DIpil Das

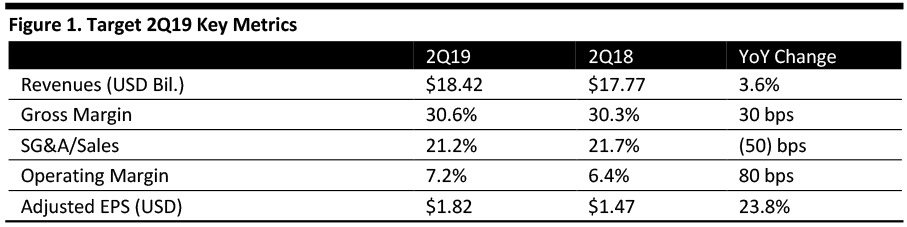

[caption id="attachment_95011" align="aligncenter" width="699"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

Target reported 2Q19 total revenues of $18.42 billion, up 3.6% and beating the $18.29 billion consensus estimate.

The operating margin expanded 80 basis points (bps) to 7.2%, compared to 6.4% over the same quarter a year ago.

Comps grew 3.4% on traffic growth of 2.4% and beating the consensus of 3.0% comp growth. Average transaction value increased 0.9%.

Comparable digital sales grew 34%, contributing 1.8% to comps. Same-day fulfillment services such as BOPIS, drive-up and Shipt continued to grow. Adjusted EPS was $1.82, beating the $1.62 consensus.

By category, growth was strongest in the company’s essentials and beauty lines, and apparel, both of which delivered comp increases above 5%. Baby, beauty and over-the-counter products were the three fast-growing sub-categories in essentials and beauty.

In apparel, categories including intimates and sleepwear, jewelry, accessories and shoes, baby and performance activewear also showed positive growth.

Among the remaining core categories, both food and beverage and home assortments saw low single-digit comp increases. In food, growth was driven mainly by adult beverages, which delivered another quarter of double-digit growth. In home, results were led by décor.

In hardlines, comps were approximately flat. The mobile category grew at a healthy rate during the quarter, which was offset by comp declines in the electronics and entertainment categories.

Target finished the quarter with 1,853 stores, up from 1,844 a year ago.

Details from the Quarter

Management was pleased with financial performance.

Other points:

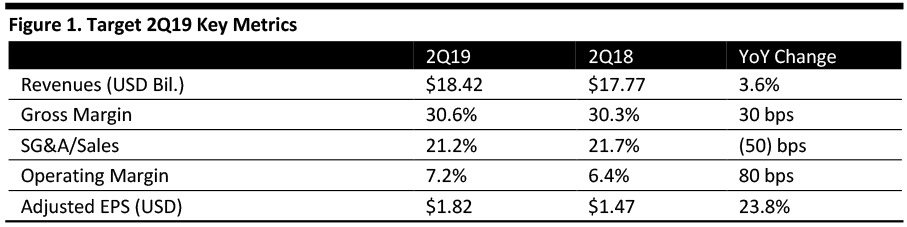

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Target reported 2Q19 total revenues of $18.42 billion, up 3.6% and beating the $18.29 billion consensus estimate.

The operating margin expanded 80 basis points (bps) to 7.2%, compared to 6.4% over the same quarter a year ago.

Comps grew 3.4% on traffic growth of 2.4% and beating the consensus of 3.0% comp growth. Average transaction value increased 0.9%.

Comparable digital sales grew 34%, contributing 1.8% to comps. Same-day fulfillment services such as BOPIS, drive-up and Shipt continued to grow. Adjusted EPS was $1.82, beating the $1.62 consensus.

By category, growth was strongest in the company’s essentials and beauty lines, and apparel, both of which delivered comp increases above 5%. Baby, beauty and over-the-counter products were the three fast-growing sub-categories in essentials and beauty.

In apparel, categories including intimates and sleepwear, jewelry, accessories and shoes, baby and performance activewear also showed positive growth.

Among the remaining core categories, both food and beverage and home assortments saw low single-digit comp increases. In food, growth was driven mainly by adult beverages, which delivered another quarter of double-digit growth. In home, results were led by décor.

In hardlines, comps were approximately flat. The mobile category grew at a healthy rate during the quarter, which was offset by comp declines in the electronics and entertainment categories.

