DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

2Q19 Results

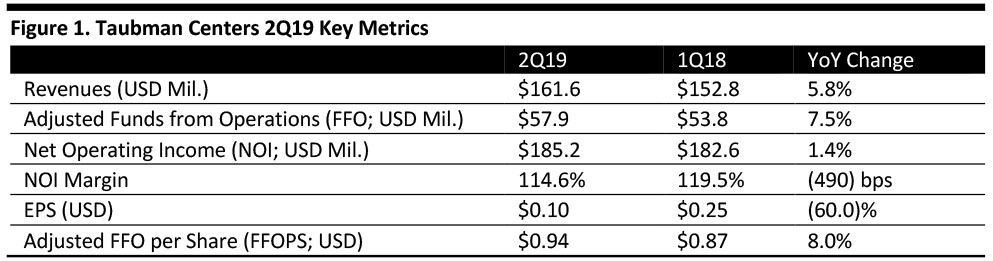

Taubman Centers reported 2Q19 revenues of $161.6 million, up 5.8% year over year, beating the consensus estimate of $159.7 million.

Excluding lease cancellation income and foreign exchange rate impacts, comparable center NOI increased 1.4%. Beneficial interest in NOI for the total portfolio excluding lease cancellation income was up 4.7% to $145.5 million.

Comparable center mall tenant sales per square foot were up 8.8% year over year, which brings the company’s trailing 12-month sales per square foot to $848, up 10.8% from the 12-month period ended June 30, 2018. This represents the 12th consecutive quarter of positive sales growth.

Tenant sales per square foot in US comparable centers were up 10.6%, and the trailing 12-month US sales per square foot was $940, up 10.9% from the 12-months ended June 30, 2018.

Average rent per square foot in comparable centers increased 2.1% to $56.79 in the quarter.

Ending occupancy in comparable centers was 92.2% on June 30, 2019, down 0.4% from June 30, 2018.

Leased space in comparable centers was 95.1% on June 30, 2019, unchanged from June 30, 2018.

GAAP EPS was $0.10, down 60.0% from $0.25 in the year-ago quarter.

FFO fell 15.2% to $0.78 per share, missing the consensus estimate of $0.83. Adjusted FFO was $0.94 per share, up 8.0% year over year.

Recent Events

In addition to the $4 million of business interruption insurance proceeds received in the first quarter of 2019, the company received a final payment for claims related to damage and business interruption at The Mall of San Juan caused by Hurricane Maria in September 2017. This payment resulted in a net FFO contribution of $3.5 million in the quarter.

Details from the Quarter

Factors that affected sales in the quarter include:

- Tesla vehicle deliveries increased, but to a lesser extent than last quarter.

- Easter shifted from Q1 to Q2 this year, benefiting April results.

- Foreign exchange rates hurt Asia sales by 7%.

- The quarter faced a tough comparison with the year-ago quarter.

Growth continues in the key categories such as apparel, shoes and electronics.

Outlook

Taubman updated its guidance for 2019:

- EPS of $0.60-0.80, down from $0.68-0.92 previously, and below $0.95 in 2018.

- Adjusted FFOPS, excluding $0.17 adjustments, of $3.64-3.74, up from the previous range of $3.62-3.72.

- FFOPS of $3.47-3.57, lowered from of $3.60-3.72 previously, and below FFOPS of $3.83 in 2018.

This guidance excludes the impact of an agreement to sell 50% of its interest in three Asia-based shopping centers to Blackstone and also assumptions for future costs associated with shareowner activism.