Nitheesh NH

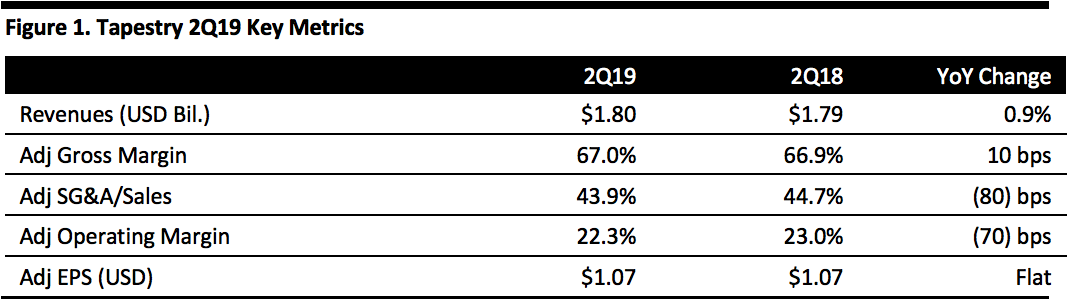

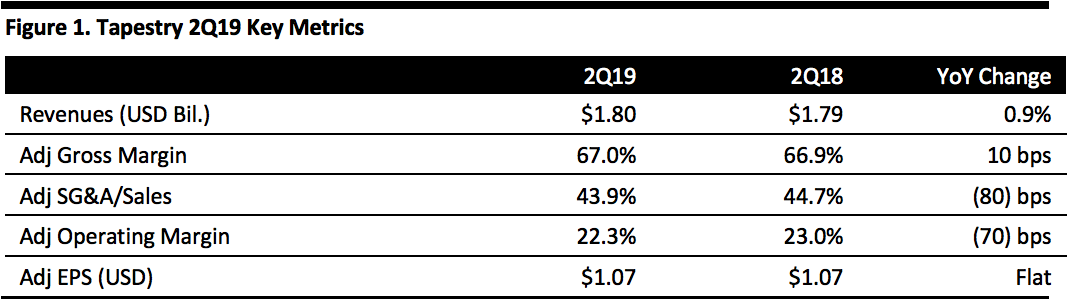

[caption id="attachment_72001" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

Tapestry reported flat adjusted 2Q19 EPS of $1.07 and missed the $1.11 consensus estimate. Total revenues were $1.80 billion, up 0.9% year over year and below the $1.86 billion consensus estimate.

By brand, Coach net sales were $1.25 billion, up 1.5% year over year, Kate Spade brand sales declined 1.4% to $428 million and Stuart Weitzman brand sales increased 2.6% to $124 million.

At Coach, global comparable store sales rose 1%, led by outperformance in international and e-commerce channels. Business in Greater China accelerated and Coach’s business with the Chinese consumer increased. Comps were positive in Europe and Japan as well, offset by negative comps in North America and Korea. Comps declined 11% at Kate Spade as the business transitions to a new design team. Marketing to support the launch of Nicola Glass’s new collection was moved to the current quarter (3Q19), and the initial read is positive.

Adjusted gross margin expanded 10 bps to 67%, reflecting 120 bps gross margin improvement at Kate Spade and a 10 bp increment at Coach, offset by a 380 bp decline at Stuart Weitzman.

Adjusted operating profit declined 2.2% to $402 million, or 22.3% of sales, down 70 bps year over year, with higher SG&A expenses reflecting JV consolidation, new store distribution at Kate Spade and increased marketing at Coach. By brand, adjusted operating margin was 30.3% at Coach, up 40 bps year over year; 22.2% at Kate Spade, down 100 bps; and at Stuart Weitzman, the adjusted operating profit margin was 10.3%, down from 20% in the year ago period.

Inventories increased $66 million, or 9.9%, to $732 million on a year-over-year basis.

During the quarter, Tapestry added a net 25 new store locations: A net two additions at Coach, a net 16 new stores at Kate Spade as well as 15 acquired store locations in Singapore and Malaysia, and seven new Stuart Weitzman locations. For FY19, the company expects to report a net decrease for Coach due to net closures in North America and Japan. The company is on track to add a net 60-70 new Kate Spade locations (40-50 of which will be international) and plans approximately 30 net new locations for Stuart Weitzman, primarily in China.

Outlook

The company updated FY19 guidance to reflect the 2Q results and the unstable global environment.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Tapestry reported flat adjusted 2Q19 EPS of $1.07 and missed the $1.11 consensus estimate. Total revenues were $1.80 billion, up 0.9% year over year and below the $1.86 billion consensus estimate.

By brand, Coach net sales were $1.25 billion, up 1.5% year over year, Kate Spade brand sales declined 1.4% to $428 million and Stuart Weitzman brand sales increased 2.6% to $124 million.

At Coach, global comparable store sales rose 1%, led by outperformance in international and e-commerce channels. Business in Greater China accelerated and Coach’s business with the Chinese consumer increased. Comps were positive in Europe and Japan as well, offset by negative comps in North America and Korea. Comps declined 11% at Kate Spade as the business transitions to a new design team. Marketing to support the launch of Nicola Glass’s new collection was moved to the current quarter (3Q19), and the initial read is positive.

Adjusted gross margin expanded 10 bps to 67%, reflecting 120 bps gross margin improvement at Kate Spade and a 10 bp increment at Coach, offset by a 380 bp decline at Stuart Weitzman.

Adjusted operating profit declined 2.2% to $402 million, or 22.3% of sales, down 70 bps year over year, with higher SG&A expenses reflecting JV consolidation, new store distribution at Kate Spade and increased marketing at Coach. By brand, adjusted operating margin was 30.3% at Coach, up 40 bps year over year; 22.2% at Kate Spade, down 100 bps; and at Stuart Weitzman, the adjusted operating profit margin was 10.3%, down from 20% in the year ago period.

