Nitheesh NH

[caption id="attachment_75864" align="aligncenter" width="620"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

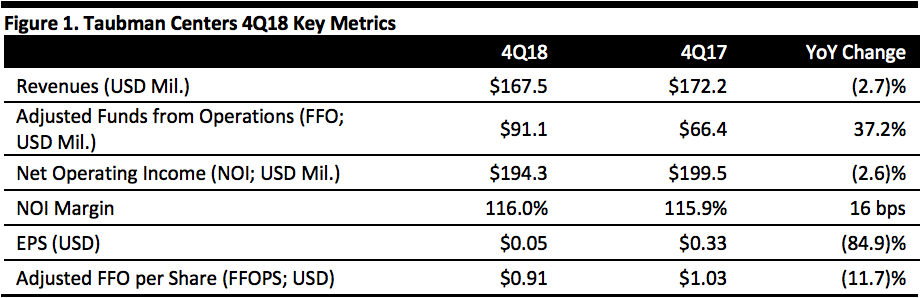

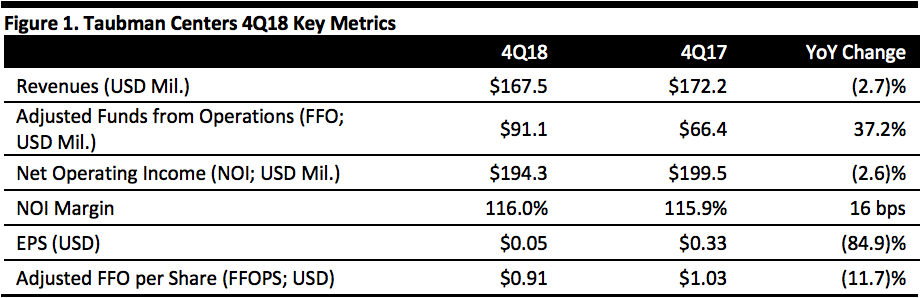

Taubman Centers reported 4Q18 revenues of $167.5 million, down 2.7% year over year.

NOI was $194.3 million, down 2.6%, due to the timing of net recoveries and major retail holidays in Asia, which shifted from the fourth quarter last year to the third quarter this year.

Comparable center mall tenant sales per square foot were up 10.1%. Tenant sales per square foot in U.S. comparable centers were up 10.8%.

Average rent per square foot in comparable centers was $57.76, up 3.3%. Average rent per square foot in comparable U.S. centers was $61.92, up 2.2%.

EPS was $0.05, compared to $0.33 in the year-ago quarter.

Adjusted FFO was $0.91 per share, ahead of the $0.89 consensus estimate.

FY18 Results

Revenues for the year were $640.9 million, up 1.9%.

Comparable center NOI was $757.8 million, up 4.4%, the best annual NOI growth rate in six years, with U.S. and Asia assets contributing equally. Comparable center NOI excluding lease cancellation income was up 3.8%.

Comparable center mall tenant sales per square foot were $824 in the year, an increase of 8.6%. Twelve-month trailing U.S. sales per square foot hit a record high of $875, an increase of 8.2% and broad-based among nearly all centers and categories. Apparel was up 8%.

Average rent per square foot in comparable centers was $57.51 for the year, up 3.9% from $55.36 last year.

Average rent per square foot in the company’s U.S. comparable centers hit $61.75, an all-time high and an increase of 2.4% over the prior year.

The releasing spread per square foot for the year was 3.9% percent, still impacted by a small number of spaces that have an average lease terms of less than two years. Excluding these leases, the spread was nearly 10%.

Ending occupancy in comparable centers was 94.7% at the end of the year, down 1.0% from 95.7% at the end of the prior year. Ending occupancy in all centers was 94.6%, down 0.2% from the prior year.

Leased space in all centers was 96.2%, up 0.3% the prior year. Leased space in comparable centers was 96.3% percent at the end of the year, down 0.3% from the end of 2017.

EPS was $0.95, up 4.4%.

Adjusted FFOPS was $3.83, up 3.8%.

