The Tenant of the Future - A Global View

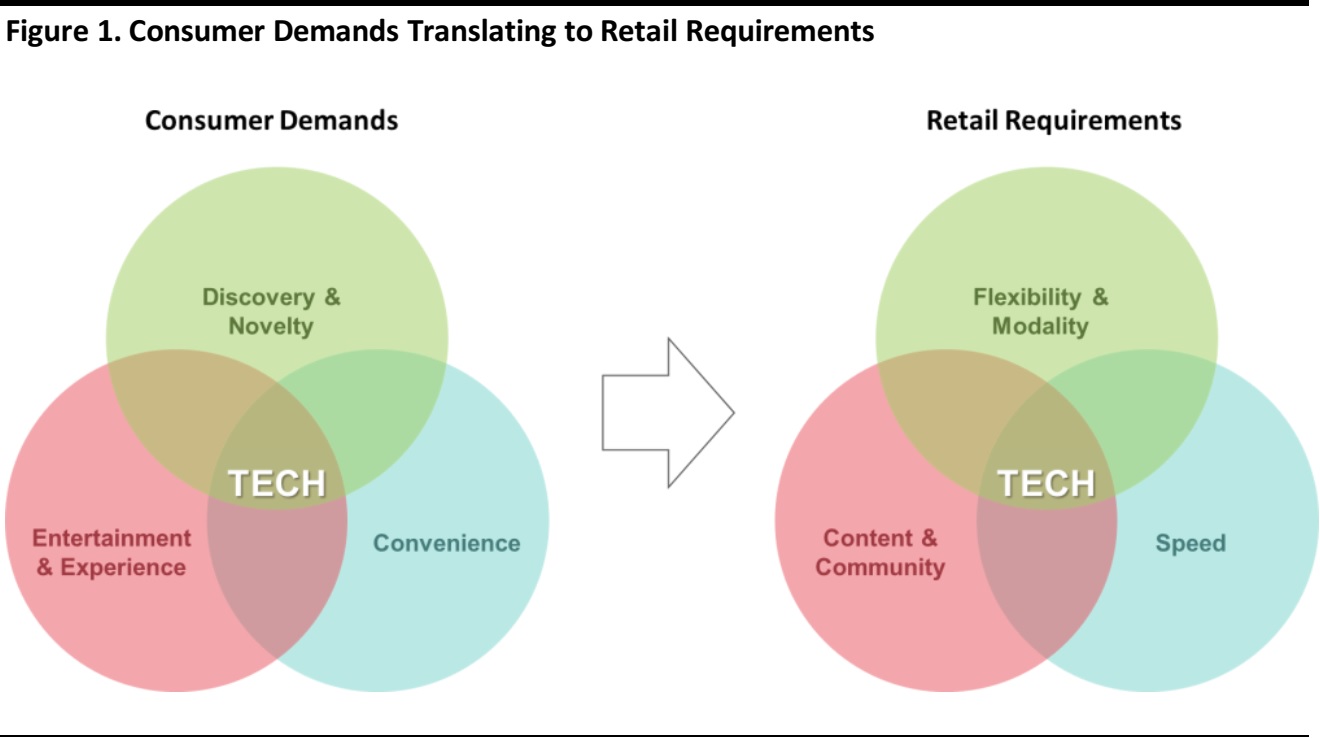

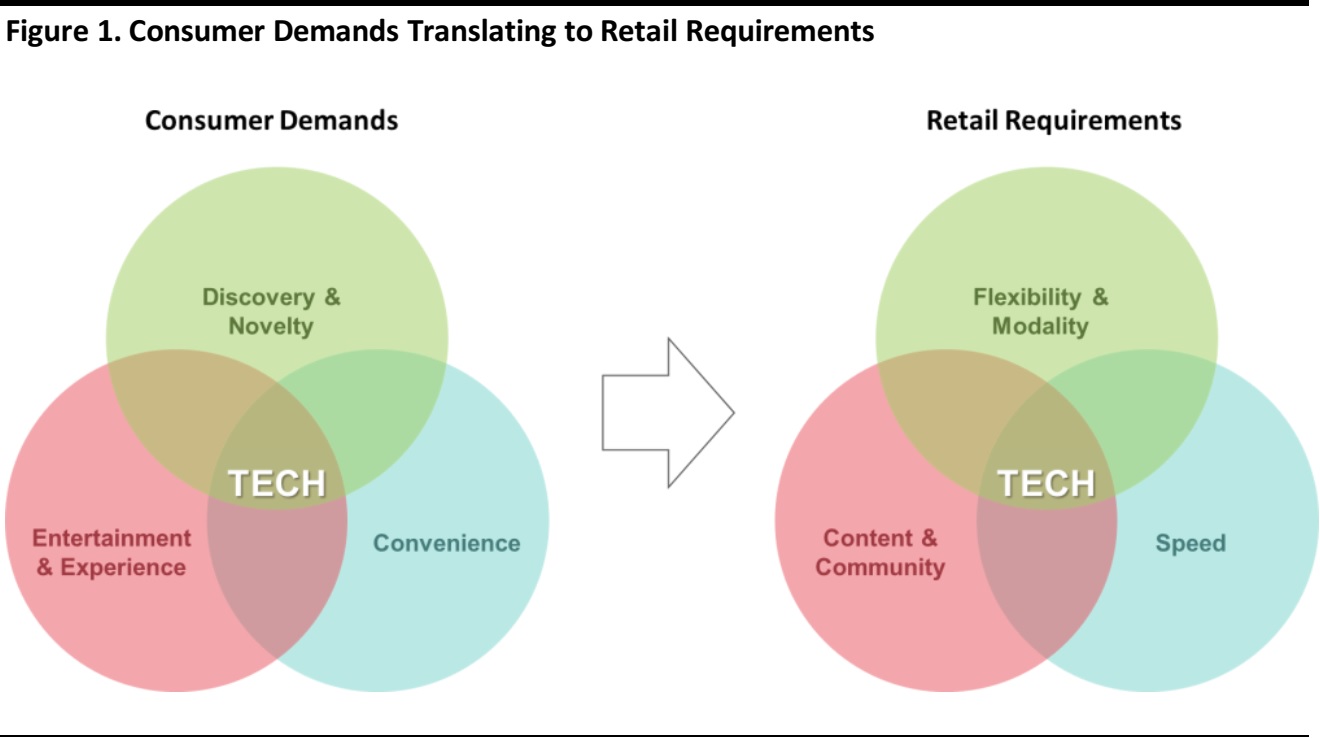

The expectations of today’s shoppers are constantly evolving, calling for different retail experiences and for retailers and shopping centers to reinvent themselves. Consumers today shop via multiple channels, and they look to social media influencers, mobile devices and computers to help inform their decisions and purchases. Shopping centers globally are experiencing a metamorphosis as a result, becoming places were people go for dining, entertainment, fitness, health, information and education. High streets are also becoming more diverse, with pop-ups and multi-purpose spaces on the rise in major markets.

While technology is impacting consumer behavior and retail business models, the drivers behind the evolution of tenants occupying shopping centers and high streets are certainly more complex. Below, we examine two major drivers of the change: the blurring between online and offline and the segmentation of the shopping experience between convenience and experience.

Trend Drivers

New Retail: Online Going Offline

New Retail, the term coined by Alibaba Founder Jack Ma, is the integration of online, offline, logistics and data across a single value chain. The pursuit of New Retail strategies has seen retailers such as Alibaba and JD.com in China move from being online-only companies to establishing physical retail footprints, and analogously, in the US, Amazon has moved offline by opening bookstores, pop-ups and, with the acquisition of Whole Foods, into the grocery space. In addition, digitally-native direct-to-consumer brands have strategically moved offline, emulating the principle behind the New Retail concept. Companies such as Bonobos (recently acquired by Walmart), Warby Parker, Birchbox and Everlane have followed the logic that consumers need to be able to interact with brands both online and offline, experiencing products and receiving in-person customer service. In this sense, the physical store is part of a more holistic brand experience that incorporates online and offline channels.

