DIpil Das

[caption id="attachment_88884" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

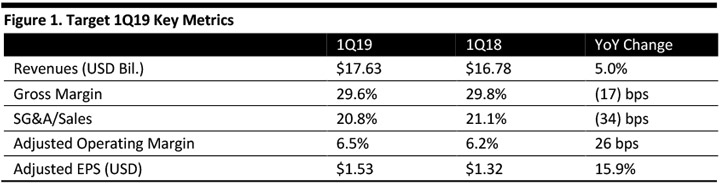

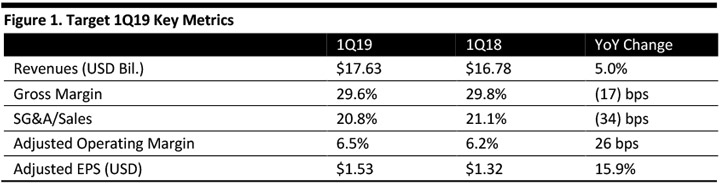

Target reported 1Q19 total revenues of $17.63 billion, up 5.0% and beating the $17.46 billion consensus estimate.

Operating margins expanded due to disciplined expense control and a favorable mix of digital fulfillment.

Comps grew 4.8%, on traffic growth of 4.3% and beating the consensus of 4.1%. Average transaction value increased 0.5%.

Digital sales growth accelerated to 42%, following the 28% growth in the year-ago quarter and contributing 2.1 percentage points to comp growth. Same-day fulfillment services such as BOPIS, drive-up and Shipt contributed well over half of the digital-sales growth. Some 7.1% of sales were digitally originated, up from 5.2% in the year-ago quarter.

Adjusted EPS was $1.53, beating consensus by a dime. GAAP EPS was $1.53, compared to $1.33 in the year-ago quarter.

Target finished the quarter with 1,851 stores, up from 1,829 a year ago.

Details from the quarter

Management characterized the quarterly results as outstanding, benefiting from investments over the last two years to build a durable financial model designed to drive consumer relevance and sustainable growth. Management cited market-share gains as evidence of the success of its strategy.

Other points:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Target reported 1Q19 total revenues of $17.63 billion, up 5.0% and beating the $17.46 billion consensus estimate.

Operating margins expanded due to disciplined expense control and a favorable mix of digital fulfillment.

Comps grew 4.8%, on traffic growth of 4.3% and beating the consensus of 4.1%. Average transaction value increased 0.5%.

Digital sales growth accelerated to 42%, following the 28% growth in the year-ago quarter and contributing 2.1 percentage points to comp growth. Same-day fulfillment services such as BOPIS, drive-up and Shipt contributed well over half of the digital-sales growth. Some 7.1% of sales were digitally originated, up from 5.2% in the year-ago quarter.

Adjusted EPS was $1.53, beating consensus by a dime. GAAP EPS was $1.53, compared to $1.33 in the year-ago quarter.

Target finished the quarter with 1,851 stores, up from 1,829 a year ago.

Details from the quarter

Management characterized the quarterly results as outstanding, benefiting from investments over the last two years to build a durable financial model designed to drive consumer relevance and sustainable growth. Management cited market-share gains as evidence of the success of its strategy.

Other points:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Target reported 1Q19 total revenues of $17.63 billion, up 5.0% and beating the $17.46 billion consensus estimate.

Operating margins expanded due to disciplined expense control and a favorable mix of digital fulfillment.

Comps grew 4.8%, on traffic growth of 4.3% and beating the consensus of 4.1%. Average transaction value increased 0.5%.

Digital sales growth accelerated to 42%, following the 28% growth in the year-ago quarter and contributing 2.1 percentage points to comp growth. Same-day fulfillment services such as BOPIS, drive-up and Shipt contributed well over half of the digital-sales growth. Some 7.1% of sales were digitally originated, up from 5.2% in the year-ago quarter.

Adjusted EPS was $1.53, beating consensus by a dime. GAAP EPS was $1.53, compared to $1.33 in the year-ago quarter.

Target finished the quarter with 1,851 stores, up from 1,829 a year ago.

