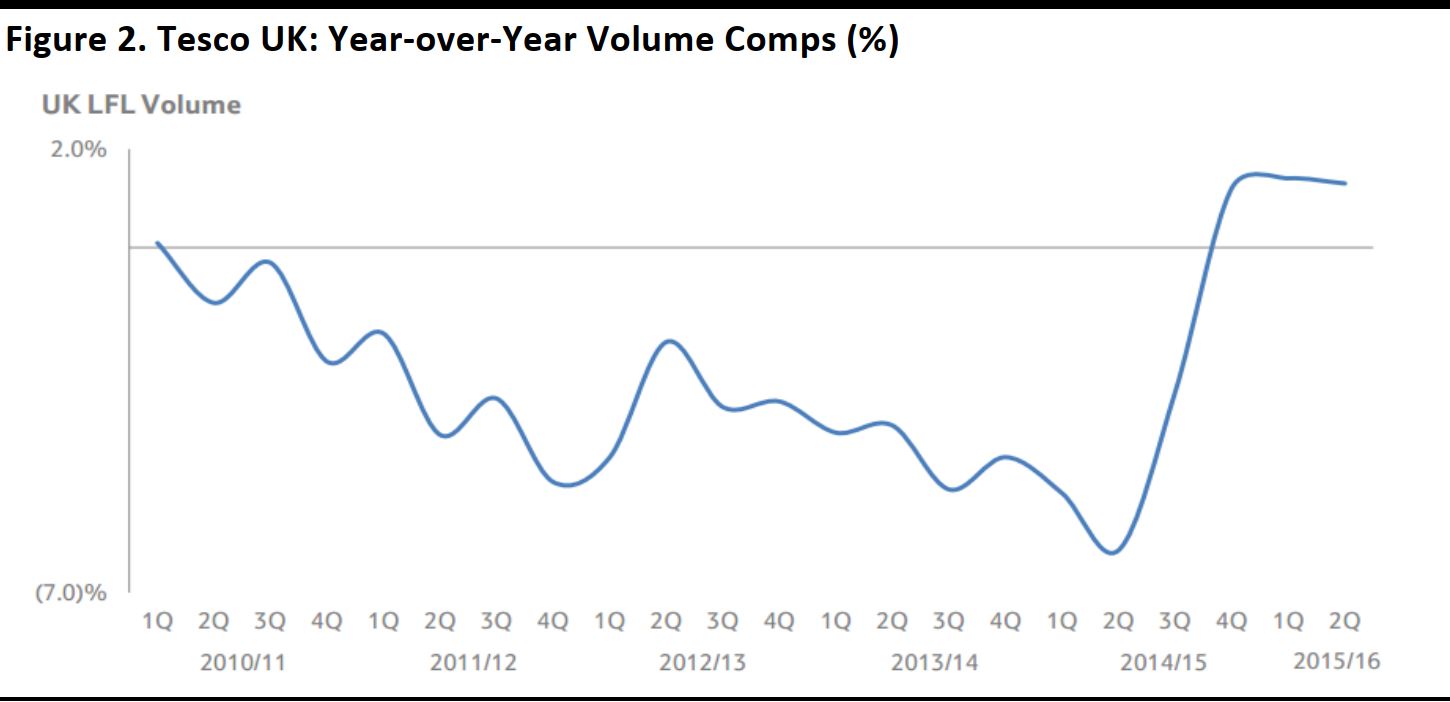

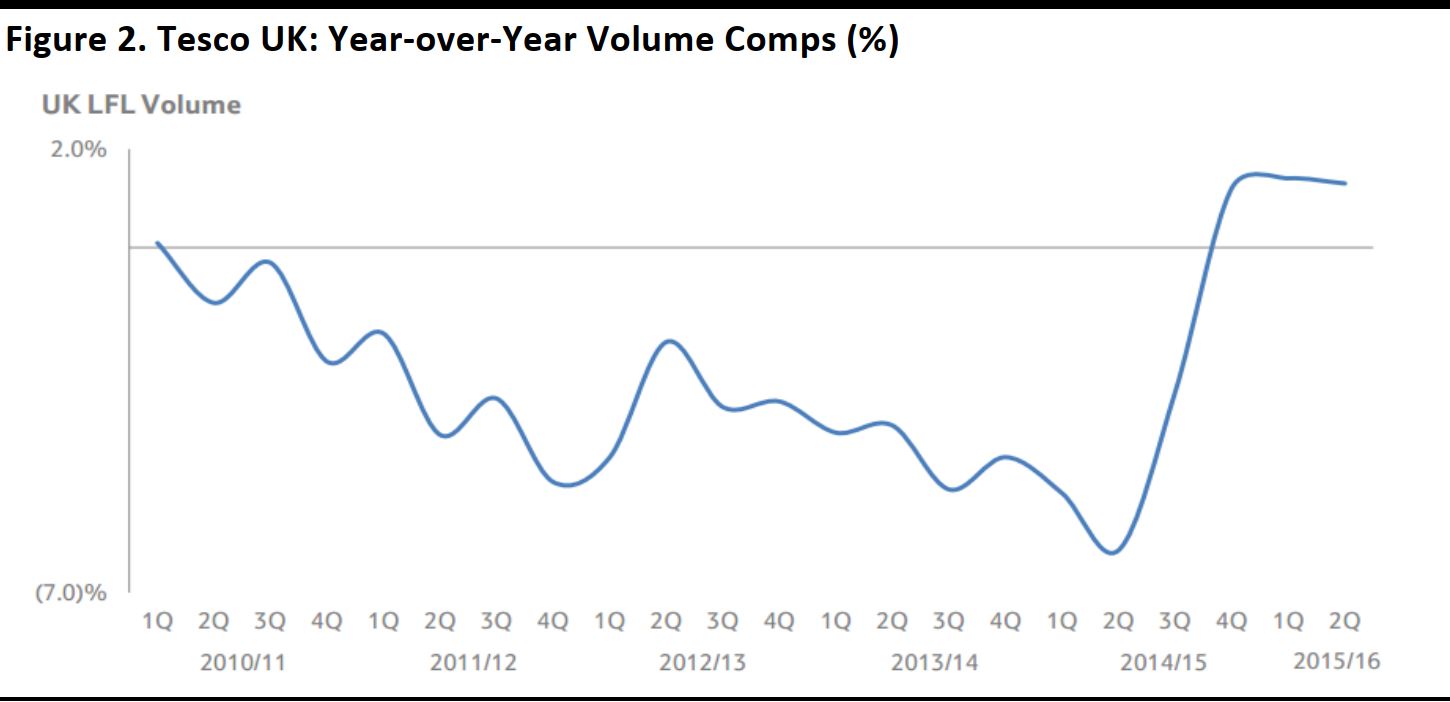

Volumes were up on a comparable (like-for-like) basis, in spite of the ongoing decline in value comps.

