Nitheesh NH

[caption id="attachment_79278" align="aligncenter" width="620"] Source: Company reports/Coresight Research[/caption]

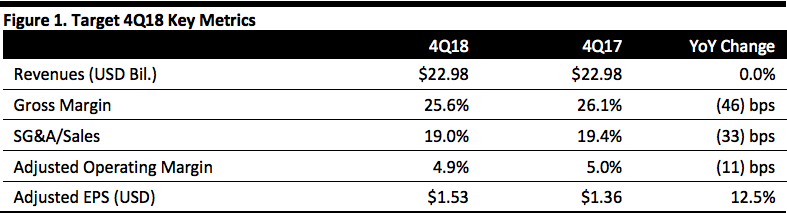

4Q18 Results

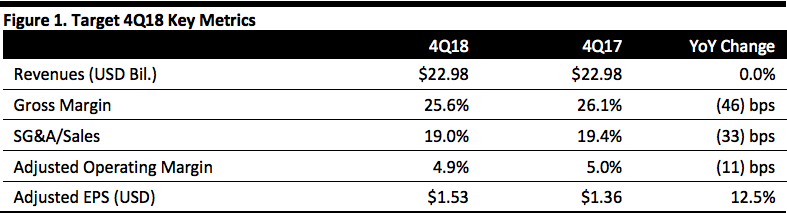

Target reported flat 4Q18 total revenues of $22.98 billion, slightly below consensus, however, the year-ago quarter included one extra week of sales. Adjusting the $1.2 billion of sales in the year-ago quarter, revenue grew 1.6%.

Comps grew 5.3%, beating guidance, with a 4.5% increase in the number of transactions plus an 0.8% increase in average transaction value.

Store comps grew 2.9%, and digital added 2.4 percentage points to comps. Digital sales grew 31%.

Stores fulfilled nearly three-quarters of Target’s digital sales in 4Q18.

Adjusted EPS was $1.53, beating consensus by a penny. GAAP EPS was $1.52, down 23.5% and excluding a penny per share due to the Tax Act.

FY18 Results

Full-year total revenues were $75.36 billion, up 3.6%.

Comps including digital increased 5.0%, the strongest increase since 2005. Store-only comparable sales grew 3.2%.

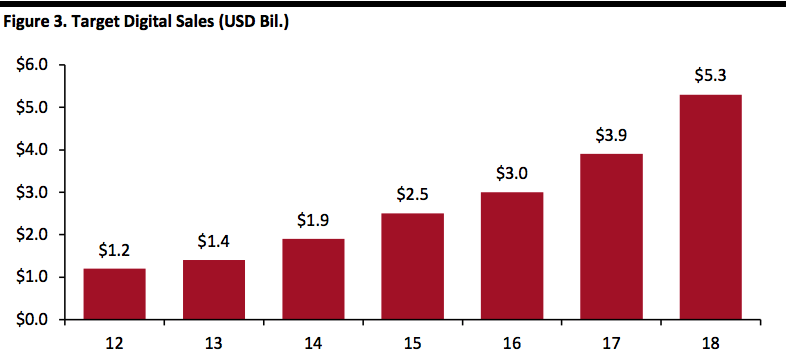

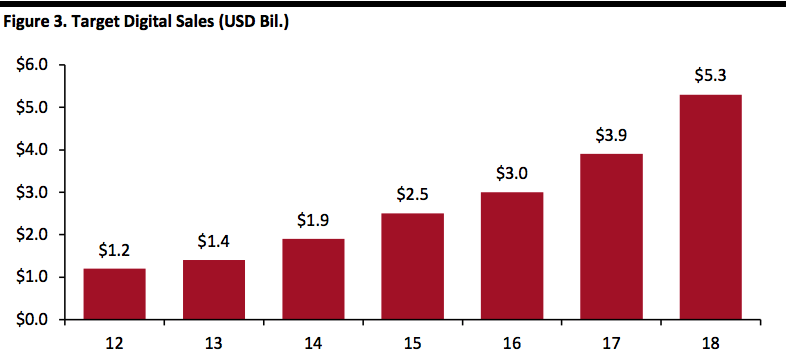

Digital sales grew 36%, marking the fifth consecutive year with sales greater than 25%.

