DIpil Das

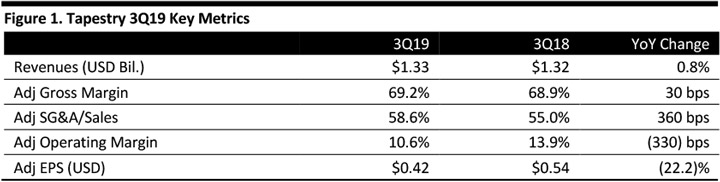

[caption id="attachment_87496" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

3Q19 Results

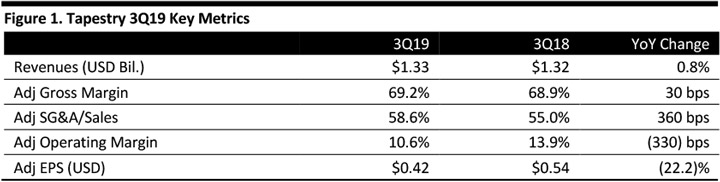

Tapestry reported adjusted 3Q19 EPS of $0.42, down 22.2% from the prior year period and beating the $0.41 consensus estimate. Total revenues were $1.33 billion, up 0.8% (2% currency neutral) year over year and below the $1.34 billion consensus estimate.

By brand, Coach net sales were $965 million, down from $969 million from the prior year period, up 1% at constant exchange rates; Kate Spade brand sales grew 4% (5% currency neutral) to $281 million and Stuart Weitzman brand sales increased 2% (4% currency neutral) to $85 million.

Adjusted gross margin expanded 30 bps to 69.2%. Adjusted gross margin for Coach was 71.3%, down from 71.4%; for Kate Spade was 64.8%, up from 63.9%; for Stuart Weitzman was 55.2%, down from 56.6% in the prior year. At constant exchange rates, gross margin for Stuart Weitzman increased 70 bps year over year.

Comps for Coach increased 1%, driven by an increase in global e-commerce. Comps for Kate Spade declined 3%, despite of the positive impact of around 700 bps from global e-commerce.

SG&A expense as a percentage of sales expanded 360 basis points to 58.6% compared with the year-ago period. The ratio increased in all three brands and Stuart Weitzman had the highest ratio, up 820 bps to 70%.

Adjusted operating income was $141 million, down from $184 million in the prior year. Adjusted operating margin contracted 330 bps to 10.6%.

At Coach, global business with Chinese consumers continued to grow again, driven by domestic consumption. Coach’s Shanghai fashion show led to an improvement in Coach's unaided awareness, from 32% to 41%, and aided awareness from 69% to 72%, driven by growth amongst millennials according to the company’s recent handbag brand-tracking survey fielded in China. Awareness for both the Kate Spade and Stuart Weitzman brands is growing with the introduction of tailored marketing and local brand ambassadors. In the same China handbag brand-tracking survey, Kate Spade's unaided awareness was 4% versus 2% previously, and aided awareness improved from 11% to 16%, also driven by growth among millennials. The company noted the importance of its clicks-to-bricks strategy, as it has expanded reach through opening new stores. Tapestry opened a net four Kate Spade locations and seven Stuart Weitzman stores in Greater China.

The company will continue to decrease Coach brand store count in fiscal 2019, primarily because of net closures in North America and Japan, and projects 40 to 50 net new door openings for Kate Spade, and to add 50 directly operated locations globally, with the majority of 30 net new openings in China. The company had added six stores in southern China and 12 in Australia through regional buybacks.

The company also introduced its first China-market-tailored marketing campaign, featuring actress Soon Yi, to drive engagement on Weibo and WeChat.

Inventories increased $97 million, to $811 million on a year-over-year basis, driven by a higher level of in-transit inventory related to port congestion in Asia.

The company announced the approval of a $1 billion share repurchase authorization.

Outlook

The company reaffirmed fiscal 2019 guidance:

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Tapestry reported adjusted 3Q19 EPS of $0.42, down 22.2% from the prior year period and beating the $0.41 consensus estimate. Total revenues were $1.33 billion, up 0.8% (2% currency neutral) year over year and below the $1.34 billion consensus estimate.