Target finished the quarter with 1,853 stores, up from 1,844 a year ago.

Details from the Quarter

Management was pleased with financial performance.

Other points:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Target reported 2Q19 total revenues of $18.42 billion, up 3.6% and beating the $18.29 billion consensus estimate.

The operating margin expanded 80 basis points (bps) to 7.2%, compared to 6.4% over the same quarter a year ago.

Comps grew 3.4% on traffic growth of 2.4% and beating the consensus of 3.0% comp growth. Average transaction value increased 0.9%.

Comparable digital sales grew 34%, contributing 1.8% to comps. Same-day fulfillment services such as BOPIS, drive-up and Shipt continued to grow. Adjusted EPS was $1.82, beating the $1.62 consensus.

By category, growth was strongest in the company’s essentials and beauty lines, and apparel, both of which delivered comp increases above 5%. Baby, beauty and over-the-counter products were the three fast-growing sub-categories in essentials and beauty.

In apparel, categories including intimates and sleepwear, jewelry, accessories and shoes, baby and performance activewear also showed positive growth.

Among the remaining core categories, both food and beverage and home assortments saw low single-digit comp increases. In food, growth was driven mainly by adult beverages, which delivered another quarter of double-digit growth. In home, results were led by décor.

In hardlines, comps were approximately flat. The mobile category grew at a healthy rate during the quarter, which was offset by comp declines in the electronics and entertainment categories.

Target finished the quarter with 1,853 stores, up from 1,844 a year ago.

Details from the Quarter

Management was pleased with financial performance.

Other points:

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Target reported 2Q19 total revenues of $18.42 billion, up 3.6% and beating the $18.29 billion consensus estimate.

The operating margin expanded 80 basis points (bps) to 7.2%, compared to 6.4% over the same quarter a year ago.

Comps grew 3.4% on traffic growth of 2.4% and beating the consensus of 3.0% comp growth. Average transaction value increased 0.9%.

Comparable digital sales grew 34%, contributing 1.8% to comps. Same-day fulfillment services such as BOPIS, drive-up and Shipt continued to grow. Adjusted EPS was $1.82, beating the $1.62 consensus.

By category, growth was strongest in the company’s essentials and beauty lines, and apparel, both of which delivered comp increases above 5%. Baby, beauty and over-the-counter products were the three fast-growing sub-categories in essentials and beauty.

In apparel, categories including intimates and sleepwear, jewelry, accessories and shoes, baby and performance activewear also showed positive growth.

Among the remaining core categories, both food and beverage and home assortments saw low single-digit comp increases. In food, growth was driven mainly by adult beverages, which delivered another quarter of double-digit growth. In home, results were led by décor.

In hardlines, comps were approximately flat. The mobile category grew at a healthy rate during the quarter, which was offset by comp declines in the electronics and entertainment categories.

Target finished the quarter with 1,853 stores, up from 1,844 a year ago.

Details from the Quarter

Management was pleased with financial performance.

Other points:

- Delivery: Combined sales for in-store pickup, drive-up and Shipt have more than doubled over the last year, contributing nearly three-quarters of Target's 34% digital comps in the second quarter. Nearly 1.5% of the company's overall comp growth was driven by same-day shipping services.

- Merchandising: Target launched a new multi-category owned brand, More Than Magic, in the quarter. And the company expanded the test of Levi's Red Tab denim for both men and women to 50 stores. On Aug 19, the company announced the launch of its largest in-house brand, Good & Gather, with more than 2,000 items.

- Stores: Target remodeled 84 stores in the quarter and is on track to remodel a total of 300 by the end of the year. Customers visit remodeled store more often, driving incremental traffic and sales.

- Shopping holiday: The July Deal Days event was outstanding, according to the company, both in terms of guest response to promotions and the ability of its operations functions to handle the surge in demand. The company also sees encouraging early results in back-to-school and back-to-college categories.

- For both 3Q and second half of FY19: Comps to increase 3.4%, in line with growth in 2Q19.

- For 3Q: Adjusted EPS of $1.04-1.24.

- For the second half of FY19: Adjusted EPS of $5.90-6.20, compared with prior guidance of $5.75-6.05.