Source: Tesco

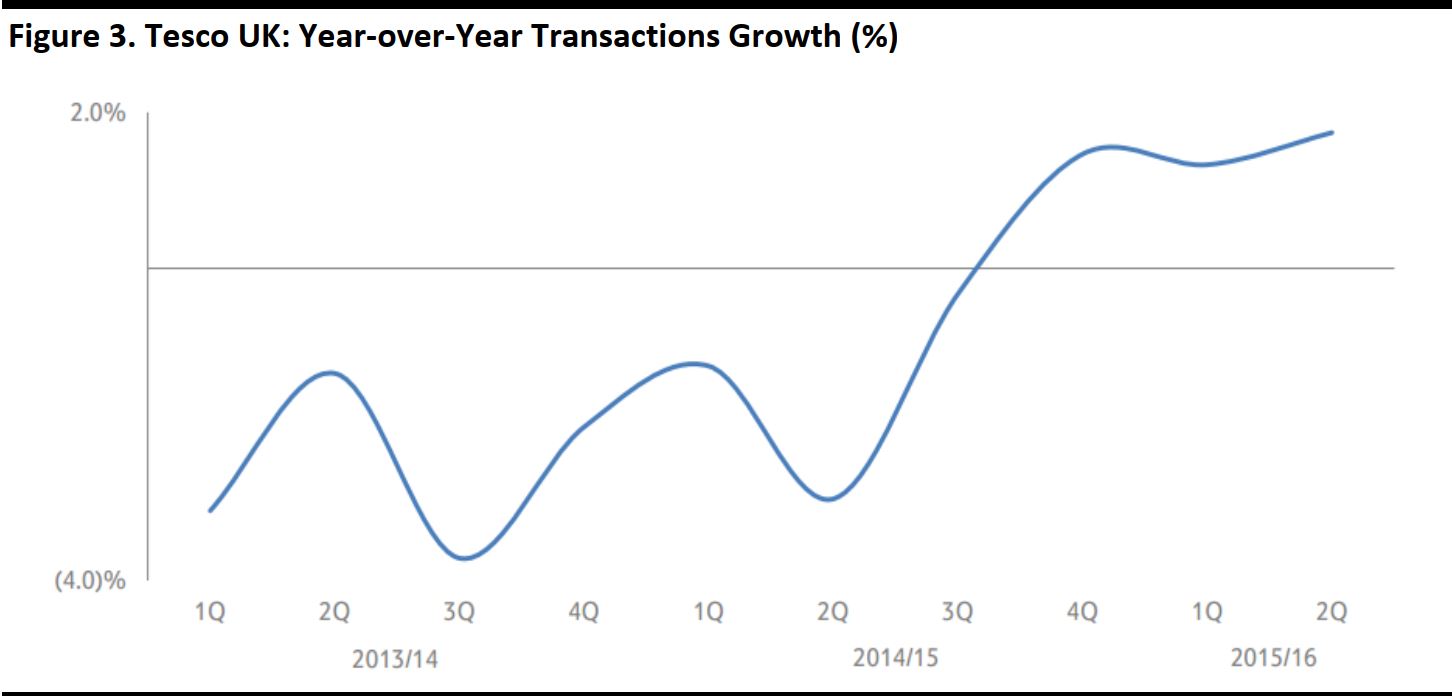

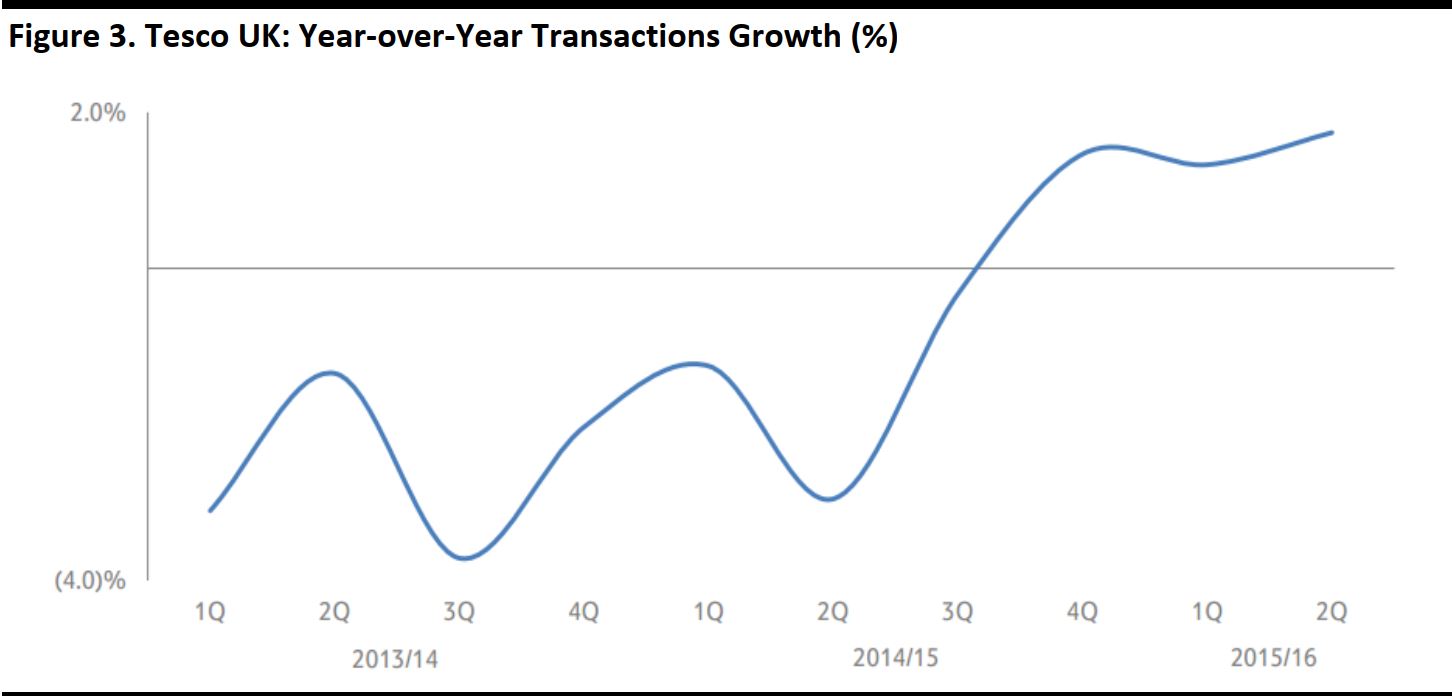

Transaction numbers were positive and growing. One caveat is that transaction numbers do not necessarily reflect customer numbers.

