Source: Company reports/FGRT

3Q17 Results

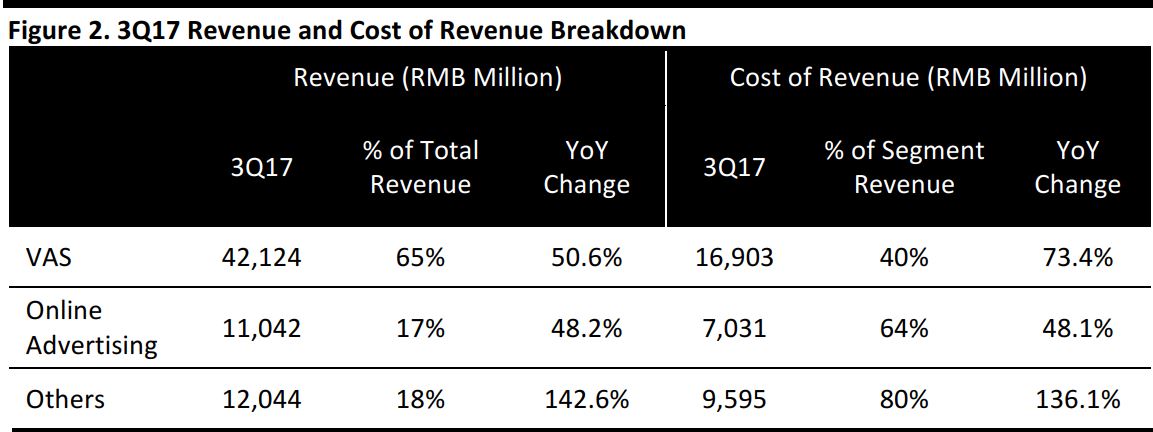

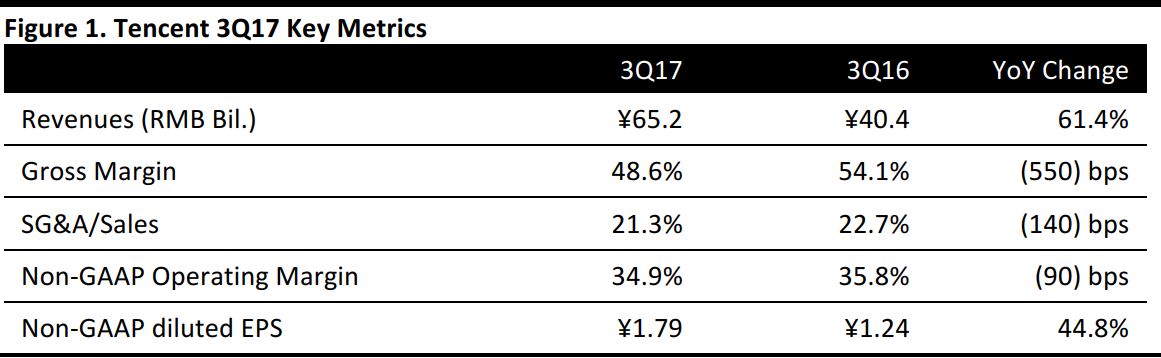

Tencent reported total revenues for 3Q17 of ¥65.2 billion ($9.8 billion), up 61.4% year over year, beating the consensus estimate of ¥61.0 billion. The gross margin decreased to 48.6% from 54.1% a year ago, and non-GAAP diluted EPS was ¥1.79 ($0.27), up 45.0% year over year.

