Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

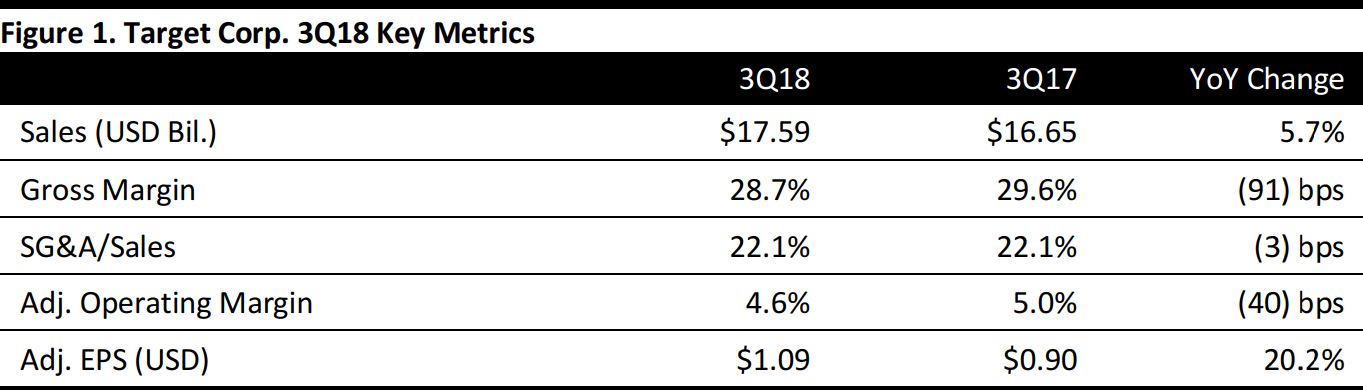

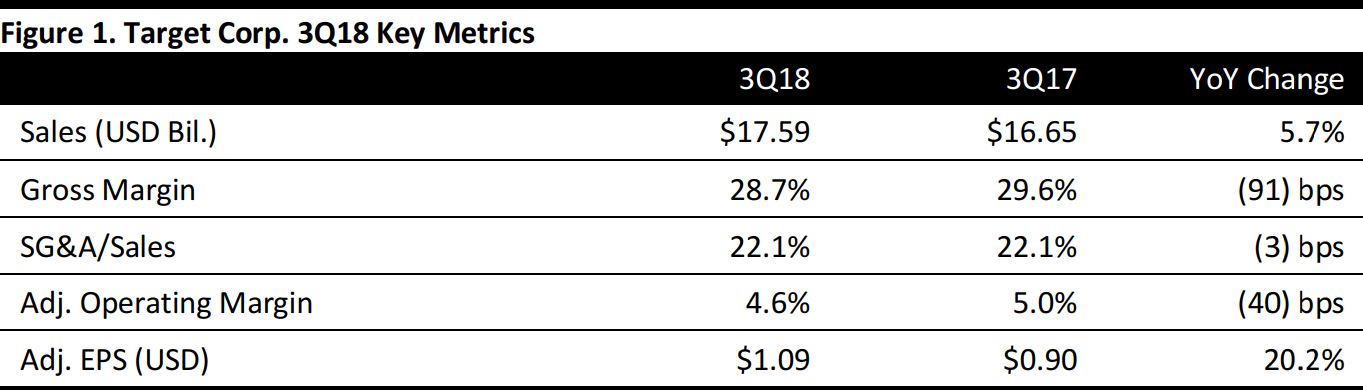

3Q18 Results

Target reported 3Q18 sales of $17.59 billion, up by 5.7% year over year and missing the consensus estimate of $17.70 billion. Total revenues were $17.82 billion, up 5.6%, which includes $231 million of other revenue.

Total comps were up 5.1%, based on a 5.3% increase in the number of transactions, offset by a 0.2% decline in the average transaction amount.

Adjusted EPS was $1.09, missing the $1.11 consensus estimate. GAAP EPS was $1.16, up 33.9% from the prior year, which includes a $0.07 per share gain related to the Tax Cuts and Jobs Act.

Details from the Quarter

Management characterized the quarter as outstanding and outlined investments the company has made going into the holidays, as well as plans for 2019 to achieve greater scale, drive greater efficiencies and deliver cost savings.

Other points in the quarter:

- Adjusted EPS of $1.09 set a new high for third-quarter earnings for Target.

- Comparable sales growth of 5.1% was in line with management’s expectation and slightly stronger than the pace established in the first half of the year. Management was pleased that comps were driven by in-store traffic and via digital channels.

- Comps in digital channels grew 49% in the quarter, outpacing the industry, which management attributed to Target’s efforts to make the digital experience easy and seamless; to deliver new and innovative items through own, exclusive and national brand assortments; and, to offer convenient fulfillment options.

- In addition to strong digital traffic, Target saw healthy traffic and sales growth in stores, reflecting investments in store remodeling, enhancements of the assortment and presentation in key categories. Investments in the team also enables the team to provide an elevated experience and higher level of service.

- New stores contributed more than 0.5 percentage points to Q3 sales growth, driven by new small-format locations in dense urban settings and near college campuses across the country. These stores are small in square footage terms, but sales productivity is high, offering strong financial returns and enabling Target to reach previously unserved segments.

- Management outlined the strategic initiatives driving traffic and sales growth, including:

- The remodel program.

- Efforts to rejuvenate its portfolio of own and exclusive brands.

- Rolling out new fulfillment options focused on delivering ease and convenience, including restock, drive-up and personal shopping in as little as two hours with Shipt.

- Investments that allow stores to fulfill an increasing number of target.com shipments so the company can deliver quickly while also controlling costs.

- New digital capabilities to make shopping faster, easier and more inspiring.

- Work to ensure that daily pricing is correct while delivering the appropriate number of clear, compelling promotions.

- Investments in hours, wages and training for the floor staff to further differentiate the shopping experience in Target’s stores

- Target also continues to benefit from a healthy consumer and macroeconomic backdrop. In addition, as other retailers continue to close stores and liquidate in the face of rapid changes in consumer preferences and shopping behavior, management believes these investments position the company to capture sales and market share by serving consumers no longer shopping at those retailers.

- Other investments include tools and technology that boost labor efficiency, freeing Target’s team members to focus on customers; cost discipline, beginning at headquarters and spanning through all operations; brand development work, which supports strong performance in the highest-margin home and apparel categories; and, the development, testing and rollout of automation in the supply chain. Moreover, work to optimize and automate inventory replenishment, now in the early stages, should deliver further savings over the next few years.

Outlook

Full year:

- Target reiterated its adjusted EPS guidance of $5.30–$5.50, the midpoint of which is roughly in line with the $5.41 consensus estimate.

Fourth quarter:

- The company expects sales growth of 5% for 4Q18 to $23.9 billion, above the $22.9 consensus estimate.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research