Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

1Q18 Results

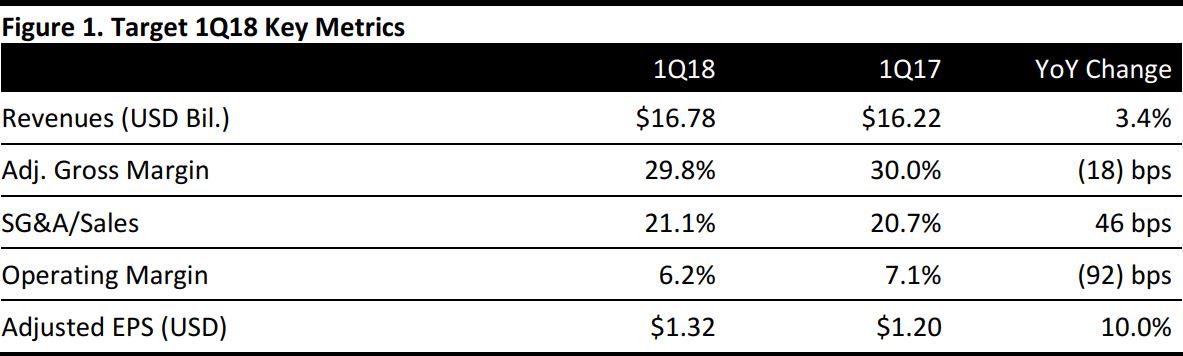

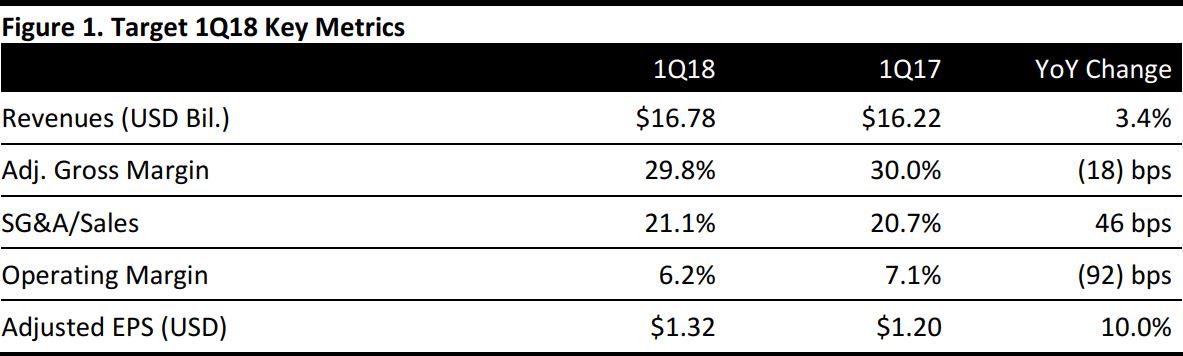

Target reported 1Q18 revenues $16.78 billion, up by 3.4% year over year, and roughly in line with the consensus estimate of $16.58 billion.

Adjusted EPS was $1.32, below the consensus estimate of $1.39, and included a penny charge for income tax adjustments. GAAP EPS was $1.33, compared with $1.21 in the year-ago quarter.

Details from the Quarter

- Traffic growth was 3.7%, the best performance in 10 years, and momentum accelerated during the quarter.

- Comps were up by 3.0%, beating the 2.8% consensus estimate, driven by a 3.7% increase in transactions, offset by a 0.6% decrease in transaction value.

- Digital sales increased by 28.0%, on top of 21.0% in the year-ago quarter, and contributed 1.1% to comp growth.

- Sales growth was characterized as strong in the home, essentials and food and beverage categories, which offset the impact of delayed sales in temperature-sensitive categories.

- The company claimed broad market-share gains across its core merchandise categories.

- Target remodeled 56 stores and opened seven new stores in the quarter. The company typically sees a 2%–4% lift in sales following a remodel.

- In addition, Target is rolling out presentation enhancements to a broader set of stores, focusing on key categories such as beauty, apparel, home and food and beverage.

- Target is investing in hours, tools and training on the sales floor to provide its customers a richer experience, in the store, online and even in the parking lot.

- The company also launched three new brands and a limited-time collaboration with Hunter.

- Target continues to roll out small-format stores in previously unserved neighborhoods, which serve as a beacon for the brand and deliver outstanding sales productivity and financial performance.

- The company remains focused on offering convenience for its customers, such as rolling out two-day free shipping at the beginning of the year and using its stores as a distribution point for digital orders.

- Target continues to roll out its drive-through service across the country, launching its drive-up service in more than 250 stores, expanding Target Restock nationwide and rolling out same-day delivery from more than 700 stores, enabled by the recent acquisition of Shipt.

- Same-day shipment through Shipt continues to expand, having reached nearly half of Target stores by the end of the quarter. In addition, the company is rolling out a separate same-day delivery service for stores located in dense metro areas.

- Target continues to expand its next-day offerings for Essentials and Target Restock. In the quarter, the company expanded this service nationwide and reduced its delivery fee further.

- Total REDcard penetration was 24.1%, compared to 24.7% a year ago. In the quarter, the REDcard app gained a new wallet feature to redeem offers and receive a discount at checkout.

- The company ended the quarter with 1,829 stores and 239.7 million square feet, compared to 1,807 stores and 239.8 million square feet a year ago.

Outlook

For the full year, Target reiterated its guidance of:

- Comps in the low single digits.

- GAAP and adjusted EPS of $5.15–$5.45, compared to the consensus estimate of $5.29.

For the second quarter, the company expects:

- Comps to accelerate into the low to mid single-digit range, compared to the 1.7% consensus estimate.

- GAAP and adjusted EPS of $1.30–$1.50, compared to the consensus estimate of $1.35.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research