Management characterized the annual results as good in a challenging environment, with earnings growth driven by better rents and recoveries, lower operating expenses and positive contributions from newer centers. In addition, sales productivity and average rents reached new highs in the year.

Major Projects in the Year

Major milestones in the year include the following:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Taubman Centers reported 4Q18 revenues of $167.5 million, down 2.7% year over year.

NOI was $194.3 million, down 2.6%, due to the timing of net recoveries and major retail holidays in Asia, which shifted from the fourth quarter last year to the third quarter this year.

Comparable center mall tenant sales per square foot were up 10.1%. Tenant sales per square foot in U.S. comparable centers were up 10.8%.

Average rent per square foot in comparable centers was $57.76, up 3.3%. Average rent per square foot in comparable U.S. centers was $61.92, up 2.2%.

EPS was $0.05, compared to $0.33 in the year-ago quarter.

Adjusted FFO was $0.91 per share, ahead of the $0.89 consensus estimate.

FY18 Results

Revenues for the year were $640.9 million, up 1.9%.

Comparable center NOI was $757.8 million, up 4.4%, the best annual NOI growth rate in six years, with U.S. and Asia assets contributing equally. Comparable center NOI excluding lease cancellation income was up 3.8%.

Comparable center mall tenant sales per square foot were $824 in the year, an increase of 8.6%. Twelve-month trailing U.S. sales per square foot hit a record high of $875, an increase of 8.2% and broad-based among nearly all centers and categories. Apparel was up 8%.

Average rent per square foot in comparable centers was $57.51 for the year, up 3.9% from $55.36 last year.

Average rent per square foot in the company’s U.S. comparable centers hit $61.75, an all-time high and an increase of 2.4% over the prior year.

The releasing spread per square foot for the year was 3.9% percent, still impacted by a small number of spaces that have an average lease terms of less than two years. Excluding these leases, the spread was nearly 10%.

Ending occupancy in comparable centers was 94.7% at the end of the year, down 1.0% from 95.7% at the end of the prior year. Ending occupancy in all centers was 94.6%, down 0.2% from the prior year.

Leased space in all centers was 96.2%, up 0.3% the prior year. Leased space in comparable centers was 96.3% percent at the end of the year, down 0.3% from the end of 2017.

EPS was $0.95, up 4.4%.

Adjusted FFOPS was $3.83, up 3.8%.

Management characterized the annual results as good in a challenging environment, with earnings growth driven by better rents and recoveries, lower operating expenses and positive contributions from newer centers. In addition, sales productivity and average rents reached new highs in the year.

Major Projects in the Year

Major milestones in the year include the following:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Taubman Centers reported 4Q18 revenues of $167.5 million, down 2.7% year over year.

NOI was $194.3 million, down 2.6%, due to the timing of net recoveries and major retail holidays in Asia, which shifted from the fourth quarter last year to the third quarter this year.

Comparable center mall tenant sales per square foot were up 10.1%. Tenant sales per square foot in U.S. comparable centers were up 10.8%.

Average rent per square foot in comparable centers was $57.76, up 3.3%. Average rent per square foot in comparable U.S. centers was $61.92, up 2.2%.

EPS was $0.05, compared to $0.33 in the year-ago quarter.

Adjusted FFO was $0.91 per share, ahead of the $0.89 consensus estimate.

FY18 Results

Revenues for the year were $640.9 million, up 1.9%.

Comparable center NOI was $757.8 million, up 4.4%, the best annual NOI growth rate in six years, with U.S. and Asia assets contributing equally. Comparable center NOI excluding lease cancellation income was up 3.8%.

Comparable center mall tenant sales per square foot were $824 in the year, an increase of 8.6%. Twelve-month trailing U.S. sales per square foot hit a record high of $875, an increase of 8.2% and broad-based among nearly all centers and categories. Apparel was up 8%.

Average rent per square foot in comparable centers was $57.51 for the year, up 3.9% from $55.36 last year.

Average rent per square foot in the company’s U.S. comparable centers hit $61.75, an all-time high and an increase of 2.4% over the prior year.

The releasing spread per square foot for the year was 3.9% percent, still impacted by a small number of spaces that have an average lease terms of less than two years. Excluding these leases, the spread was nearly 10%.

