Source: Company reports/FGRT

2Q17 Results

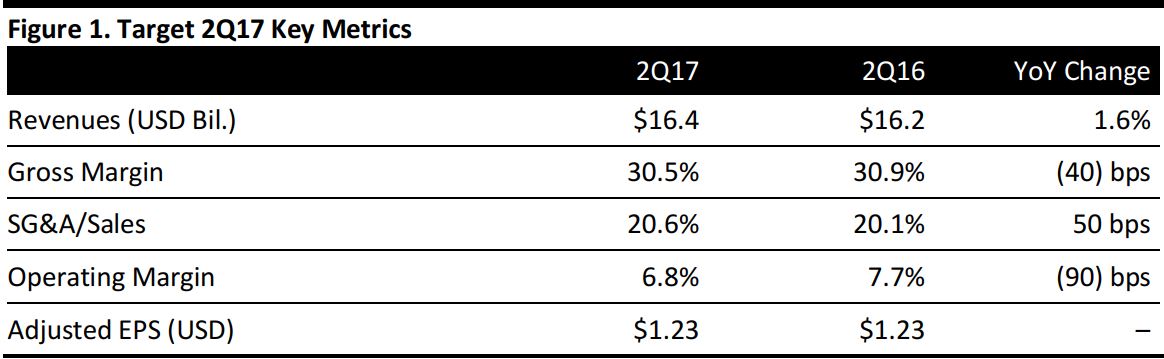

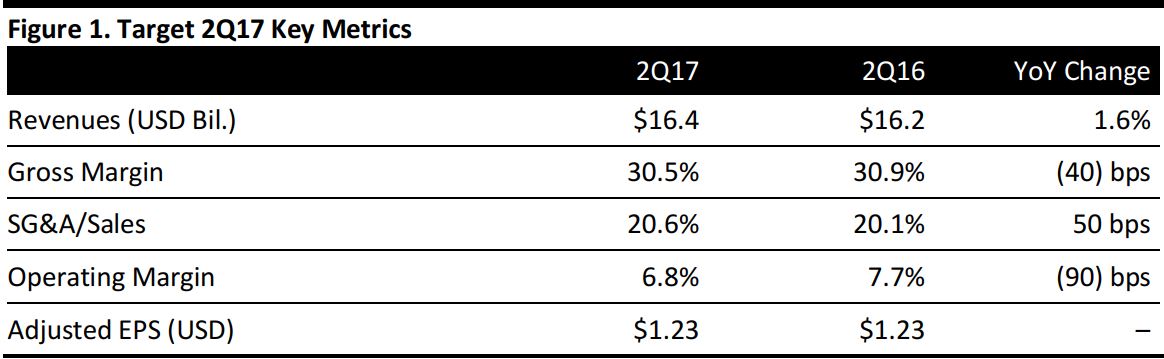

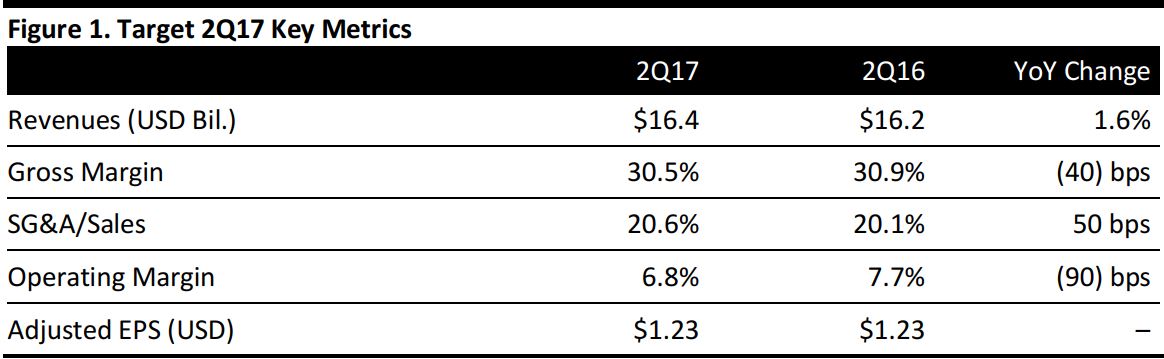

Target reported 2Q17 total revenues of $16.4 billion, up 1.6% year over year and above the $16.3 billion consensus estimate. Comps were up 1.3%, beating the consensus estimate of 0.3%. Adjusted EPS was $1.23, compared with $1.23 in the year-ago quarter and above the $1.19 consensus estimate.

Management was pleased with the quarterly results. Second-quarter store traffic was up 2%, reflecting growth in both the store and digital channels. E-commerce sales were up 32% year over year, contributing 1.1 percentage points to sales growth.Target’s gross margin deteriorated by 40 basis points, driven by the company’s efforts to improve both digital fulfillment costs and pricing. The company saw improved performance in five broad merchandising categories—apparel, home, food and beverage, essentials, and hardlines.

Target is on track to transform 100 stores in 2017 and more than 600 stores in three years, including doubling its number of small-format stores this year as part of its previously announced strategic plan. In the next two years, Target will launch 12 new brands that will replace about $10 billion in sales in current brands.

The company’s inventory position was another area of improvement in the quarter:Target reduced its total inventory by more than 4% while improving its quality by bringing down unproductive inventory.

Outlook

The company raised its full-year guidance based on better-than-expected first-half results. For the full year, Target now expects EPS of $4.34–$4.54, about 11% higher than its prior guidance. The company expects 3Q17 EPS of $0.75–$0.95.

With the accelerated pace of store remodeling, Target expects some accelerated depreciation. Capital expenditure for the next fiscal year is expected to increase. In October 2017, Target will launch a new women’s athletic fashion brand that was designed based on style and wellness factors.