Web Developers

Summary

The FGRT team attended Walmart’s 2017 Investment Community Meeting, held near the company’s headquarters in Bentonville, Arkansas, this week. The team also visited selected Walmart stores and was introduced to the company’s new services and technologies, including the “tower of power” in-store pickup tower. In this report, we highlight the key takeaways from the meeting and our store visits.

Source: Walmart

1) Walmart Aims to Move with Speed on a Stronger Foundation

Walmart CEO Doug McMillon outlined the company’s plan to play to its strengths, build on its momentum and remain disciplined. The strategy centers on Walmart’s revitalized mission to serve its customers by combining physical and digital retail in a way that results in a seamless shopping experience. Walmart believes that it has discovered the sweet spot of retail, where customers who shop both in-store and online spend more than twice as much as customers who shop only in-store, and where in-store customers also spend more online than the average customer.

Source: News.walmart.com

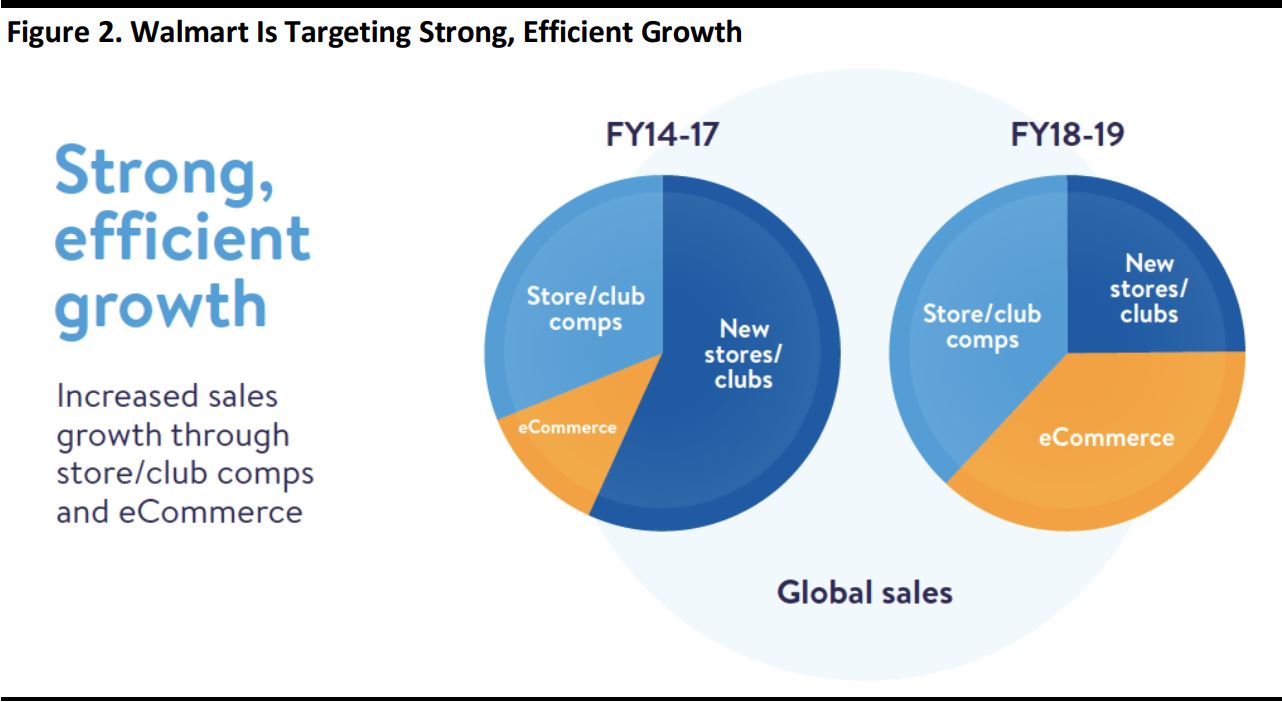

McMillon cited Forrester data showing that the grocery e-commerce market is highly under penetrated versus general retail, and he said that Walmart offers the three key delivery methods that enable a seamless grocery shopping experience: in-store, in-store pickup and delivery. McMillon further outlined the four elements of Walmart’s plan for success: Make every day easier for busy families. Walmart’s customer base has embraced mobile technology in a major way, and technology can be used to perform tasks that consumers do not want to perform. Walmart has empowered its associates with technology, but it also empowers them to act instinctively in terms of merchandising, so as to drive sales. Walmart aims to use technology to make shopping easy, fast, friendly and fun. Change how the company works. Walmart is investing in and empowering associates to create a high-performance culture, but it is also working to strengthen diversity and inclusion. McMillon outlined several initiatives designed to improve communication. For example,the company’s China-based associates are using the WeChat platform to share their ideas on sales. Deliver results and operate with discipline. Management is pursuing strong, efficient growth based on consistent operating discipline. The company is also strategically allocating capital.For example, it is slowing the speed of new store openings and using capital to remodel existing stores. Be the most trusted retailer. Walmart aims to practice excellence in global compliance and ethics and be a leader on the social and environmental fronts. The company contributes within the communities in which it operates and aims to tell its story more effectively.

Source: Walmart

2) Walmart Seeks to Win with Both Customers and Shareholders