Adjusted EPS was a record $5.39, up 15.1% and near the high end of the initial $5.15-$5.45 guidance. GAAP EPS was $5.51, up 4.2% and includes $0.10 per share resulting from the Tax Cuts and Jobs Act of 2017 and other tax items.

The company ended the quarter and year with 1,844 stores.

Outlook

The company offered the following guidance.

FY19:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Target reported flat 4Q18 total revenues of $22.98 billion, slightly below consensus, however, the year-ago quarter included one extra week of sales. Adjusting the $1.2 billion of sales in the year-ago quarter, revenue grew 1.6%.

Comps grew 5.3%, beating guidance, with a 4.5% increase in the number of transactions plus an 0.8% increase in average transaction value.

Store comps grew 2.9%, and digital added 2.4 percentage points to comps. Digital sales grew 31%.

Stores fulfilled nearly three-quarters of Target’s digital sales in 4Q18.

Adjusted EPS was $1.53, beating consensus by a penny. GAAP EPS was $1.52, down 23.5% and excluding a penny per share due to the Tax Act.

FY18 Results

Full-year total revenues were $75.36 billion, up 3.6%.

Comps including digital increased 5.0%, the strongest increase since 2005. Store-only comparable sales grew 3.2%.

Digital sales grew 36%, marking the fifth consecutive year with sales greater than 25%.

Adjusted EPS was a record $5.39, up 15.1% and near the high end of the initial $5.15-$5.45 guidance. GAAP EPS was $5.51, up 4.2% and includes $0.10 per share resulting from the Tax Cuts and Jobs Act of 2017 and other tax items.

The company ended the quarter and year with 1,844 stores.

Outlook

The company offered the following guidance.

FY19:

Source: Company reports[/caption]

Cornell also highlighted the company’s changes through the four stores now open in Midtown and Downtown Manhattan, plus with more in other boroughs and on Long Island.

Target now offers delivery, drive-up, free two-day shipping, and same-day delivery via Shipt, which the company says is helping it become “America’s easiest place to shop.” He commented that every piece of the company’s strategy is working, together, as follows:

Stores

Source: Company reports[/caption]

Cornell also highlighted the company’s changes through the four stores now open in Midtown and Downtown Manhattan, plus with more in other boroughs and on Long Island.

Target now offers delivery, drive-up, free two-day shipping, and same-day delivery via Shipt, which the company says is helping it become “America’s easiest place to shop.” He commented that every piece of the company’s strategy is working, together, as follows:

Stores

Source: Company reports[/caption]

Cornell discussed the importance of the convergence of digital and physical, which Target accomplished by investing in:

Source: Company reports[/caption]

Cornell discussed the importance of the convergence of digital and physical, which Target accomplished by investing in:

Source: Company reports[/caption]

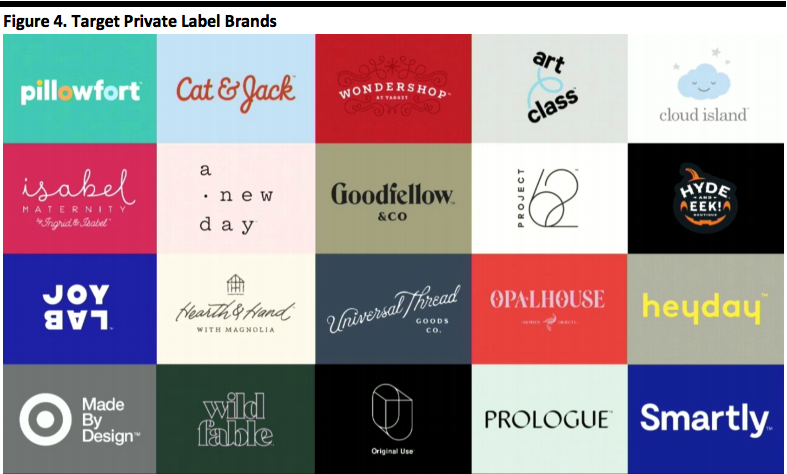

Other subsequent new brands include: Colsie, Auden and Stars Above (sleepwear and intimates) and a partnership with Vineyard Vines. Target is focusing on:

