Source: Company reports/Coresight Research

2Q18 Results

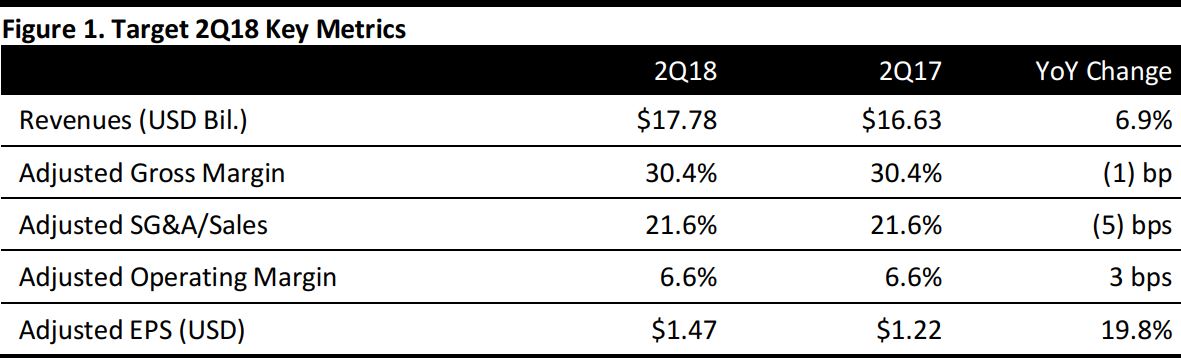

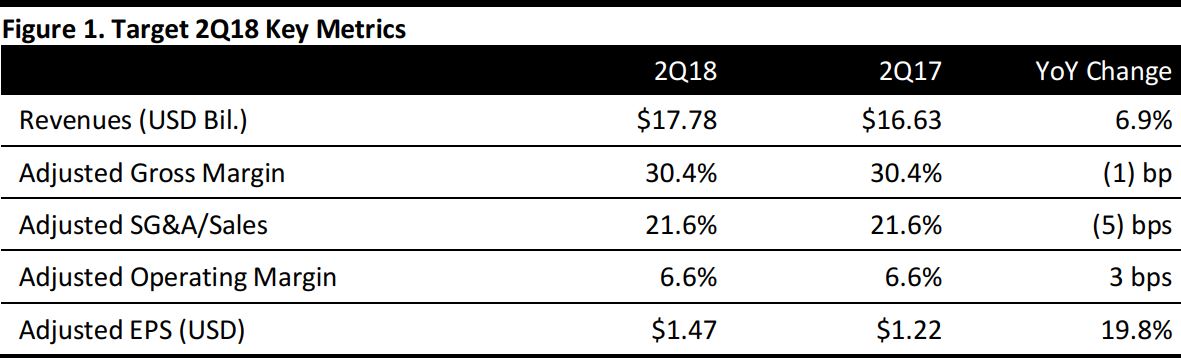

Target reported 2Q18 revenues $17.78 billion, up by 6.9% year over year and beating the consensus estimate of $17.31 billion.

Total comps were up 6.5%, comprising 4.9% for stores and 1.5% for digital. Comparable digital sales grew 41%, on top of 32% growth a year ago.

Adjusted EPS was $1.47, beating the consensus estimate of $1.40. GAAP EPS was $1.49, compared with $1.22 in the year-ago quarter.

Details from the Quarter

- Management characterized the total comp of 6.5% as the strongest quarterly performance since 2005, driven by a 6% increase in traffic.

- The 6.9% revenue growth includes half a point from new and non-mature stores.

- The 41% growth in digital sales benefited from customers’ continuing response to a growing menu of convenient fulfillment options, newness throughout merchandising categories, freshly remodeled stores and a higher level of service. Target also saw a meaningful incremental lift from its one-day sale in July, which exceeded the company’s expectations.

- With strong traffic in-store and online, the company saw accelerating comp sales trends in all five of its core merchandising categories. Comp growth in the home category was strong, up nearly 10%, and hardlines saw high single-digit comp growth, driven by strength in both toys and electronics.

- The company reported 19.8% growth in adjusted EPS, despite remodels of approximately 1,000 stores over a three-year period, work to completely transform its supply chain and opening new small-format stores across the country.

- Other investments include support of the pay-less brand promise, work to deliver a constant stream of new merchandise throughout the company’s own and exclusive brand portfolio, the rollout of new digital capabilities for use with REDcard and investments in hours, wages and training for employees, which should enable the company to deliver higher levels of service and productivity.

- The guidance raise reflects current business trends, including a very strong start to back-to-school and back-to-college, and the company continues to focus on opportunities in key toy and baby categories, given the recent closure of Toys“R”Us and Babies“R”Us.

- Throughout the remainder of the year, Target plans to continue the rollout of new fulfillment capabilities such as drive-up and Shipt, brand launches in multiple categories, the completion of additional remodels and the opening of more small-format stores.

- Beyond 2018, Target aims to move into the next phase of its strategic plan and achieve scale across the full slate of its growth initiatives, generating efficiencies and cost savings and further strengthening its guest experience and overall market position.

- By the end of 2020, Target aims to operate a newly refreshed base of stores, reflecting its plan to complete more than 1,100 remodels in a four-year period through 2020.

- Target’s goal for the year is to deliver well over 300 remodels, and the company believes it is on track to deliver that plan. The company completed remodels of 113 stores in the second quarter on top of the 56 completed in the first quarter, with more underway. In July, Target had 258 locations undergoing remodeling, the largest number in the company’s history.

- Customers appear to be responding positively to the remodels, and the company continues to see traffic-driven incremental sales lifts of 2%–4% following completion. Early indications are showing that remodeled stores continue to out-comp other stores beyond the first year after the remodel.

- Target continues to see encouraging performance at newly opened small-format stores, having opened six new locations in the second quarter on top of the six opened earlier in the year. These locations deliver high sales productivity along with gross margin rates above the company average. As of the end of the second quarter, Target is operating 26 mature small-format stores, and on average, this group saw high single-digit comp growth during the quarter.

Outlook

For the full year, Target offered the following guidance:

- GAAP and adjusted EPS to $5.30–$5.50, up from $5.15–$5.45 previously.

- A low-single-digit increase in comps, compared to its initial guidance of sales growth in the low-to-mid single digits.

For the third quarter, the company expects:

- GAAP and adjusted EPS of $1.00–$1.20, compared to adjusted EPS of $0.90 in the year-ago quarter.

- Comps of 4.8% (also in the second half).