Walmart CFO Brett Biggs segmented his remarks into three parts: an update on expectations, financial strength and financial framework. Update on expectations. In the first half of fiscal 2018, Walmart achieved 3.1% growth in adjusted net sales, generated $11.4 billion in cash from operations, and paid out $7.5 billion in dividends and share repurchases. For the full year, Biggs reiterated guidance of adjusted EPS of $3.40–$4.40, about 3% growth in net sales (on a constant currency basis) and capital expenditure of about $11 billion. For fiscal 2019, Walmart expects to again grow revenues by about 3% andto see adjusted EPS of $4.30–$4.40.The company also announced a $20 billion sharerepurchase program that will take place over two years.

Source: News.walmart.com

Financial strength. Walmart reported $486 billion in sales in fiscal 2017—a total approaching the half-billion-dollar mark. The company maintains an AA credit rating and is serving 260 million customers per week. Financial framework. Walmart’s financial framework calls for strong, efficient growth, consistent operating discipline and strategic capital allocation. Strong, efficient growth means prioritizing comp and e-commerce growth over new customer growth. Consistent operating discipline means bringing expenses below the leverage point (currently at 21% of sales) by eliminating duplication and using technology in new ways, which is expected to deliver operating leverage next year. Strategic capital allocation entails returning cash to shareholders and deploying capital strategically in terms of acquisitions, partnerships, divestitures and tests.

Source: Walmart

3) E-Commerce Revenue Is Expected to Grow by 40% in Fiscal 2018

Marc Lore, President and CEO of Walmart eCommerce US, appeared at Walmart’s investors’ meeting last year after just 17 days on the job. At this year’s meeting, he was able to list some of his group’s accomplishments in the last year, which include:- Two-day free shipping

- Easy reorder

- Pickup discount

- Store No. 8

- Testing of in-home and to-fridge delivery

- A deal with Google

Source: News.walmart.com

Nail the fundamentals. Lore stressed the importance of executing on the fundamentals. The group has improved merchandising and logistics. It has hired 250 category specialists who focus on the products, images and prices for a given category and it is continuing to hire 40–50 specialists per month.In terms of logistics, the division is mirroring inventory in fulfillment centers to be able to deliver next day in more than 87% of the continental US; the group can already reach 99% of customers in two days via ground shipping. Leverage unique assets. The e-commerce group is able to leverage Walmart’s unique portfolio of assets and play offense on price/value, assortment and experience. It can offer price features such as the Smart Cart and a discount for orders that customers pick up themselves. Walmart’s assortment includes many billion-dollar private-label brands, the soon-to-launch Uniquely J brand and brands for digital natives, such as Bonobos, ModCloth and others. The company is also improving the shopping experience by offering grocery pickup and is testing same-day and two-hour delivery with Uber, Deliv, store associates and the recently acquired Parcel. Innovate for the future. Walmart is pursuing innovation through technologies such as artificial intelligence, drones, augmented reality and virtual reality, as well as through its Store No. 8 startup incubator.