Source: Company reports[/caption]

Other subsequent new brands include: Colsie, Auden and Stars Above (sleepwear and intimates) and a partnership with Vineyard Vines. Target is focusing on:

Source: Company reports[/caption]

Remarks from Cathy Smith, EVP and CFO

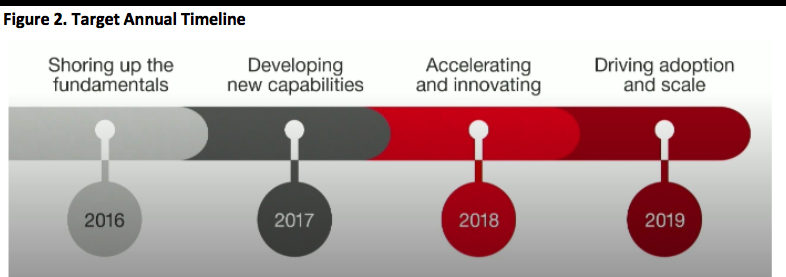

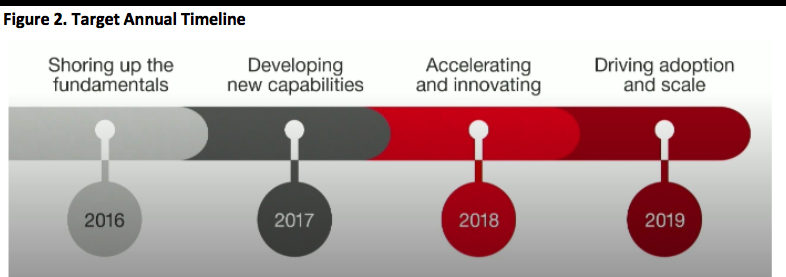

Following the negative comps and traffic in 2016, Target reassessed its priorities and found it was already focusing on the right priorities but not moving fast enough. Strengths included strong operations, well-located stores, fiercely loyal customers, a strong balance sheet, robust cash flow and a strong team. Therefore, the management team decided to make additional investments in capital and operating margin to help the company deliver more, faster to create a better experience today and into the future. These investments include:

Source: Company reports[/caption]

Remarks from Cathy Smith, EVP and CFO

Following the negative comps and traffic in 2016, Target reassessed its priorities and found it was already focusing on the right priorities but not moving fast enough. Strengths included strong operations, well-located stores, fiercely loyal customers, a strong balance sheet, robust cash flow and a strong team. Therefore, the management team decided to make additional investments in capital and operating margin to help the company deliver more, faster to create a better experience today and into the future. These investments include:

Source: Company reports[/caption]