By brand, Coach net sales were $965 million, down from $969 million from the prior year period, up 1% at constant exchange rates; Kate Spade brand sales grew 4% (5% currency neutral) to $281 million and Stuart Weitzman brand sales increased 2% (4% currency neutral) to $85 million.

Adjusted gross margin expanded 30 bps to 69.2%. Adjusted gross margin for Coach was 71.3%, down from 71.4%; for Kate Spade was 64.8%, up from 63.9%; for Stuart Weitzman was 55.2%, down from 56.6% in the prior year. At constant exchange rates, gross margin for Stuart Weitzman increased 70 bps year over year.

Comps for Coach increased 1%, driven by an increase in global e-commerce. Comps for Kate Spade declined 3%, despite of the positive impact of around 700 bps from global e-commerce.

SG&A expense as a percentage of sales expanded 360 basis points to 58.6% compared with the year-ago period. The ratio increased in all three brands and Stuart Weitzman had the highest ratio, up 820 bps to 70%.

Adjusted operating income was $141 million, down from $184 million in the prior year. Adjusted operating margin contracted 330 bps to 10.6%.

At Coach, global business with Chinese consumers continued to grow again, driven by domestic consumption. Coach’s Shanghai fashion show led to an improvement in Coach's unaided awareness, from 32% to 41%, and aided awareness from 69% to 72%, driven by growth amongst millennials according to the company’s recent handbag brand-tracking survey fielded in China. Awareness for both the Kate Spade and Stuart Weitzman brands is growing with the introduction of tailored marketing and local brand ambassadors. In the same China handbag brand-tracking survey, Kate Spade's unaided awareness was 4% versus 2% previously, and aided awareness improved from 11% to 16%, also driven by growth among millennials. The company noted the importance of its clicks-to-bricks strategy, as it has expanded reach through opening new stores. Tapestry opened a net four Kate Spade locations and seven Stuart Weitzman stores in Greater China.

The company will continue to decrease Coach brand store count in fiscal 2019, primarily because of net closures in North America and Japan, and projects 40 to 50 net new door openings for Kate Spade, and to add 50 directly operated locations globally, with the majority of 30 net new openings in China. The company had added six stores in southern China and 12 in Australia through regional buybacks.

The company also introduced its first China-market-tailored marketing campaign, featuring actress Soon Yi, to drive engagement on Weibo and WeChat.

Inventories increased $97 million, to $811 million on a year-over-year basis, driven by a higher level of in-transit inventory related to port congestion in Asia.

The company announced the approval of a $1 billion share repurchase authorization.

Outlook

The company reaffirmed fiscal 2019 guidance:

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Tapestry reported adjusted 3Q19 EPS of $0.42, down 22.2% from the prior year period and beating the $0.41 consensus estimate. Total revenues were $1.33 billion, up 0.8% (2% currency neutral) year over year and below the $1.34 billion consensus estimate.

By brand, Coach net sales were $965 million, down from $969 million from the prior year period, up 1% at constant exchange rates; Kate Spade brand sales grew 4% (5% currency neutral) to $281 million and Stuart Weitzman brand sales increased 2% (4% currency neutral) to $85 million.

Adjusted gross margin expanded 30 bps to 69.2%. Adjusted gross margin for Coach was 71.3%, down from 71.4%; for Kate Spade was 64.8%, up from 63.9%; for Stuart Weitzman was 55.2%, down from 56.6% in the prior year. At constant exchange rates, gross margin for Stuart Weitzman increased 70 bps year over year.

Comps for Coach increased 1%, driven by an increase in global e-commerce. Comps for Kate Spade declined 3%, despite of the positive impact of around 700 bps from global e-commerce.

SG&A expense as a percentage of sales expanded 360 basis points to 58.6% compared with the year-ago period. The ratio increased in all three brands and Stuart Weitzman had the highest ratio, up 820 bps to 70%.

Adjusted operating income was $141 million, down from $184 million in the prior year. Adjusted operating margin contracted 330 bps to 10.6%.

