Nitheesh NH

Tapestry, Inc.

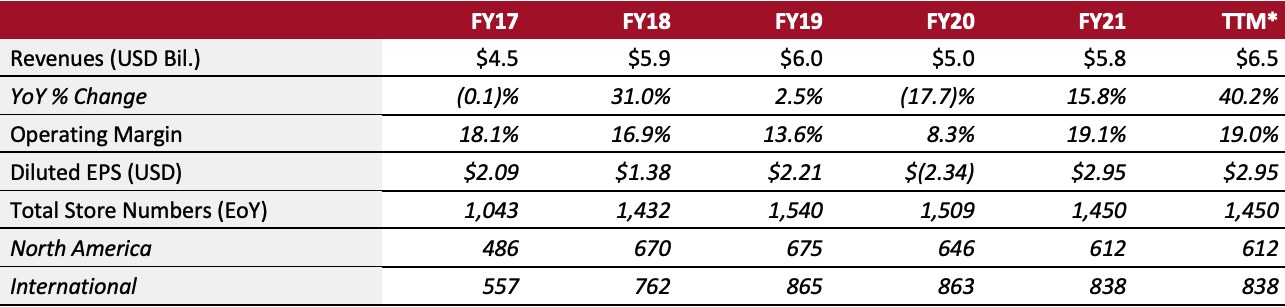

Sector: Luxury Countries of operation: Over 55 countries, including China, the UK and the US Key product categories: Accessories, footwear, handbags and luggage Annual Metrics [caption id="attachment_145008" align="aligncenter" width="700"] Fiscal year ends June 30 of the same calendar year

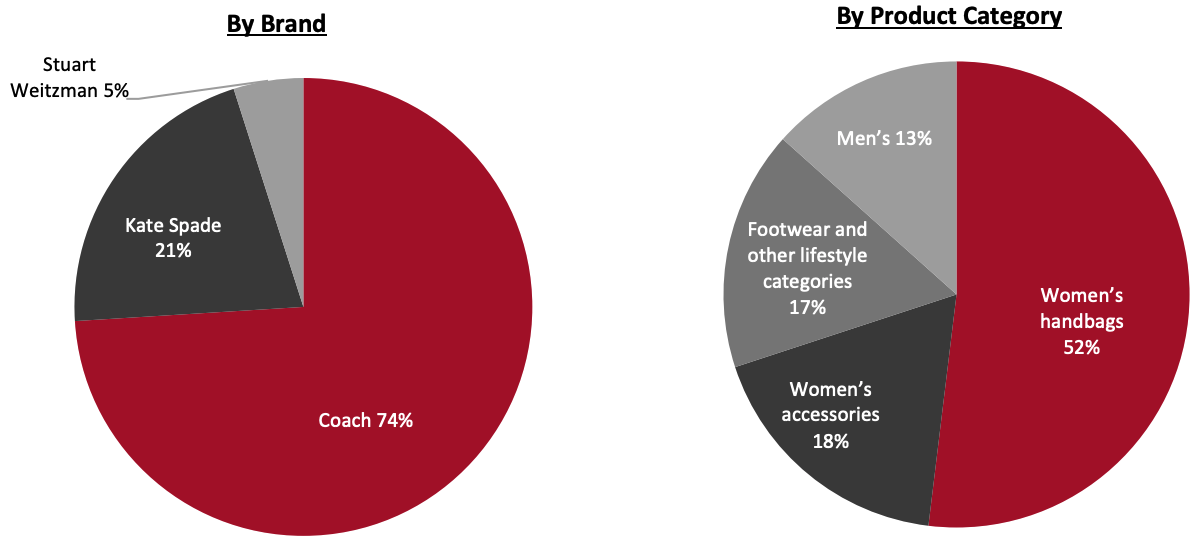

Fiscal year ends June 30 of the same calendar year*Trailing 12 months ended January 1, 2022[/caption] Summary Headquartered in New York, Tapestry owns modern luxury accessories, handbags and lifestyle brands Coach, Kate Spade and Stuart Weitzman. Founded in 1941 as Coach, Inc., the company operates 1,450 stores globally as of July 3, 2021. Following the 2015 acquisition of luxury footwear company Stuart Weitzman and the 2017 acquisition of accessories and ready-to-wear brand Kate Spade, the company changed its name to Tapestry. Reportable segments are its three brands: Coach, Kate Spade and Stuart Weitzman. Company Analysis Coresight Research insight: Like many other luxury houses, Tapestry was severely impacted by the pandemic. In its fiscal 2020 (ended June 30, 2020), the company experienced a revenue decline of 17.7%—but it has since managed to recover, posting 15.8% revenue growth in its fiscal 2021 (ended July 3, 2021). Tapestry continues to optimize its global physical store fleet—a strategy that preceded the pandemic but was spurred into greater urgency by it. The company also enhanced its digital capabilities, and improved its customer experience across its e-commerce and social media channels over fiscal 2021. These initiatives have generated positive results for Tapestry, both bringing in 4 million new customers through e-commerce in North America, “representing gains versus prior year,” and causing high single-digit revenue growth in China across its brands compared to pre-pandemic levels, according to the company’s fiscal 2021 annual report. We think Tapestry’s continued digital storefront improvements and the simplification of its operations will help the company expand across high-growth markets.

