Home Depot’s 2017 Investor and Analyst Conference

Home Depot held its annual Investor and Analyst Conference on December 6 in Boston, MA. The home improvement retailer discussed plans to accelerate investments in its business over the next three years as it pursues a new target of almost $120 billion in annual sales.

Home Depot announced that it is doubling its total investment spending over three years amid growing online and brick-and-mortar competition. CEO Craig Menear noted that the retail landscape is changing at an unprecedented pace and said, “We plan to invest for the future to address the evolving needs of our customers.”

Home Depot plans to increase investment in its supply chain and delivery capabilities, employees, stores, online business, and customer experience.

The company guided for annual capital expenditure equal to 2.5% of sales, above the 1.7%–1.8% average over the past four years. While that could slow the company’s margin expansion, management believes it will better position the company in the long term.

At the start of the meeting, Home Depot reaffirmed its fiscal 2017 financial guidance. The company expects:

- Revenues to increase by 6.3% year over year, implying total revenues of $100.55 billion versus the $100.67 billion consensus estimate.

- Same-store sales to increase by 6.5% year over year.

- EPS of $7.36 versus the $7.38 consensus estimate.

Management also issued long-term targets for 2018 through 2020. The company expects:

- Sales of $114.7–$119.8 billion in fiscal 2020, implying a 14%–19% increase from this year’s guidance of $100.55 billion.

- Sales to grow through 2020 at a CAGR of 4.5%–6% versus the 4% consensus estimate.

- Operating margin of 14.5%–15% versus the 15.9% consensus estimate for 2020 and the 15.1% consensus estimate for 2018.

- Annual capital expenditure to represent about 2.5% of sales, above the 1.7%–1.8% average over the past four years.

- To buy back $15 billion in shares over the next three years.

- Return on invested capital of 36.4%–39.6%.

Below, we summarize our key takeaways from the conference.

1. Enhancing the Customer Experience

Home Depot management highlighted various ways the company is leveraging physical and digital assets to keep pace with changing customer expectations. The retailer is focusing on improving its online services by offering new merchandise options for specific types of customers, including professionals (Pro customers) and homeowners doing their own projects and repairs.