Ending occupancy in comparable centers was 94.7% at the end of the year, down 1.0% from 95.7% at the end of the prior year. Ending occupancy in all centers was 94.6%, down 0.2% from the prior year.

Leased space in all centers was 96.2%, up 0.3% the prior year. Leased space in comparable centers was 96.3% percent at the end of the year, down 0.3% from the end of 2017.

EPS was $0.95, up 4.4%.

Adjusted FFOPS was $3.83, up 3.8%.

Management characterized the annual results as good in a challenging environment, with earnings growth driven by better rents and recoveries, lower operating expenses and positive contributions from newer centers. In addition, sales productivity and average rents reached new highs in the year.

Major Projects in the Year

Major milestones in the year include the following:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Taubman Centers reported 4Q18 revenues of $167.5 million, down 2.7% year over year.

NOI was $194.3 million, down 2.6%, due to the timing of net recoveries and major retail holidays in Asia, which shifted from the fourth quarter last year to the third quarter this year.

Comparable center mall tenant sales per square foot were up 10.1%. Tenant sales per square foot in U.S. comparable centers were up 10.8%.

Average rent per square foot in comparable centers was $57.76, up 3.3%. Average rent per square foot in comparable U.S. centers was $61.92, up 2.2%.

EPS was $0.05, compared to $0.33 in the year-ago quarter.

Adjusted FFO was $0.91 per share, ahead of the $0.89 consensus estimate.

FY18 Results

Revenues for the year were $640.9 million, up 1.9%.

Comparable center NOI was $757.8 million, up 4.4%, the best annual NOI growth rate in six years, with U.S. and Asia assets contributing equally. Comparable center NOI excluding lease cancellation income was up 3.8%.

Comparable center mall tenant sales per square foot were $824 in the year, an increase of 8.6%. Twelve-month trailing U.S. sales per square foot hit a record high of $875, an increase of 8.2% and broad-based among nearly all centers and categories. Apparel was up 8%.

Average rent per square foot in comparable centers was $57.51 for the year, up 3.9% from $55.36 last year.

Average rent per square foot in the company’s U.S. comparable centers hit $61.75, an all-time high and an increase of 2.4% over the prior year.

The releasing spread per square foot for the year was 3.9% percent, still impacted by a small number of spaces that have an average lease terms of less than two years. Excluding these leases, the spread was nearly 10%.

Ending occupancy in comparable centers was 94.7% at the end of the year, down 1.0% from 95.7% at the end of the prior year. Ending occupancy in all centers was 94.6%, down 0.2% from the prior year.

Leased space in all centers was 96.2%, up 0.3% the prior year. Leased space in comparable centers was 96.3% percent at the end of the year, down 0.3% from the end of 2017.

EPS was $0.95, up 4.4%.

Adjusted FFOPS was $3.83, up 3.8%.

Management characterized the annual results as good in a challenging environment, with earnings growth driven by better rents and recoveries, lower operating expenses and positive contributions from newer centers. In addition, sales productivity and average rents reached new highs in the year.

Major Projects in the Year

Major milestones in the year include the following:

- Nordstrom is opening a new, approximately 116,000-square-foot store at Country Club Plaza, the company’s joint venture in Kansas City, Missouri.

- The company entered into a redevelopment agreement for Taubman Prestige Outlets Chesterfield (in Chesterfield, Missouri) with The Staenberg Group (TSG).

- Taubman announced Taubman Asia’s fourth investment and its second joint venture with Shinsegae Group to build, lease and manage a 1.1 million square foot shopping mall in Anseong, Gyeonggi Province, Korea, just south of Seoul.

- The company celebrated Beverly Center’s (in Los Angeles) Grand Reveal following a $500 transformation.

- Starfield Hanam (Hanam, Korea)

- Xi’an (Xi’an, China)

- Zhengzhou (Zhengzhou, China)

- EPS of $0.84-1.08, whose $0.96 midpoint is one cent above EPS of $0.95 in 2018.

- FFOPS of $3.62-3.74, below FFOPS of $3.83 in 2018.

- NOI growth of about 2%, implying NOI of $772.9 million.