Source: Tesco

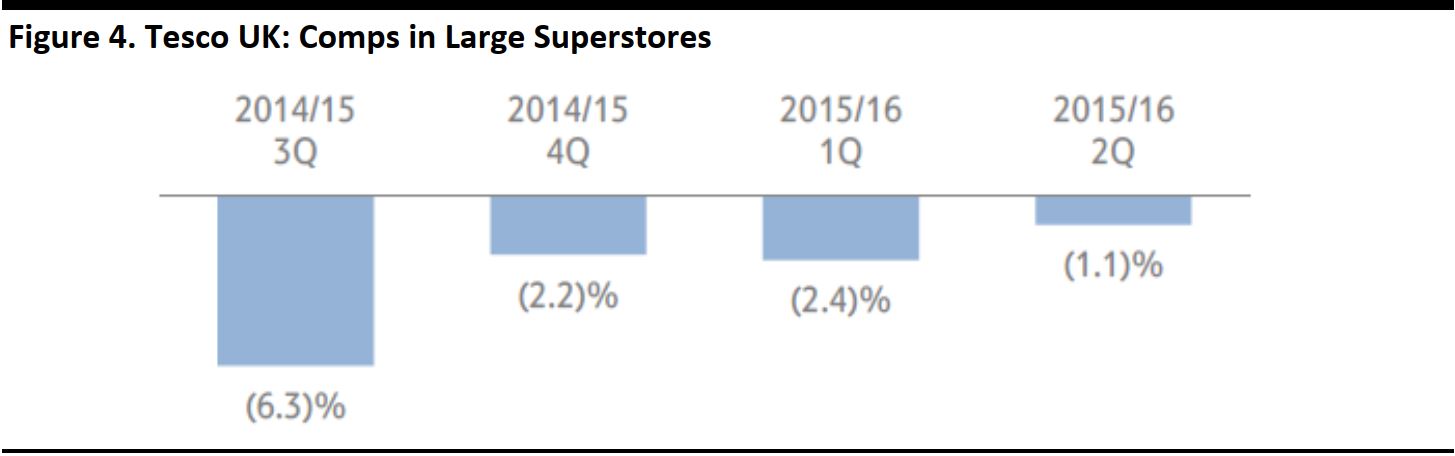

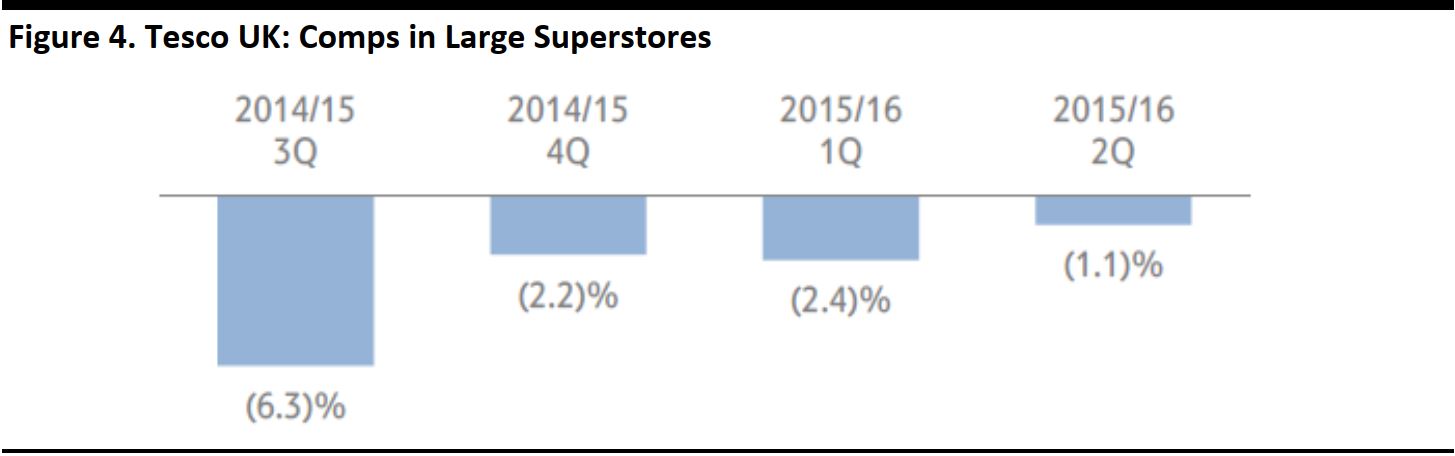

There is an improving trend in comps in Tesco’s largest UK stores, despite the much-reported decline of big stores.

Source: Tesco

What Is Tesco UK Doing?

Dave Lewis joined Tesco 13 months ago and has focused on resetting the UK business to drive up customer numbers and sales volumes. Key elements of his changes include:

- Lower, more stable prices: Lewis said that a typical basket of goods costing £46.98 last year would now cost a shopper £45.48—£1.50 (3.2%) less. He also noted that ranges now see 21% fewer price changes per period on average, as Tesco has nudged a little closer to an everyday low price proposition (but only a little, in our view).

- Simplifying ranges: 21 product categories have been reviewed so far, with an average 15% reduction in those reviewed. Lewis emphasized that this was not about Tesco becoming like a discounter, as some media have suggested—the retailer already has the biggest range in UK grocery, he noted.

Lewis said the customer-facing element of Tesco’s strategy was all about “serving Britain’s shoppers a little better every day.”

Profit Down

Bad news came in the form of a group operating profit that was more than halved, principally due to a 69% slump in UK and Ireland operating profit.

- In the UK and Ireland, Stewart noted three hits to operating profit: lower sales; lower prices—due to external deflation and internal price investment; and investment in se Cost savings partially offset some of these impacts.

- Internationally, investment in the customer offer and legislative changes in Hungary both impacted profits.

Stewart reiterated Tesco’s view that year-over-year comparisons are not the most relevant measure in the context of a business reset. The important factor, he said, is that the company has begun to rebuild from a full-year loss last year.

Prospects for Profit

Looking ahead, the question is: Are these hits to profit likely to ease? We think red flags remain over three of the five noted pressures on operating profit:

Lower sales:

Lower sales: Tesco’s UK comps are likely to remain negative in the coming quarters, given that the improvements in this measure are only incremental. Positive volume comps in the first half did little to help operating profit in this reporting period.