The fact that New Retail is emerging as a dominant retail strategy in key markets around the world outlines one clear shift when it comes to the physical retail footprint of brands and retailers: New Retail companies view their physical stores as a lot more than just a distribution channel. These companies are leveraging the store to its full potential, which means they see it as a unique and powerful source of consumer data, a testing ground for new products and services, a driver of community and brand loyalty, and a fulfilment center for digital purchases. We examine each of these in detail below.

Convenience Versus Experience

One trend that is shaping what stores look like is the segmentation of the shopping experience between convenience and experience. On the one hand, retail is becoming more experiential, with flagship stores that offer products, services and entertainment. On the other, we are seeing increasingly more convenience-driven store formats enabled by technology such as Amazon Go in the US and BingoBox in China. This leads to the deduction that the store of the future will clearly be optimized for convenience or experience-driven purchases, and, in some cases, for both—think Starbucks’s mobile app for quick pick-up balanced with a chilled and relaxed coffee shop atmosphere.

Based on the two drivers discussed above, we next categorize three value propositions of physical stores that we believe describe what the tenant of the future will look like.

The Store: Three Value Propositions

1) The Store as a Testing Ground, Launch Platform and Conversion Engine

For brands with a primarily digital presence, physical stores offer a way to test offline strategies and markets, get new product feedback, or simply drive conversion. Companies such as Casper, Birchbox and, most notably, Amazon favor using pop-ups to do precisely that. Pop-up spaces, however, require short-term leases and flexible spaces which can be remodeled quickly and efficiently. Naturally, as the demand for retail flexibility has increased, there have been a number of platforms that have started offering pop-up retail space as a service. We see these companies as enablers of the store as a temporary installation and validators of the trend.

- By Reveal deploys small-format boutiques throughout cities to provide interactive vignettes where consumers can discover artists, brands and designers.

