Source: : CCompany reports

3Q16 RESULTS

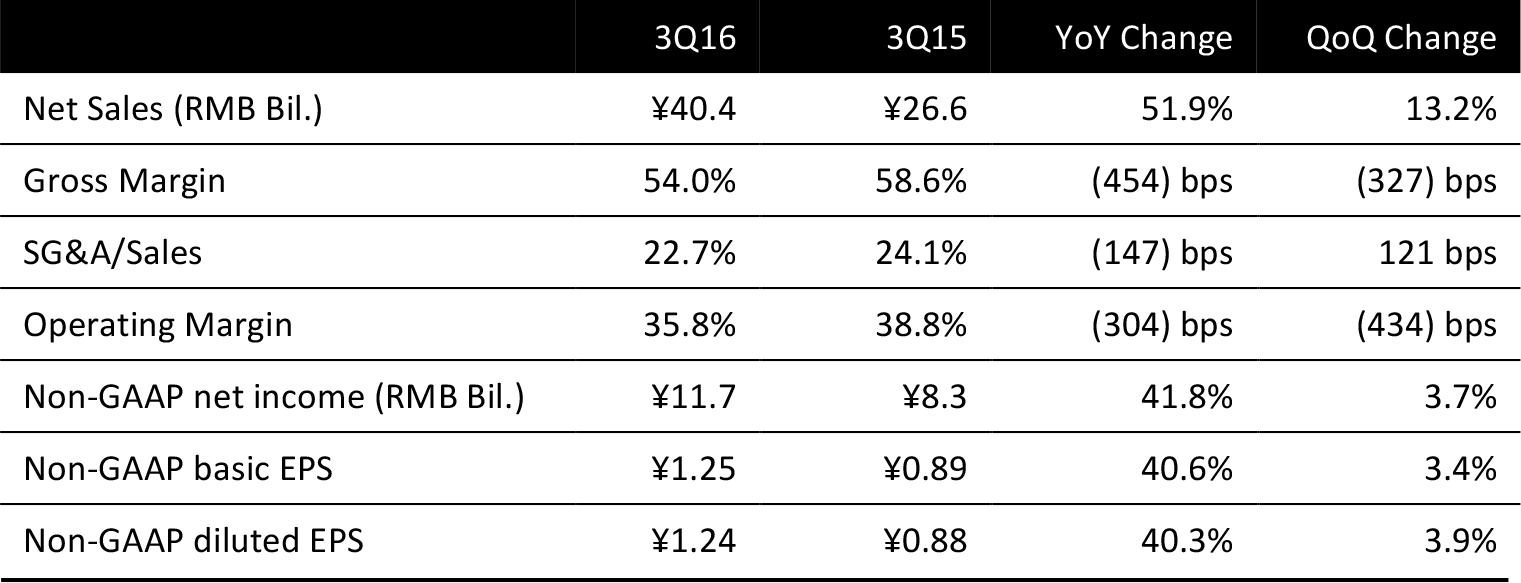

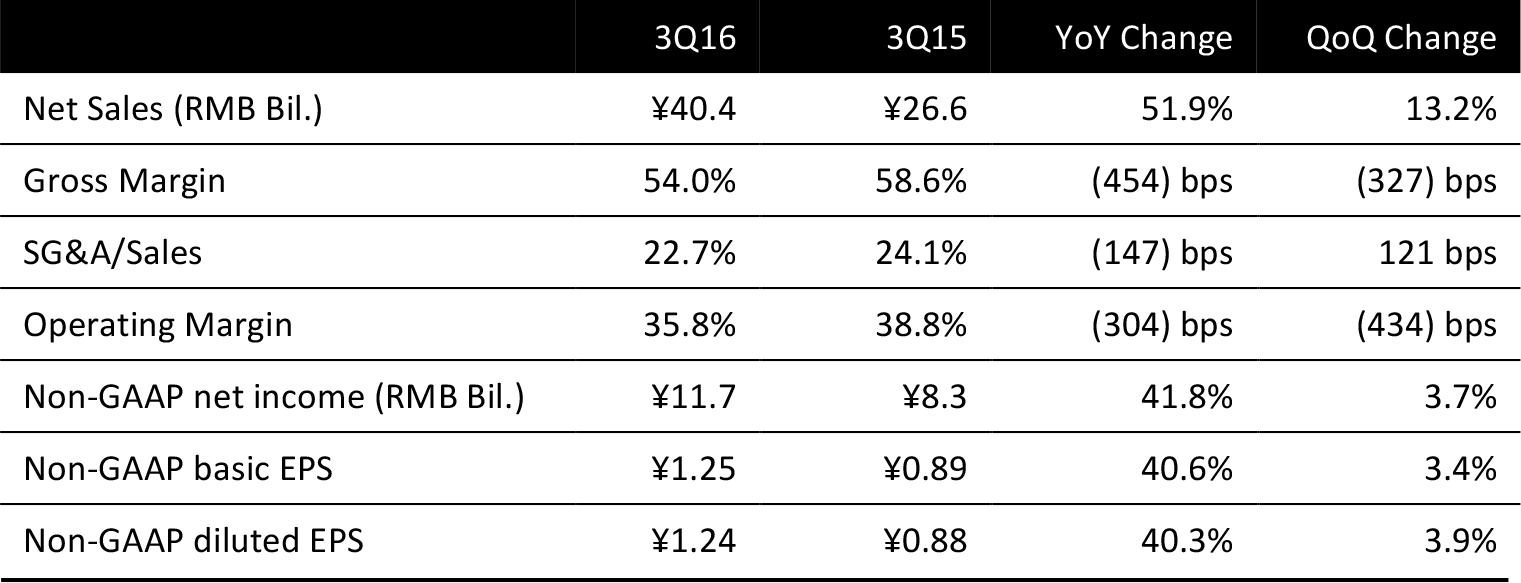

Tencent reported third-quarter total revenues of ¥40.4 billion, up 51.9% year over year. Operating margin decreased to 35.8% from 38.8% a year ago, due in part to investments in in the payment and cloud business. Non-GAAP diluted EPS was ¥1.24, up 40.3% year over year. GAAP diluted EPS was ¥1.12, up 41.5% from the year-ago quarter.

SEGMENT OPERATIONS BREAKDOWN

3Q total revenue of ¥40.4 billion was up 51.9% year over year. Below, we outline the performance of value-added service, online advertising and other segments.

Value-added service (VAS): Revenue was ¥28.0 billion, up 36% year over year, and comprised 69% of total revenue. Within VAS, online games revenue increased 27% year over year to ¥18.2 billion, driven by player-versus-player (PvP) and RPG genre smartphone games as well as major PC titles. Social networks revenue increased by 58% year over year to ¥9.8 billion, driven mainly by higher revenues from digital-content subscription services and virtual-item sales.

Online advertising: Revenue for this segment was ¥7.4 billion, up 51% year over year, and comprised 18% of total revenue. Performance-based advertising revenues increased by 83% year over year to ¥4.4 billion, due to higher contributions from advertising revenues derived from Weixin Moments, Tencent mobile news app and Weixin Official Accounts.

Other: Revenue was ¥5.0 billion, up 348% year over year, reflecting revenue growth from payment-related and cloud services.

