Source: Company reports

4Q15 RESULTS

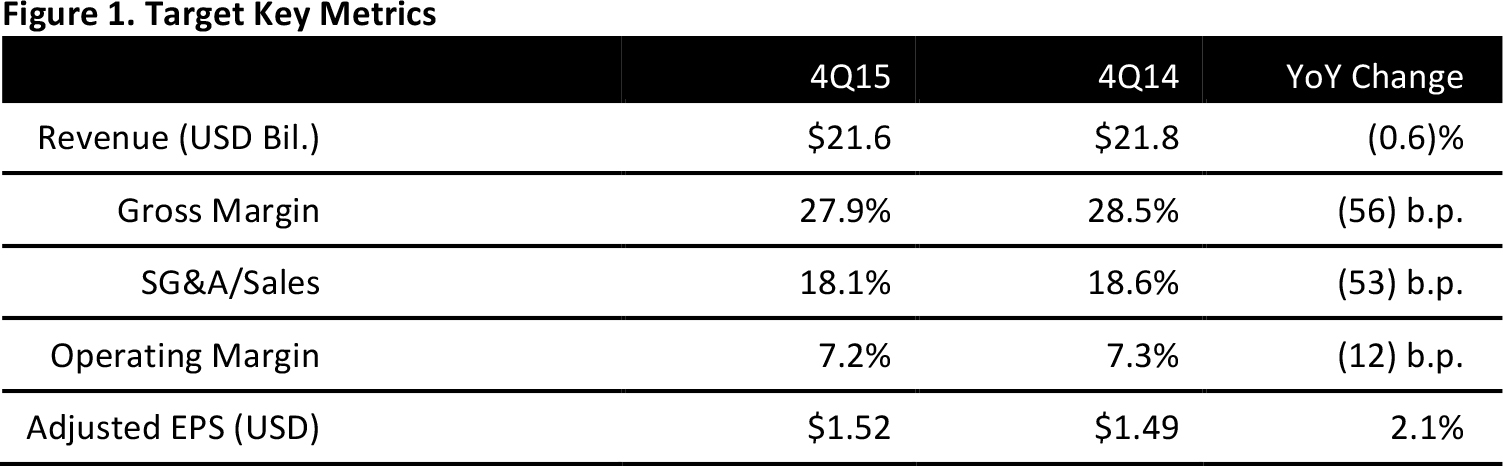

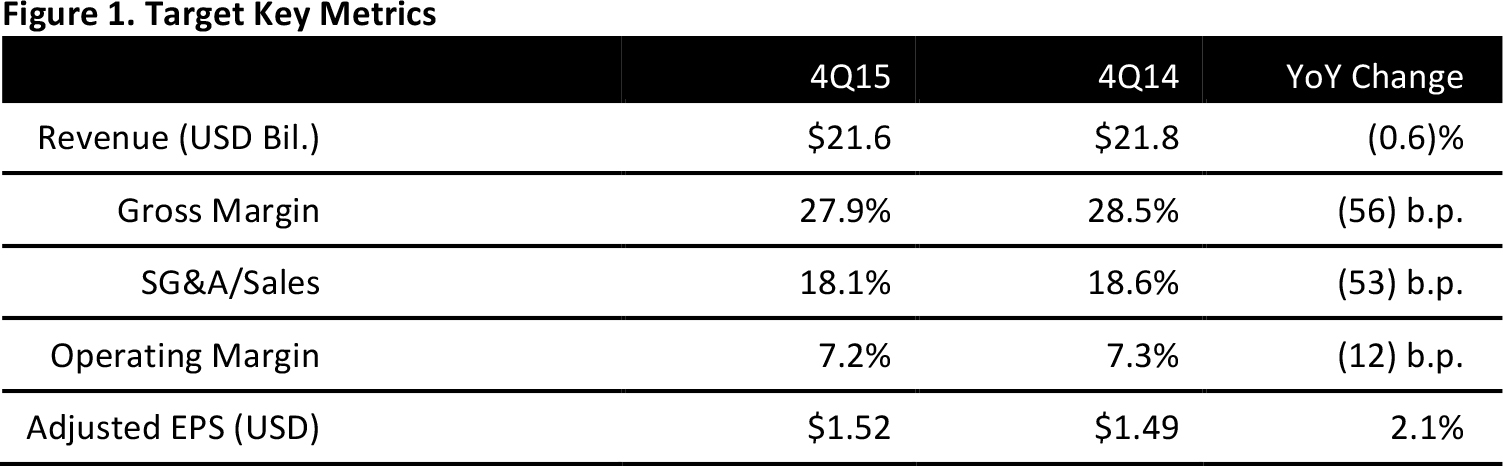

Target’s 4Q15 revenues were $21.6 billion, down 0.6% from $21.8 billion in 4Q14.

In the same period, total comps were up 1.9%, driven by a 1.3% increase in traffic thanks to accelerated sales growth in four signature categories: style, baby, kids and wellness.

Adjusted EPS was $1.52, up three cents from last year’s strong performance, in line with guidance but missing the consensus estimate by two cents. Strong e-commerce sales performance during the Black Friday and Cyber Monday weeks contributed to the record 34% year-over-year growth in digital channel sales in the quarter.

Target’s four signature categories delivered combined comp sales growth of 7%, which was more than three times overall comp growth. Other top-performing categories included home, toys and food. Wearables were the only bright spot in the underperforming electronics category.

2015 RESULTS

Revenues in 2015 were $73.8 billion, up 1.6% from $72.6 billion the prior year. Adjusted EPS was $4.69 for the year, up 11.3% from $4.22 in 2014. Comps increased by 2.1% for the overall business.

GUIDANCE

The company guided for EPS of $1.15–$1.25 for 1Q16 and for adjusted EPS from continuing operations of $5.20–$5.40 for the year, higher than the current consensus estimate of $4.70.

The company also guided for a 1.5%–2.5% increase in comp sales for 2016 and a 4.5%–5.0% sales decline from divestiture of the pharmacy business. Based on this guidance, we estimate total revenues of $71.3–$72.4 billion (i.e., down 2.0%–3.5%), versus the current consensus estimate of $71.8 billion. As Target improves its omni-channel capability, management will make less of a distinction between digital and in-store sales.