albert Chan

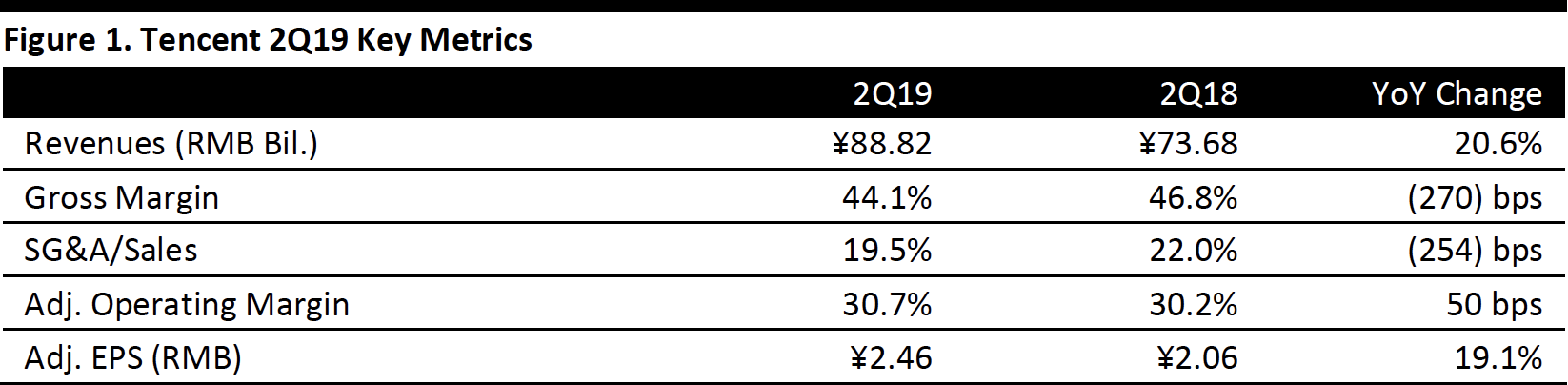

Source: Company reports/Coresight Research[/caption]

2Q19 Results

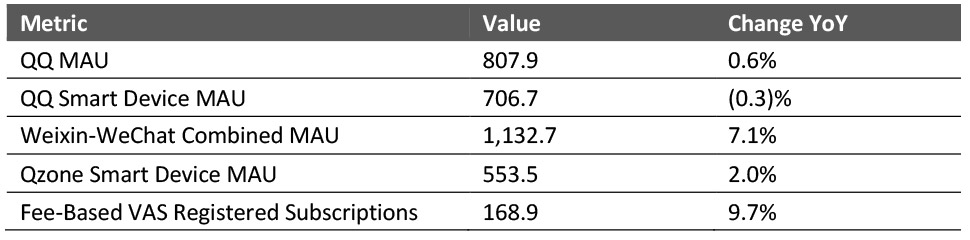

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Tencent reported 2Q19 revenues of ¥88.82 billion (US$12.9 billion), up 20.6% year over year and below the ¥92.93 billion consensus estimate.

Adjusted EPS was ¥2.46 (US$0.35), up 19.1% year over year and beating the ¥2.23 consensus estimate. GAAP EPS was ¥2.52, up 34.9% year over year.

Results by Segment- Value-Added Service revenues were ¥48.1 billion, up 14% year over year.

o Online game revenues were ¥27.3 billion, up 8% year over year, due to growth from smartphone games.

o Social network revenues were ¥20.8 billion, up 23% year over year, driven by higher digital content revenue from live broadcast services and video-streaming.

- FinTech and Business Services revenues were ¥22.9 billion, up 37% year over year, driven by growth in commercial payments and cloud, partly offset by lower interest.

- Online advertising revenues were ¥16.4 billion, up 16% year over year.

o Social and online advertising revenues were ¥12.0 billion, up 16% year over year, due to higher advertising revenue from Weixin Moments, Mini Programs and QQ KanDian.

o Media advertising revenues were ¥4.4 billion, down 7%.

- Other revenues were ¥1.4 billion, up 75% year over year.

- Management characterized user growth and the company’s execution on key initiatives as solid in a challenging business environment.

- Gaming—The company released several successful new titles in different genres, with new play modes, and extending its popular season passes. The company is extending its Healthy Gameplay System for promoting balanced gameplay for young users.

- Payments—Merchant acceptance increased for mobile payment services, which drove increases in average transaction volume and in total payment volume in addition to acceptance by commercial payment users.

- Digital Content—The company broadened its exclusive relationship with the National Basketball Association, reinforcing its position as a leading digital entertainment platform.

Other highlights:

Other highlights:

- Communications and Social—The number of medium-to-long-tail Mini Programs more than doubled year over year, and more than a dozen content Mini Programs have attained over 1 million daily active users. The company also launched a major upgrade for Mobile QQ and introduced QQ Mini Programs, with entertainment and games-related programs.

- Online Games—Tencent released 10 games during the quarter, and the in-house tactical tournament game, Peacekeeper Elite, exceeded 50 million DAU since its launch in May. The company is in the early stages of implementing season passes for several of its key titles. PC client games revenues were down 15% sequentially due to weak seasonality.

- Digital Content—Fee-based VAS subscriptions increased 10% year over year to 168.9 million, mainly due to video and music subscriptions. Tencent Video subscription counts were 96.9 million, up 30% year over year, benefitting from joint membership promotions with strategic partners and a popular Chinese anime series. During the 2018-2019 season of the NBA, 490 million Internet users in China watched one or more games on Tencent’s platforms.

- Online Advertising—Online advertising revenues were RMB16.4 billion, up 16% year over year, amid a challenging macro environment. Media advertising revenues were down year over year, due to delays in airing certain drama series and the absence of the World Cup.

- Fintech and Business Services—Within FinTech Services, commercial payments grew rapidly in terms of users, merchants, transaction volume and revenues. Within Business Services, cloud revenues grew robustly year over year as the company expanded its sales team and product offerings, as well as increasing its penetration of small and medium businesses through close partnerships with independent software vendors and resellers.