Nitheesh NH

Introduction

Tencent is an Internet giant in China—a conglomerate that excels in social platforms and gaming and that has interests in retail through its investment in JD.com. It has launched a myriad of business-to-consumer (B2C) products that reveal its strength in developing user-centric products, including instant-messaging platform QQ, multi-functional super app WeChat and many game titles that are popular among domestic and overseas players. However, since a major organizational change in 2018, Tencent has been shifting its corporate focus to the B2B arena through the formation of the Cloud & Smart Industries Group. The new business group has a Smart Retail department provides information technology solutions to businesses. In this report, we study Tencent’s Smart Retail proposition and how it helps the company to tap into the B2B retail sector. We also discuss the company’s traditional strengths in gaming and digital entertainment as well as other initiatives that enhance Tencent’s capabilities in servicing businesses.Smart Retail Is the Building Block

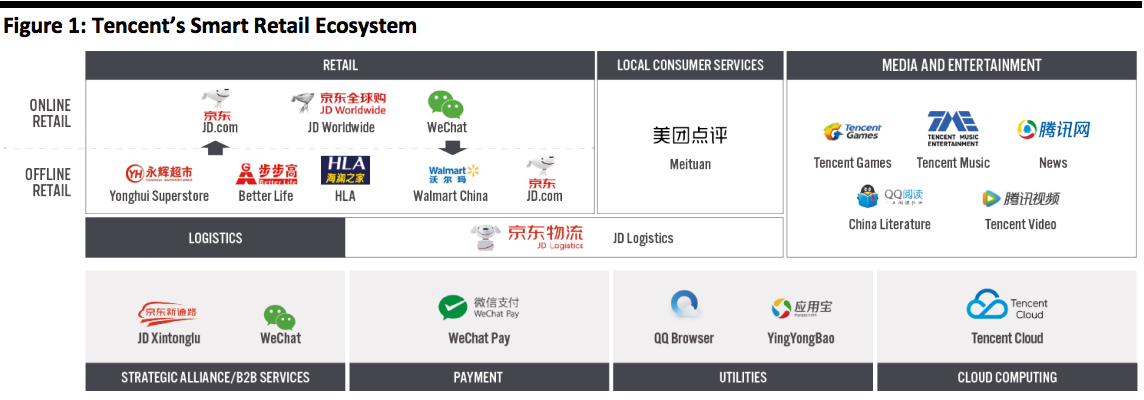

Tencent’s Smart Retail unit was established in March 2018 before it merged into the Cloud & Smart Industries Group later that year. The company’s vision is to help merchants connect with their customers and Tencent’s ecosystem of partners. Tencent primarily serves as a utility provider but has invested in retail arm JD.com to build up its Smart Retail ecosystem. [caption id="attachment_101001" align="aligncenter" width="700"] Source: Company reports[/caption]

Key to providing an improved customer experience is digitalized operations. Smart Retail is Tencent’s answer to Alibaba’s New Retail, which refers to the integration of online and offline commerce and the transformation of the supply chain through digitalization, data and technology. Similarly, Tencent’s Smart Retail solution facilitates the online-offline integration process.

To implement its Smart Retail strategy, Tencent’s main initiatives include:

Source: Company reports[/caption]

Key to providing an improved customer experience is digitalized operations. Smart Retail is Tencent’s answer to Alibaba’s New Retail, which refers to the integration of online and offline commerce and the transformation of the supply chain through digitalization, data and technology. Similarly, Tencent’s Smart Retail solution facilitates the online-offline integration process.

To implement its Smart Retail strategy, Tencent’s main initiatives include:

- leveraging social app WeChat as a multifunctional platform that merchants and consumers can use;

- parternering with incumbent e-commerce platforms and physical retailers and brands to expedite its progress as a latecomer in the retail space; and

- developing its cloud and artificial intelligence (AI) technologies to supply solutions to businesses.