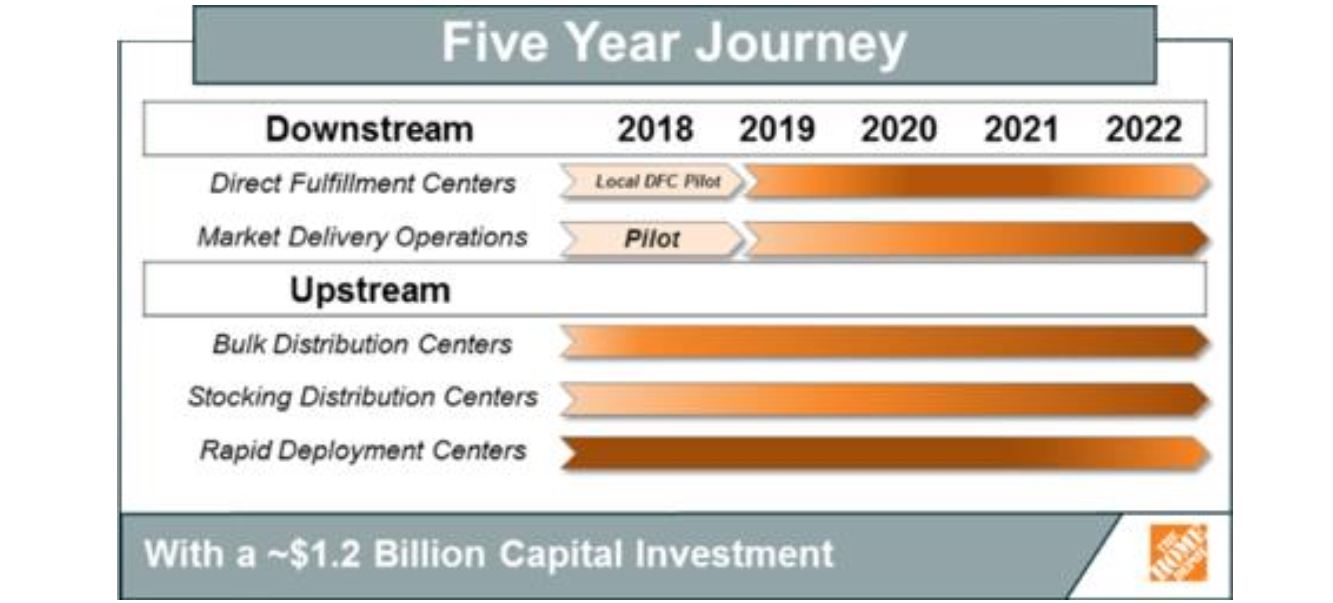

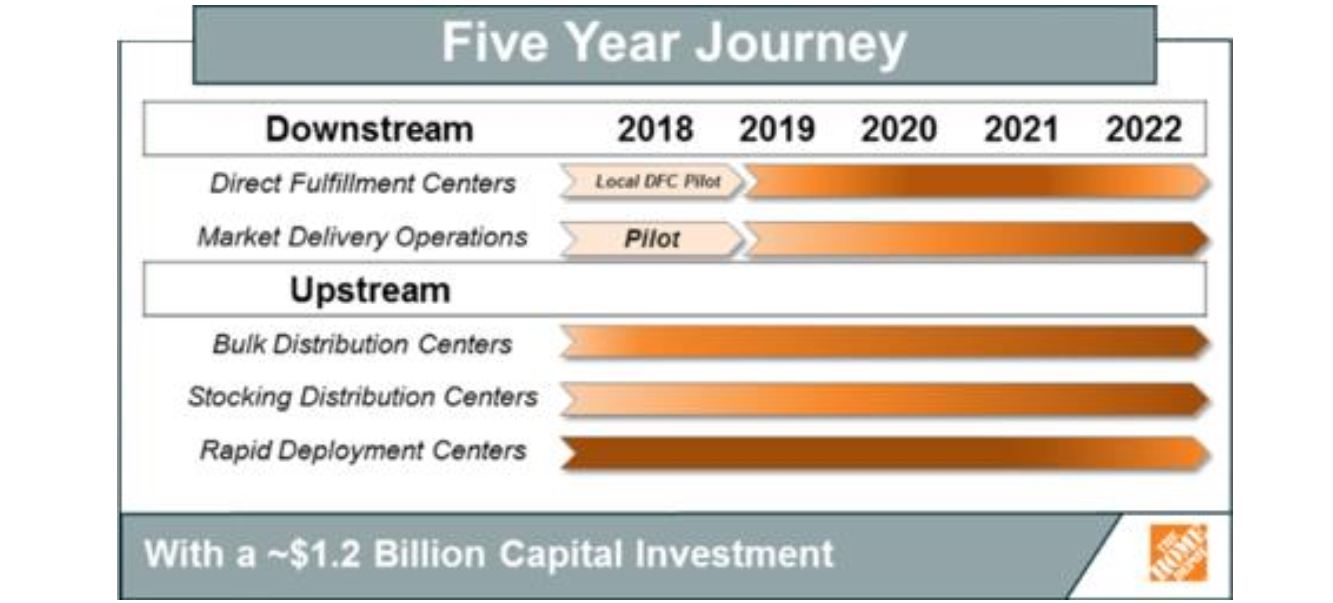

To improve its delivery capabilities, Home Depot is investing $1.2 billion in its supply chain from 2018 to 2022. Management said it will increase its number of direct fulfillment centers to increase the speed of deliveries.

Source: Home Depot

The company plans to invest more in its stores and employees over the next three years. Management said it will invest in employee wages and improve on-staff scheduling in stores to make checkout faster for customers and that it will add digital signage to make it easier for customers to navigate stores.

