Source: Company reports

1Q17 Results

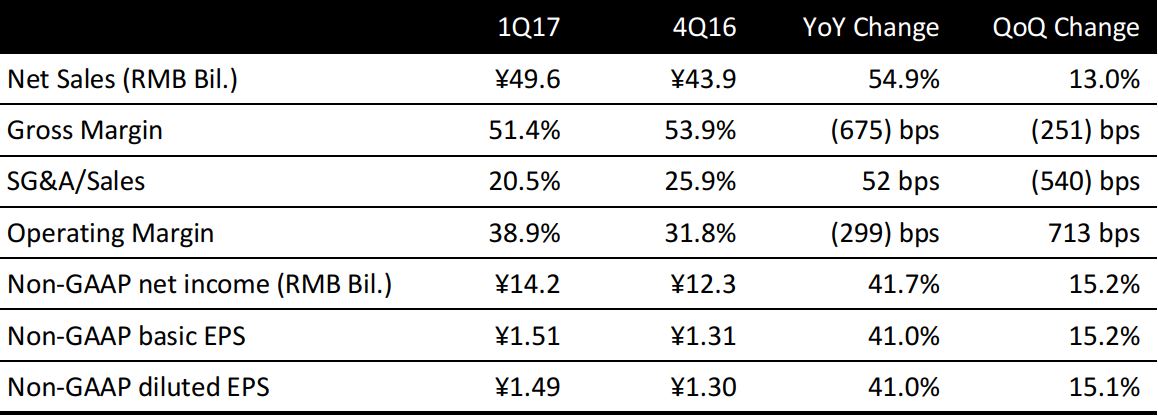

Tencent reported total revenues for 1Q17of ¥49.6 billion ($7.2 billion), up 54.9% year over year, beating the consensus estimate of ¥46.4 billion by 6.5%. The gross margin decreased to 51.4% from 58.1% a year ago. Non-GAAP diluted EPS was ¥1.49 ($0.22), up 41.0% year over year.

Segment Operations Breakdown

Source: Company reports/Fung Global Retail & Technology

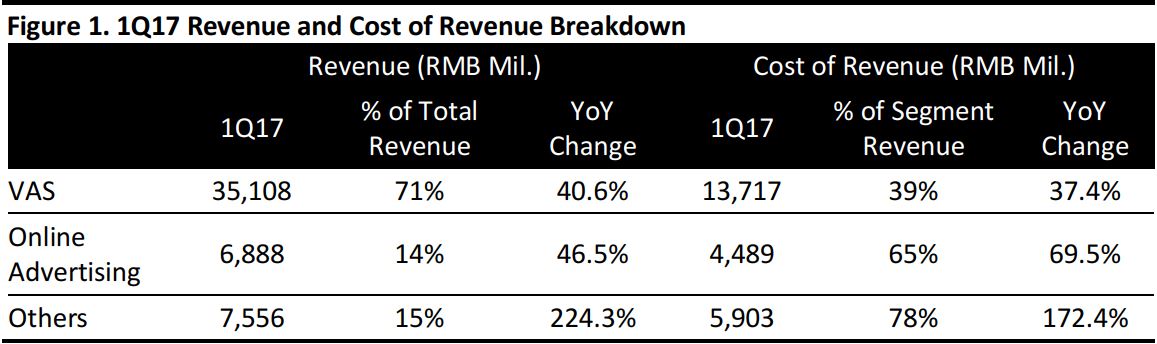

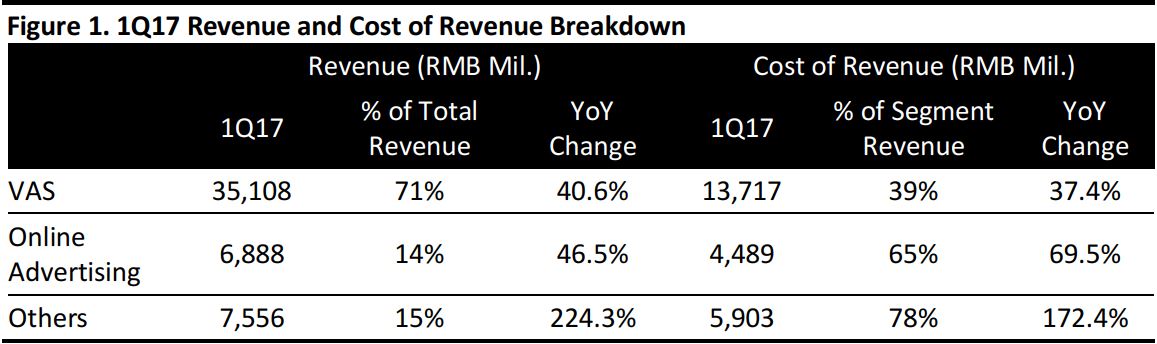

Total revenues of ¥49.6 billion for 1Q17 were up 54.9% year over year. Below, we outline the performance of VAS, online advertising and other segments.