COSTS AND MARGIN PERFORMANCE

Tencent’s gross margin slipped to 54.0% in 3Q16 from 58.6% a year ago, and the operating margin also decreased to 35.8% from 38.8% in 3Q15. The squeeze in margin was mainly due to investments into new businesses, including payments and cloud. SG&A costs as a percentage of revenue declined to 22.7% in 3Q16 from 24.1% in 3Q15.

PERFORMANCE OF OPERATING DRIVERS

During the quarter:

- QQ had 877 million monthly active user (MAU) accounts, up 2% year over year.

- QQ’s smart device MAU was 647 million, up 1% year over year.

- The combined MAU accounts of Weixin and WeChat were 846 million, up 30% year over year.

- Fee-based VAS registered subscriptions numbered 105 million, up 19% year over year.

OUTLOOK

In the future, Tencent plans to:

- Launch a new Weixin function called Mini Programs, whereby users will enjoy a native-app-like experience without leaving the Weixin interface.

- Ramp up investments in infrastructure platforms, especially cloud and payment services, to support the company’s ecosystem as well as content to engage users.

- Focus more on providing better tools such as interactive advertising formats and advertising performance measurements to utilize the existing ad inventory more efficiently.

- Shift the engagement focus for PC games away from maximizing user time spent in the game to broadening overall user engagement.

The company will continue to invest in games, cloud, payments, security and app-installment promotions to provide a wider ecosystem for user engagement.