Source: Company reports

2Q 2016 RESULTS

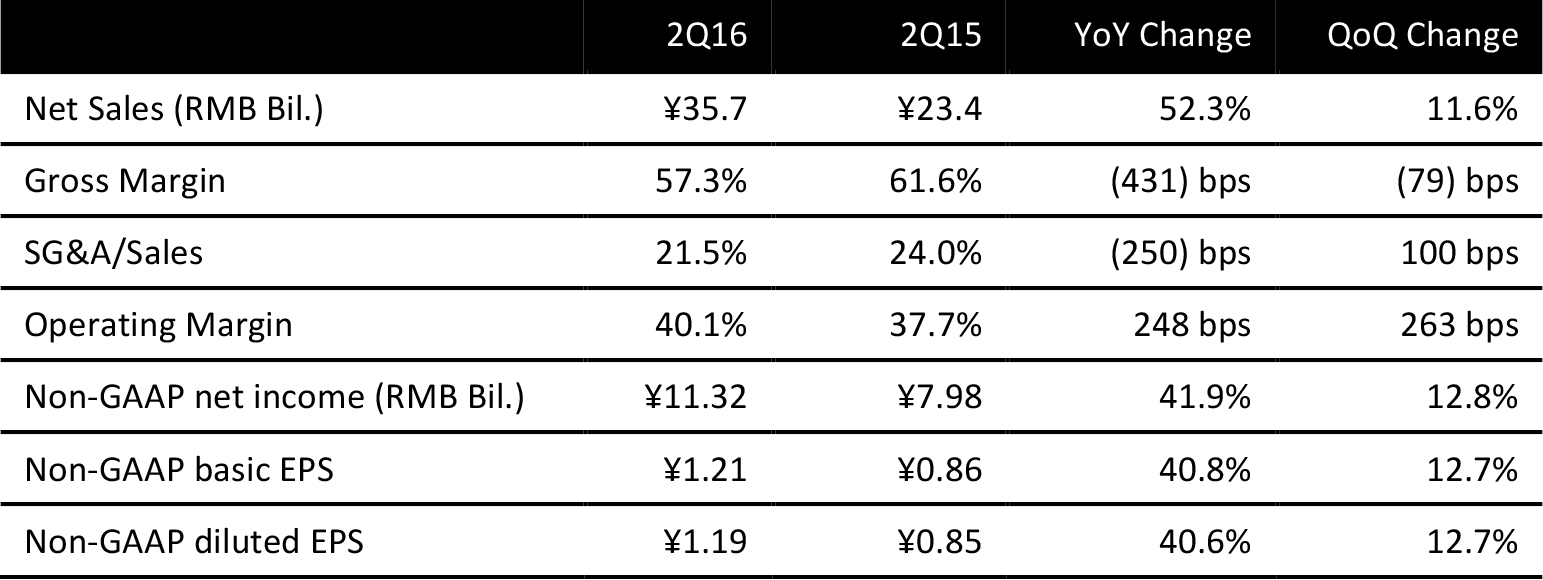

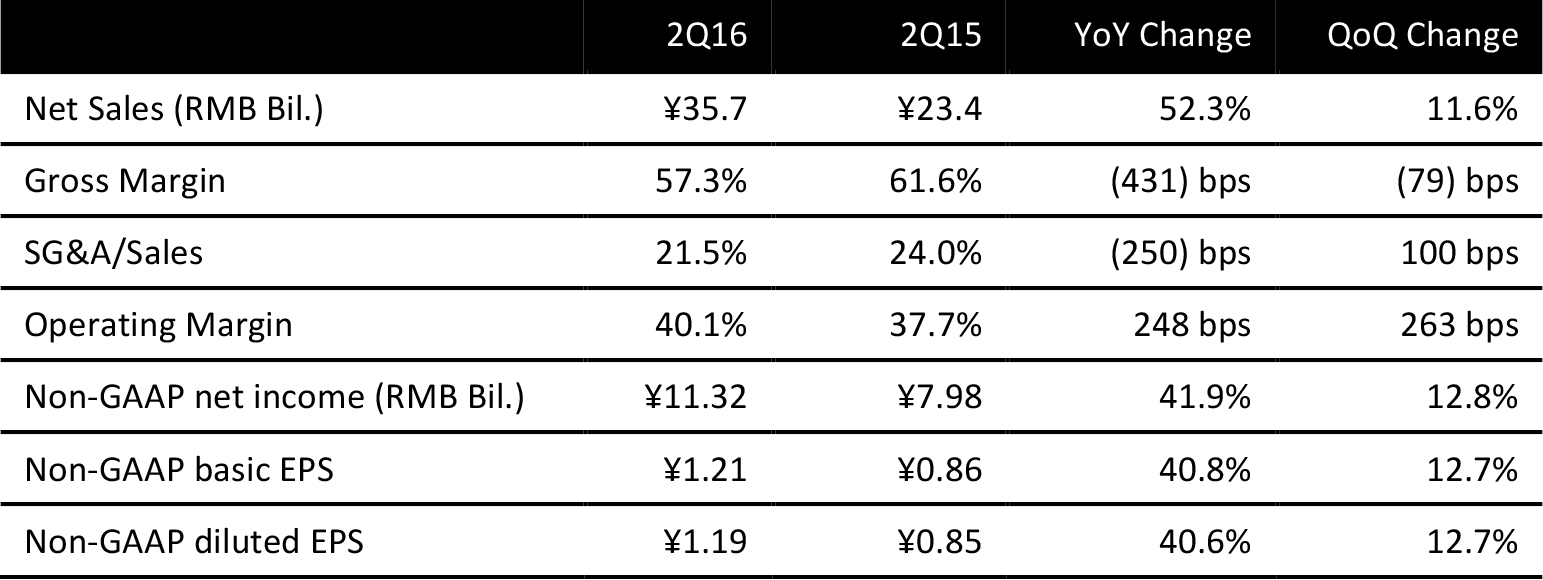

Tencent reported second-quarter total revenues of ¥35.7 billion (US$5.37 billion), up 52.3% year over year and beat consensus forecast by 7%. The company’s operating margin increased to 40.1% from 37.7% a year ago. Non-GAAP diluted EPS was RMB1.19, up 41% year over year and beat consensus forecast by 9%. GAAP diluted EPS was ¥1.13, up 46% from the year-ago quarter. The second-quarter earnings did not include the acquisition of an 84% equity interest in Supercell, which is expected to be completed by the end of 2016.

SEGMENT OPERATIONS

Second-quarter total revenue of ¥35.7 billion was up 52.3% year over year. First-half 2016 revenue of ¥67.7 billion is tracking broadly in line with the consensus estimate for full-year revenue of ¥141.3 billion

Value added service (VAS) segment revenue was ¥25.7 billion, up 39.4% year over year and comprised 72% of total revenue. Within VAS, online games revenue increased 32% year over year to RMB17.1 billion, driven by contributions from new mobile game launches. Social networks revenue increased 57% year over year to RMB8.6 billion on the back of improved digital content subscription services, QQ membership subscription services and virtual item sales.

Online Advertising segment revenue was ¥6.5 billion, up 60.4% year over year and comprised 18% of total revenue. The year-over-year increase reflects a larger advertiser base, higher traffic and improved monetization because Tencent added new advertising formats. Approximately 80% of advertising revenues were generated on mobile platforms.

Other segment revenue was ¥3.5 billion, up 274.9% year over year.

COSTS AND MARGIN PERFORMANCE