2. Blending Digital and Physical Retail: “One Home Depot”

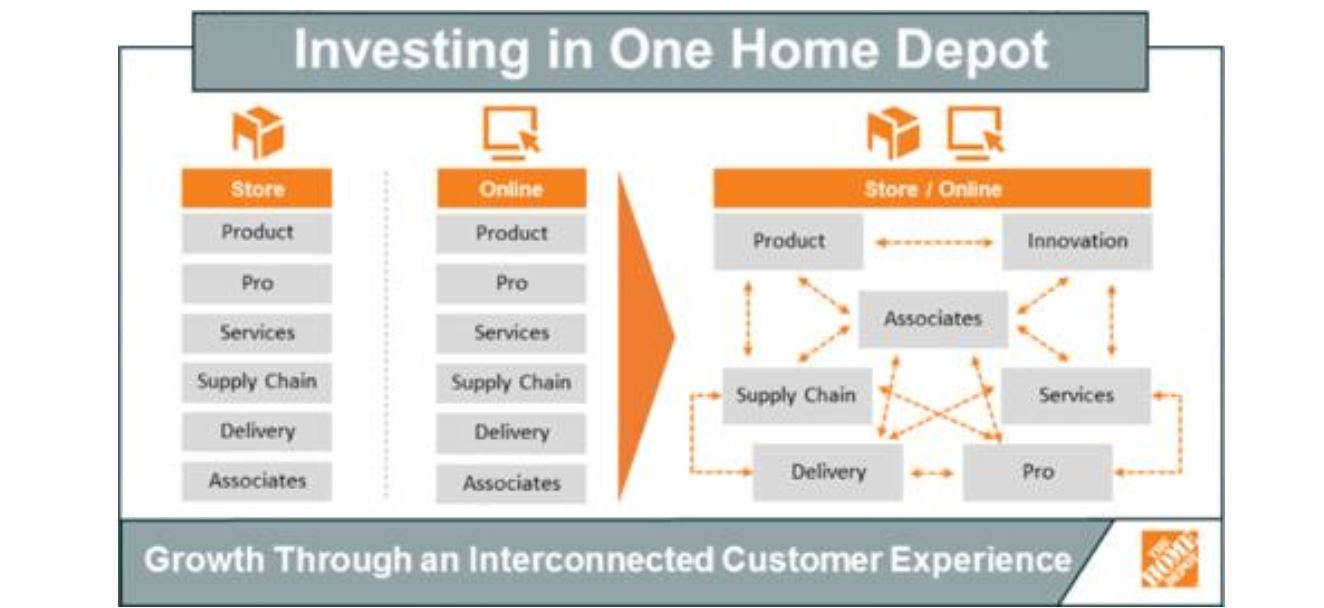

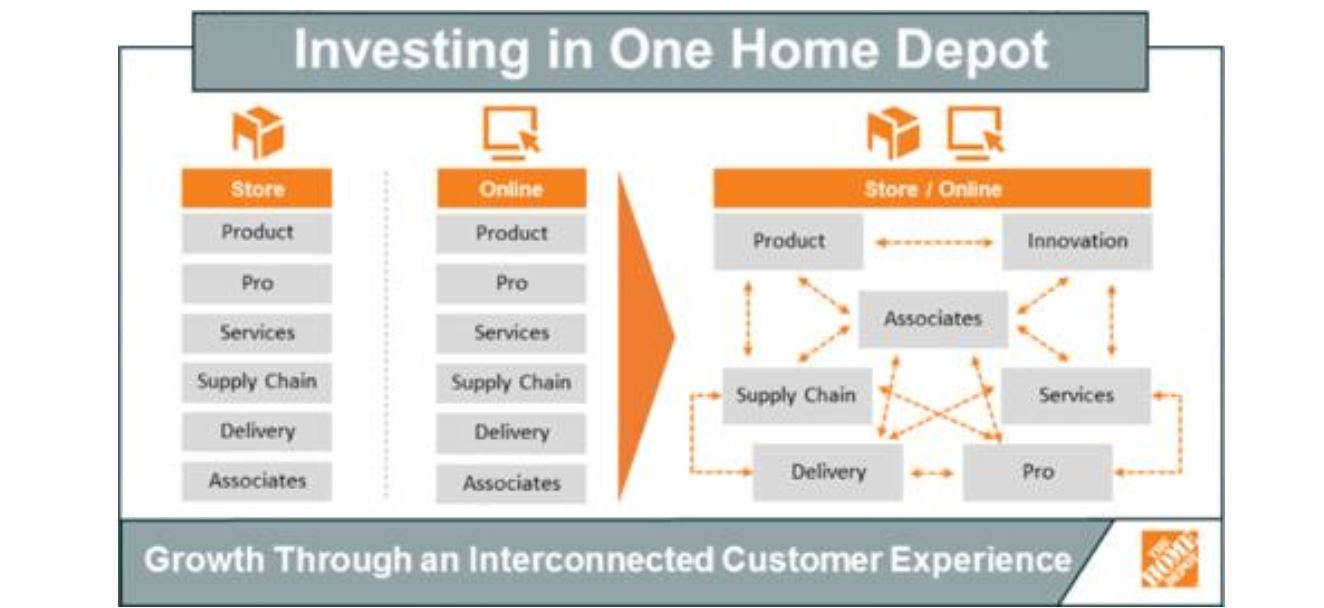

Management discussed key investments to position the company as “One Home Depot.” The retailer is focusing on better connecting its online services, fulfillment and sales to its brick-and-mortar operations.The company sees its e-commerce and in-store operations as two parts of a whole that each reinforce the other rather than viewing them as separate businesses.

Home Depot’s online operations continue to help drive in-store traffic, including when items are picked up from or, if need be, returned to its stores. The One Home Depot philosophy underlies the company’s omnichannel strategy, and management believes it is a significant competitive advantage over pure play rivals.

The strategy continues to drive sales both in stores and online; online sales grew by approximately 19% in the most recent quarter and about 45% of online orders were picked up in stores by customers, indicating that the strategy is a driving factor of Home Depot’s e-commerce growth,according to Menear.

Source: Home Depot

An additional benefit from this strategy is that when customers pick up their orders, they can see more offers and products available in the store. As a result, approximately 20% of the time, customers end up buying more than just the original online purchase, according to the company. By focusing on an integrated channel strategy, Home Depot has been able to increase its revenue per square foot, which has ensured that its existing store network is being efficiently used to drive revenue.

3. Strengthen Merchandise Options, Big Focus on Pro Customers

Home Depot plans to offer more options and change its merchandise more frequently for specific types of customers, including Pros and homeowners doing their own projects and repairs. During the company’s presentation, management stated that the Pro customer will be a big focus, as Pro sales have been significantly “outpacing” DIY sales growth.

