DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

4Q19 Results

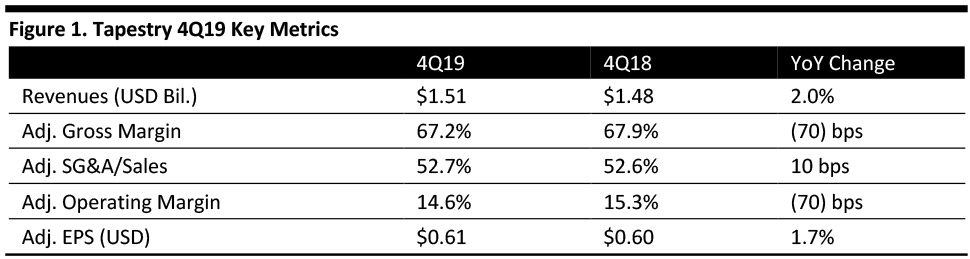

Tapestry reported adjusted 4Q19 EPS of $0.61, up 1.7% from the prior year period, and meeting the $0.61 consensus estimate. Total revenues grew 2% (4% currency neutral) to $1.51 billion, shy of the $1.53 billion consensus estimate.

By brand, Coach net sales were $1.10 billion, flat with the year-ago period, up 2% at constant exchange rates; Kate Spade brand sales increased 6% (7% currency neutral) to $332 million and Stuart Weitzman brand sales increased 17% (20% currency neutral) to $85 million.

Adjusted gross margin contracted 70 bps to 67.2%. Adjusted gross margin for Coach was 69.7%, up 10 bps from 69.6%; for Kate Spade adjusted gross margin declined 300 bps to 62.2%; and for Stuart Weitzman, adjusted gross margin expanded 130 bps to 54.8%.

Comps for Coach increased 2% globally, driven by an increase in global e-commerce (150 bps). Despite the challenging North American retail environment of weakened traffic trends in both outlet and full-price retail malls and continued pressure from low tourist spend, Coach is executing well and comps improved sequentially in North America to flat versus last year. All international regions comped positively. Comps for Kate Spade declined 6%, despite the positive impact of around 600 bps from global e-commerce and positive comps in China.

The rapid deterioration in traffic in May impacted the Kate Spade brand, and in the outlet channel, the adaptation of full-price best sellers for the outlet channel didn’t work as well as it traditionally has for sister brand Coach. Tapestry is focused on protecting the brand in the increasingly promotional outlet channel and increased product differentiation and distinctive newness to drive conversion. In the company’s brand surveys, the Kate Spade brand leads the key emotional attributes of fashionable, fun and feminine, and management is confident this brand is a $2 billion opportunity with gross margins similar to Coach in like categories.

Adjusted SG&A expense as a percentage of sales expanded 10 basis points to 52.7% compared with the year-ago period. The ratio decreased 60 bps at Coach to 42.3% and 1,170 bps to 66.2% at Stuart Weitzman, offset by a 60-bps year-over-year increase at Kate Spade to 52.9% of sales.

Adjusted operating income was $221 million, down modestly from $228 million in the prior year. Adjusted operating margin contracted 70 bps to 14.6%.

During FY19 Tapestry gained traction with the Chinese consumer globally. This shopper represents a high-teen percentage of consolidated sales. Coach captured 1.6 billion impressions at its first runway show in Shanghai. China remains a key priority for all the brands in FY20 and the company announced the launch of ChinaNext, an initiative connecting Tapestry’s key strategic priorities: driving digital innovation and growing its Chinese business that will incorporate driving local engagement and leveraging digital learnings globally.

Heading into FY20, COO Tom Glaser is tasked with identifying opportunities to improve Tapestry’s demand-to-production planning cycle while increasing speed to market across categories in tandem with efforts to accelerate product innovation customization programs within the Tapestry brand portfolio.

Regarding tariffs, Tapestry’s diversified manufacturing base has relatively limited exposure to China for handbags and small leather goods; however, its fast-growing categories of footwear and ready-to-wear are currently exposed to China and this is included in FY2020 guidance.

Inventories increased $105 million, to $778 million on a year-over-year basis.

Outlook

The company provided 1Q and FY20 guidance:

- Tapestry projects 1Q revenue slightly below the prior year, reflecting low-single-digit comp growth at Coach and a high-teen comp decline at Kate Spade, based on the current traffic trends and product and merchandising challenges. An operating loss is expected at Stuart Weitzman. Gross margin will be slightly pressured, impacted by FX, notably at Coach, while SG&A is expected to increase driven by new store openings and higher depreciation associated with systems investment. 1Q EPS are guided to be $0.35-$0.37.

- Total revenues are projected to increase at a low-single-digit rate in FY20 from $5.88 billion based on: low-single-digit growth at Coach from $4.27 billion, driven by continued positive low-single-digit comp; low- to mid-single-digit sales growth at Kate Spade, from $1.37 billion, driven by distribution; and at Stuart Weitzman, solid sales growth from $389 million in FY2019.

- Modest gross margin contraction reflects the negative impacts associated with bringing Kate Spade's footwear business in-house, and FX and incorporates the impact of US tariffs on imports from China, including the 25% tariff on handbags and small leather goods currently in place as well as the recently announced 10% tariff on the list of $300 billion of goods expected to go into effect on September 1 for categories such as footwear and ready-to-wear.

- SG&A expense growth is expected to be in line with top line growth.

- FY20 adjusted EPS are expected to be roughly even with FY19’s $2.57 and this incorporates the expectation of approximately $300 million in share repurchases.