At Coach, global business with Chinese consumers continued to grow again, driven by domestic consumption. Coach’s Shanghai fashion show led to an improvement in Coach's unaided awareness, from 32% to 41%, and aided awareness from 69% to 72%, driven by growth amongst millennials according to the company’s recent handbag brand-tracking survey fielded in China. Awareness for both the Kate Spade and Stuart Weitzman brands is growing with the introduction of tailored marketing and local brand ambassadors. In the same China handbag brand-tracking survey, Kate Spade's unaided awareness was 4% versus 2% previously, and aided awareness improved from 11% to 16%, also driven by growth among millennials. The company noted the importance of its clicks-to-bricks strategy, as it has expanded reach through opening new stores. Tapestry opened a net four Kate Spade locations and seven Stuart Weitzman stores in Greater China.

The company will continue to decrease Coach brand store count in fiscal 2019, primarily because of net closures in North America and Japan, and projects 40 to 50 net new door openings for Kate Spade, and to add 50 directly operated locations globally, with the majority of 30 net new openings in China. The company had added six stores in southern China and 12 in Australia through regional buybacks.

The company also introduced its first China-market-tailored marketing campaign, featuring actress Soon Yi, to drive engagement on Weibo and WeChat.

Inventories increased $97 million, to $811 million on a year-over-year basis, driven by a higher level of in-transit inventory related to port congestion in Asia.

The company announced the approval of a $1 billion share repurchase authorization.

Outlook

The company reaffirmed fiscal 2019 guidance:

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Tapestry reported adjusted 3Q19 EPS of $0.42, down 22.2% from the prior year period and beating the $0.41 consensus estimate. Total revenues were $1.33 billion, up 0.8% (2% currency neutral) year over year and below the $1.34 billion consensus estimate.

By brand, Coach net sales were $965 million, down from $969 million from the prior year period, up 1% at constant exchange rates; Kate Spade brand sales grew 4% (5% currency neutral) to $281 million and Stuart Weitzman brand sales increased 2% (4% currency neutral) to $85 million.

Adjusted gross margin expanded 30 bps to 69.2%. Adjusted gross margin for Coach was 71.3%, down from 71.4%; for Kate Spade was 64.8%, up from 63.9%; for Stuart Weitzman was 55.2%, down from 56.6% in the prior year. At constant exchange rates, gross margin for Stuart Weitzman increased 70 bps year over year.

Comps for Coach increased 1%, driven by an increase in global e-commerce. Comps for Kate Spade declined 3%, despite of the positive impact of around 700 bps from global e-commerce.

SG&A expense as a percentage of sales expanded 360 basis points to 58.6% compared with the year-ago period. The ratio increased in all three brands and Stuart Weitzman had the highest ratio, up 820 bps to 70%.

Adjusted operating income was $141 million, down from $184 million in the prior year. Adjusted operating margin contracted 330 bps to 10.6%.

At Coach, global business with Chinese consumers continued to grow again, driven by domestic consumption. Coach’s Shanghai fashion show led to an improvement in Coach's unaided awareness, from 32% to 41%, and aided awareness from 69% to 72%, driven by growth amongst millennials according to the company’s recent handbag brand-tracking survey fielded in China. Awareness for both the Kate Spade and Stuart Weitzman brands is growing with the introduction of tailored marketing and local brand ambassadors. In the same China handbag brand-tracking survey, Kate Spade's unaided awareness was 4% versus 2% previously, and aided awareness improved from 11% to 16%, also driven by growth among millennials. The company noted the importance of its clicks-to-bricks strategy, as it has expanded reach through opening new stores. Tapestry opened a net four Kate Spade locations and seven Stuart Weitzman stores in Greater China.

The company will continue to decrease Coach brand store count in fiscal 2019, primarily because of net closures in North America and Japan, and projects 40 to 50 net new door openings for Kate Spade, and to add 50 directly operated locations globally, with the majority of 30 net new openings in China. The company had added six stores in southern China and 12 in Australia through regional buybacks.

The company also introduced its first China-market-tailored marketing campaign, featuring actress Soon Yi, to drive engagement on Weibo and WeChat.

Inventories increased $97 million, to $811 million on a year-over-year basis, driven by a higher level of in-transit inventory related to port congestion in Asia.

The company announced the approval of a $1 billion share repurchase authorization.

Outlook

The company reaffirmed fiscal 2019 guidance:

- Revenue growth of a low-to-mid-single-digit from FY18’s $5.88 billion.

- Adjusted EPS between $2.55 and $2.60.