Segment Operations Breakdown

Source: Company reports/FGRT

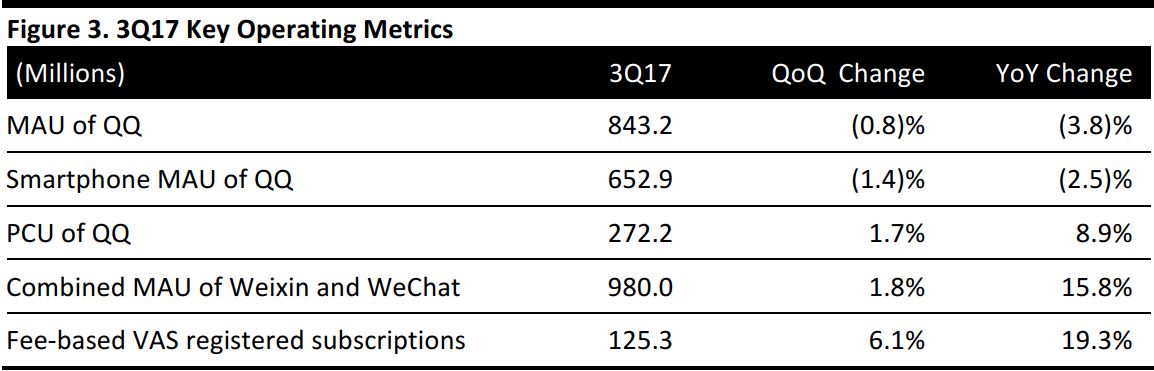

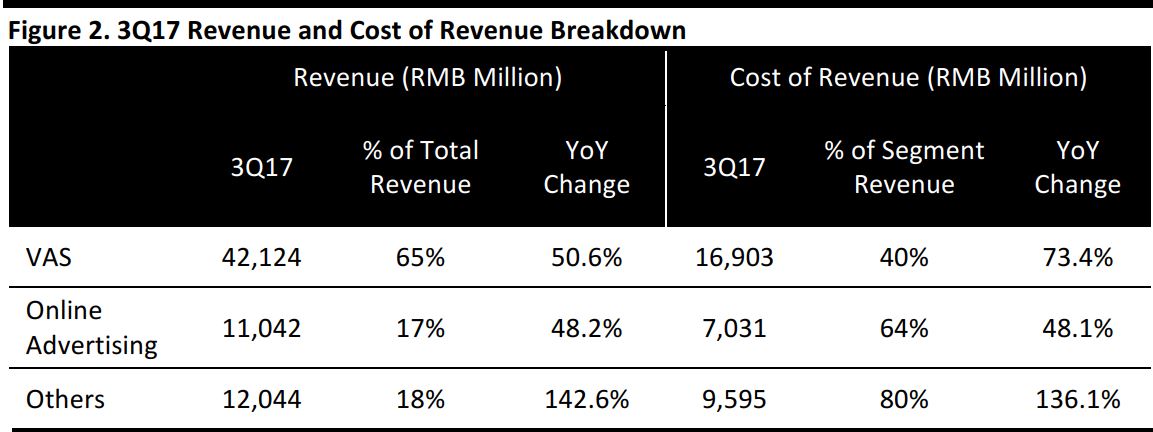

Below, we outline the performance of VAS, online advertising and other segments.

Value-added service (VAS): Revenues for this segment were ¥42.1 billion for the quarter, up 50.6% year over year, and comprised 65% of total revenues. Within VAS, online games revenues increased 47.7% year over year to ¥26.8 billion, driven by higher revenue from both PC games (e.g., Dungeon & Fighter and League of Legends) and smartphone games (e.g., Honor of Kings, Contra Return, Tian Long Ba Bu, Legend of XuanYuan Mobile and Journey to the Fairyland Mobile). Social network revenues increased by 56% year over year to ¥15.3 billion, driven mainly by digital content services such as live broadcasts and subscription video on-demand, as well as from in-game virtual-item sales.

Online advertising: Revenues for online advertising were ¥11.0 billion for the quarter, up 48.2% year over year, and comprised 17% of total revenues. Media advertising revenues increased by 29% to ¥4.1 billion, primarily due to growth in revenues from mobile media platforms such as Tencent Video. Social and others advertising revenues grew by 63% to ¥6.9 billion, reflecting higher advertising revenues derived from Weixin.

Others: Revenues for the others segment were ¥12.0 billion, up 142.6% year over year, reflecting revenue growth from payment-related and cloud services.

Costs and Margin Performance

Tencent’s gross margin slipped to 48.6% in 3Q17 from 54.1% a year ago, and the operating margin also decreased to 34.9% from 35.8% in 3Q16. The squeeze in gross margin was due mainly to greater sharing and content costs, the costs of payment-related services, as well as channel costs for smartphone games, which increased as a result of extended cooperation with third-party app stores.

