Source: Company reports

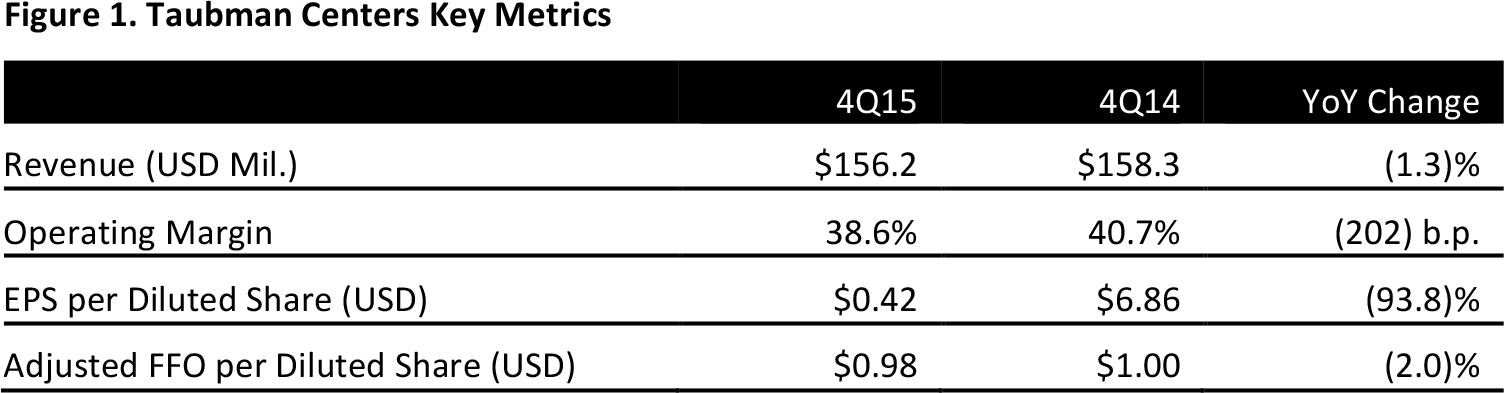

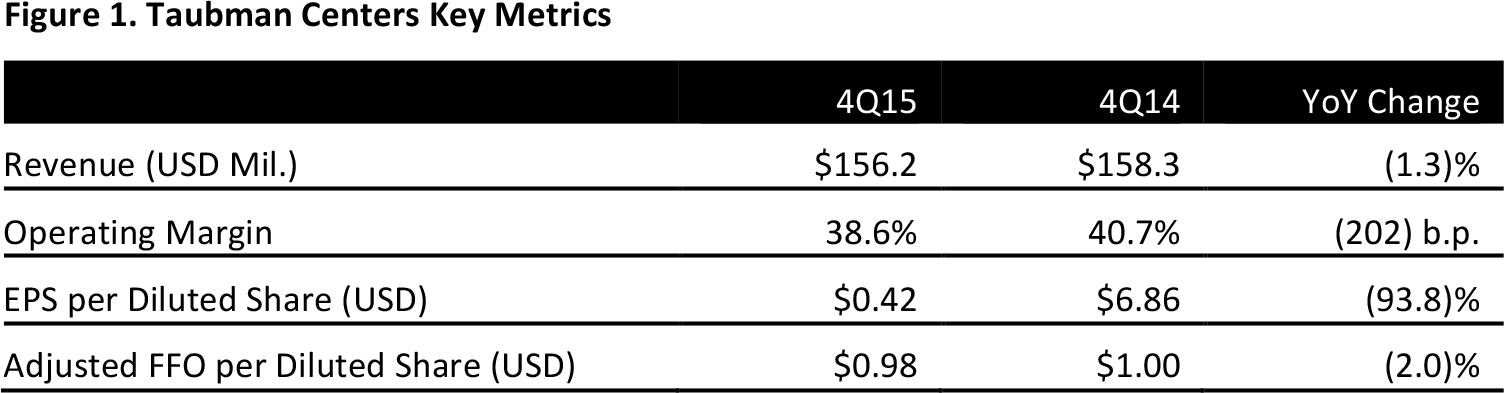

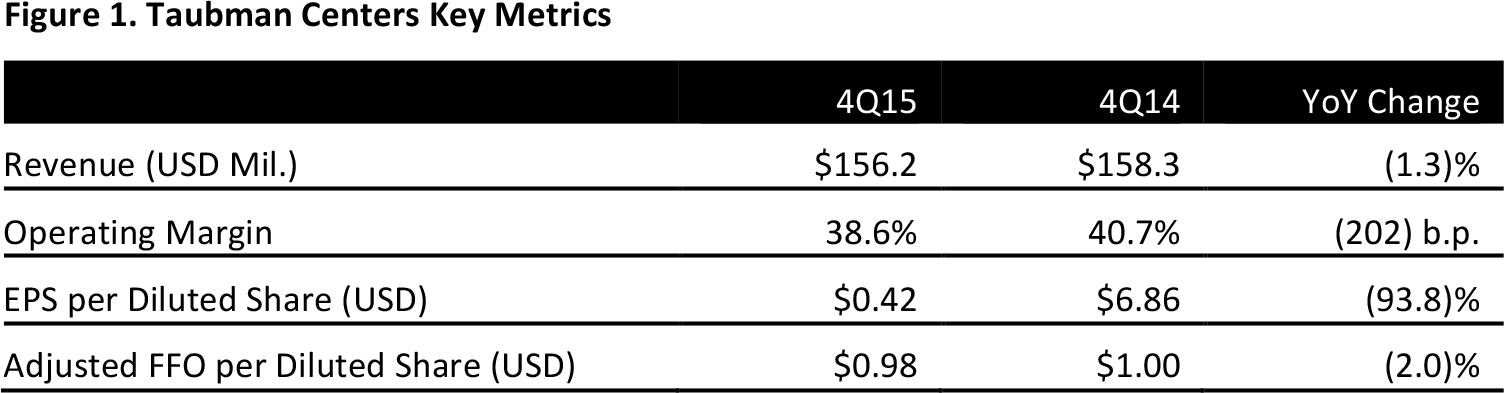

For the quarter, Taubman centers reported adjusted FFO of $60.4 million, or $0.98 per share. The company reported that 4Q15 comparable center net operating income (NOI), excluding lease cancellation income, rose by 3.4% year over year. The growth was driven by an increase in occupancy, mall tenant sales per square foot and average rent per square foot. Comparable center NOI increased by 3.1% for the year ending December 31, 2015.

For FY15, EPS was down 93.8% to $1.76, due to the sell-off of business units that recognized a net gain of $477 million ($5.30 per share) and $606 million ($6.72 per share). Taubman reported FFO of $214 million, or adjusted FFO of $3.42 per diluted share. Revenue was reported at $557.2 million.

For 4Q15, comparable center mall tenant sales per square foot were down 2.2%. For FY15, mall tenant sales per square foot were $800, an increase of 1% over 2014. Weakness in South American tourism and the strengthening US dollar negatively impacted two tourist-oriented centers in Florida. Excluding those, comparable mall tenant sales were up 3.8% for the year.

Average rent per square foot in comparable centers was $60.71 in 4Q15, up 1.7% from $59.96 in the year-ago quarter. For FY15, average rent per square foot in comparable centers was $60.38, up 2.1% from FY14. For the FY15 trailing 12-month period, releasing spread per square foot was strong, at 23.3%.

As of December 31, 2015, the comparable centers’ portfolio was 97% leased, up 0.8% from 96.2% on December 31, 2014. Ending occupancy in comparable centers was 95.3%, up 0.6% year over year.

In January 2016, the company announced an agreement with Macerich to acquire Country Club Plaza in Kansas City, MO. The mixed-use retail and office property cost $660 million in cash, excluding transaction costs. Taubman and Macerich will each have a 50% interest in the center.

Guidance

The company expects FY16 FFO per diluted share to be $3.45–$3.65, slightly below the consensus estimate of $3.67. FFO guidance excludes the positive impact of the Country Club Plaza acquisition. The guidance assumes comparable center NOI growth, excluding lease cancellation income, of 4.5%–5% for the year.

Net income attributable to common shareholders (EPS) for the year is expected to be $1.55–$1.80.