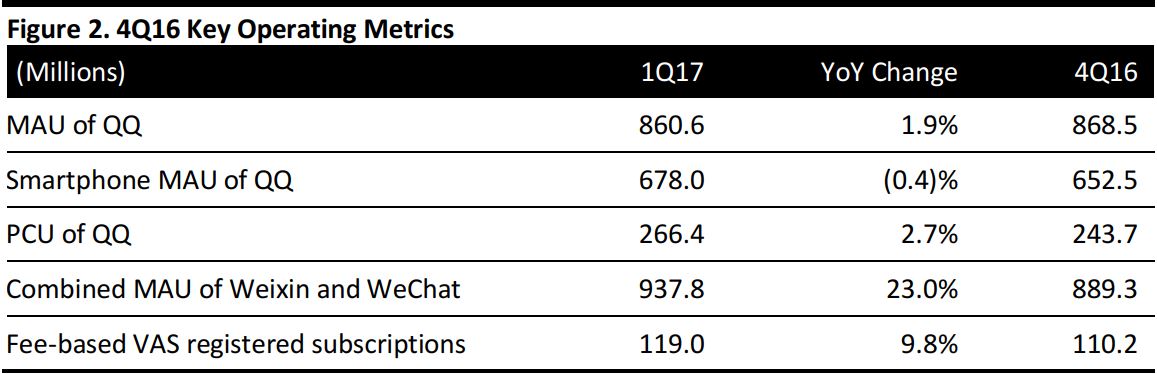

Value-added service (VAS): VAS Revenues were ¥35.1 billion for the quarter, up 40.6% year over year, and comprised 71% of total revenue. Within VAS, online games revenues increased 33.5% year over year to ¥22.8 billion, driven by higher revenue from both PC games (e.g.,League of Legends) and smartphone games (e.g., Honor of Kings). Revenue from PC games grew 24% year over year, due to the Chinese New Year Promotion and seasonal expansion pack, while smartphone games increased by 57% year over year, mainly due to an expanded number of paying users. Social network revenues increased by 56.1% year over year to ¥12.3 billion, driven mainly by revenue growth in digital-content services including the digital music, video and literature business, and virtual item sales.

Online advertising: Revenues for this segment were ¥6.9 billion for the quarter, up 46.5% year over year, and comprised 14% of total revenue. A decrease of 16.9% quarter over quarter reflects the weaker seasonality on advertisers’ spending in the first quarter. Online advertising revenues are being reclassified by advertising properties, which includes media advertising revenues and social and other advertising revenues. Media advertising revenues increased by 20% year over year to ¥2.5 billion, driven mainly by revenue growth in the mobile media platform, Tencent News and Tencent Video. Social and other advertising revenues increased by 67% year over year to ¥4.4 billion, driven by higher advertising revenues from Weixin Moments, Weixin Official Accounts, the app store and mobile browser.

Others: Revenues for the others segment were ¥7.6 billion, up 224.3% year over year, reflecting revenue growth from payment-related and cloud services.Management continued to reiterate cloud and payment services as key infrastructure for the ecosystem and, therefore, will continue to invest heavily in these areas.

Costs and Margin Performance

Tencent’s gross margin slipped to 51.4% in 1Q17 from 58.1% a year ago, and the operating margin also decreased to 38.9% from 41.9% in 1Q16. The squeeze in gross margin was mainly due to the increased contribution from other segments, which is of a lower margin, but now comprises 15% of total revenue, and also a decrease in VAS gross margin, primarily driven by a change of revenue mix.

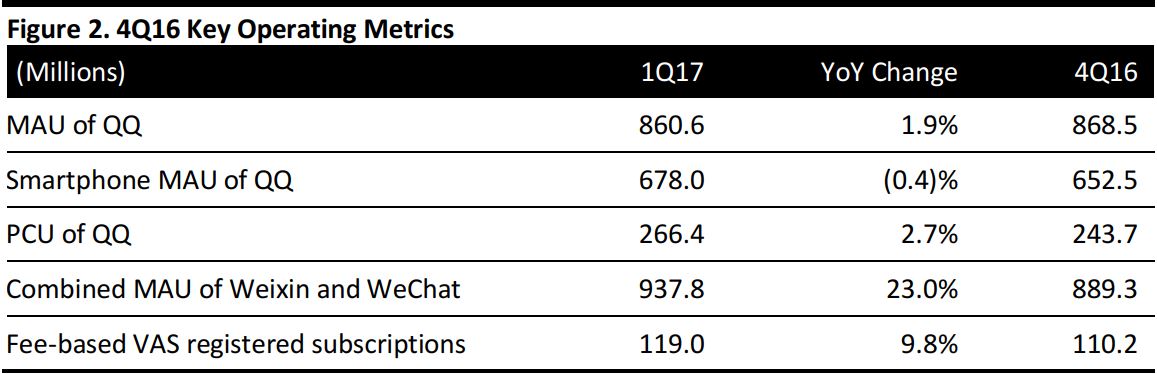

Performance of Operating Drivers

Source: Company reports/Fung Global Retail & Technology

Management Comments

Management is optimistic about the outlook for 2017.

Gaming as a Priority

The company continues to put its gaming business as the no.1 priority. Management hinted at launching self-developed games in the overseas market, but cautioned that the process would require time. Honor of Kings continued to be one of the most successful mobile games ever launched, with the largest number of DAU among global mobile games. The success of this game has mainly been driven by its popular game format and Tencent’s ability to overcome latency in mobile networks. Despite its success, management believes Honor of Kings is still early in its lifecycle and the company will continue to invest and add features to the game.

Cloud and AI Business

The cloud and AI business are regarded as core infrastructure in the Internet age, as reiterated by management. Tencent’s cloud business is currently focusing on the Chinese market, which, at a later stage, it hopes can leverage on the global presence of its Chinese customers to scale overseas. Management also remarked that sales and marketing for cloud services has room to grow and that it will remain a top priority within this segment. Management also commented on the recent investment in Tesla as a chance for Tencent to improve its cloud and AI technology in the field of automobiles—management believes the car is becoming a connected smart device.