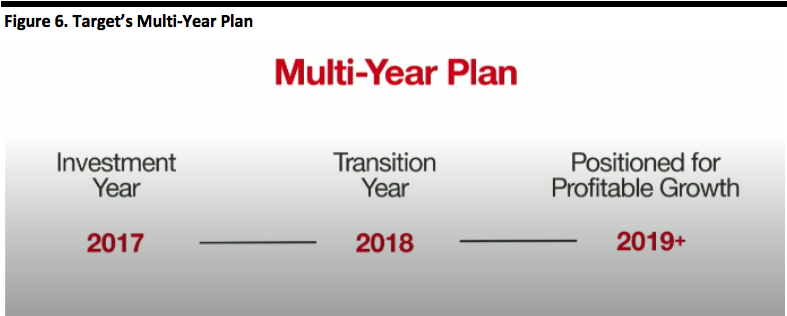

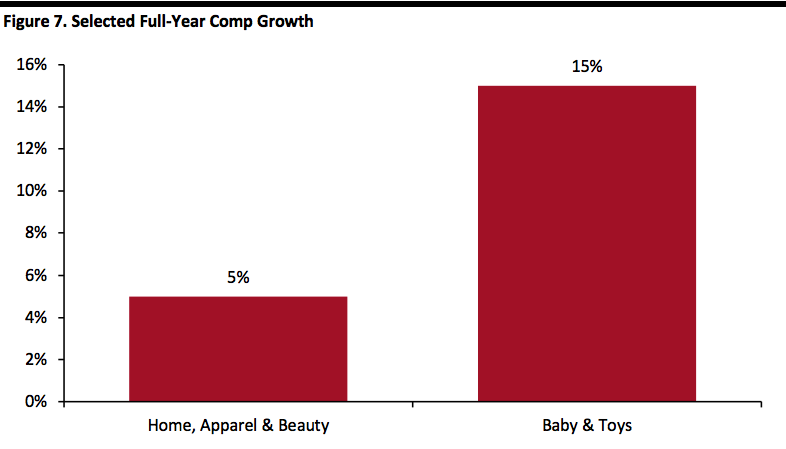

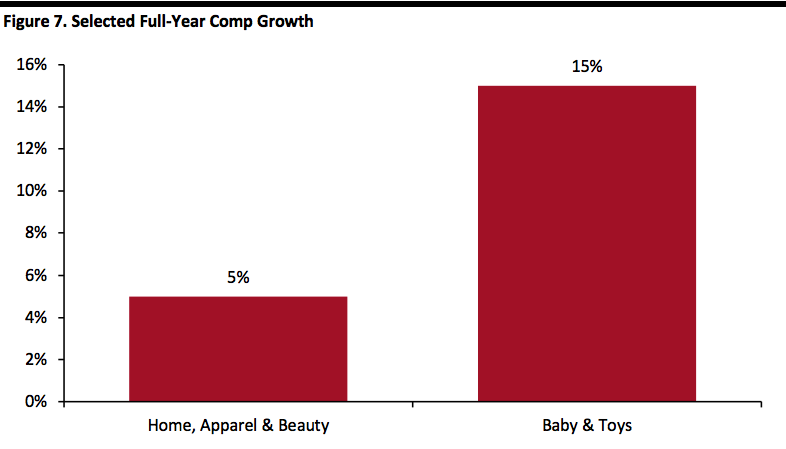

Although 2018 had been planned as a transition year, it turned out to be one of the most productive for Target, with the strongest sales and traffic in more than a decade. 2018 EPS of $5.39 set a record. Half of the gross margin decline in 2018 was driven by sales mix and half from pricing/promotions and fulfillment. The graph below shows Target’s sales gains in home, apparel and beauty and baby and toys (aided by the closure of Toys “R” Us and Babies “R” Us.)

[caption id="attachment_79284" align="aligncenter" width="620"]

Source: Company reports[/caption]

Although 2018 had been planned as a transition year, it turned out to be one of the most productive for Target, with the strongest sales and traffic in more than a decade. 2018 EPS of $5.39 set a record. Half of the gross margin decline in 2018 was driven by sales mix and half from pricing/promotions and fulfillment. The graph below shows Target’s sales gains in home, apparel and beauty and baby and toys (aided by the closure of Toys “R” Us and Babies “R” Us.)

[caption id="attachment_79284" align="aligncenter" width="620"] Source: Company reports[/caption]

