Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

1Q18 Results

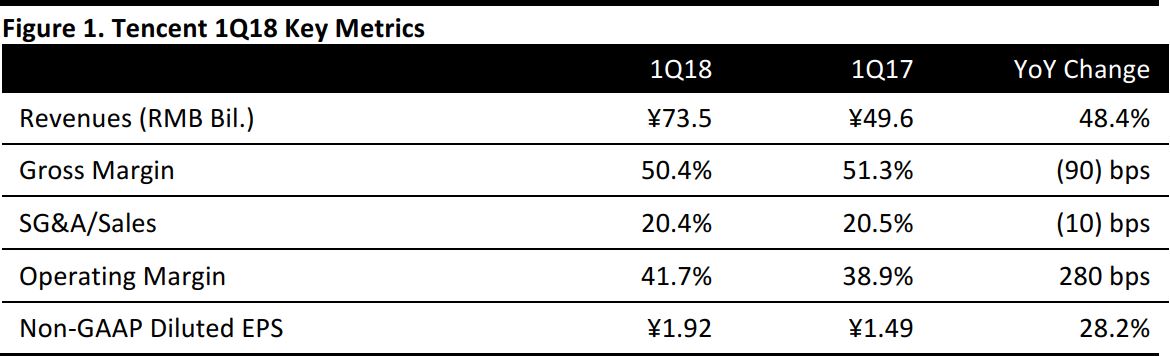

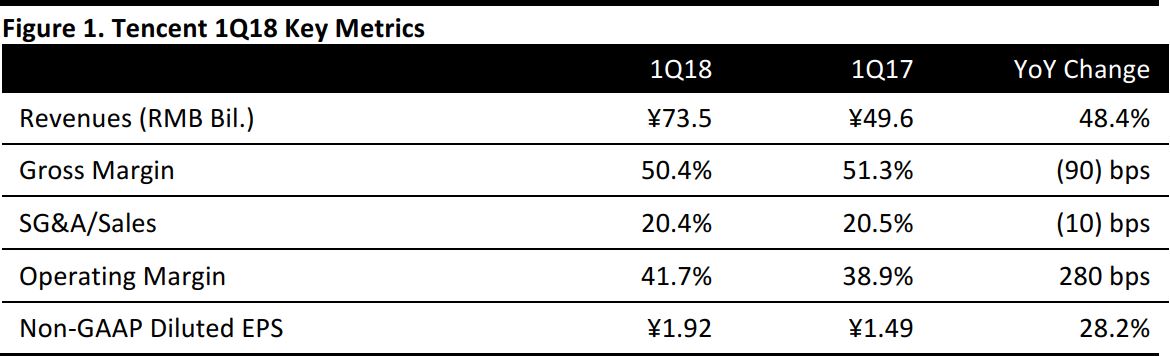

Tencent reported total revenues for 1Q18 of ¥73.5 billion ($11.7 billion), up 48% year over year. The gross margin decreased slightly by 90 basis points to 50.4% from 51.3% a year ago. Non-GAAP diluted EPS was ¥1.92, up 28.2% year over year. Below, we outline the performance of VAS, online advertising and other segments.

Value-added services (VAS): Revenues were ¥46.9 billion for the quarter, up 33.5% year over year, and comprised over 60% of total revenues. Within VAS, online games revenues increased by 26% year over year to ¥28.8 billion, mainly driven by strong revenue growth from smartphone games, including existing titles such as Honour of Kings and newly launched titles such as MU Awakening and QQ Speed Mobile.Revenues from PC games were broadly stable. Social network revenues increased by 47% year over year to ¥18.1 billion, driven mainly by digital content services such as live broadcast and video streaming subscriptions, as well as its music service, namely WeSing.

Online advertising: Revenues for this segment were ¥10.7 billion for the quarter, up 55% year over year, and comprised 23% of total revenues. Media advertising revenues increased by 31% to ¥3.3 billion, primarily due to growth in revenues from Tencent Video, due to an increase in video views and new ad formats within original productions.Social and other advertising revenues grew by 69% to ¥7.4 billion, reflecting an expanded advertiser base boosting advertising fill rates in Weixin Moments and higher cost per click for the mobile advertising network.

Others: Revenues for the others segment were ¥16.0 billion, up 111% year over year, reflecting revenue growth from payment-related and cloud services.

Performance of Operating Drivers

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

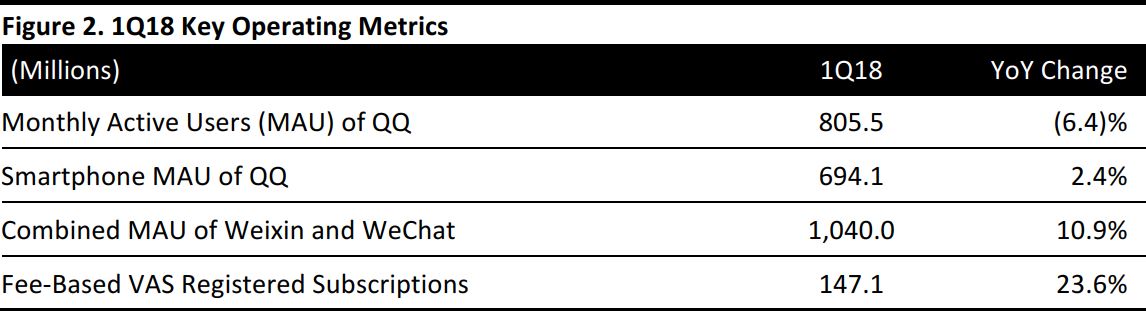

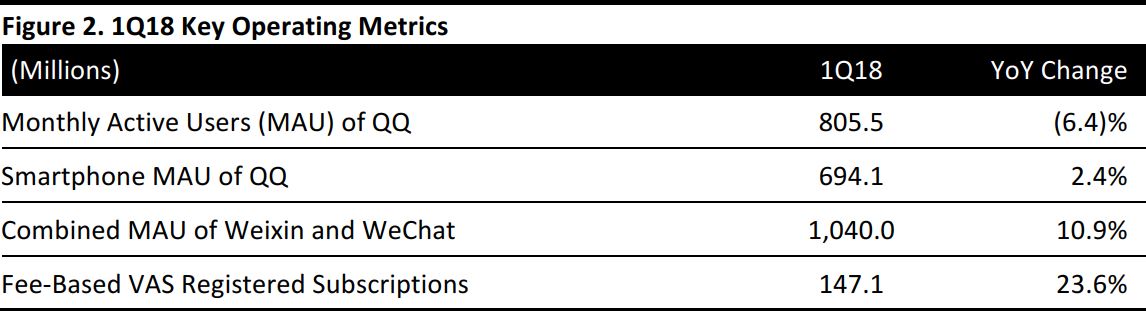

1 monthly active users (MAU) of Weixin and WeChat surpassed the 1 billion mark in 1Q18. The social media and instant messaging app continue to deepen user engagement, particularly by enhancing the capabilities of Tencent’s mini programs. We see strong monetization potential from the top Chinese social media app for years to come.

Outlook

Management has not provided guidance for the coming quarters. Ma Huateng, Chairman and CEO of Tencent, commented that the company will continue to invest in improving its own products as well as enabling services for its partners, in order to fulfill the company mission of enhancing the quality of life through Internet services.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Source: Company reports/Coresight Research

Source: Company reports/Coresight Research