albert Chan

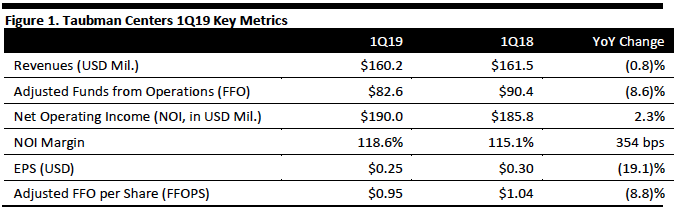

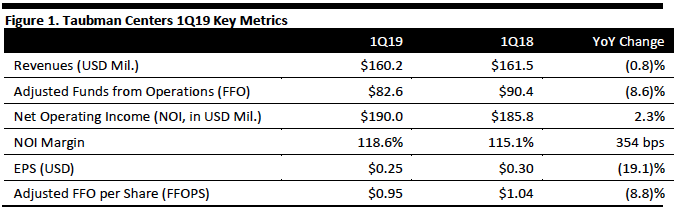

[caption id="attachment_85900" align="aligncenter" width="674"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Taubman Centers reported 1Q19 revenues of $160.2 million, down 0.8% year over year, beating the consensus estimate of $157.3 million.

Excluding lease cancellation income, comparable center NOI increased 2.3%. Beneficial interest in NOI for the total portfolio excluding lease cancellation income was up 5.7% to $147.1 million.

Comparable center mall tenant sales per square foot were up 18.6% year over year, which brings the company’s trailing 12-month sales per square foot to $832, up 10.3% from the 12-month period ended March 31, 2018. This represents the 11th consecutive quarter of positive sales growth. This figure also includes sales from CityOn.Zhengzhou (in China), which has two years of sales history.

Tenant sales per square foot in US comparable centers were up 21.7%, and the trailing 12-month US sales per square foot was $919, up 10.9% from the 12-month ended March 31, 2018.

Average rent per square foot in comparable centers increased 1.3% to $56.15 in the quarter.

Ending occupancy in comparable centers was 93.5% at the end of March 2019, up 30 basjs points from the prior year and the highest Q1 level in five years.

Leased space in comparable centers was 95.9% percent at the end of the year, up 70 bps from March 31, 2018.

Net Income decreased 18.8%, mainly driven by higher depreciation expense.

EPS was $0.25, down 19.1% from $0.30 in the year-ago quarter.

Adjusted FFO was $0.95 per share, ahead of the $0.90 consensus estimate. The comparison was hurt by $12.5 million of lease-termination received in 1Q18. Excluding this income, adjusted FFO would have increased 3.8%.

Recent Events

In March, the company completed a CNY 1.2 billion ($179 million) 10-year financing at a fixed, 6% interest rate for its CityOn.Xi’an joint venture, located in Xi’an, China.

In April, the company acquired a 48.5% interest in The Gardens Mall in Palm Beach Gardens, Florida, an off-market non-cash transaction of 1.5 million Taubman Realty Group Limited Partnership units and the assumption of debt, sharing ownership with the Forbes family, which has owned the center since 1988. Management considers the mall a premier retail asset in the affluent and growing Palm Beach market and believes its quality is above the median of its portfolio.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Taubman Centers reported 1Q19 revenues of $160.2 million, down 0.8% year over year, beating the consensus estimate of $157.3 million.

Excluding lease cancellation income, comparable center NOI increased 2.3%. Beneficial interest in NOI for the total portfolio excluding lease cancellation income was up 5.7% to $147.1 million.

Comparable center mall tenant sales per square foot were up 18.6% year over year, which brings the company’s trailing 12-month sales per square foot to $832, up 10.3% from the 12-month period ended March 31, 2018. This represents the 11th consecutive quarter of positive sales growth. This figure also includes sales from CityOn.Zhengzhou (in China), which has two years of sales history.

Tenant sales per square foot in US comparable centers were up 21.7%, and the trailing 12-month US sales per square foot was $919, up 10.9% from the 12-month ended March 31, 2018.

Average rent per square foot in comparable centers increased 1.3% to $56.15 in the quarter.

Ending occupancy in comparable centers was 93.5% at the end of March 2019, up 30 basjs points from the prior year and the highest Q1 level in five years.

Leased space in comparable centers was 95.9% percent at the end of the year, up 70 bps from March 31, 2018.

Net Income decreased 18.8%, mainly driven by higher depreciation expense.

EPS was $0.25, down 19.1% from $0.30 in the year-ago quarter.

Adjusted FFO was $0.95 per share, ahead of the $0.90 consensus estimate. The comparison was hurt by $12.5 million of lease-termination received in 1Q18. Excluding this income, adjusted FFO would have increased 3.8%.

Recent Events

In March, the company completed a CNY 1.2 billion ($179 million) 10-year financing at a fixed, 6% interest rate for its CityOn.Xi’an joint venture, located in Xi’an, China.

In April, the company acquired a 48.5% interest in The Gardens Mall in Palm Beach Gardens, Florida, an off-market non-cash transaction of 1.5 million Taubman Realty Group Limited Partnership units and the assumption of debt, sharing ownership with the Forbes family, which has owned the center since 1988. Management considers the mall a premier retail asset in the affluent and growing Palm Beach market and believes its quality is above the median of its portfolio.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Taubman Centers reported 1Q19 revenues of $160.2 million, down 0.8% year over year, beating the consensus estimate of $157.3 million.

Excluding lease cancellation income, comparable center NOI increased 2.3%. Beneficial interest in NOI for the total portfolio excluding lease cancellation income was up 5.7% to $147.1 million.