The firm’s gross margin slipped to 57.3% in 2Q 2016 from 61.6% a year ago, due to higher sharing, and content and channel costs. The firm’s operating margin still increased to 40.1% in 2Q 2016 from 37.7% in 2Q 2015. This was due to a lower-than-expected increase in general and administrative expenses, which more than offset the increase in sales and marketing expense. As a percentage of revenue, SG&A costs declined to 21.5% in 2Q 2016 from 24% in 2Q 2015.

PERFORMANCE OF OPERATING DRIVERS

During the quarter:

- QQ had 899 million monthly active user (MAU) accounts, up 7% year over year.

- QQ’s smart device MAU was 667 million, up 6% year over year.

- The combined MAU accounts of Weixin and WeChat were 806 million, up 34%.

- Fee-based VAS registered subscriptions numbered 105 million, up 25%.

UPDATE ON SUPERCELL ACQUISITION

On June 21, 2016, Tencent announced it would pay US$7.8 billion to acquire a 84.3% equity stake in Supercell, a Finnish mobile game developer. The acquisition is expected to be completed by the end of 2016, and Tencent is in discussions with potential co-investors to form an investment consortium.

Outlook

In the future, the company plans to:

- Invest in and develop its mobile ecosystem for Weixin and Mobile QQ, and further enhance its enterprise communication products.

- Strengthen its smartphone game portfolio by leading a consortium to acquire an 84% equity stake in Supercell, leveraging PC game IPs and launching new genres.

- Reinforce online video business’ upstream presence with additional investments in film/TV series studios and its own production projects.

- Grow its digital content businesses, including online video, music and literature. The company integrated QQ Music with China Music Corporation, a leading music streaming platform in China.