Source: Company reports/Coresight Research

4Q17 Results

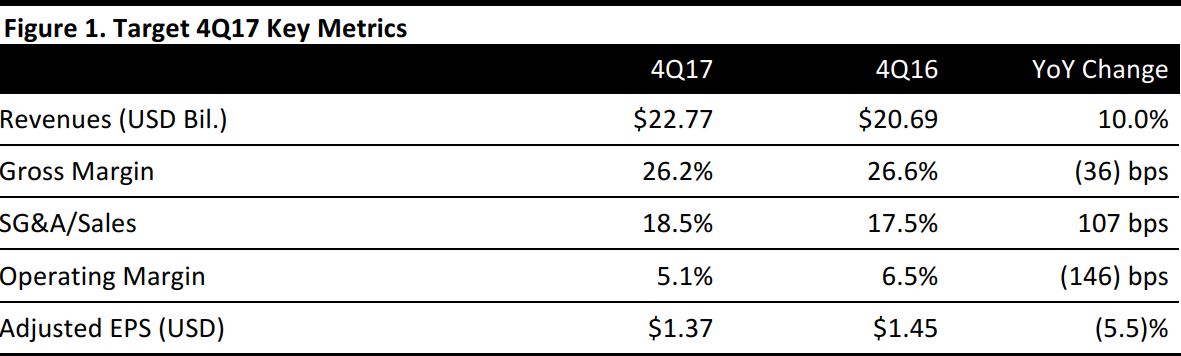

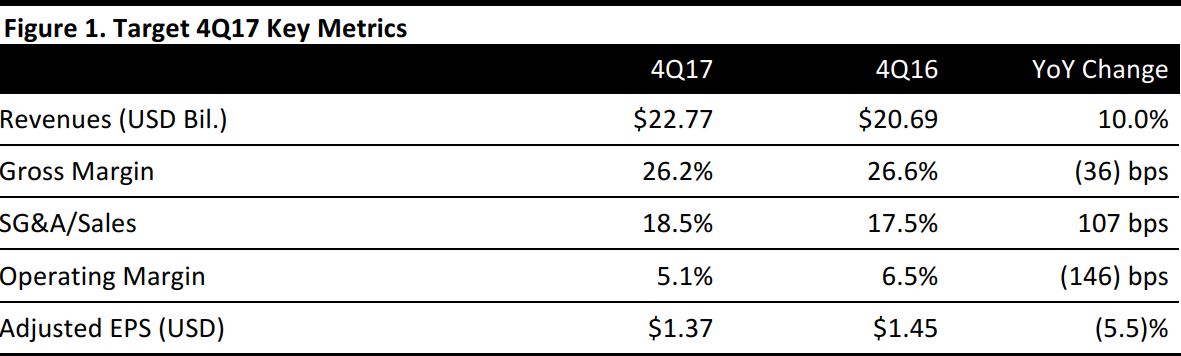

Target reported 4Q17 revenues $22.77 billion, up 10% from the year-ago quarter and ahead of the $20.53 billion consensus estimate. The quarter included a 53rd week.

Comparable sales were up 3.6%, ahead of the consensus estimate of 3.4%, on a 3.2% increase in traffic. Higher average transaction amounts added 0.4 points to comps. Comps grew by more than 4% in January.

Digital channel sales grew by 29% and contributed 1.8 points to comps.

The company’s gross margin was 26.2%, down 36 basis points due to pressure from digital fulfillment costs.

SG&A expense was 18.5% of revenues, up 107 basis points year over year due to higher compensation costs, including an increase in team member incentives and the impact of investments in store team member hours and wage rates, which were partially offset by cost-saving initiatives.

Adjusted EPS was $1.37, down 5.5% from the year-ago quarter and in line with both the consensus estimate and guidance of $1.30–$1.40. GAAP EPS was $2.02, compared with $1.45 in the year-ago quarter.

Other Details from the Quarter

Management commented that the quarterly results reflect the significant investments the company made in its team and business throughout 2017. Management highlighted strong fourth-quarter traffic growth in stores and digital channels, which drove healthy comparable sales in all core merchandise categories.

- Digital accounted for 8.2% of sales, compared with 6.8% in the year-ago quarter.

- Total REDcard penetration was 24.0%, comprising 12.7% for Target Debit Cards and 11.4% for Target Credit Cards, compared with 24.3% in the year-ago quarter.

- The company ended the year with 1,822 stores comprising 239,555 square feet, compared with 1,802 stores comprising 239,502 square feet at the end of the prior year.

FY17 Results

Target’s revenues increased by 3.4% year over year in FY17, to $71.88 billion.

Adjusted EPS was $4.71, down 6.0% year over year. GAAP EPS was $5.33, up 13.5% from the prior year.

Financial Community Meeting Preview

Target’s Financial Community Meeting was scheduled to be held later on the same day as its earnings announcement. Management commented that it would outline plans in that meeting to continue investing in its team and make 2018 a year of acceleration in distinctive areas, including its stores, exclusive brands and rapidly growing suite of fulfillment options. Management believes that its long-term investments will best position the company for profitable growth in a rapidly changing consumer and retail environment. (Please see our separate report on Target’s Financial Community Meeting.)

Outlook

For FY18, the company guided for:

- EPS of $5.15–$5.45, the midpoint of which is above the $5.21 consensus estimate.

- Comps in the low single digits, versus the 1.7% consensus estimate.

For 1Q18, the company guided for:

- EPS of $1.25–$1.45, the midpoint of which is below the $1.40 consensus estimate.

- Comps in the low single digits, versus the 2.4% consensus estimate.