Leveraging Social App WeChat

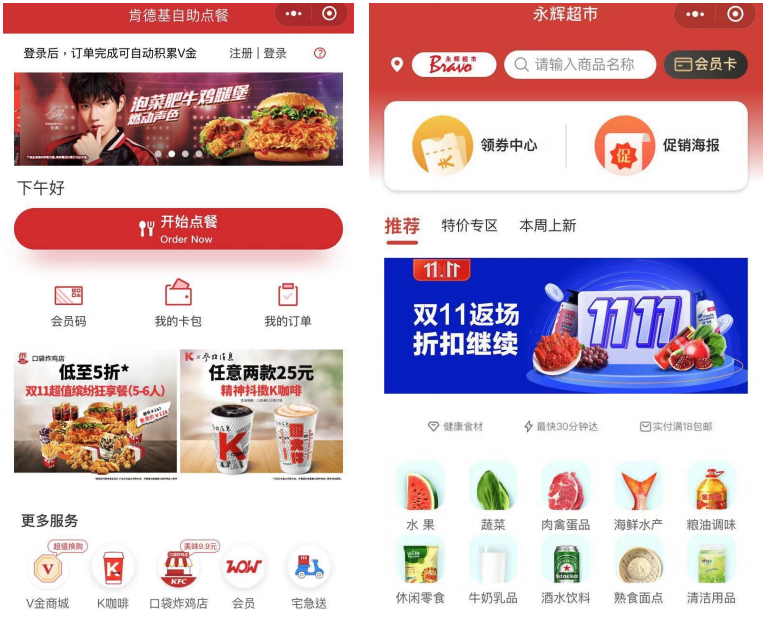

Social app WeChat was launched in 2011, taking over the dominant status of another Tencent instant-messaging product, QQ, as the new mainstream communication app in China. More than just a social platform, WeChat is a super app in China that enables users to make payments, communicate with merchants and government institutions, send gifts and access learning and booking services thanks to the integration of WeChat Pay and WeChat mini programs. As of June 2019, WeChat has 1.1 billion monthly active users globally, according to Tencent’s 2019 interim financial report. This huge user base provides many monetization opportunities for the company. WeChat mini programs were launched in 2016 as apps that run within the WeChat platform. Brands, retailers and social influencers have long operated their own WeChat official accounts, similar to official Facebook Pages, to interact with their followers and customers. However, the funtionality was not previously dynamic enough for these parties to acheive greater engagement. 1. WeChat mini programs enhance merchants’ ability to serve WeChat mini programs are like mini tools for merchants to increase customer interaction. They can build in-app loyalty programs, mini e-commerce shops, interative games, group buying apps and more. This functionality has been effectively adopted by a number of retailers, such as the following:- Fast-food chain KFC set up a WeChat mini program that serves as a digital membership card for its loyalty program members.

- Local supermarket chain Yonghui Superstore developed a WeChat mini program that allows customers to scan product QR codes and pay directly with WeChat Pay in its physical stores.

- Luxury brand Longchamp’s WeChat mini program allows customers to design their own bags by choosing their favourite color and features.

- Luxury brand Dior’s gift-card mini program enables users to buy and send virtual gift cards to their contacts on WeChat.

- WeChat mini programs have faciliated community group buying, where residents in the same neighouborhood often buy fresh produce and daily consumables together.

KFC’s WeChat mini program (left) and Yonghui Superstore’s WeChat mini program (right)

KFC’s WeChat mini program (left) and Yonghui Superstore’s WeChat mini program (right)Source: WeChat[/caption] 2. WeChat mini programs have a B2B root as an open platform WeChat mini programs are powerful because they are open to third-party developers, which is beneficial to the growth of the ecosystem. Of the 630,000 newly developed WeChat mini programs in 2019, around one-third were developed by third-party companies, according to Chinese media Technode. Tencent has enhanced the WeChat miniprogram ecosystem by launching a growth program that provides training and development tools to better support miniprograms owners. A dashboard tool called Industry Assistant was introduced in October that enables WeChat miniprogram owners to gain analytical insight into their operations. Opening the platform has faciliated e-commerce operations too. In March, Tencent launched a logistics interface that allows mini-program third-party vendors to directly connect to a number of courier companies so that merchants and customers can track the shipment status without exiting WeChat. WeChat mini programs are therefore an important tool for Tencent to service businesses and enhance its foothold in retail. They are generally less expensive to develop compared to native apps, which is good for small businesses. As users can easily access companies’ mini programs by typing on WeChat and bookmarking the frequently visited accounts, large brands are eager to set up WeChat mini programs that provide a more dedicated branded environment compared to crowded online marketplaces.

