Source: Company reports

2Q 2016 RESULTS

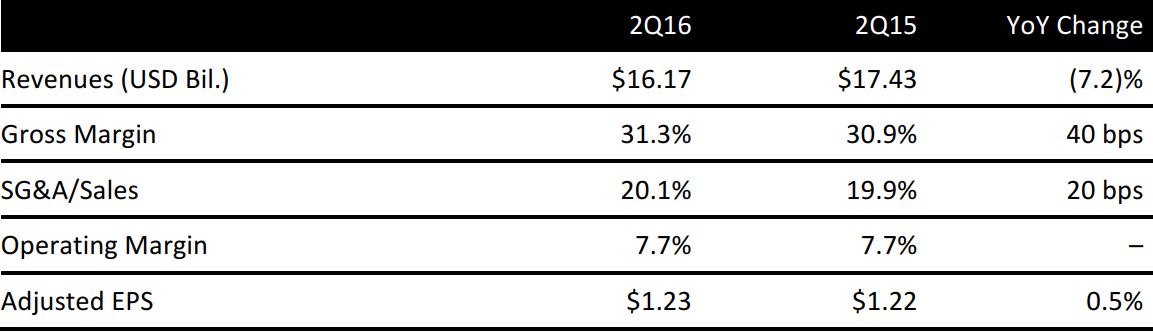

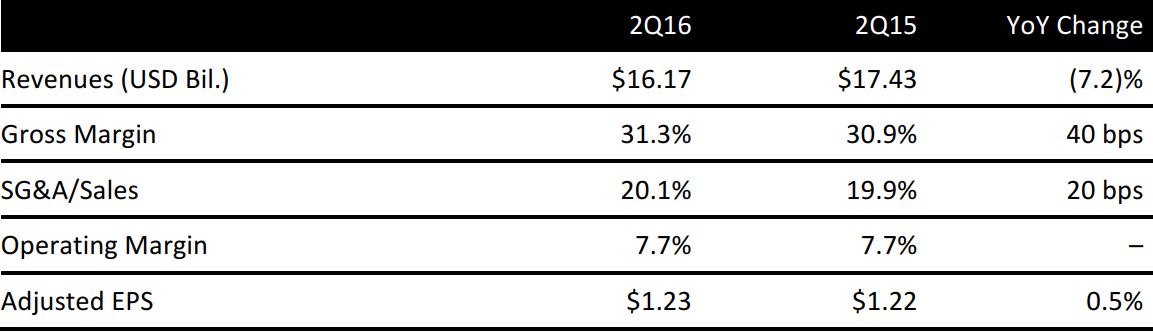

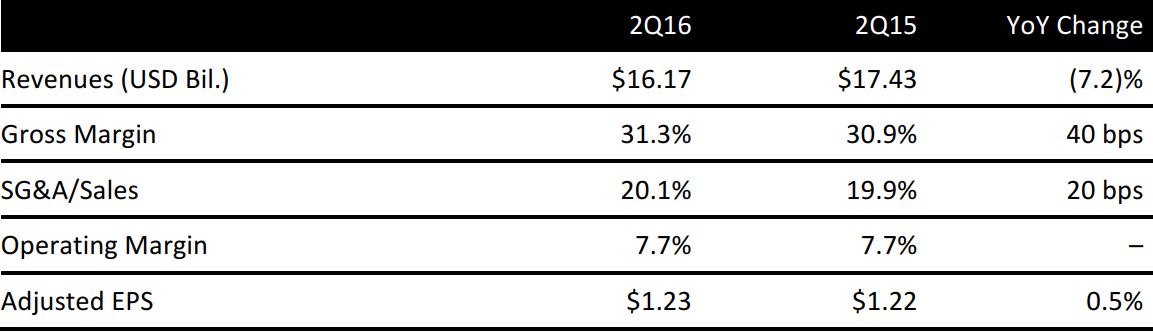

Target reported 2Q16 adjusted EPS of $1.23 versus the consensus estimate of $1.13. Upside was driven by ongoing cost-saving programs that benefited both gross margins and expense rates and helped offset pressure from the current promotional environment.

Total revenue was $16.17 billion, in line with expectations. Total sales declined by 7.2% year-over-year, reflecting the loss of sales from the pharmacy business. Comps were down 1.1% versus expectations of a 0.7% decline and guidance of flat–(2)%.

Traffic was down 2.2%, but the decline was partially offset by a 2.6% increase in average selling price. Units per transaction were down 1.5%. The biggest challenge the company faced in the period was traffic, which affected sales across all merchandise categories. During the quarter, sales were stronger around key holidays, which included Memorial Day and July 4th, and during the beginning of the back-to-school season.

Electronics comps were down by double digits and accounted for about 70 basis points of the total comp decline; Apple products were down more than 20%. Grocery comps declined modestly, with food deflation negatively impacting them by 20 basis points. Traffic was also weak in the pharmacy segment.

Comps in Target’s signature categories were up 2%, and particular strength was seen in both the kids and style categories. Within kids, the recently launched Cat & Jack brand was up 20% compared with Circo and Cherokee last year. In style, women’s apparel was strong and comps increased by mid-single digits, driven by double-digit growth in the Xhilaration brand. The Who What Wear brand also performed well, and is one of the most productive brands on the women’s floor.

Comparable digital sales increased by 16% in the quarter, and represented 3.3% of total sales, up from 2.7% last year. Digital sales contributed 50 basis points to total comp growth.

REDcard penetration increased to 23.9% in the period from 22.1% in the year-ago quarter.

Management also pointed out that trends continue to be volatile, as weekly and regional sales have been more variable than in the past.

2016 OUTLOOK

For 3Q16, the company guided for EPS of $0.75–$0.95, below consensus of $0.96, based on flat–(2)% comp growth.

Target lowered its full-year EPS guidance to $4.80–$5.20 from $5.20–$5.40 previously; consensus calls for EPS of $5.13. The company lowered its outlook for 2H16 comps based on the current retail environment. Management is planning for a challenging second half of the year.