Web Developers

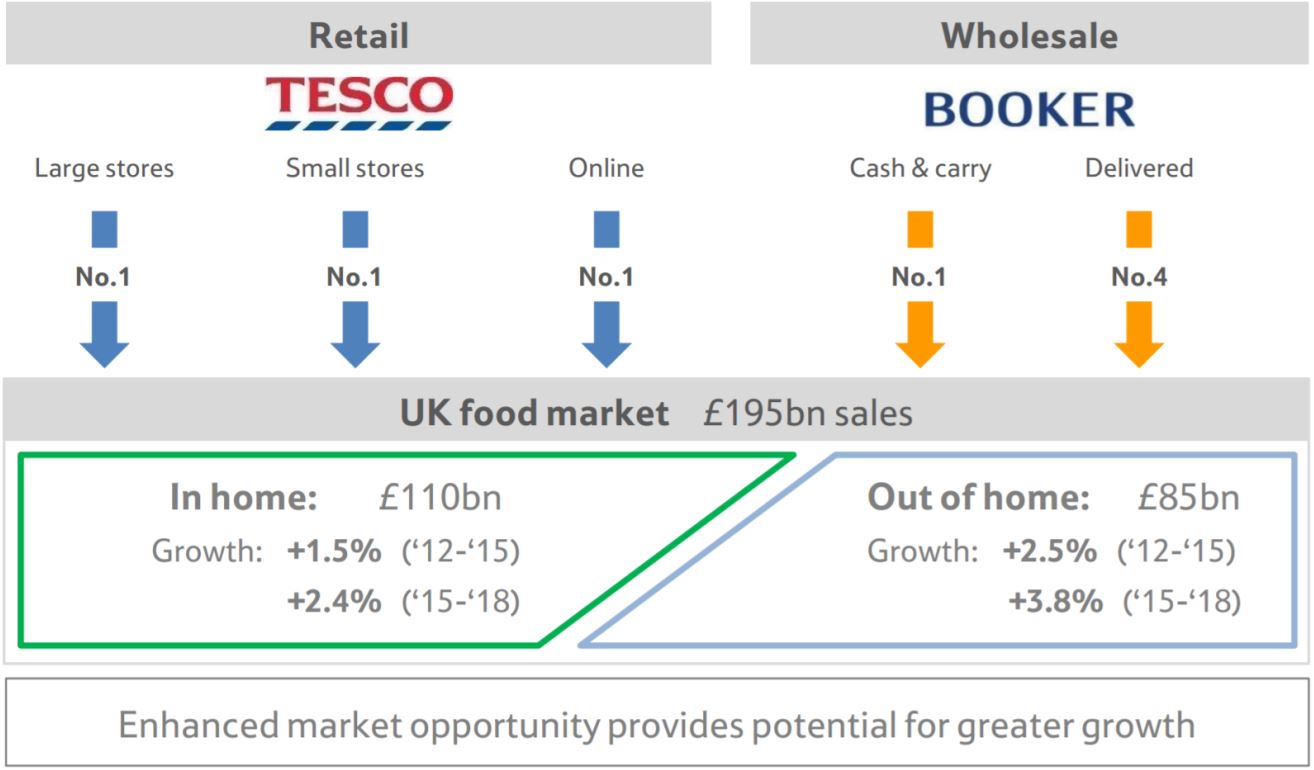

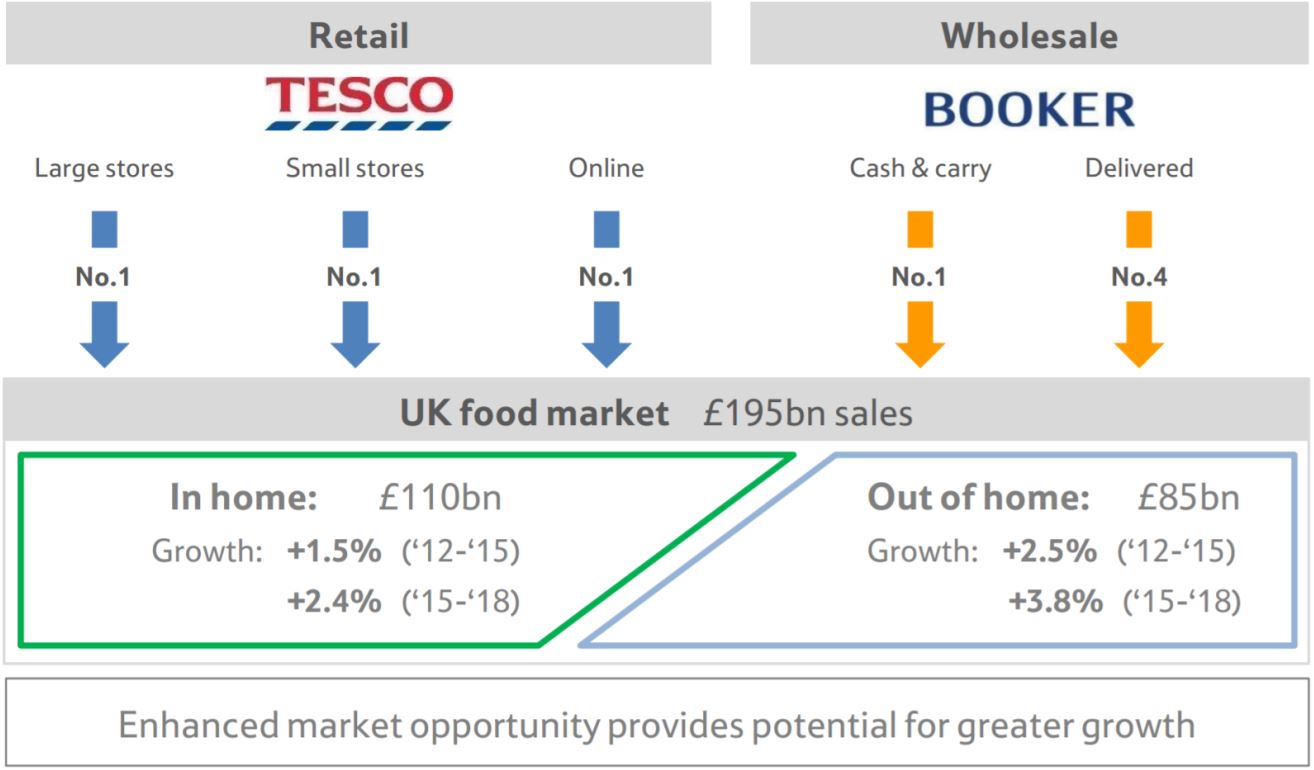