- WithMe is a retail platform that develops, deploys and runs pop-up stores. All products and fixtures are RFID-embedded, and the stores include beacons so that customers with the ShopWithMe app can receive product suggestions and personalized messages.

- PopUp Angels is a full-service platform for finding, renting and setting up pop-up spaces in Hong Kong.

- Appear Here has pop-up locations around the world that are searchable online.

- Storefront is a rental platform operating in eight major markets: London, Paris, New York, Los Angeles, San Francisco, Hong Kong, Amsterdam and Milan.

2) The Store as an Experiential Hub for Engagement and Community

Optimizing for experience has led brands to invest in stores that provide entertainment and community offerings, for example, an apparel brand running an in-store coffee shop or a sportswear brand offering in-store classes and training. Recent notable examples of the trend are Apple, Adidas and Lululemon:

- Apple is one of the pioneers of the store as a gathering place, and Apple stores are nearly always packed with consumers testing products and interacting with store associates. The company recently renamed its stores as “Town Squares,” or places where people can get together as a community for events, classes and entertainment.

- Adidas’s flagship New York store features experiential areas where customers can try out, customize and personalize products, or watch sports events. The store serves as a one-stop shop for products, services and entertainment.

- Lululemon offers numerous in-store classes to its community members, servicing a healthy lifestyle more than simply selling products.

3) Factory, Fulfillment Center and Data-Collection Hub

Under the New Retail construct, stores play an important role in capturing consumer data, providing an omnichannel fulfillment option and even going further up the supply chain by serving as a place where products are made:

- Ministry of Supply placed a robotic 3D-knitting machine in its Boston flagship store, allowing customers to design and create their own blazers on demand.

- Amazon Go uses its “just walk out” technology to enable checkout-free shopping.

- BingoBox is a Chinese automated mobile convenience store company that operates over 200 completely staffless locations. BingoBox uses computer vision and facial recognition technology to create a seamless shopping experience. Payments are processed using the most popular mobile payment solutions in China: Alipay and WeChat Pay.

- Alibaba’s Hema supermarket combines online and offline retail and operates as a fulfillment center for 30-minute deliveries by crowd-sourced delivery agents. Alibaba claims that its Hema store on average achieves about five times more sales per square meter than traditional grocery stores in China due to its fulfilment catchment area.

In summary, the tenant of the future will be a New Retail tenant. This means the physical store will be optimized as an integral node of a more holistic consumer experience. It will be a source of rich consumer data captured with technology and a response to the evolving demands of the consumer around convenience, entertainment and novelty.

Source: FGRT

Hong Kong Retail Market 2017 - Presented by Nigel Smith, Managing Director, Colliers International

