Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

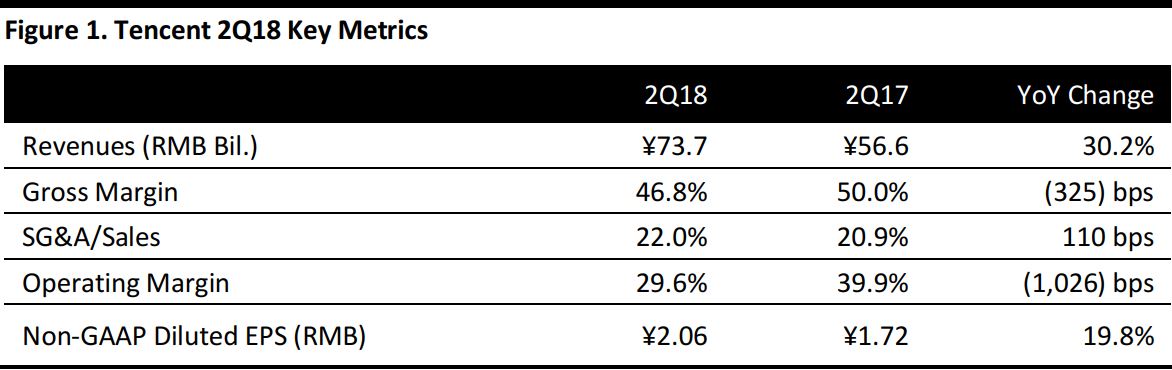

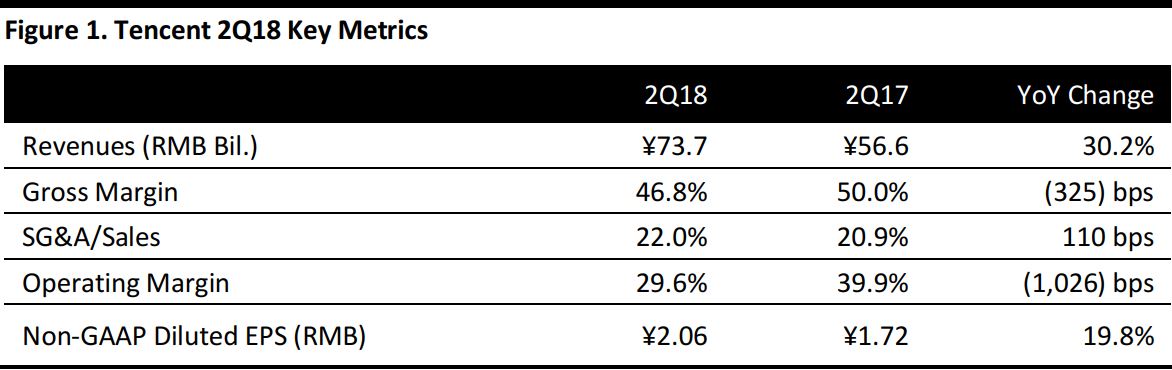

2Q18 Results

Tencent reported total revenues for 2Q18 of ¥73.7 billion ($11.1 billion), up 30.2% year over year. The gross margin decreased by 300 basis points to 47% from 50% a year ago. Non-GAAP diluted EPS was ¥2.06, up 19.8% year over year. Below, we outline the performance of VAS, online advertising and other segments.

Value-added services (VAS): Revenues were ¥42.1 billion for the quarter, up 14.3% year over year, and comprised 57% of total revenues. Within VAS, online games revenues increased by 6% year over year to ¥25.2 billion, mainly driven by smartphone games such as Honor of Kings and QQ Speed Mobile. Revenues from PC games were down by 5% year over year. Social network revenues increased by 30% year over year to ¥16.9 billion, driven mainly by digital content services such as video streaming subscriptions and live broadcast services.

Online advertising: Revenues for this segment were ¥14.1 billion for the quarter, up 39.0% year over year, and comprised 19% of total revenues. Media advertising revenues increased by 16% to ¥4.7 billion, primarily due to growth in revenues from Tencent Video, which consists of a wider content portfolio such as the variety show Produce 101 and a sequential increase in advertising sponsorships. Social and other advertising revenues grew by 55%, reflecting an expanded advertiser base boosting advertising fill rates in Weixin Moments and Mini Programs, higher cost per click for the mobile advertising network and enhanced traffic and monetization for the QQ KanDian news feed.

Others: Revenues for the others segment were ¥17.5 billion, up 81.2% year over year, reflecting revenue growth from payment-related and cloud services.

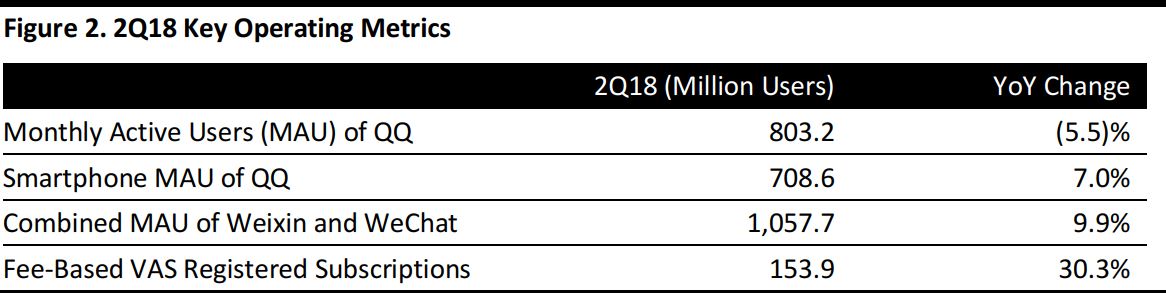

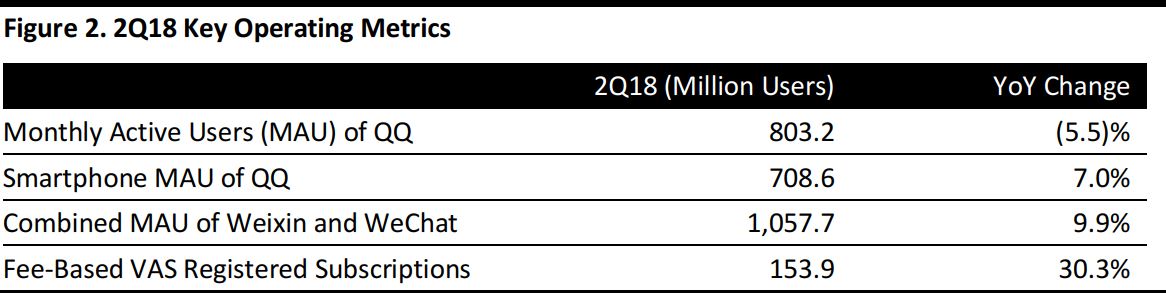

Performance of Operating Drivers

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Combined monthly active users (MAU) of Weixin and WeChat rose by 9.9% year over year. Thanks to the fast growth of Mini Programs and Weixin Pay use cases, daily active users (DAU) grew at a quicker rate than MAU, showing greater user engagement and stickiness. Continued growth of DAU in mobile games is conducive to gaming development in the near future.

Outlook

Management seeks to enhance mobile game revenue growth by increasing engagement with existing major titles, monetizing tactical tournament games, widening the range of high-ARPU games and launching China-developed games internationally. The monetization per DAU for gaming should be positive, given the increase in DAU.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Source: Company reports/Coresight Research

Source: Company reports/Coresight Research