| Tailwinds | Headwinds |

|

|

- Increase market share by driving average unit retail and unit growth, developing iconic product families, and emphasizing approachable and inclusive global communication

- Invest in and grow digital capabilities, creating differentiated omnichannel experiences and experimenting with new formats to attract youthful consumers

- Continue to drive growth in China by taking advantage of its growing middle class and building brand awareness with dedicated capsule collections for the region

- Grow men’s departments by increasing brand awareness and presence in Asia

- Maintain a consumer-centric approach, reinforcing Tapestry’s position as a lifestyle brand, and continually engage customers to drive lifetime value

- Continue to build out core product assortments and promote recent introductions

- Drive brand interest with multi-platform promotions and social media marketing focused on the Kate Spade community

- Reinforce brand’s lifestyle positioning with a focus on ready-to-wear, footwear and jewelry

- Grow digital sales by enhancing the omnichannel customer experience

- Return to profitability by focusing on high-growth areas such as digital and China, and continuing with foundational changes implemented in the prior year, such as simplifying assortment and improving partner relationships

- Recruit and engage customers by developing “must have” products and capsule collections

- Drive brand awareness with consistent and culturally relevant messaging

- Fuel continued growth in China with e-commerce and store network expansion, and offer dedicated, culturally relevant capsule collections

- Accelerate wholesale partnerships by building upon momentum gathered in prior fiscal year and focusing on key accounts

Company Developments

Company Developments

| Date | Development |

| January 20, 2022 | Tapestry and Coach forge partnership with Savory Institute’s Land to Market Program—a sourcing solution for regenerative agriculture, in an effort to progress towards its emissions reduction targets. |

| November 16, 2021 | Breaks ground at new fulfilment center in North Las Vegas, which will serve Coach and Kate Spade upon expected completion in 2022. The facility will span 788,000 square feet, distribute 22.2 million units annually and hold 4 million units in inventory. |

| September 23, 2021 | Signs the Science Based Targets initiative (SBTi) Business Ambition for 1.5⁰C, committing to establish science-based emissions reduction targets to limit global warming to 1.5°C and to achieve net-zero global emissions by 2050. The SBTi is a partnership between several environment-focused nonprofit groups including CDP and the World Wide Fund for Nature. |

| July 28, 2021 | Establishes $50 million Tapestry Foundation to drive environmental, social and governance initiatives, including committing to a minimum $15 per hour wage for US hourly workers. |

| April 29, 2021 | Appoints Scott , replacing Andrea Shaw Resnick, who held the position of Interim CFO beginning July 2020. Roe will be responsible for all finance functions and lead Tapestry’s Strategy and Consumer Insights teams. |

| April 29, 2021 | Appoints Andrea Shaw Resnick as Chief Communications Officer, effective June 1, 2021. Resnick was previously Interim CFO and global head of investor relations. |

| April 29, 2021 | Promotes Christina Colone, VP of Investor Relations, to Global Head of Investor Relations, effective June 1, 2021. |

| April 15, 2021 | Appoints Todd Kahn as effective immediately. Kahn will be responsible for all aspects of the brand. |

| March 4, 2021 | Kate Spade announces a new creative organizational structure to deepen focus on the consumer, promote innovation and grow collaborations. Two new roles are formed as part of this move: SVP, Brand Concept & Strategy and Head of Product Design. Kristen Naiman, SVP, Brand Creative at Kate Spade will step into the role of SVP, Brand Concept and Strategy, effective April 1, 2021. The brand is yet to appoint a Head of Product Design. |

- Joanne Crevoiserat—CEO

- Scott Roe—CFO and Head of Strategy

- Tom Glaser—COO

- Noam Paransky—Chief Digital Officer

- Andrea Shaw Resnick—Chief Communications Officer

- Christina Colone—Global Head of Investor Relations

Source: Company reports/S&P Capital IQ