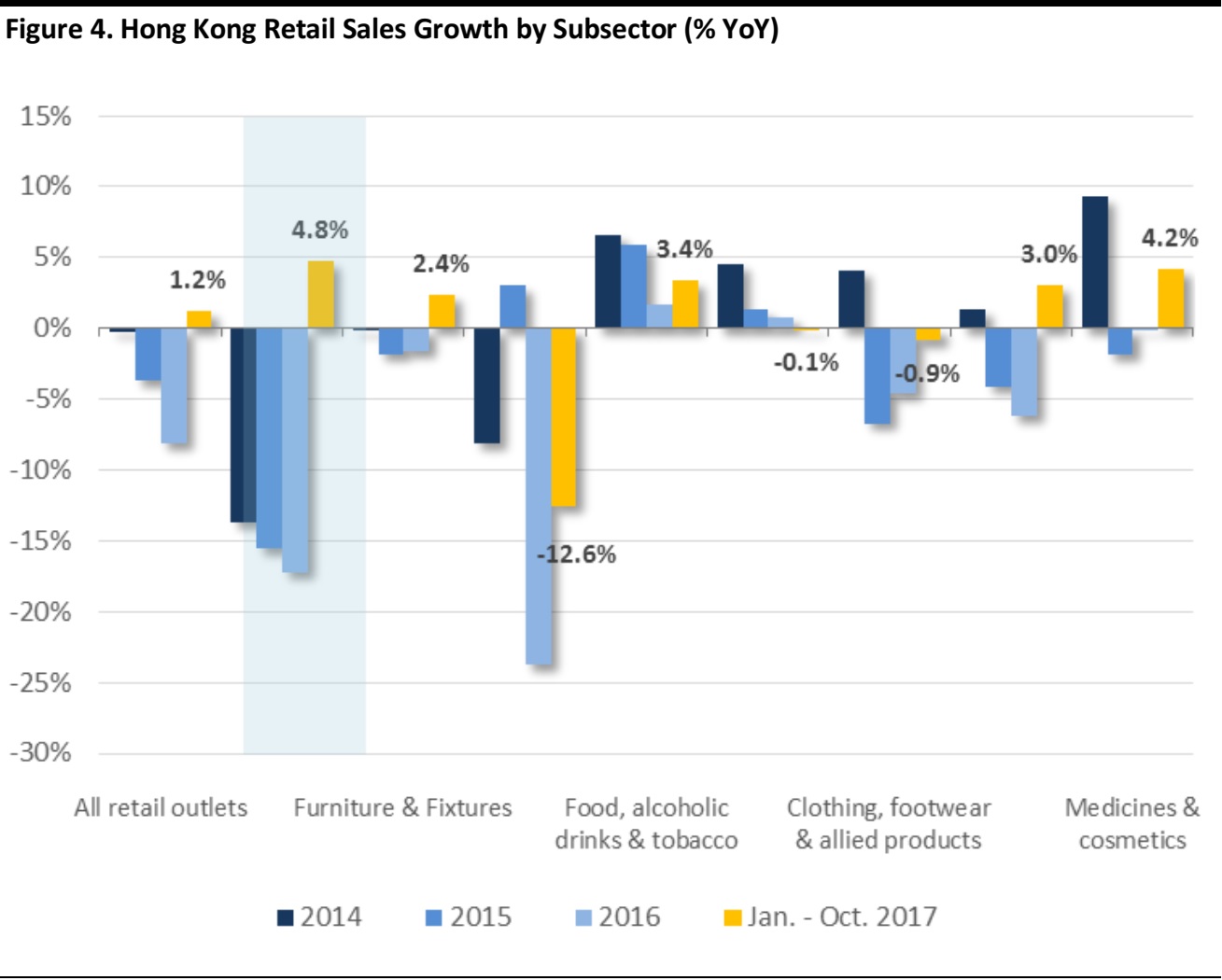

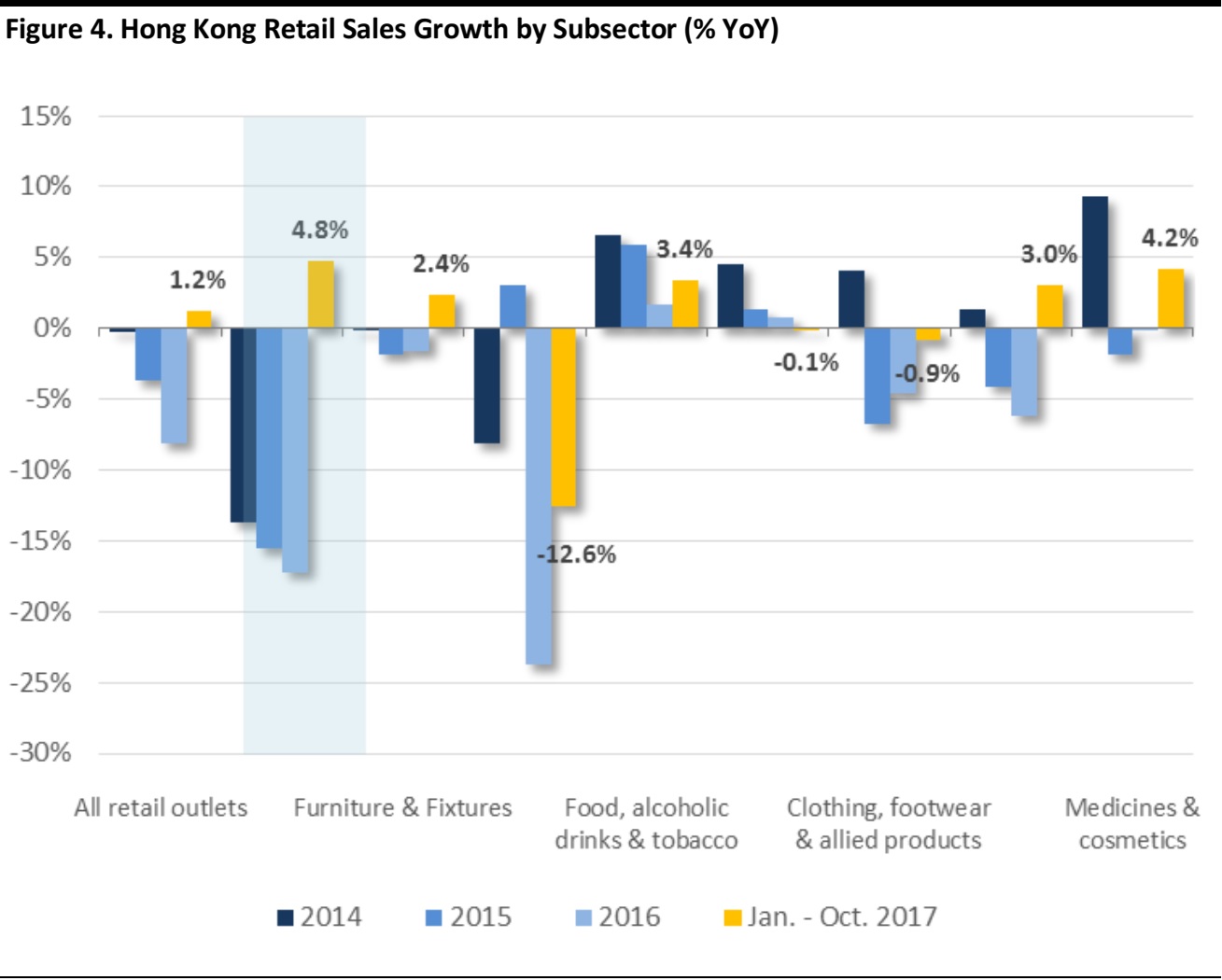

In 2017, Hong Kong has experienced a recovery of retail sales, with more emphasis on new shopping experiences. Retail sales rose 4.1% year over year in the third quarter of 2017, which is the highest rate of growth in over three years. The trends shaping the landscape are an uptake in tourists from the Chinese Mainland, changing consumer behavior that is increasingly digital and the market entry of new international brands. The sectors that have performed well are lifestyle brands, cosmetic shops and food and beverage (F&B) concepts. From a rents perspective, high-street rents, which have been on the decline, are nearing the bottom and will likely start to trend up in early 2018.

