Source: Company reports

2Q16 RESULTS

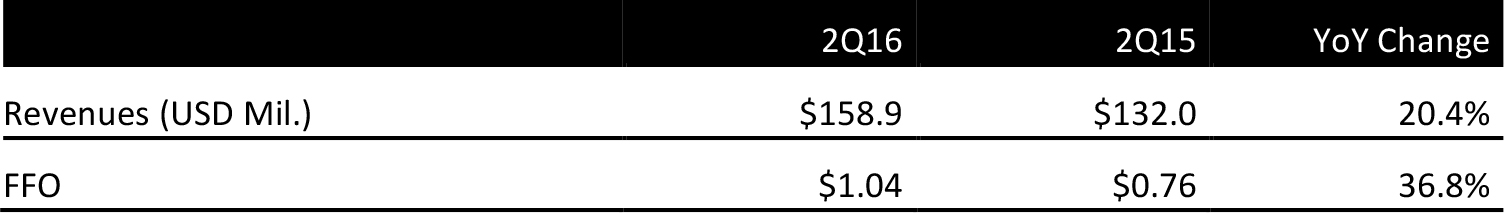

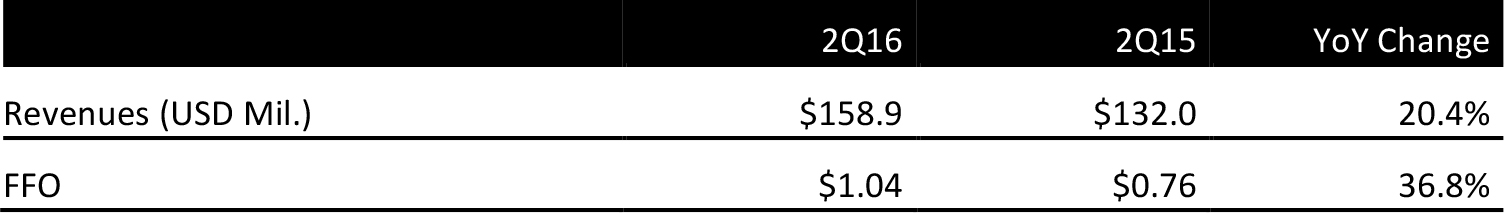

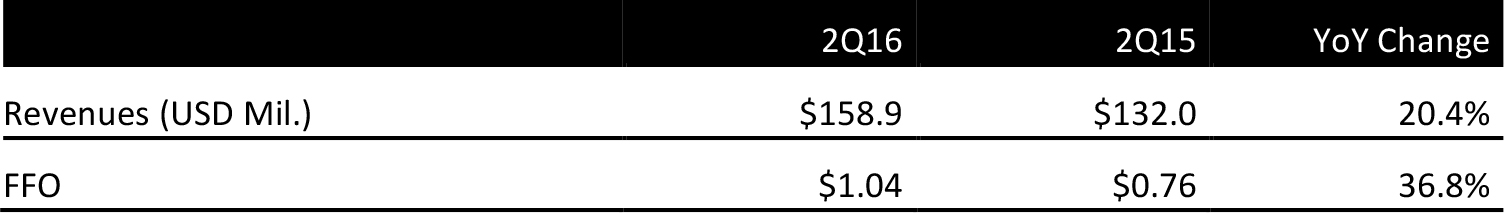

Taubman Centers reported 2Q16 revenues of $158.9 million, up 20.4% from the year-ago quarter and beating the consensus estimate of $143.4 million.

Average rent per square foot for the quarter was $62.61, up 5.4% from the year-ago quarter. Occupancy in comparable centers was 93.8% at the end of the quarter, an increase of 0.8% from the year-ago quarter.

Comparable center mall tenant sales per square foot decreased by 0.7% year over year, bringing the company’s 12-month trailing mall tenant sales per square foot to $789. This represented a decrease of 1% year over year, and was particularly related to slowing sales in the company’s South Florida centers.

Taubman acquired Maple Real Estate’s 35% interest in CityOn.Zhengzhou, increasing the company’s ownership to a 49% stake. The center is expected to open in March 2017; the opening was pushed back due to delays constructing a government-built power station on which the mall will rely

2016 OUTLOOK

The company updated its guidance for FY16, and now expects earnings per diluted common share of $1.73–$1.93, down from $1.85–$2.10 previously. FFO is expected to be $3.75–$3.90, revised from $3.75–$3.95 previously.

The changes in the company’s guidance are primarily due to lower lease cancellation income and an unanticipated, two-cent legal charge that was incurred in the second quarter and that affected FFO.