Online and Offline Retail Expansion by Partnership and Investment

As a latecomer to retail, Tencent has been expanding its online and offline presence in the sector by forming partnerships with, and investing in, established retail players since 2017. According to S&P Capital IQ and company reports, these activities include the following:- Investing in JD.com, China’s second largest e-commerce platform, for an 18% stake

- Investing in Vipshop, China’s online discount retailer for an 8.7% stake

- Investing in supermarket chain Yonghui Superstore for a 5% stake

- Investing in retail group Better Life for a 6% stake

- Investing in menswear brand HLA for a 5% stake

- Investing in on-demand local services platform Meituan Dianping for a 20% stake

- Forming a strategic partnership with Walmart China

- Forming a Smart Retail-themed joint venture with real-estate group Wanda

- Forming a strategic partnership with Luckin Coffee, a local emergent coffee brand that is increasingly posing a threat to Starbucks’ s operations in China

A customer uses Walmart’s WeChat mini program to pay (left). A Super Species supermarket (right)

A customer uses Walmart’s WeChat mini program to pay (left). A Super Species supermarket (right)Source: Walmart China/Super Species[/caption]

Logistics, Technology, B2B Services and Physical Retail, with JD.com as an Extended Retail Arm

Besides online retail, Tencent is focused on building its business ecosystem, while JD.com acts as an extended arm for brick-and-mortar retail.- Logistics and Delivery: JD.com has invested in its nationwide logistics network and data-driven delivery technologies that allow customers to enjoy same- and next-day delivery.

- Technology and Innovation: JD.com is focused on research and development in retail, logistics and the supply chain. Next-generation technologies are being researched and integrated into retail supply chains to bring new shopping experiences to consumers—these include big data, blockchain, Internet of Things, natural language processing, image and visual recognition, AR and virtual reality, machine learning and deep learning.

- B2B Services: The company has launched the JD Xintonglu program, which acts as a supplier for physical retailers, connecting shops directly with brands. The idea was announced on January 16, 2016 by CEO Richard Liu during the company’s annual conference, and it is similar to Alibaba’s LST.

- Physical Retail: JD.com has opened “JD Retail Experience Shops,” which provide physical touchpoints for customers to experience products first hand, ranging from home appliances to JD’s DingDong smart speaker to parent-and-baby products, all of which are sourced from JD.com. Product assortment is tailored on a store-by-store basis using big data based on each neighborhood’s shopping habits.

JD.com’s JD Retail Experience Shops

JD.com’s JD Retail Experience ShopsSource: JD.com[/caption]

Payment

Tencent’s mobile payment solution WeChat Pay launched in 2013 and sits within WeChat. The addition of this feature turned the social platform into a prevalent mobile wallet that boosts the adoption of mobile payment in China. Domestic users can pay for products and services, transportation, utility bills, government and institutional services and even shop at a variety of overseas merchants when travelling abroad, building a cornerstone for Tencent to extend its reach in retail. [caption id="attachment_101007" align="aligncenter" width="320"] WeChat Pay is easily accessible on WeChat’s interface.

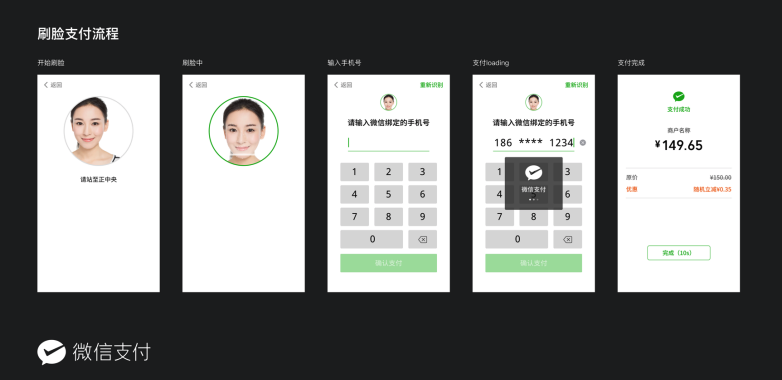

WeChat Pay is easily accessible on WeChat’s interface.Source: WeChat[/caption] Tencent’s retail partners have embraced the WeChat ecosystem by adopting WeChat Pay as their default mobile payment method. For example, after teaming up with Tencent, Walmart China dropped Alipay, Alibaba’s mobile payment app, as one of the payment options in its stores in the western region of the country. Luckin Coffee has also set WeChat Pay as the only accepted mobile payment method on its app. In the innovation front, Tencent has cooperated with many offline stores to apply facial-recognition payment in stores. YouTu Lab and Tencent Cloud have partnered with Miss Fresh, a China-based O2O fresh food e-commerce start-up, to develop a smart shelving solution based on product identification technology. Customers can simply take a product from the shelf and the transaction is made automatically, with the bill generated on their pre-set account. [caption id="attachment_101008" align="aligncenter" width="700"]

Tencent provides guides for setting up facial-recognition payment with WeChat Pay.