Inventories increased $66 million, or 9.9%, to $732 million on a year-over-year basis.

During the quarter, Tapestry added a net 25 new store locations: A net two additions at Coach, a net 16 new stores at Kate Spade as well as 15 acquired store locations in Singapore and Malaysia, and seven new Stuart Weitzman locations. For FY19, the company expects to report a net decrease for Coach due to net closures in North America and Japan. The company is on track to add a net 60-70 new Kate Spade locations (40-50 of which will be international) and plans approximately 30 net new locations for Stuart Weitzman, primarily in China.

Outlook

The company updated FY19 guidance to reflect the 2Q results and the unstable global environment.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Tapestry reported flat adjusted 2Q19 EPS of $1.07 and missed the $1.11 consensus estimate. Total revenues were $1.80 billion, up 0.9% year over year and below the $1.86 billion consensus estimate.

By brand, Coach net sales were $1.25 billion, up 1.5% year over year, Kate Spade brand sales declined 1.4% to $428 million and Stuart Weitzman brand sales increased 2.6% to $124 million.

At Coach, global comparable store sales rose 1%, led by outperformance in international and e-commerce channels. Business in Greater China accelerated and Coach’s business with the Chinese consumer increased. Comps were positive in Europe and Japan as well, offset by negative comps in North America and Korea. Comps declined 11% at Kate Spade as the business transitions to a new design team. Marketing to support the launch of Nicola Glass’s new collection was moved to the current quarter (3Q19), and the initial read is positive.

Adjusted gross margin expanded 10 bps to 67%, reflecting 120 bps gross margin improvement at Kate Spade and a 10 bp increment at Coach, offset by a 380 bp decline at Stuart Weitzman.

Adjusted operating profit declined 2.2% to $402 million, or 22.3% of sales, down 70 bps year over year, with higher SG&A expenses reflecting JV consolidation, new store distribution at Kate Spade and increased marketing at Coach. By brand, adjusted operating margin was 30.3% at Coach, up 40 bps year over year; 22.2% at Kate Spade, down 100 bps; and at Stuart Weitzman, the adjusted operating profit margin was 10.3%, down from 20% in the year ago period.

Inventories increased $66 million, or 9.9%, to $732 million on a year-over-year basis.

During the quarter, Tapestry added a net 25 new store locations: A net two additions at Coach, a net 16 new stores at Kate Spade as well as 15 acquired store locations in Singapore and Malaysia, and seven new Stuart Weitzman locations. For FY19, the company expects to report a net decrease for Coach due to net closures in North America and Japan. The company is on track to add a net 60-70 new Kate Spade locations (40-50 of which will be international) and plans approximately 30 net new locations for Stuart Weitzman, primarily in China.

Outlook

The company updated FY19 guidance to reflect the 2Q results and the unstable global environment.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Tapestry reported flat adjusted 2Q19 EPS of $1.07 and missed the $1.11 consensus estimate. Total revenues were $1.80 billion, up 0.9% year over year and below the $1.86 billion consensus estimate.

By brand, Coach net sales were $1.25 billion, up 1.5% year over year, Kate Spade brand sales declined 1.4% to $428 million and Stuart Weitzman brand sales increased 2.6% to $124 million.

At Coach, global comparable store sales rose 1%, led by outperformance in international and e-commerce channels. Business in Greater China accelerated and Coach’s business with the Chinese consumer increased. Comps were positive in Europe and Japan as well, offset by negative comps in North America and Korea. Comps declined 11% at Kate Spade as the business transitions to a new design team. Marketing to support the launch of Nicola Glass’s new collection was moved to the current quarter (3Q19), and the initial read is positive.

Adjusted gross margin expanded 10 bps to 67%, reflecting 120 bps gross margin improvement at Kate Spade and a 10 bp increment at Coach, offset by a 380 bp decline at Stuart Weitzman.

Adjusted operating profit declined 2.2% to $402 million, or 22.3% of sales, down 70 bps year over year, with higher SG&A expenses reflecting JV consolidation, new store distribution at Kate Spade and increased marketing at Coach. By brand, adjusted operating margin was 30.3% at Coach, up 40 bps year over year; 22.2% at Kate Spade, down 100 bps; and at Stuart Weitzman, the adjusted operating profit margin was 10.3%, down from 20% in the year ago period.

Inventories increased $66 million, or 9.9%, to $732 million on a year-over-year basis.

During the quarter, Tapestry added a net 25 new store locations: A net two additions at Coach, a net 16 new stores at Kate Spade as well as 15 acquired store locations in Singapore and Malaysia, and seven new Stuart Weitzman locations. For FY19, the company expects to report a net decrease for Coach due to net closures in North America and Japan. The company is on track to add a net 60-70 new Kate Spade locations (40-50 of which will be international) and plans approximately 30 net new locations for Stuart Weitzman, primarily in China.

Outlook

The company updated FY19 guidance to reflect the 2Q results and the unstable global environment.

- Guidance for consolidated revenues is a low to mid-single digit percentage increase from FY18’s $5.88 billion, which includes a low-single digit growth rate at Coach driven by positive low-single digit comps. Previous guidance issued in August was for a mid-single digit revenue gain.

- Gross margin is on track to modestly expand and management continues to expect $100-115 million cost savings related to the Kate Spade acquisition and the impact of distributor consolidations and buybacks, and systems investments.

- FY19 EPS guidance was reduced to the range of $2.55-2.60 from $2.70-2.80.