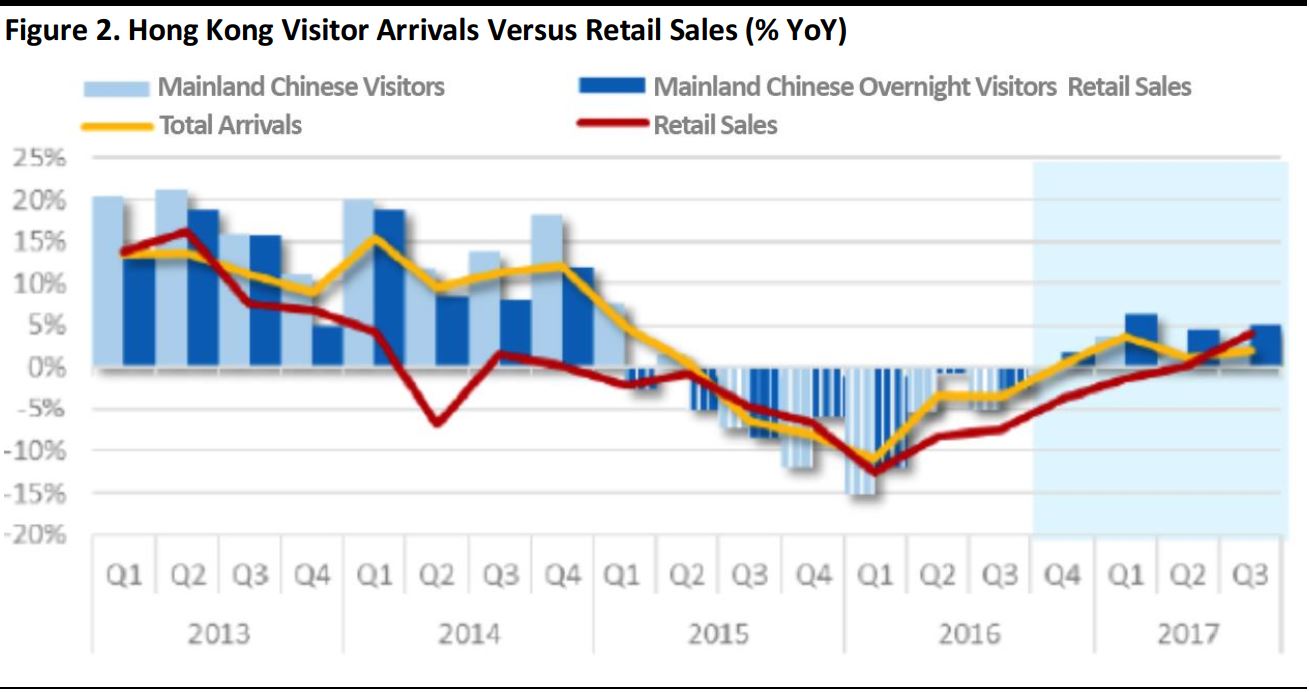

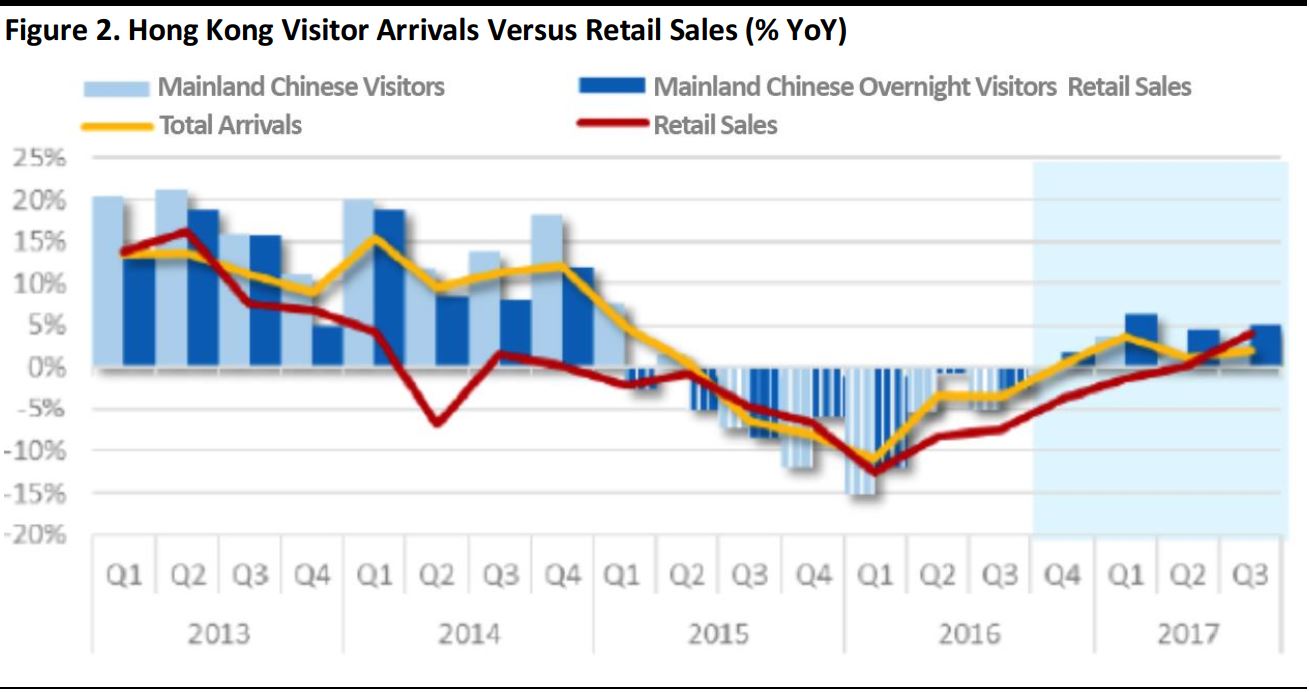

Chinese Tourists

From January to October, Hong Kong saw 36.5 million visitors from Mainland China, which represents a modest 3.1% increase compared to 2016. However, a shift from shopping to experiential tourism has led to a continued decline in retail spending by Chinese visitors. In the long term, the number of tourists to Hong Kong is expected to increase slowly as the city remains a top destination for Chinese outbound travelers.

