DIpil Das

[caption id="attachment_88013" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

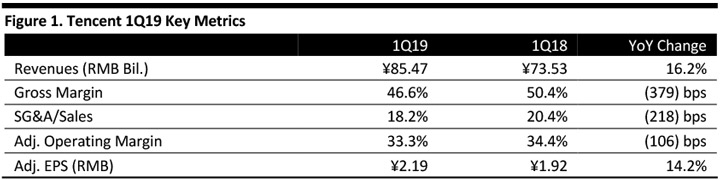

Tencent reported 1Q19 revenues of ¥85.47 billion (USD 12.4 billion), up 16.2% year over year and below the ¥88.41 billion consensus estimate.

Adjusted EPS was ¥2.19 (USD $0.32), up 14.2% year over year and beating the ¥1.99 consensus estimate. GAAP EPS was ¥2.84, up 16.8% year over year.

Adjusted EBITDA was ¥35.6 billion, up 15% year over year.

Capital spending was ¥4.5 billion, down 29% year over year.

Results by Segment

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Tencent reported 1Q19 revenues of ¥85.47 billion (USD 12.4 billion), up 16.2% year over year and below the ¥88.41 billion consensus estimate.

Adjusted EPS was ¥2.19 (USD $0.32), up 14.2% year over year and beating the ¥1.99 consensus estimate. GAAP EPS was ¥2.84, up 16.8% year over year.

Adjusted EBITDA was ¥35.6 billion, up 15% year over year.

Capital spending was ¥4.5 billion, down 29% year over year.

Results by Segment

Other highlights:

Other highlights:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

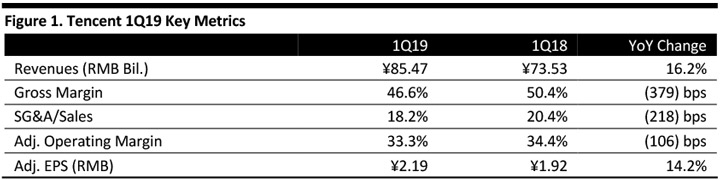

Tencent reported 1Q19 revenues of ¥85.47 billion (USD 12.4 billion), up 16.2% year over year and below the ¥88.41 billion consensus estimate.

Adjusted EPS was ¥2.19 (USD $0.32), up 14.2% year over year and beating the ¥1.99 consensus estimate. GAAP EPS was ¥2.84, up 16.8% year over year.

Adjusted EBITDA was ¥35.6 billion, up 15% year over year.

Capital spending was ¥4.5 billion, down 29% year over year.

Results by Segment

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Tencent reported 1Q19 revenues of ¥85.47 billion (USD 12.4 billion), up 16.2% year over year and below the ¥88.41 billion consensus estimate.

Adjusted EPS was ¥2.19 (USD $0.32), up 14.2% year over year and beating the ¥1.99 consensus estimate. GAAP EPS was ¥2.84, up 16.8% year over year.

Adjusted EBITDA was ¥35.6 billion, up 15% year over year.

Capital spending was ¥4.5 billion, down 29% year over year.

Results by Segment

- Value-Added Service (VAS) revenues were ¥49.0 billion, up 4.5% year over year.

- Online game revenues were ¥28.5 billion, flat year over year. Social network revenues were ¥20.5 billion, up 13% year over year, driven by higher digital content revenue from live broadcast services and video-streaming subscriptions.

- FinTech and Business Services revenues were ¥21.8 billion, up 43.5% year over year, driven by higher revenues from commercial payment and cloud services.

- Online advertising revenues were ¥13.4 billion, up 25.1% year over year.

- Social and online advertising revenues were ¥9.9 billion, up 34%, due to higher advertising revenue from Weixin Moments, Mini Programs and QQ KanDian.

- Media advertising revenues were ¥3.5 billion, driven by higher contributions from advertising on the Tencent News Service.

- Other revenues were ¥49.0 billion, up 69.9% year over year.

- Notable growth in the number of short videos uploads and shared by Weixin and QQ users.

- Reinvigoration of the game business with releases such as Perfect World Mobile (in China) and PUBG MOBILE internationally.

- Though in an early stage, the FinTech and cloud services are generating substantial revenues.

- The company is building solid foundations for the consumer and industrial internet domains.

- The growing need for digital payments and financial services from opportunities in the industrial internet.

- Synergies between new services and existing services, such as communication and social platforms and peer-to-peer payment services, and between Mini Programs and WeChat Work services.

- The scale and experience from substantial organic investments in these areas.

Other highlights:

Other highlights:

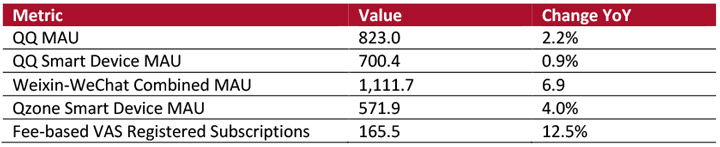

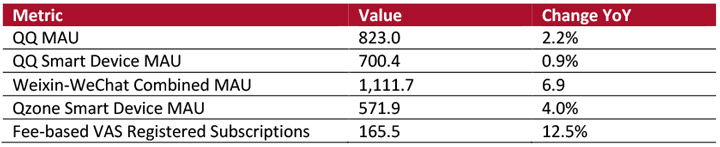

- Communications and Social—Users become more engaged with the QQ platform and their MAU grew by double digits. China Internet users are increasingly using Weixin’s and QQ”s in-app camera functions to record short videos, which they share in chats, group chats and timelines.

- Online Games—Cash receipt for games grew 10% year over year, however reported revenues decreased 1% due to the company’s revenue deferral policies. Smartphone game revenues (including games and revenues attributable to social networks) were ¥21.2 billion, down 2% year over year due to fewer new game releases.

- Digital Content—Tencent video subscriptions were 89.0 million, up 43% year over year, driven by popular self-commissioned IP content.