Web Developers

On September 15, Target announced a partnership with Instacart to offer delivery of groceries purchased online in as little as an hour within the Minneapolis metropolitan area. In addition to groceries, Target’s customers will be able to purchase selected household, health and beauty, pet, and baby products via the Instacart mobile app or on Instacart.com.

The Twin Cities are the 18th metropolitan area that three-year-old Instacart has entered. The deal makes Target the second-largest partner of Instacart by revenue, after Costco. Other Instacart partners include Whole Foods and Petco.

According to IBISWorld, the online grocery industry is a $10.9 billion market in the US, and is expected to grow at a 9.6% compound annual growth rate through 2019. An analyst from Piper Jaffray noted that some grocery stores receive as much as 1%–2% of their revenues through Instacart.

Customers in the Minneapolis area can enter their ZIP code on Instacart.com to determine if they live in a qualifying neighborhood or suburb. Delivery is free for the first order and each subsequent order is $5.99 for delivery within an hour or $3.99 for delivery within two hours (for orders over $35). The minimum order value is $10. Instacart makes deliveries from 9:00 a.m. to 10:00 p.m. daily and during Target’s store hours on holidays.

This fee stands in contrast to that of Amazon Fresh, which offers same-day delivery of groceries and other items (and includes Amazon Prime membership) for a $299 annual fee (along with a $50 minimum order requirement), following free 30-day trials in some markets. Target customers already receive free delivery within five days with a $25 minimum order.