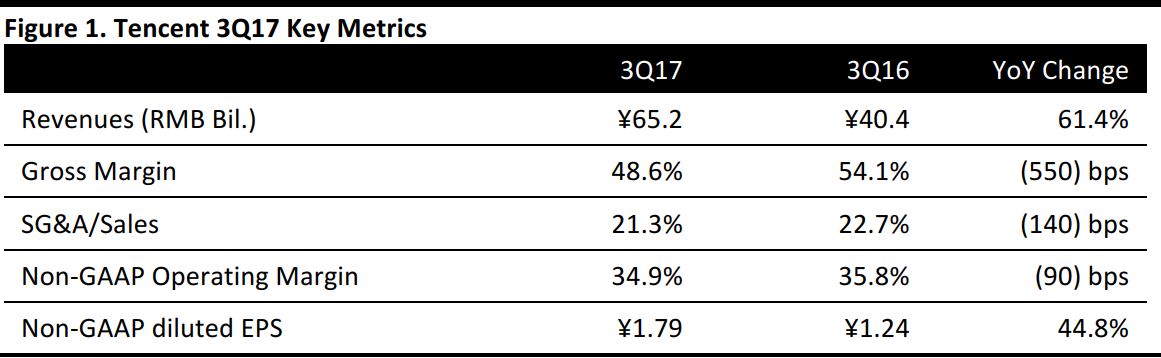

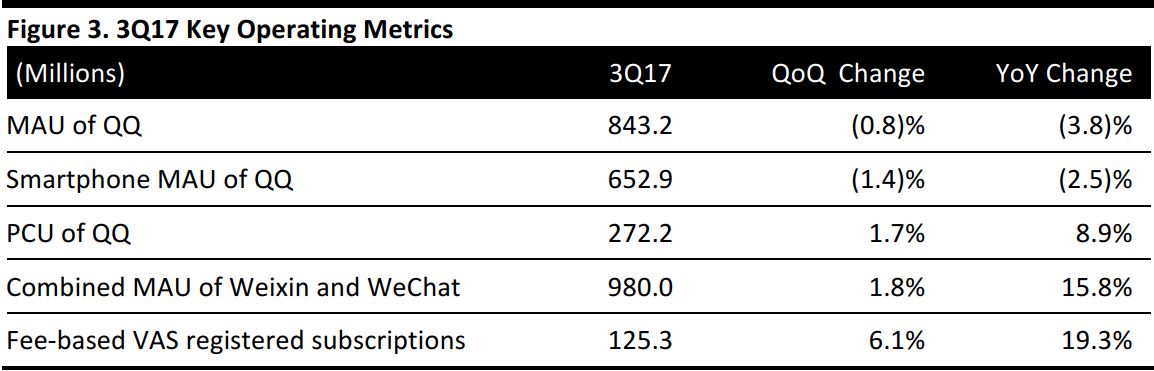

Performance of Operating Drivers

Source: Company reports/FGRT

Management Comments and Strategy

Management made the following comments in the earnings release and during the earnings call.

WeChat Moment Advertising

Management explained that the revenue growth is the result of improved technology for targeting users and an increased presence in local markets, which allow smaller advertisers to target a smaller group of users.

Mobile Payment

Management mentioned that it prefers to cooperate with local expertise for Tencent’s overseas expansion. Since local players have already established a payment-related ecosystem and finance-related businesses are heavily regulated, it makes sense to pursue a partnership strategy.

Cloud and AI

Management emphasized several key ways in which its “AI in all” strategy can help improve its existing business.

- AI can help the content business by providing better recommendations to users; the advertising business by better targeting customers; and the financial business by catering offers and analyzing credit worthiness.

- By making AI technology available through cloud services to all of its partners and industry customers, Tencent believes it can help them become more efficient and understand their users and data better.

New Emerging Gaming Genres

Management is excited to see survival-genre shooter games taking off, driven mainly by PlayerUnknown’s Battlegrounds (PUBG), which is a survival and battle royale-style, first-person shooter game that has sold 20 million copies worldwide. Tencent released a survival shooter expansion pack called Deserted Island for its CrossFire Mobile game on November 15. The company will also release a new survival shooting title, Glorious Mission, in late November. Each of these titles have already accumulated over 20 million registrations within their first week of availability.

Digital Content Expansion

Management reiterated its strategy to expand Tencent’s content catalogue while investing heavily to increase its talent pool and accumulate a key IP collection. Internally, the company has established production teams comprising producers, screenwriters and editors, and introduced a review mechanism to better manage the selection and production of original content. Externally, Tencent has invested in a number of leading studios specialized in producing different content genres.