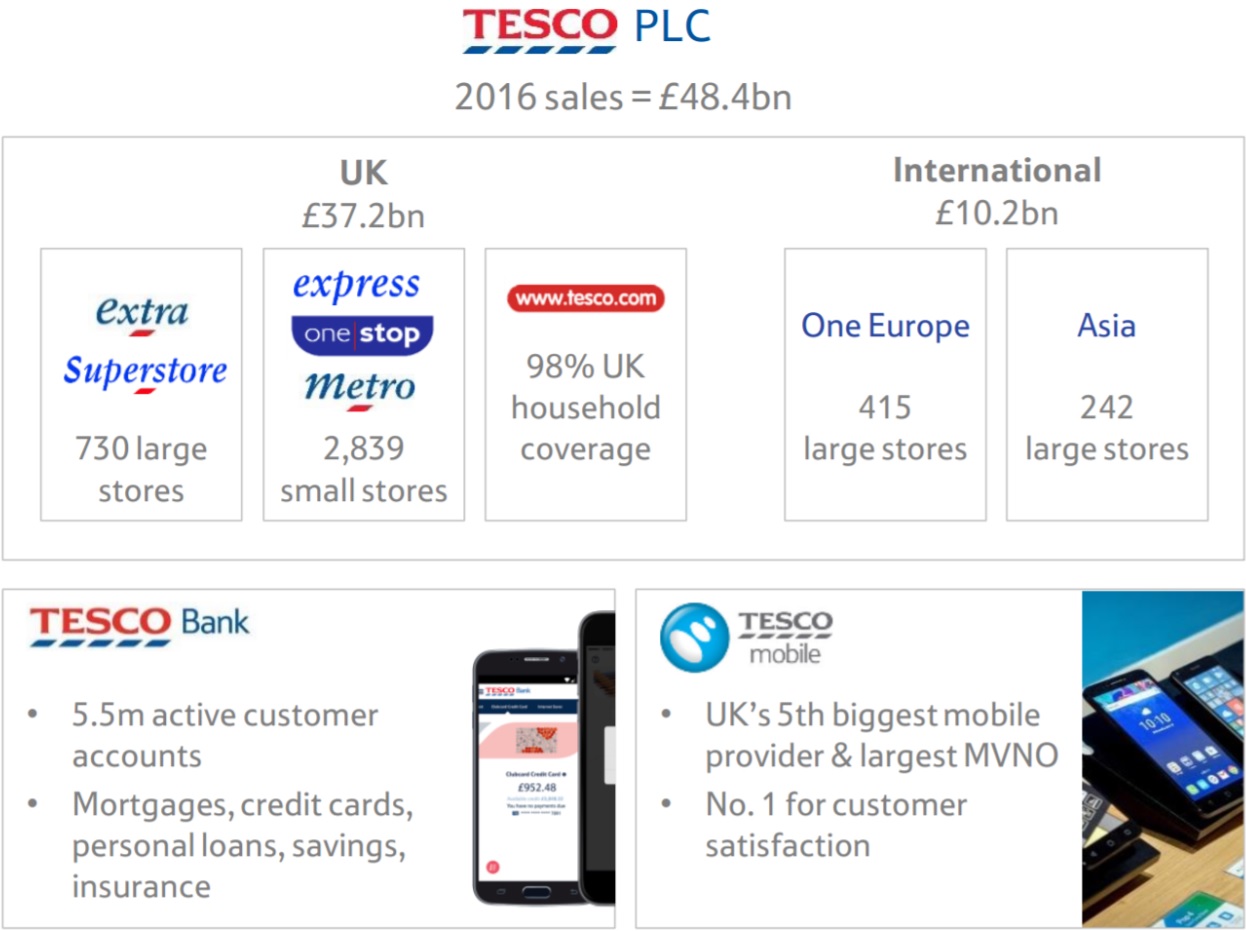

Tesco, the UK’s biggest grocery retailer, and Booker, the UK’s largest cash-and-carry wholesale supplier, have announced an agreement to merge.