Comparable center mall tenant sales per square foot were up 18.6% year over year, which brings the company’s trailing 12-month sales per square foot to $832, up 10.3% from the 12-month period ended March 31, 2018. This represents the 11th consecutive quarter of positive sales growth. This figure also includes sales from CityOn.Zhengzhou (in China), which has two years of sales history.

Tenant sales per square foot in US comparable centers were up 21.7%, and the trailing 12-month US sales per square foot was $919, up 10.9% from the 12-month ended March 31, 2018.

Average rent per square foot in comparable centers increased 1.3% to $56.15 in the quarter.

Ending occupancy in comparable centers was 93.5% at the end of March 2019, up 30 basjs points from the prior year and the highest Q1 level in five years.

Leased space in comparable centers was 95.9% percent at the end of the year, up 70 bps from March 31, 2018.

Net Income decreased 18.8%, mainly driven by higher depreciation expense.

EPS was $0.25, down 19.1% from $0.30 in the year-ago quarter.

Adjusted FFO was $0.95 per share, ahead of the $0.90 consensus estimate. The comparison was hurt by $12.5 million of lease-termination received in 1Q18. Excluding this income, adjusted FFO would have increased 3.8%.

Recent Events

In March, the company completed a CNY 1.2 billion ($179 million) 10-year financing at a fixed, 6% interest rate for its CityOn.Xi’an joint venture, located in Xi’an, China.

In April, the company acquired a 48.5% interest in The Gardens Mall in Palm Beach Gardens, Florida, an off-market non-cash transaction of 1.5 million Taubman Realty Group Limited Partnership units and the assumption of debt, sharing ownership with the Forbes family, which has owned the center since 1988. Management considers the mall a premier retail asset in the affluent and growing Palm Beach market and believes its quality is above the median of its portfolio.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Taubman Centers reported 1Q19 revenues of $160.2 million, down 0.8% year over year, beating the consensus estimate of $157.3 million.

Excluding lease cancellation income, comparable center NOI increased 2.3%. Beneficial interest in NOI for the total portfolio excluding lease cancellation income was up 5.7% to $147.1 million.

Comparable center mall tenant sales per square foot were up 18.6% year over year, which brings the company’s trailing 12-month sales per square foot to $832, up 10.3% from the 12-month period ended March 31, 2018. This represents the 11th consecutive quarter of positive sales growth. This figure also includes sales from CityOn.Zhengzhou (in China), which has two years of sales history.

Tenant sales per square foot in US comparable centers were up 21.7%, and the trailing 12-month US sales per square foot was $919, up 10.9% from the 12-month ended March 31, 2018.

Average rent per square foot in comparable centers increased 1.3% to $56.15 in the quarter.

Ending occupancy in comparable centers was 93.5% at the end of March 2019, up 30 basjs points from the prior year and the highest Q1 level in five years.

Leased space in comparable centers was 95.9% percent at the end of the year, up 70 bps from March 31, 2018.

Net Income decreased 18.8%, mainly driven by higher depreciation expense.

EPS was $0.25, down 19.1% from $0.30 in the year-ago quarter.

Adjusted FFO was $0.95 per share, ahead of the $0.90 consensus estimate. The comparison was hurt by $12.5 million of lease-termination received in 1Q18. Excluding this income, adjusted FFO would have increased 3.8%.

Recent Events

In March, the company completed a CNY 1.2 billion ($179 million) 10-year financing at a fixed, 6% interest rate for its CityOn.Xi’an joint venture, located in Xi’an, China.

In April, the company acquired a 48.5% interest in The Gardens Mall in Palm Beach Gardens, Florida, an off-market non-cash transaction of 1.5 million Taubman Realty Group Limited Partnership units and the assumption of debt, sharing ownership with the Forbes family, which has owned the center since 1988. Management considers the mall a premier retail asset in the affluent and growing Palm Beach market and believes its quality is above the median of its portfolio.

Details from the Quarter

- Factors affecting the sales increase in the quarter include:

o Sales of its Model 3 vehicle, which are reported with a one-quarter lag.

o Foreign exchange rates hurt Asia sales by 5% but less than 1% across the portfolio.

o The timing of Easter this year shifted from Q1 to Q2 this year.

o The quarter faced a tough comparison with the year-ago quarter.

- Excluding these factors, management believes sale growth was positive.

- Growth continues in the key categories of apparel, shoes and electronics.

o Luxury brands such as Louis Vuitton, Gucci, Dolce & Gabbana and Coach all posted strong results.

o UNTUCKit and Zara were among the best performers in apparel.

- On last quarter’s call, management sized the company’s exposure to retail bankruptcies at 31 stores. Today, the company’s exposure measures 50 stores, of which management estimates that 20 will close, which could hurt its occupancy rate by 70 basis points. The company is actively at work on re-tenanting and expects to have two thirds of those stores filled by year-end so as to maintain its 95% occupancy rate.

- Management characterized tenant demand as strong. Digitally native retailers, emerging brands and coworking and entertainment concepts are generating interest in the company’s best assets. In 2018, Taubman signed 57 deals with digitally native retailers and emerging brand and has signed another 20 deals year to date. The company ‘s portfolio has the largest concentration of digitally native brands, according a third-party researcher.

- One upscale provider of coworking space, with 65 locations in 40 cities (which is likely Industrious), plans to open a location in the Mall at Short Hills (in New Jersey) and took 30,000 feet of space in a former Saks store, and has completed leasing of that space.

- EPS of $0.68-0.92, down from $0.84-1.08 previously, and below $0.95 in 2018.

- FFOPS of $3.60-3.72, lowered from $3.62-3.74 previously, and below FFOPS of $3.83 in 2018.