Lower prices:

Lower prices: There is little sign of food-price deflation easing, and we expect grocery price competition to remain intense in the near future, not least because the discounters refuse to be undercut on price. We think further price investment will be necessary at Tesco, and we would not be surprised to see some before Christmas 2015.

Legislation in Hungary:

Legislation in Hungary: Somewhat idiosyncratic changes in the country’s law have forced large stores to close on Sundays and outlawed retailers operating at a loss for more than two years. The latter is a substantial near-term threat for Tesco Hungary, as it is for other international retailers in Hungary.

International investment in the customer offer:

International investment in the customer offer: Tesco has not provided details on what kinds of investments these are, but it has said that it will continue to spend more here, helped by savings in restructuring its Central and Eastern European teams across buying, marketing and operations.

Investment in service:

Investment in service: Additional investment here will annualize, meaning there should be minimal year-over-year impact on profit in future periods, although increased staffing costs will remain. Tesco has a history of funding waves of improved service, only to retreat when profits come under pressure—though we think this would not be a wise move, given the intense competition facing the retailer.

The Outlook: FBIC’s View

- In operational terms, Lewis has had an impressive 13 months as CEO of Tesco. Regaining momentum in UK volume comps and increasing UK transaction numbers have been notable achievements. UK comps are being held back by grocery deflation.

- We think price competition will remain strong in the near future, and we think further price investment will be necessary. So, we do not see Tesco returning to positive UK comps in the immediate future. In turn, rebuilding operating margins will not be easy.

- UK grocery has seen margin attrition in the past few years and, while a number of retailers—including Tesco—may well have already reached their low point, it is very unlikely that grocery retailers will see a serious rebuilding of margins in the near term.