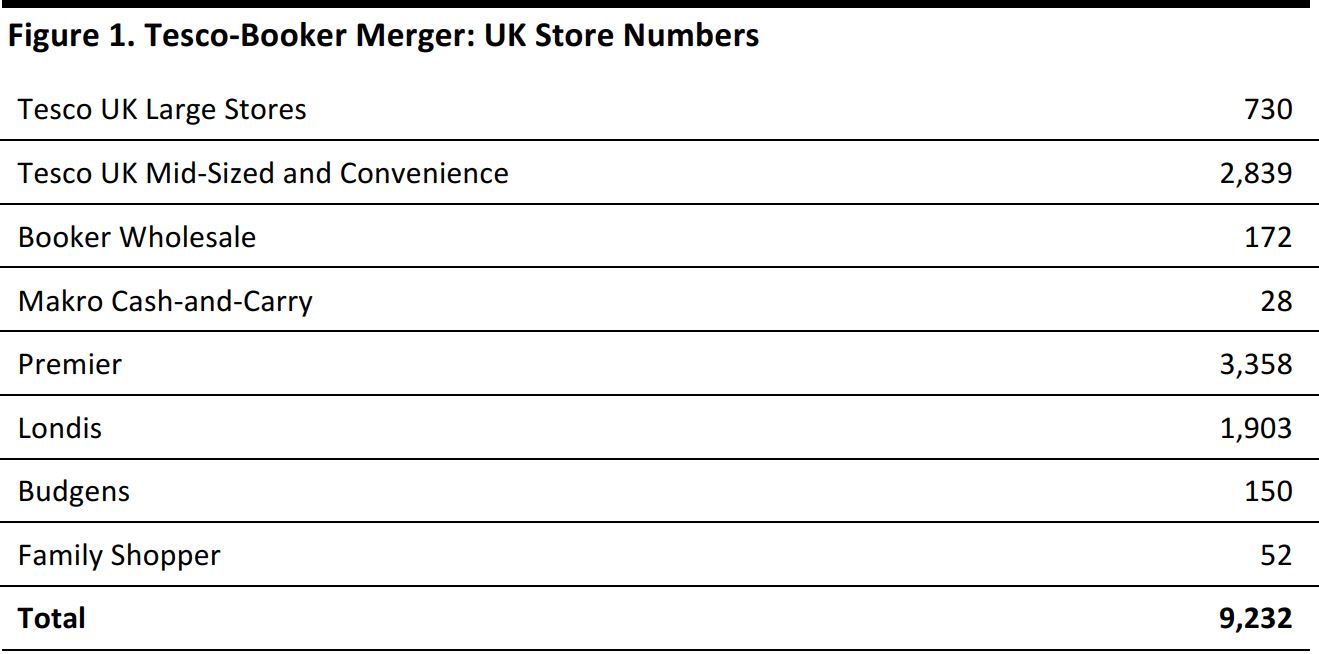

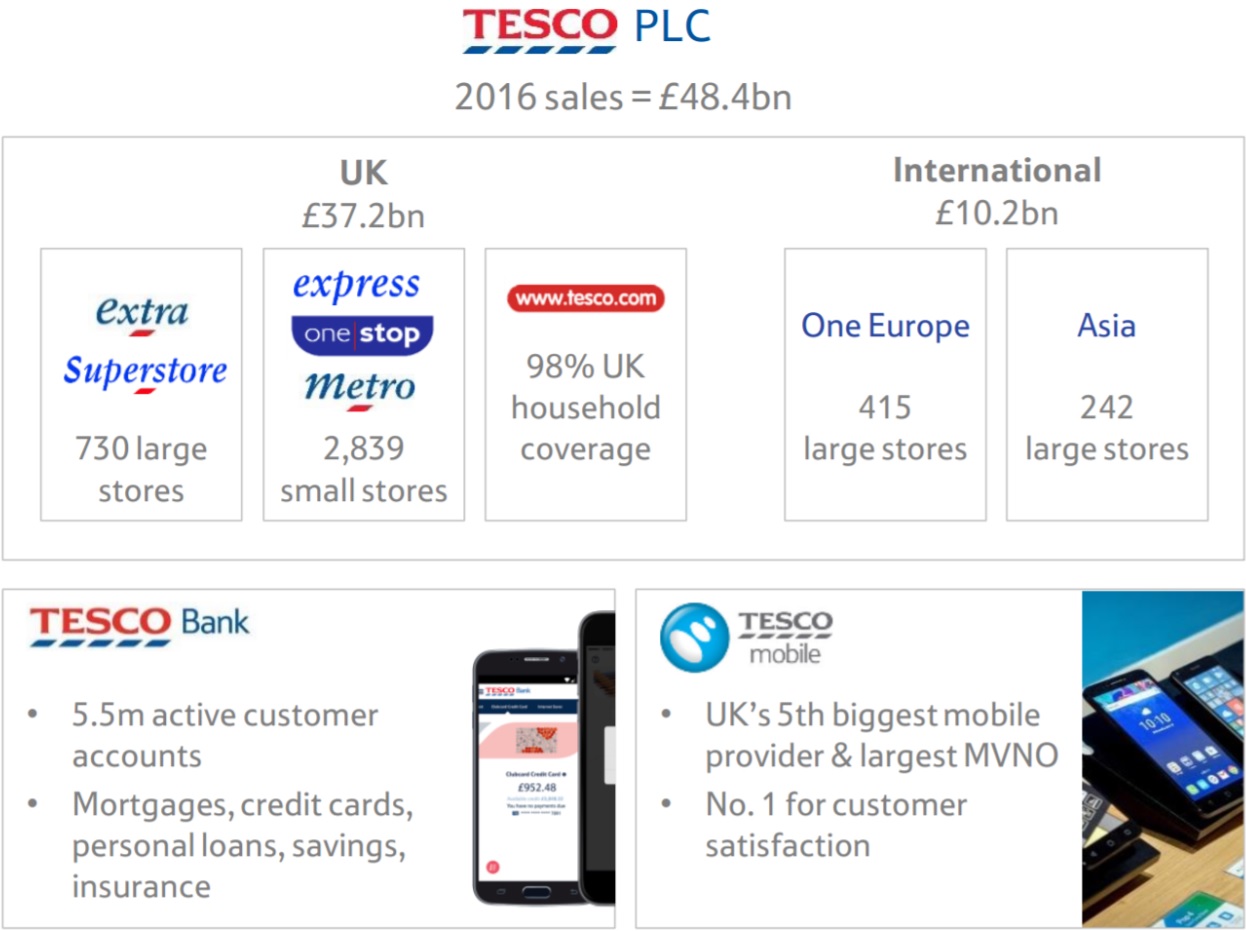

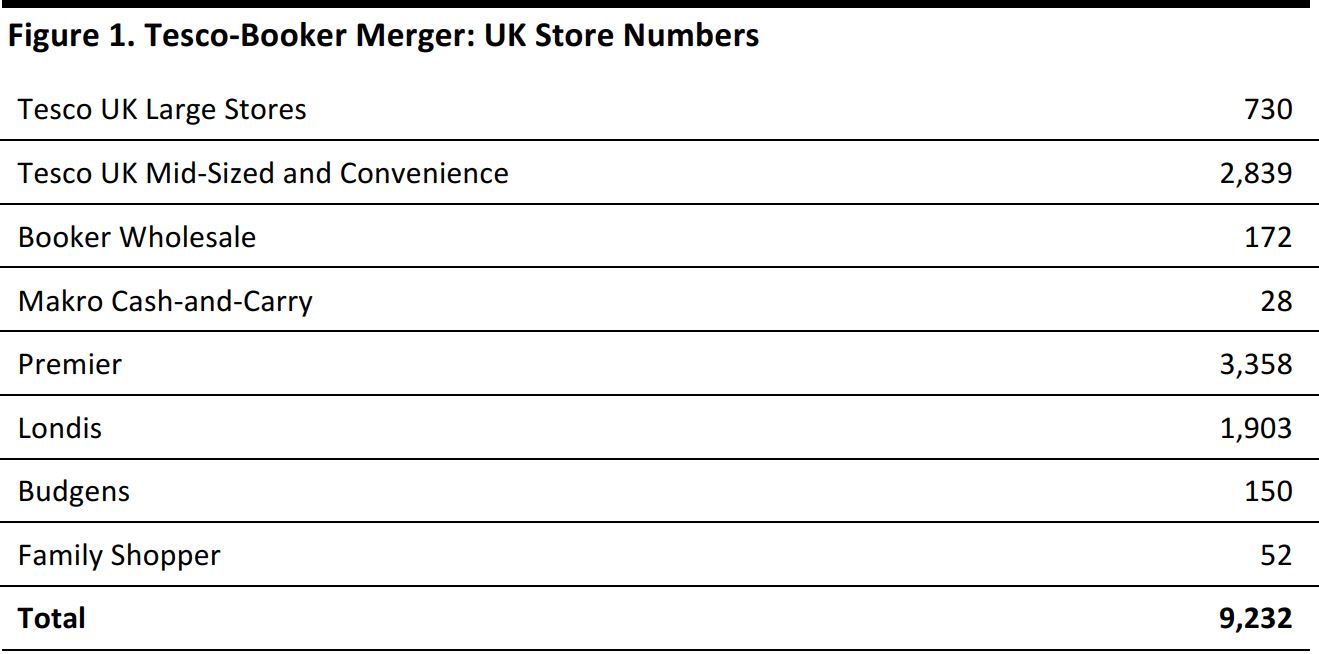

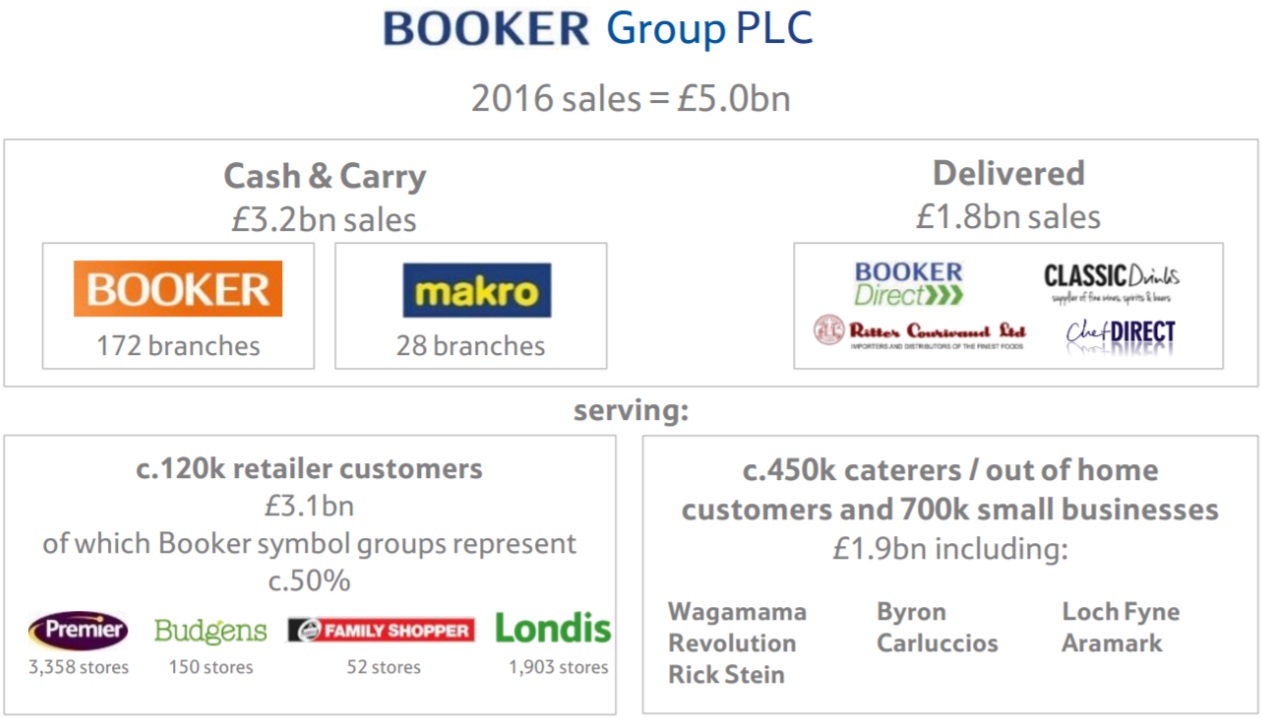

The Booker Group comprises Booker Wholesale, Makro, Booker Direct, Classic Drinks, Ritter Courivaud, Chef Direct and Booker India; Booker’s retail operations include non-owned convenience symbol groups Premier, Londis, Budgens and Family Shopper. Tesco operates hypermarkets, supermarkets, convenience stores and online sites under its own name; Tesco also includes the One Stop convenience chain, whose stores are largely company-owned, though which began franchising in 2013.