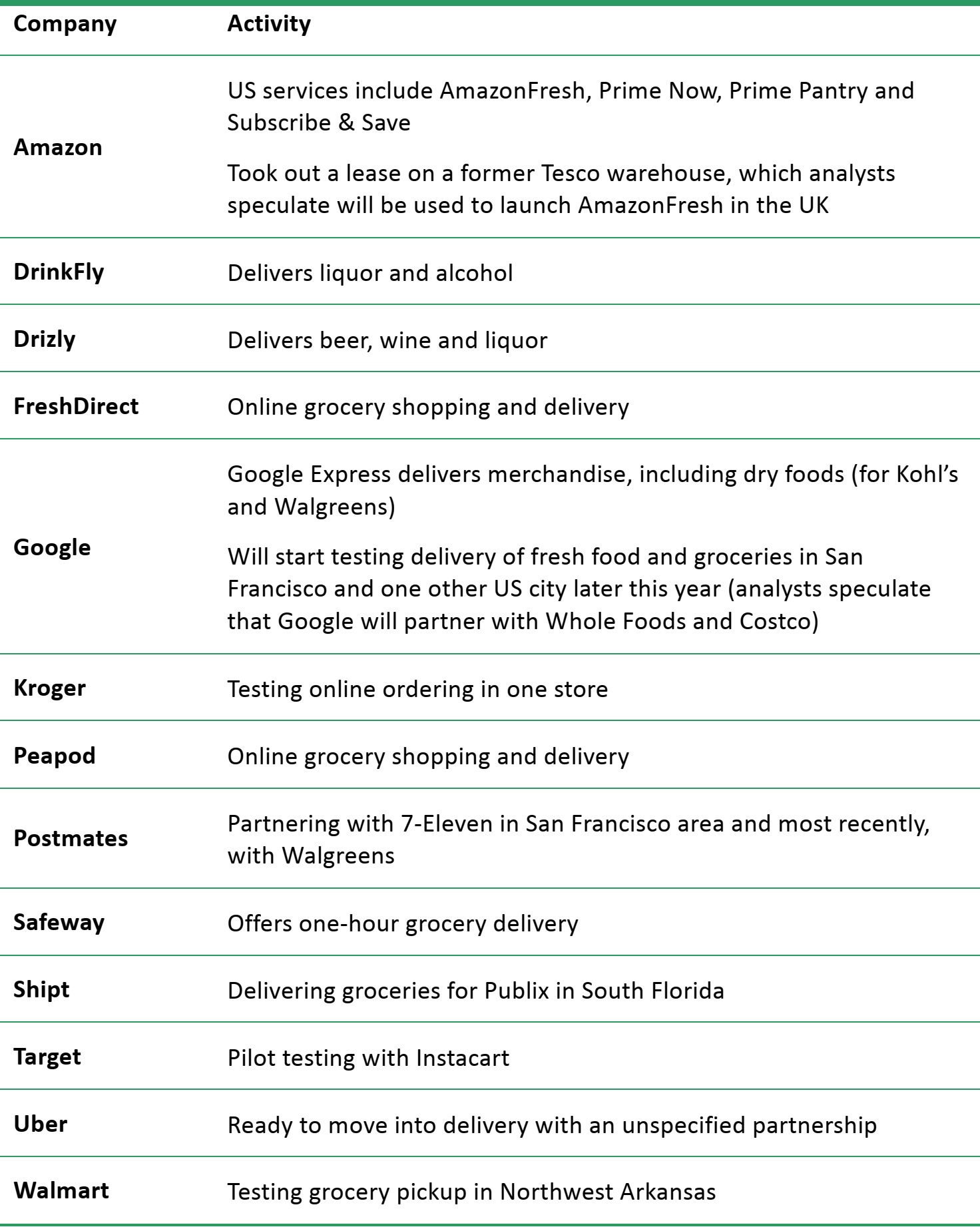

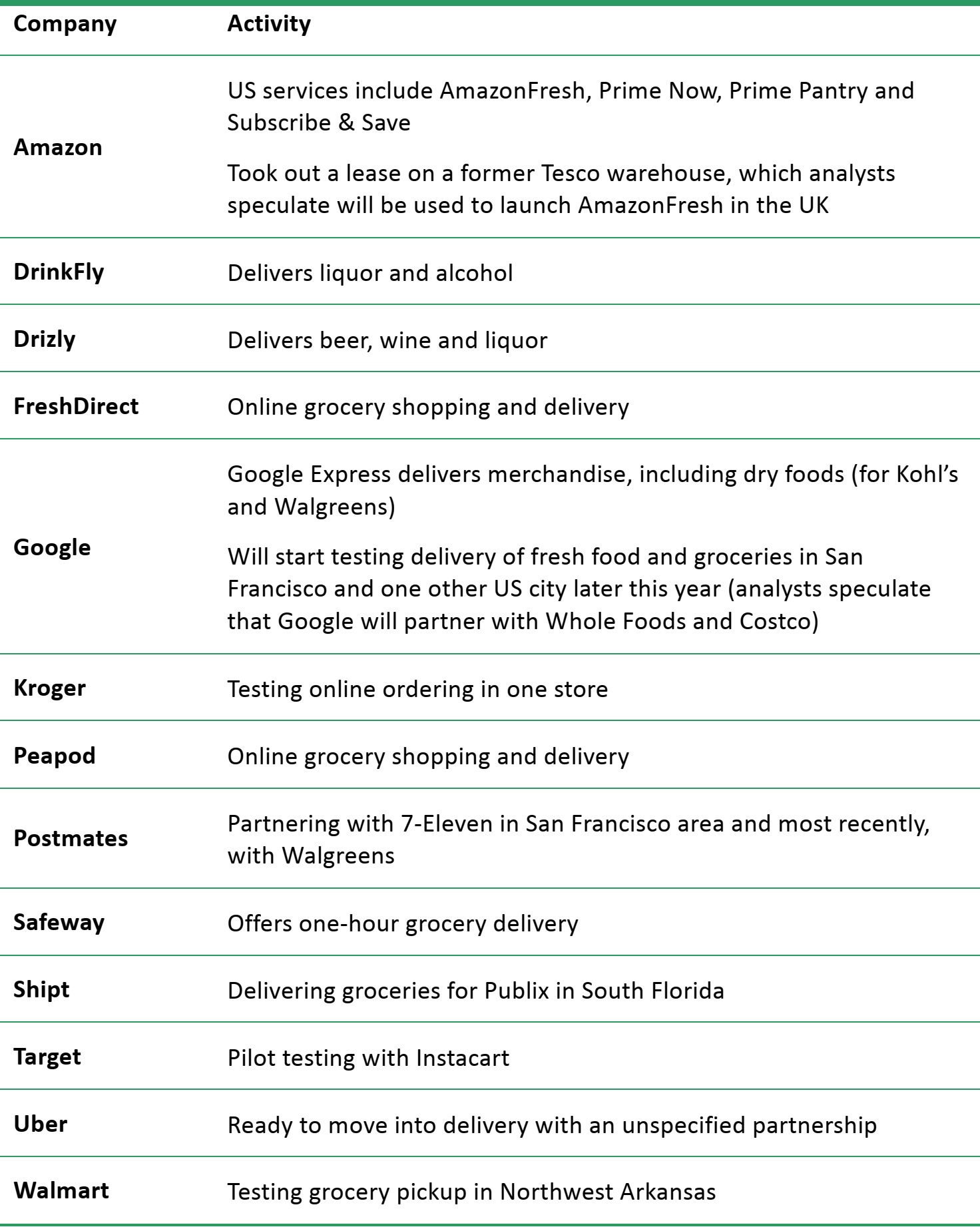

Target faces some competition, though: Bloomberg quoted an analyst at ITG Investment Research who pegged Amazon’s share of online grocery orders in Seattle at 80% during the second quarter and FreshDirect’s share in New York City at more than 80%. Activity in grocery and delivery is definitely heating up, as illustrated in the table below:

According to IBISWorld, the online grocery industry is a $10.9 billion market in the US, and is expected to grow at a 9.6% compound annual growth rate through 2019. An analyst from Piper Jaffray noted that some grocery stores receive as much as 1%–2% of their revenues through Instacart.

Customers in the Minneapolis area can enter their ZIP code on Instacart.com to determine if they live in a qualifying neighborhood or suburb. Delivery is free for the first order and each subsequent order is $5.99 for delivery within an hour or $3.99 for delivery within two hours (for orders over $35). The minimum order value is $10. Instacart makes deliveries from 9:00 a.m. to 10:00 p.m. daily and during Target’s store hours on holidays.

This fee stands in contrast to that of Amazon Fresh, which offers same-day delivery of groceries and other items (and includes Amazon Prime membership) for a $299 annual fee (along with a $50 minimum order requirement), following free 30-day trials in some markets. Target customers already receive free delivery within five days with a $25 minimum order.

Target faces some competition, though: Bloomberg quoted an analyst at ITG Investment Research who pegged Amazon’s share of online grocery orders in Seattle at 80% during the second quarter and FreshDirect’s share in New York City at more than 80%. Activity in grocery and delivery is definitely heating up, as illustrated in the table below:

According to IBISWorld, the online grocery industry is a $10.9 billion market in the US, and is expected to grow at a 9.6% compound annual growth rate through 2019. An analyst from Piper Jaffray noted that some grocery stores receive as much as 1%–2% of their revenues through Instacart.

Customers in the Minneapolis area can enter their ZIP code on Instacart.com to determine if they live in a qualifying neighborhood or suburb. Delivery is free for the first order and each subsequent order is $5.99 for delivery within an hour or $3.99 for delivery within two hours (for orders over $35). The minimum order value is $10. Instacart makes deliveries from 9:00 a.m. to 10:00 p.m. daily and during Target’s store hours on holidays.

This fee stands in contrast to that of Amazon Fresh, which offers same-day delivery of groceries and other items (and includes Amazon Prime membership) for a $299 annual fee (along with a $50 minimum order requirement), following free 30-day trials in some markets. Target customers already receive free delivery within five days with a $25 minimum order.

Target faces some competition, though: Bloomberg quoted an analyst at ITG Investment Research who pegged Amazon’s share of online grocery orders in Seattle at 80% during the second quarter and FreshDirect’s share in New York City at more than 80%. Activity in grocery and delivery is definitely heating up, as illustrated in the table below:

According to IBISWorld, the online grocery industry is a $10.9 billion market in the US, and is expected to grow at a 9.6% compound annual growth rate through 2019. An analyst from Piper Jaffray noted that some grocery stores receive as much as 1%–2% of their revenues through Instacart.

Customers in the Minneapolis area can enter their ZIP code on Instacart.com to determine if they live in a qualifying neighborhood or suburb. Delivery is free for the first order and each subsequent order is $5.99 for delivery within an hour or $3.99 for delivery within two hours (for orders over $35). The minimum order value is $10. Instacart makes deliveries from 9:00 a.m. to 10:00 p.m. daily and during Target’s store hours on holidays.

This fee stands in contrast to that of Amazon Fresh, which offers same-day delivery of groceries and other items (and includes Amazon Prime membership) for a $299 annual fee (along with a $50 minimum order requirement), following free 30-day trials in some markets. Target customers already receive free delivery within five days with a $25 minimum order.

Target faces some competition, though: Bloomberg quoted an analyst at ITG Investment Research who pegged Amazon’s share of online grocery orders in Seattle at 80% during the second quarter and FreshDirect’s share in New York City at more than 80%. Activity in grocery and delivery is definitely heating up, as illustrated in the table below:

OVERVIEW OF ONLINE GROCERY/DELIVERY ACTIVITY