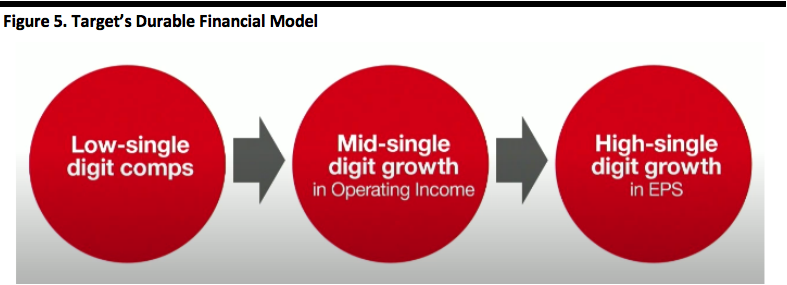

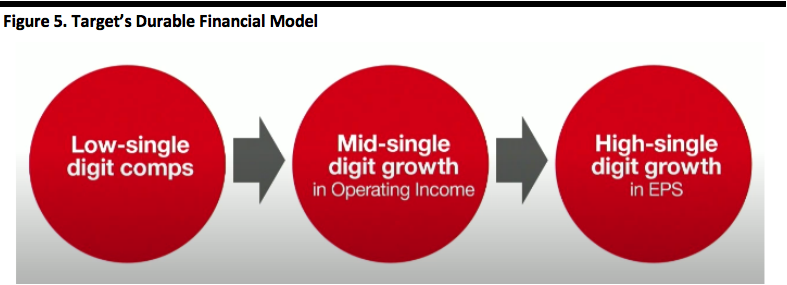

Target’s “Durable” Business Model:

Source: Company reports[/caption]

Target’s “Durable” Business Model:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Target reported flat 4Q18 total revenues of $22.98 billion, slightly below consensus, however, the year-ago quarter included one extra week of sales. Adjusting the $1.2 billion of sales in the year-ago quarter, revenue grew 1.6%.

Comps grew 5.3%, beating guidance, with a 4.5% increase in the number of transactions plus an 0.8% increase in average transaction value.

Store comps grew 2.9%, and digital added 2.4 percentage points to comps. Digital sales grew 31%.

Stores fulfilled nearly three-quarters of Target’s digital sales in 4Q18.

Adjusted EPS was $1.53, beating consensus by a penny. GAAP EPS was $1.52, down 23.5% and excluding a penny per share due to the Tax Act.

FY18 Results

Full-year total revenues were $75.36 billion, up 3.6%.

Comps including digital increased 5.0%, the strongest increase since 2005. Store-only comparable sales grew 3.2%.

Digital sales grew 36%, marking the fifth consecutive year with sales greater than 25%.

Adjusted EPS was a record $5.39, up 15.1% and near the high end of the initial $5.15-$5.45 guidance. GAAP EPS was $5.51, up 4.2% and includes $0.10 per share resulting from the Tax Cuts and Jobs Act of 2017 and other tax items.

The company ended the quarter and year with 1,844 stores.

Outlook

The company offered the following guidance.

FY19:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Target reported flat 4Q18 total revenues of $22.98 billion, slightly below consensus, however, the year-ago quarter included one extra week of sales. Adjusting the $1.2 billion of sales in the year-ago quarter, revenue grew 1.6%.

Comps grew 5.3%, beating guidance, with a 4.5% increase in the number of transactions plus an 0.8% increase in average transaction value.

Store comps grew 2.9%, and digital added 2.4 percentage points to comps. Digital sales grew 31%.

Stores fulfilled nearly three-quarters of Target’s digital sales in 4Q18.

Adjusted EPS was $1.53, beating consensus by a penny. GAAP EPS was $1.52, down 23.5% and excluding a penny per share due to the Tax Act.

FY18 Results

Full-year total revenues were $75.36 billion, up 3.6%.

Comps including digital increased 5.0%, the strongest increase since 2005. Store-only comparable sales grew 3.2%.

Digital sales grew 36%, marking the fifth consecutive year with sales greater than 25%.

Adjusted EPS was a record $5.39, up 15.1% and near the high end of the initial $5.15-$5.45 guidance. GAAP EPS was $5.51, up 4.2% and includes $0.10 per share resulting from the Tax Cuts and Jobs Act of 2017 and other tax items.

The company ended the quarter and year with 1,844 stores.

Outlook

The company offered the following guidance.

FY19:

- Comps to increase by a low- to mid-single-digit percentage.

- Operating income to increase by the mid-single digits.