The transaction was announced as a merger. However, Tesco has a £15.3 billion market cap to Booker’s £3.2 billion, meaning it is, in practice, an acquisition that values Booker at £3.7 billion. Booker shareholders will receive 0.861 new Tesco shares and 42.6 pence in cash for each Booker share; they will own approximately 16% of the new group.

The merger will be subject to approval by the Competition and Markets Authority, and that body may raise concerns over the concentration of share in the convenience retail sector.

What It Means

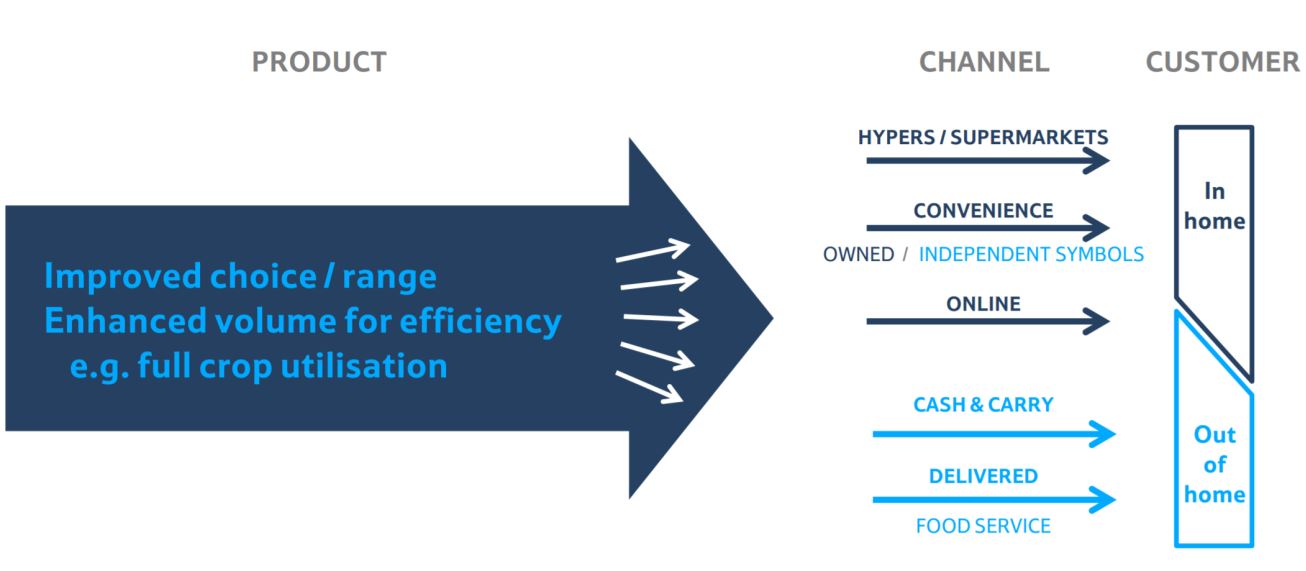

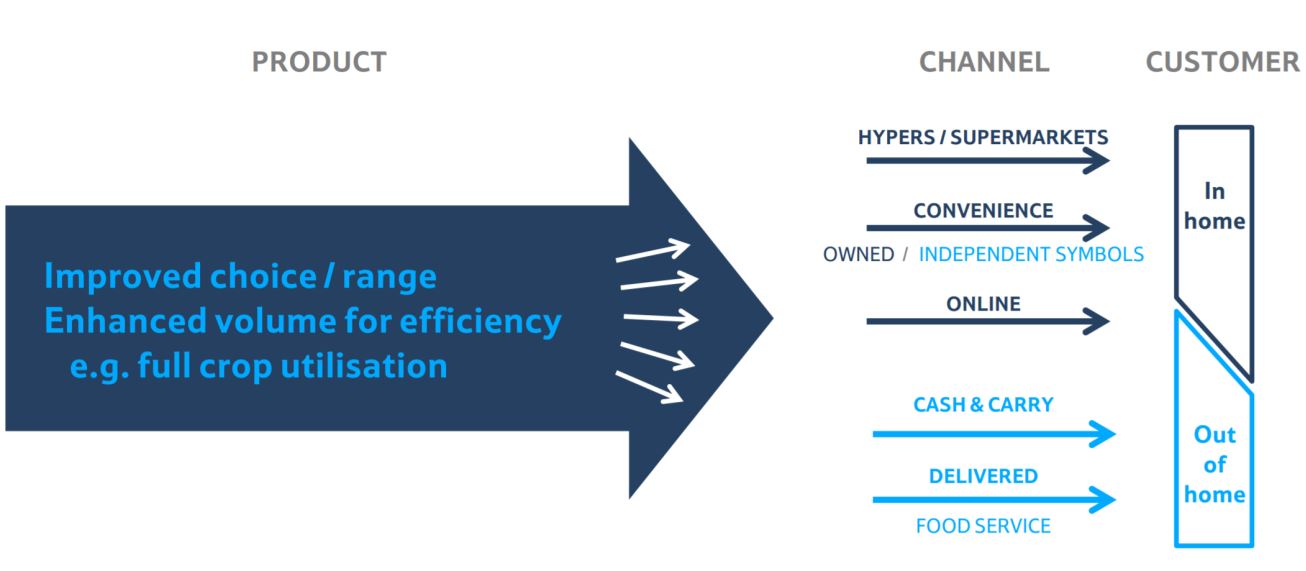

As a retailer and wholesaler, respectively, Tesco and Booker are complementary businesses. While Booker has retail interests through convenience stores, these are non-owned symbol groups, to which it wholesales. The transaction offers Tesco exposure to the foodservice sector and boosts its presence in convenience retail—both faster-growing sectors than traditional supermarket retailing.

Source: Tesco

Expected benefits of the merger include: Greater Scale: Higher volumes will be valuable in the UK’s highly competitive, lower-margin grocery market. Pro forma, the group generated some £59 billion in revenue in FY16, with Booker contributing 9% of this. Tesco says that it expects total quantifiable synergies of at least £200 million within three years, including £175 million in cost savings and £25 million in incremental operating profit. Cost savings will be across procurement, distribution and fulfilment, and central costs. Tapping Foodservice: The merger allows Tesco to tap the out-of-home food market, via Booker’s wholesaling to restaurants. In the UK, as in other