Source: Colliers/Hong Kong Tourism Board

The Digital Consumer

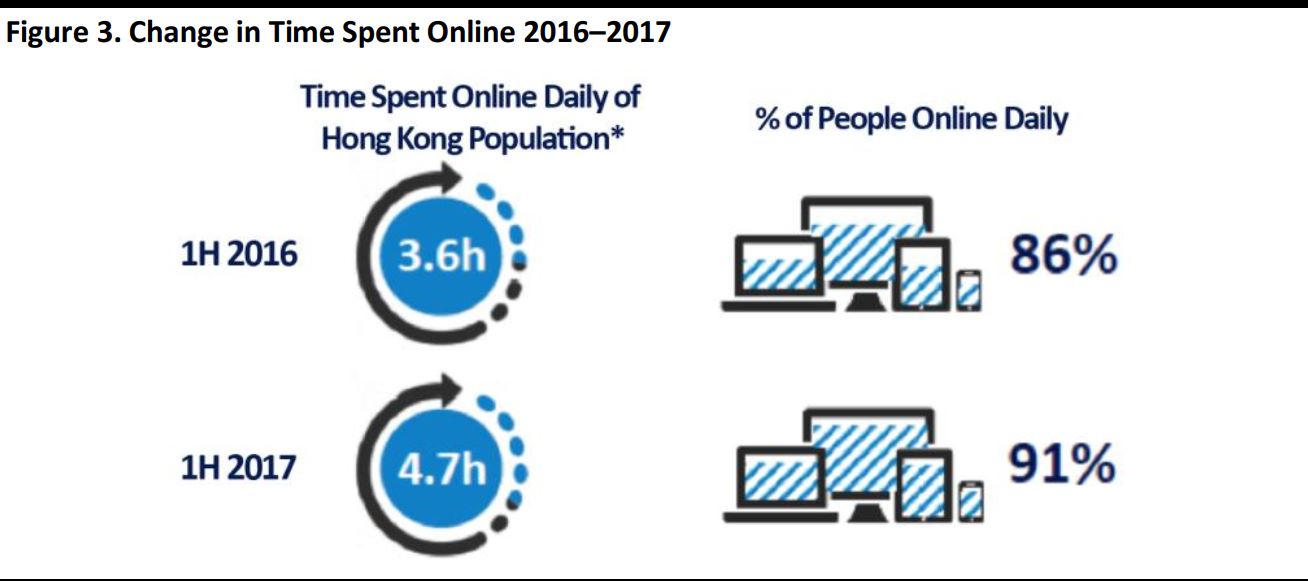

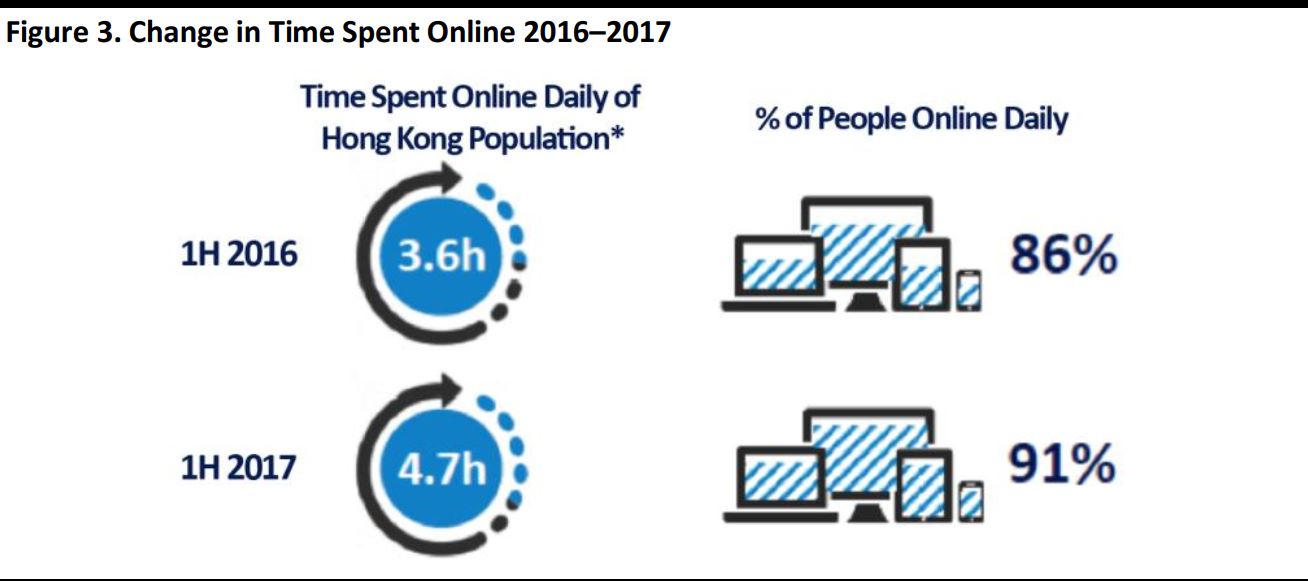

The changing shopping behaviors of the now highly connected consumers are driving innovation in customer engagement. Hong Kong consumers are more connected than ever before, particularly through their mobile devices. They are increasingly embracing online shopping, resulting in rising e-commerce revenues, which are expected to grow 58% by 2022.

*Average for population aged 12-64

Source: Colliers/Nielsen

In response, retailers and shopping centers are embracing digital tools to help boost engagement. SHKP Malls and YOHO Mall developed by Sun Hung Kai Real Estate and MTR Malls developed by the MTR Corporation are apps that bring the shopping mall experience to the mobile devices of consumers, while brands such as Neutrogena, Shiseido and Adidas have begun to use artificial intelligence (AI)-based chatbots for their e-commerce businesses.

A Sector View

The jewelry and watch subsector, which was hit by declining sales between 2014 and 2016, is experiencing a modest recovery with 4.8% year-over-year growth during the January to October period in 2017. The medicines and cosmetics market is also up by 4.2%, while the electrical goods and photographic subsector is down 12.6% from an even larger decline in 2016.

Source: Colliers/Census and Statistics Department

The F&B sector has continued to expand in 2017. Total restaurant receipts grew by 5.1% year over year in the third quarter and 4.4% year over year in the first three quarters of 2017. Naturally, shopping malls are shifting their tenant mixes to feature more F&B concepts. New players have also entered the market—HEXA and Paper Moon are two examples, while Le Comptoir Group, Gaia Group and Lubuds Group have expanded their footprint.

Rents and Forecasts

In terms of rents, there is a growing preference for smaller-size stores (<3,000 square feet).The decline in high street rents is narrowing further, with overall high street shop rents falling by 10.6% year over year in the third quarter and 3.9% year to date in 2017 when compared to the fourth quarter of 2016. However, second- and third-tier high street shop rents remain under pressure.

Colliers expects that for 2017 there will be an overall decline in prime retail rents of 5% before we see a more widespread recovery of slight growth of 1%–3% in 2018.

