Source: Company reports/Fung Global Retail & Technology

1Q17 Results

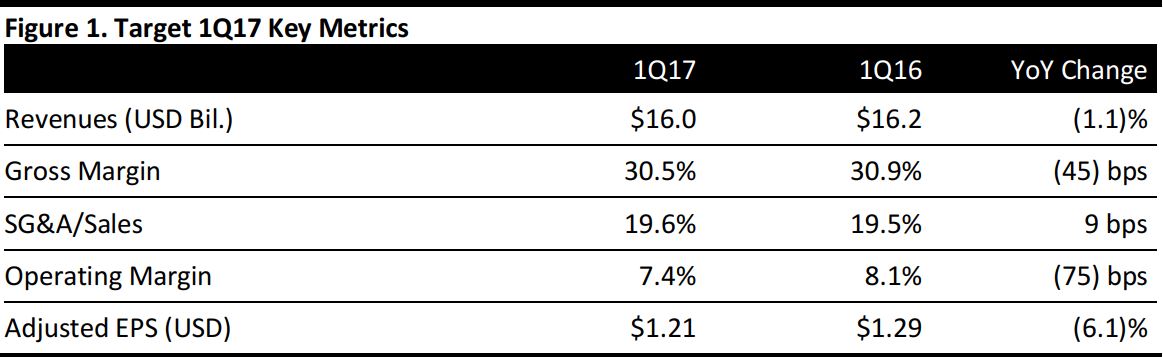

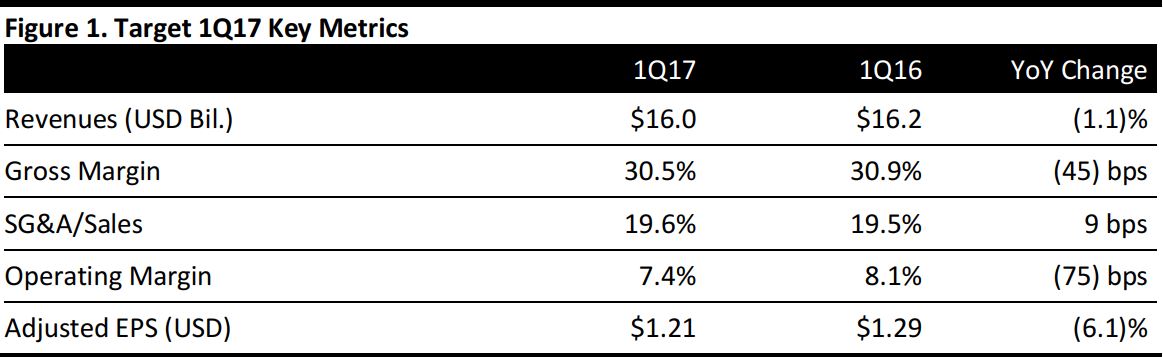

Target reported 1Q17 total revenues of $16.0 billion, down 1.1% year over year, but above the $15.65 billion consensus estimate.Comps were down 1.3%; the decline was partially offset by a contribution from new stores.

E-commerce sales were up 22% year over year and accounted for 4.3% of revenues, contributing 0.8 percentage points to sales growth.

Adjusted EPS was $1.21, compared with $1.29 in the year-ago quarter and well above the $0.91 consensus estimate. GAAP EPS from continuing operations was $1.22 (including a penny from discontinued operations) versus $1.02 a year ago.

Details from the Quarter

- CEO Brian Cornell commented that the first quarter started with very soft trends, but that the company saw improvement later in the quarter, particularly in March. Although management is confident in its plans, Target is facing multiple headwinds.

- Cornell outlined Target’s capital plan of investing $7 billion over the next three years to improve the company’s technology and supply chain, as well as improve 600 stores and open 100 new small-format locations.

- Capital investment in 1Q17 totaled $500 million,out of $2 billion earmarked for the year.

- Target plans to spend an additional $1 billion of operating margin this year, primarily in equipping its team to offer enhanced service, convenience and deeper product expertise.

Target also provided updates in the following three areas:

- Digital and fulfillment:

- Target Restock—offering next-day delivery of household essentials such as toothpaste and diapers.

- Tribeca delivery pilot—the company will begin testing delivery in Manhattan and parts of Brooklyn and Queens in New York.

- Target Finds—the company will offer web pages curated by Target members.

- The company is using CGI to create 360-degree shoppable rooms on Target.com.

- Assortment:

- The electronics business launched the Nintendo Switch.

- Millions of guests shopped the Victoria Beckham collection.

- Target saw share gains across the board in apparel, particularly in the swim category.

- Stores:

- Target provided a look at its next-generation store design; the first new store with the design is to open in Houston.

- The company announced that it would open three new stores in New York City.

Outlook

Full Year

Although Target did not update its full-year EPS guidance (i.e., GAAP and adjusted EPS of $3.80–$4.20), the company suggested that its first-quarter performance increases the likelihood of actual full-year EPS ending up above the midpoint of the range (i.e., above $4.00).

Second Quarter

For 2Q17, Target expects:

- A low single-digit decline in comps.

- GAAP and adjusted EPS of $0.95–$1.15, in line with the $1.00 consensus estimate.