Source: Company reports/FGRT

3Q17 Results

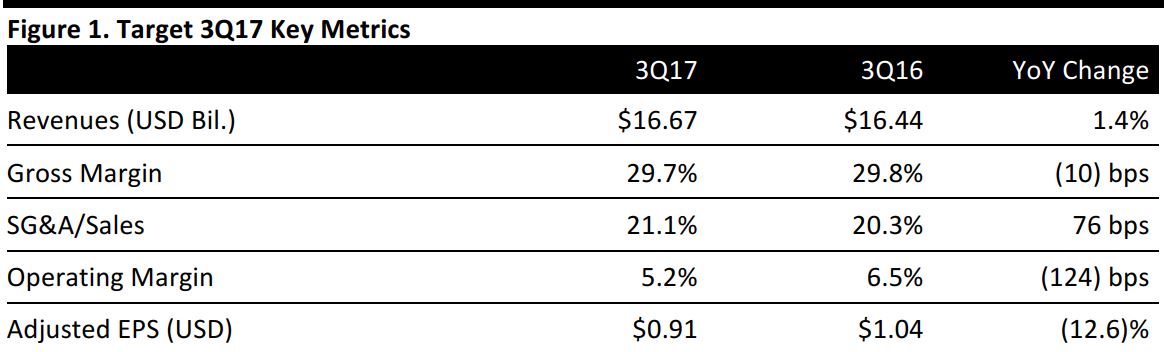

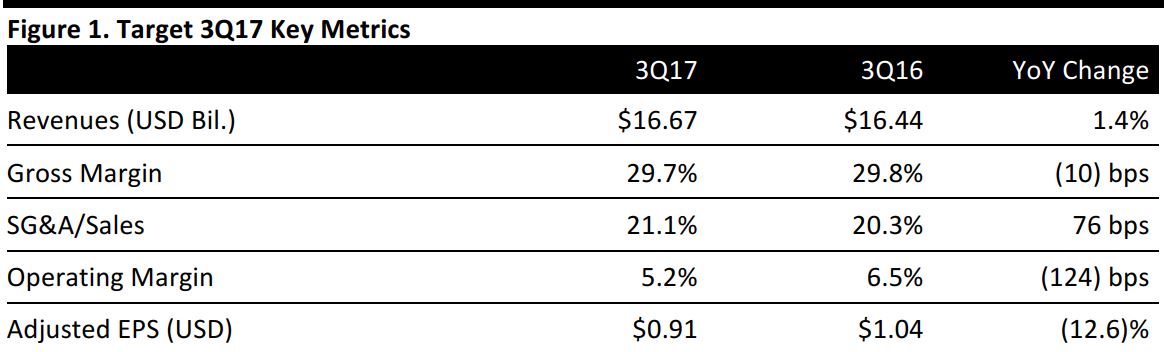

Target reported 3Q17 total sales of $16.67 billion, up 1.4% year over year and above the $16.60 billion consensus estimate.

Comps were up 1.4% year over year, beating the 0.4% consensus estimate. Comparable digital channel sales grew by 24% and contributed 0.8 percentage points to comparable sales growth.

Adjusted EPS was $0.91, compared with $1.04 in the year-ago quarter and above the $0.86 consensus estimate. Adjusted EPS excludes a charge of $0.14 per share for the early retirement of debt that was partially offset by a $0.10-per-share income tax charge. GAAP EPS from continuing operations was $0.87 (including a penny per share from discontinued operations) versus $1.06 in the year-ago quarter.

Details from the Quarter

- Target rolled out four new owned brands across its home and apparel categories during the quarter and announced a new designer partnership with Chip and Joanna Gaines called Hearth and Hand with Magnolia, which launched last week.

- The company remodeled 37 stores in the quarter as part of its plan to transform 110 stores this year. Target also opened 12 new stores in a single week in October, including a new Herald Square location in New York City and a new store in Honolulu, Hawaii.

- In September, the company announced plans to hire an additional 100,000 employees for the peak holiday season, up from 70,000 during last year’s holiday season. The company subsequently announced plans to increase its minimum wage nationally to $11 an hour in October as part of a commitment to raise the national minimum to $15 an hour by the end of 2020.

- Target Restock has become fully operational in 11 key markets throughout the US, and the company continues to expand the list of eligible items while extending the order deadline for next-day delivery. Same-day delivery has been tested and rolled out in four locations in New York City, supported by the company’s recent acquisition of Grand Junction, and Target rapidly tested and rolled out a new drive-up service in 50 locations in the Twin Cities in Minnesota.

- At the start of the holiday season this year, the number of ship-from-store locations has grown more than tenfold, to more than 1,400 locations across the country.

- More than half of total digital volume is provided through the pickup and ship-from-store capabilities, which will peak at well above 80% in the days leading up to Christmas. Target stores are planning to ship more than 30 million units related to digital orders in the peak four weeks of the holiday season, up from about 18 million units last holiday season.

- Across Target’s five broad merchandising categories, hardlines led in the third quarter with a strong single-digit comp increase. This growth was driven by continued double-digit comp growth in electronics and benefited particularly from the video game and mobile segments.

- The home category also saw a healthy comp increase in the quarter, led by the successful launch of the company’s Project 62 owned brand. Category sales also benefited from the continued trend of consumers spending on their homes.

- In apparel and accessories, where consumer spending in the overall market is currently declining, Target gained share in the quarter. Despite lean inventories and unusually warm weather across most of the country, the overall comp was down only slightly.

- Third-quarter comp sales in food and beverage were up slightly despite a continued headwind from deflation in several subcategories and adjustments from work on pricing.

- In the essentials category, the company saw a slight comp decline in the third quarter. Within beauty, Target continued to gain market share, benefiting from investments to differentiate both its assortment and store service model.

Outlook

FY17

For FY17, Target expects:

- Comparable sales growth of flat–1%.

- Adjusted EPS of $4.40–$4.60, compared with prior guidance of $4.34–$4.54 and a $4.52 consensus estimate.

4Q17

For 4Q17, Target expects:

- Comparable sales growth of flat–3%.

- Adjusted EPS in the range of $1.05–$1.25, compared with the $1.24 consensus estimate.