Key Takeaways from the “Tenant of the Future” Expert Panel Discussion

The Tenant of the Future event, part of the FGRT and Urban Land Institute (ULI) Asia Pacific event series collaboration and supported by Colliers, took place in Hong Kong in November, and featured presentations by Kiril Popov, Senior Analyst at FGRT, Nigel Smith, Managing Director at Colliers, as well as an expert panel session which represented a diverse set of views and backgrounds. The panelists who took part in the event were:

- Benjamin Liang, Executive Director, Magusta Group; Deputy Chairman of Polytek Engineering

- Cynthia Ng, Director, Retail Services, Colliers International

- Diego Dultzin Lacoste, Cofounder, OnTheList

- Syed Asim Hussain, Cofounder and Managing Partner, Black Sheep Restaurants

- Quinn Lai, Founder and Director, EONIQ

- Moderator: Kiril Popov, Senior Analyst, FGRT

Left to right: Kiril Popov, Quinn Lai, Diego Dultzin Lacoste, Benjamin Liang, Syed Asim Hussain and Cynthia Ng

Source: FGRT

1) Is There a Case for Online Brands to Go Offline in Hong Kong

The panel kicked off with a discussion on the trend of digitally-native brands going offline. Quinn Lai of EONIQ, which is one such brand, commented that pure e-commerce does not work in Hong Kong, rather an online presence combined with communication allows brands to drive traffic to stores. From EONIQ’s perspective, the company is looking to meet the customer in the most digestible way while achieving organizational learning. Following this path led EONIQ to open a physical store at the K11 shopping mall, where it allows customers to book appointments to touch and feel EONIQ’s watches and go through the customization experience in-person at the store. The team relies heavily on in-store technology, as it helps with the personalization of advertisements, which is particularly important in Hong Kong, a market with low brand loyalty.

The panel weighed in that they do not see in-store technology as a key to a great shopping experience just yet. In many cases, consumers still venture into stores to get rid of some of the technology around them. Instead, the holistic brand perception that consumers have about a brand or retailer is what drives traffic, awareness and sales.

2) The Pop-up Trend in Hong Kong

Benjamin Liang of Magusta Group commented extensively on the trend of more pop-up space in the market, sharing that pop-ups are a new attempt for Magusta. According to Liang, consumers always look for a good deal and unique products, and that is why pop-ups will remain relevant. As new concepts, pop-ups generate higher traffic for properties and create more awareness for the location. In terms of leasing, however, they follow a different model compared to traditional retail space. Liang commented that flexible formats require flexible contracts, and Cynthia Ng from Colliers echoed that pop-ups could be rented on short notice, whereas long-term leases are negotiated three to six months before the tenant moves in. Ng also added that the current trend when it comes to pop-up spaces is that they are usually larger spaces to allow brands to make a statement. This runs contrary to the market trend in long-term leasing, which is seeing more demand for smaller properties and the fragmentation of the tenant mix in shopping centers.

3) How Important Is the Community Aspect of Retail?

The panel discussed how important it is to build a community in today’s retail environment. Asim Hussain shared that for Black Sheep Restaurants the community comes first and the company second. Black Sheep has successfully turned one of its restaurants, Chôm Chôm, into a public space where people go to hang out. He commented that retail and F&B are really about creating experiences, and in this sense the location of a restaurant is part of the discovery journey. People want to escape from their daily environment and are looking for more authenticity, and providing a discovery-focused experience has proven a successful value proposition for Black Sheep.

Diego Dultzin Lacoste also weighed in on the topic. For his company OnTheList, community is key, as the company operates a community-driven business model with over 130,000 members. The company runs a flash-sale high street location in the Central District of Hong Kong, which is convenient for the prime customer and in close proximity to many of the luxury brand flagships. Lacoste commented that for OnTheList it is really important to get the right brands for its community members, and while the space currently operates “offline,” he see a big opportunity in expanding the community and the concept into a digital environment.

4) Closing Thoughts: The Tenant of the Future

The panel ended with the panelists sharing their opinions on what the tenant of the future will look like. The consensus was that brands will still need an offline presence, which they will use to provide an experiential environment to shoppers and to add value to online sales, but also that closer collaboration between tenants and landlords will be key in the environment of the future.

Lai commented that landlords can create significant value if they realize synergies between their tenants when it comes to data collection and digital marketing strategies.

Lacoste echoed that landlords can help create a community around a location as well as share more visitor data with tenants.

Hussain shared Black Sheep’s experience when a landlord openly shared their long-term development vision for a real estate project, which allowed Black Sheep to execute and fine tune a restaurant concept that is aligned with the development direction of the project.

Lastly, Liang agreed that from a landlord’s perspective, he sees more collaboration between tenants and landlords as the way to move forward.

About the ULI/FGRT Partnership

The ULI Asia Pacific and FGRT are collaborating on a series of educational conferences and panels in the APAC region, culminating with ULI’s Asia Pacific Summit in June 2018. The partnership is part of a wide-ranging initiative to showcase the future of retail real estate, to encourage greater integration of technology in shopping centers and to provide a platform where industry professionals can learn and share their views and experiences in retail and technology.

About the Urban Land Institute

The ULI is a nonprofit education and research institute supported by its members. Its mission is to provide leadership in the responsible use of land, and in creating and sustaining thriving communities worldwide. Established in 1936, the institute has more than 40,000 members worldwide, representing all aspects of land use and development disciplines, including more than 2,000 in the Asia Pacific Region. For more information, please visit

uli.org or asia.uli.org.