- EPS of $5.75-6.05, up 7-12% and above the consensus estimate of $5.61.

- Comps in the low- to mid-single digits.

- EPS of $1.32-1.52, in line with the $1.43 consensus estimate.

Source: Company reports[/caption]

Cornell also highlighted the company’s changes through the four stores now open in Midtown and Downtown Manhattan, plus with more in other boroughs and on Long Island.

Target now offers delivery, drive-up, free two-day shipping, and same-day delivery via Shipt, which the company says is helping it become “America’s easiest place to shop.” He commented that every piece of the company’s strategy is working, together, as follows:

Stores

Source: Company reports[/caption]

Cornell also highlighted the company’s changes through the four stores now open in Midtown and Downtown Manhattan, plus with more in other boroughs and on Long Island.

Target now offers delivery, drive-up, free two-day shipping, and same-day delivery via Shipt, which the company says is helping it become “America’s easiest place to shop.” He commented that every piece of the company’s strategy is working, together, as follows:

Stores

- In 2017-18, Target remodeled more than 400 stores, plans to remodel 300 more in 2019 and another 300 in 2020.

- Today, the company has nearly 100 small-format stores. Herald Square in NYC has the highest sales per square foot of any US store. Target plans to open a couple dozen small-format stores per year, including on college campuses.

- Target is redesigning store operations by investing in technology, elevating customer-facing service and raising starting wages to $15 an hour by 2020.

Source: Company reports[/caption]

Cornell discussed the importance of the convergence of digital and physical, which Target accomplished by investing in:

Source: Company reports[/caption]

Cornell discussed the importance of the convergence of digital and physical, which Target accomplished by investing in:

- Digital and technology teams.

- Infrastructure.

- Data and analytics.

Source: Company reports[/caption]

Other subsequent new brands include: Colsie, Auden and Stars Above (sleepwear and intimates) and a partnership with Vineyard Vines. Target is focusing on:

Source: Company reports[/caption]

Other subsequent new brands include: Colsie, Auden and Stars Above (sleepwear and intimates) and a partnership with Vineyard Vines. Target is focusing on:

- Growing market share.

- Attracting new guest segments.

- Finding white-space opportunities.

Source: Company reports[/caption]

Remarks from Cathy Smith, EVP and CFO

Following the negative comps and traffic in 2016, Target reassessed its priorities and found it was already focusing on the right priorities but not moving fast enough. Strengths included strong operations, well-located stores, fiercely loyal customers, a strong balance sheet, robust cash flow and a strong team. Therefore, the management team decided to make additional investments in capital and operating margin to help the company deliver more, faster to create a better experience today and into the future. These investments include:

Source: Company reports[/caption]

Remarks from Cathy Smith, EVP and CFO

Following the negative comps and traffic in 2016, Target reassessed its priorities and found it was already focusing on the right priorities but not moving fast enough. Strengths included strong operations, well-located stores, fiercely loyal customers, a strong balance sheet, robust cash flow and a strong team. Therefore, the management team decided to make additional investments in capital and operating margin to help the company deliver more, faster to create a better experience today and into the future. These investments include:

- Store remodels.

- New technology.

- A new supply-chain model.

- Owned and exclusive brands.

- Simpler pricing and promotions.

- Training, hours and wages.

Source: Company reports[/caption]

Although 2018 had been planned as a transition year, it turned out to be one of the most productive for Target, with the strongest sales and traffic in more than a decade. 2018 EPS of $5.39 set a record. Half of the gross margin decline in 2018 was driven by sales mix and half from pricing/promotions and fulfillment. The graph below shows Target’s sales gains in home, apparel and beauty and baby and toys (aided by the closure of Toys “R” Us and Babies “R” Us.)

[caption id="attachment_79284" align="aligncenter" width="620"]

Source: Company reports[/caption]

Although 2018 had been planned as a transition year, it turned out to be one of the most productive for Target, with the strongest sales and traffic in more than a decade. 2018 EPS of $5.39 set a record. Half of the gross margin decline in 2018 was driven by sales mix and half from pricing/promotions and fulfillment. The graph below shows Target’s sales gains in home, apparel and beauty and baby and toys (aided by the closure of Toys “R” Us and Babies “R” Us.)