Details from the quarter

Management characterized the quarterly results as outstanding, benefiting from investments over the last two years to build a durable financial model designed to drive consumer relevance and sustainable growth. Management cited market-share gains as evidence of the success of its strategy.

Other points:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Target reported 1Q19 total revenues of $17.63 billion, up 5.0% and beating the $17.46 billion consensus estimate.

Operating margins expanded due to disciplined expense control and a favorable mix of digital fulfillment.

Comps grew 4.8%, on traffic growth of 4.3% and beating the consensus of 4.1%. Average transaction value increased 0.5%.

Digital sales growth accelerated to 42%, following the 28% growth in the year-ago quarter and contributing 2.1 percentage points to comp growth. Same-day fulfillment services such as BOPIS, drive-up and Shipt contributed well over half of the digital-sales growth. Some 7.1% of sales were digitally originated, up from 5.2% in the year-ago quarter.

Adjusted EPS was $1.53, beating consensus by a dime. GAAP EPS was $1.53, compared to $1.33 in the year-ago quarter.

Target finished the quarter with 1,851 stores, up from 1,829 a year ago.

Details from the quarter

Management characterized the quarterly results as outstanding, benefiting from investments over the last two years to build a durable financial model designed to drive consumer relevance and sustainable growth. Management cited market-share gains as evidence of the success of its strategy.

Other points:

- REDcard debit card penetration was 13.1% and credit card penetration was 10.4%, for a total of 23.5%, up from 24.1% in the year-ago quarter.

- Management commented that the customer response to Target’s same-day delivery service has been very positive, and that physical stores handled 80% of 1Q digital volume.

- Weather: During the quarter, Target experienced some choppy sales results due to unfavorable weather, in addition to a late spring, towards the end of the quarter. Still, business performed well, owing to strong Valentine’s Day and Easter holiday sales, plus reliable traffic in food, beverages and essentials.

- Delivery: Continues to grow the number of marketplace participants, driving scale and relevance. CVS and Petco launched nationwide on Shipt in Q1. Target customers in more than 1,500 stores in more than 250 markets can use Shipt for delivery. Shipt offers unlimited free same-day delivery from Target and 50 other nationwide retailers for a $99 annual fee. Ships maintains an army of 100,000 shoppers delivering orders daily, and the number continues to grow. In some urban areas, Target is offering delivery for a flat $7 fee, and basket size is five times larger than average, with a strong mix of items from the home category. For pantry replenishment, customers can request delivery of a 45-pound box of essentials for a $2.99 fee. Target also doesn’t charge delivery fees for REDcard holders or with a $35 minimum order.

- Merchandising: Target launched three new private-label intimate brands in the quarter, one new private-label brand in essentials, national brands Flamingo and Welly in personal care, and a new home brand, Sun Squad, for the summer season.

- Stores: Target remodeled 53 stores in the quarter and is on track for 300 remodels this year. Customers are visiting the remodeled store more often, driving incremental traffic and sales. The company opened seven new small-format stores in Q1 in metro areas such as New York, Los Angeles, Chicago and Washington, D.C. and new markets such as Santa Barbara, California.

- Tariffs: The team continues to monitor trade negotiations and develop contingency plans to mitigate the impact of import tariffs on Chinese goods on Target customers and on the business. Management considers the company’s multi-category portfolio a competitive advantage, as it can balance an impact in one area in other areas.

- Digital: Digital contributed more than $5 billion of sales last year, and two-thirds of this figure were fulfilled by physical stores. Target aims to grow this figure by more than $1 billion in 2019, with a higher percentage fulfilled in stores. The company believes services such as Drive-Up and Shipt are driving additional trips to Target, rather than replacing traditional shopping. BOPIS increased more than 80% year over year in the quarter, yet Drive-Up and Shipt grew even faster.

- Comps to increase by a low-to-mid single digit percentage.

- Operating income to increase by mid-single digits.

- EPS of $5.75-6.05, up 7-12% and above the consensus estimate of $5.61.

- Comps in the low- to mid-single digits (unchanged from Q1).

- Mid-single digit growth in operating income.

- Adjusted EPS of $1.52-1.72, whose midpoint of $1.62 is above the $1.59 consensus estimate.