Pro customers, due to the nature of their jobs, tend to spend more money, more often, than other customers, Menear said. According to EVP of Merchandising Edward Decker, categories such as flooring, roofing and “several Pro-heavy categories” are driving these high-ticket sales.

Management suggested that there are two primary reasons for the company’s success with the Pro customer: Home Depot offers the products Pros need at the right price and it engages this customer category more than its competitors do.

Home Depot is also finding new ways to connect with Pro customers. Its cobranded credit card is now offered to Pros, for example. The card’s approval rate is 72%, while the average line of credit is $6,700. The company is finding ways to leverage its digital capabilities to attract more Pro customers, too. Decker said that although Pro customers do not make purchases online, they often check inventory levels and prices online.

4. Looking Ahead: Capital Returns and Macro Environment

Home Depot announced plans to create more value for shareholders by increasing the total value returned to them.The retailer announced a $15 billion share repurchase program.From 2002 through the third quarter of fiscal 2017, the company has returned approximately $73 billion of cash to shareholders through repurchases.

Management noted that the macroeconomic environment remains supportive to Home Depot and said that it believes the US housing market will continue to be a tailwind for the business. Home Depot has benefited from a multiyear recovery in the US housing market, which has driven owners to spend more on fixing up their properties. The retailer also benefited from reconstruction and repair work related to Hurricanes Irma and Harvey that hit the US in August and September this year.

The company currently operates 2,283 retail stores across the US, Colombia, Puerto Rico, the Virgin Islands, Guam, Canada and Mexico.