countries, consumers are growing their spend in foodservice faster than they are increasing their spending on groceries. More Convenience: The merger brings together Tesco’s Express and One Stop convenience chains with Booker’s Premier, Budgens, Londis and Family Shopper convenience banners. Booker’s convenience groups include almost 5,500 stores. We see opportunities to drive up standards in these independently owned chains, notably through Tesco’s strengths in private-label foods. New Offerings: Tesco has signaled it can boost its delivered wholesale proposition by utilizing Tesco’s delivery fleet. We could see larger Tesco stores hiving off space for wholesale customers. Financial Metrics: Booker is a higher-margin business than Tesco, with a 3.1% EBIT margin in FY16 to Tesco’s 1.9%. Booker has grown margins in previous years while Tesco’s margins have fallen from previous highs of near-6%. Tesco stated that it expects to generate a return on invested capital in excess of Tesco’s cost of capital by year two, and significantly in excess by year three, and that the transaction will be EPS accretive in the second full financial year.

Source: Tesco

Group Presence

The combination of food retail and wholesale will make Tesco broadly akin to Metro Group’s soon-to-be-demerged food wholesale and retail group—but while Metro is 80% wholesale, Tesco will remain skewed toward retail. See our recent report on the Metro Group demerger here: bit.ly/FungMetro The group will have 9,232 UK outlets, based on the latest reported numbers, distributed thus:

Source: Tesco/Fung Global Retail & Technology Further metrics from the company presentation are included below.

Source: Tesco

Source: Tesco