Tencent provides guides for setting up facial-recognition payment with WeChat Pay.Source: WeChat Pay[/caption] [caption id="attachment_101010" align="aligncenter" width="700"]

Miss Fresh’s smart shelves

Miss Fresh’s smart shelvesSource: Miss Fresh[/caption]

Local Services

Meituan is Tencent’s answer to Alibaba’s Ele.me. The company was founded in 2010 and was merged with restaurant review app Dianping in 2015. It offers local food-delivery services, consumer products and retail services to consumers. The platform has over 290 million monthly active users and 600 million registered users as of April 2018. Meituan provides discounts to its users in food delivery. In June 2019, it partnered with Tencent Video to integrate membership programs and promote its offerings. Meituan also offers services centered around in-store purchasing, hotels and tourism, bike-sharing and grocery retail. These are all fulfilling consumer needs in local services and helping businesses to better serve customers.Media and Entertainment

Exploiting Traditional Strength To Fuel Retail Development: Gaming Tencent is well known as a gaming behemoth, from PC to smartphone games. Its Honour of Kings and the current hit title PUBG Mobile are popular among Chinese gamers and have contributed significant revenues to the company. Tencent has used gaming to assist the growth of new products. For example, the company launched the Jump Jump mini-program game on WeChat in December 2017, which saw 100 million daily active users in its first month. The game drove awareness and usage of WeChat mini programs. The Smart Retail strategy facilitates the integration of retail and entertainment such as gaming. Convenience store Lawson partnered with Tencent to create a version of the QQ Speed mobile racing game to drive offline store traffic. In the game, players can access discounts and limited-edition items through Lawson’s virtual store; in the real world, shoppers can earn in-game items and discounts by purchasing certain products from Lawson’s convenience stores during the promotion period. According to Tencent, this campaign drove 13.25 million visits to Lawson’s convenience stores in China from August 17to September 2, 2018. [caption id="attachment_101012" align="aligncenter" width="700"] Lawson-QQ Speed co-branded mobile game

Lawson-QQ Speed co-branded mobile gameSource: Tencent[/caption] Exploiting Traditional Strength To Fuel Retail Development: Digital Entertainment and Information Services Tencent has a large number of subsidiaries specializing in information services and various digital entertainment categories: Tencent News, China Literature, Tencent Comic and Animation, Tencent Pictures, Tencent Music, Tencent Video, Tencent Sports and Tencent Esports. These platforms allow the company to sell advertising opportunities to merchants, and Tencent has been acquiring revenues from paid member subscriptions too. [caption id="attachment_101013" align="aligncenter" width="700"]

Tencent Video is a video-streaming service that offers various advertising opportunities.

Tencent Video is a video-streaming service that offers various advertising opportunities.Source: Tencent Video[/caption] More significantly, the company has been producing original drama series, variety shows and movies, which increase the scope for advertising and sponsorship revenue as well as offering cross-promotional opportunities both online and offline. For example, renowned Chinese film director Zhang Yimou’s award-winning movie “Shadow” was released in 2018 and co-produced by Tencent Pictures—the movie showcases the aesthetics of Chinese ink wash painting with a strong black-and-white artistic touch. To promote the movie, Tencent turned a Super Species fresh food supermarket (owned by its investee Yonghui Superstore) in Shanghai into a Shadow-themed store that imitated the aesthetics presented in the movie. This initiative created a special in-store shopping experience for grocery shoppers, driving foot traffic to the store. [caption id="attachment_101014" align="aligncenter" width="700"]

Poster of the movie “Shadow” filmed by Zhang Yimou

Poster of the movie “Shadow” filmed by Zhang YimouSource: Tencent Pictures[/caption]