Source: Walmart

4) Sam’s Club Has Identified Its Typical Customer and Is Working to Improve Its Competitive Position

Sam’s Club offered solid results in the first half of fiscal 2018, with net sales growing by 2.6% on a 1.6% increase in traffic. Its Member’s Mark private-label brand is an $11 billion business. Still, Sam’s Club CEO John Furner commented that the division’s performance needs to improve and he outlined his plans to “move the needle in a meaningful way.” He said that recent improvements have resulted in increasing confidence, a better member sign-up process and transformations to the business. Recent improvements are increasing confidence. Furner cited improvements in Member’s Mark private-label penetration (which is up to 23% from 17% a year ago), fresh comps (which grew to 5% from negative figures), e-commerce sales (which grew by 27% in the first half of the year) and member satisfaction with checkout (which has improved by 7%). Improvements made to the member sign-up process. Sam’s Club’s member sign-up process previously required five separate systems and took 8–28 minutes to complete. Furner said that the company has implemented a tablet-based process that has reduced the time it takes to sign up to 43 seconds. The company also analyzed its member profiles, and found that 74% of members choose a Savings membership and that 95% of all purchases (excluding fuel and tobacco) are of household items. Thus, Sam’s Club has distilled its profile of its target member household:it is a household with a large family (four or more children) and $75,000–$125,000 in annual income where one of the adults may also own a small business. Transformations to the business. Management has focused on people in terms of making Sam’s Club a better place to work, and on product in terms of improving merchandising to increase the number of fresh items available, enhancing private-label brands and offering exclusive merchandise.

Source: Walmart

5) Walmart International Aims to Offer Disciplined Growth Through a Strategy of Winning in China and Offering a Differentiated Value Proposition Elsewhere

Walmart International reported a 3.2% increase in sales in the first half of fiscal 2018. The division has seen continued sales momentum, strength at Walmex and in Canada, improved profitability in the UK, and several changes in China. Management is focused on actively managing the portfolio. It has a strategy to win in China and it is practicing disciplined growth throughout international markets. Actively managing the portfolio. In strong core markets in North America, the company is working to strengthen its advantages and generate leverage. In key growth markets such as China and India, the group is pursuing its strategy to win and is committing resources to those regions. In diversified portfolio markets such as Africa, Argentina, Brazil, China, Japan and the UK, the business aims to position itself to provide accretive value and stability. Strategy to win in China. Walmart has rebalanced its businesses in China to focus on priority provinces, largely in Southern China, plus Beijing and Tianjin. The company has reconfigured many of its stores to reside on a single floor and has worked hard to differentiate itself through pricing, a focus on fresh food (which involved building a supply chain) and private labels. Last month, the company opened its first “dark store” in China, offering 1,000 SKUs and processing 90% of orders within an hour. Practicing disciplined growth throughout international markets. Walmart aims to practice price leadership, develop its private-label brands, and focus on fresh food and online grocery. The group has had success in reducing the cost of goods sold and SG&A and was able to generate expense leverage in the first and second quarters of its 2018 fiscal year.

Source: Walmart

6) Walmart US Aims to Run Great Stores, Be Great Merchants and Build Trust with Customers

Greg Foran, CEO of Walmart US, began his remarks with a review of the group’s performance in the first half of fiscal 2018: net sales were up 3.1% on 1.6% comps and traffic was strong. E-commerce sales increased by 62%. Whereas management previously focused on fixing problems, it is now focused on attaining leadership through a strategy based on running great stores, being great merchants and building trust with customers. Running great stores. The group is changing how it works, developing efficient processes and practicing strong inventory management.The business has benefited from 12 new and enhanced apps launched thus far this year. Future planned measures include improving the customer experience, enhancing fresh-food offerings, and using free store space for online grocery logistics or mobile phone repairs. Being great merchants. Being a great merchant involves delivering value to customers through low prices, which are enabled by controlling expenses, managing the front end of the store and upgrading the talent of the employees within the store.

Source: News.walmart.com

Building trust with customers. Walmart can increase trust with customers by offering a disciplined assortment, increasing the freshness of its fresh-food offerings and expanding its private-label offerings. Foran hinted that the company may announce new private-label brands in future months. Walmart can build trust with associates by increasing wages, making structural changes and running academies. Walmart’s activities during and in response to natural disasters this year have served to build trust with communities.

7) Notes from Walmart Store Visits

Prior to the investors’ meeting, the FGRT team visited two Walmart Superstores in the Bentonville area. We observed:- Aesthetically appealing and well-stocked food and fresh-food areas

- In-store pickup (including drive-through) services

- Scan-and-pay consoles

- An increased focus on private-label and branded pet food

- A streamlined, mobile-driven prescription refill service

- A returns desk for in-store, online and marketplace products

- Holiday deals on toys and consumer electronics