[caption id="attachment_79284" align="aligncenter" width="620"] Source: Company reports[/caption]

Target’s “Durable” Business Model:

Source: Company reports[/caption]

Target’s “Durable” Business Model:

- Revenue growth as fast as the addressable market (nominal GDP growth is a solid benchmark), or, low-single digits or better in a typical year, driven by comps plus the contribution from new stores and even faster from new opportunities.

- Operating margins of 2018’s 5.5% will serve as a benchmark in the future. Tailwinds such as a strong sales mix, savings in cost of goods, lower unit-fulfillment costs, labor savings, expense discipline and leverage from revenue growth should offset headwinds such as growth in digital fulfillment and wage increases.

- Depreciation should moderate, as the company reached a run rate of 300 store remodels per year, which are expected to take place in 2019 and 2020.

- The stability in gross and operating margins , combined with lower depreciation and amortization expense, are expected to deliver 10 basis points of operating income leverage per year.

- Capital spending is expected remain at $3.5 billion in 2019 and 2020. Target will return cash through dividends and excess cash through share repurchases to maintain its middle-A grade credit rating.

- Earnings per share is expected to grow faster than operating income.

- Shipt has been scaled to 1,500 stores.

- Drive-up (which offers pickup within an hour) has been scaled to nearly 1,000 stores, and the company made nearly 2 million parking-lot deliveries in 2018, each with delivery from parking to handoff taking less than two minutes. The company described net promoter scores for drive-up as extremely high.

- Target is delivering hundreds of thousands of items in two days or less.

- The “stores as hubs” strategy enables Target to deliver faster, lowers its costs and drives higher return on invested capital (ROIC.)

- Target is managing fulfillment cost by:

- Reducing the distance of delivery by shipping from more than 1,400 local stores, which it claims offers a greater than 40% lower average unit cost. Order pickup and drive up have nearly 90% lower average unit costs than shipping and fulfilling from a warehouse.

- Managing cost of delivery by offering different fulfillment models. Customers pay $2.99 for the delivery of a box of essentials. Customers pay $7 to have purchases shipped from the store, and the value of these orders is five times the average order value. The crowdsourcing technology acquired from Grand Junction matches orders with local couriers who can deliver most efficiently. Finally, customers can sign up with Shipt (which has 80,000 customers in the US) for $99 per year for same-day delivery.

- Driving efficiency in operations through technology and process improvements. These improvements reduced the average cost of fulfillment by 20%, amounting to hundreds of millions of dollars of savings in 2018.

- In the past two years, customers bought twice as many items on Target.com, enabled by the company’s physical stores. The number of items shipped from stores has quadrupled over the past two years, and demand for store pickup has tripled over the past two years. In 4Q18, stores fulfilled three of four orders, doing the work of 14 fulfillment centers.

- Mulligan outlined Target’s replenishment efforts, demonstrated by a video of a fully automated warehouse in Perth Amboy, NJ. In Target’s new replenishment scheme, workers load tall carts, sorted by aisle, which are immediately used by store employees to stock the aisles while the store is in operation. This method reduces the size of back rooms, improves out-of-stocks and reduces working capital.

- Having reduced out-of-stocks, Target is now focused on reducing out-of-stock variability between individual stores, with more improvement expected as the model scales over time.

- The goal of the upstream investments is to put more associates on the sales floor, assisting customers, and employees are now being trained as specialists. Customers can check out anywhere within the store via mobile device.

- Stores see a 2-4% average sales lift after remodeling. Target’s goal is to have more than 1,000 remodeled stores by the end of 2020. After 2020, the pace of remodeling is expected to moderate. In 2018, Target opened more than 1 million square feet of space in small-format stores. Small-format stores beat the company average in sales growth and productivity.

- Target’s goal is to open 30 new stores per year over the next several years.