Takeaways from the Meeting

The Coresight Research team attended the 2018 Target Financial Community Meeting in Minneapolis this week. Takeaways distilled from remarks by CEO Brian Cornell, COO John Mulligan and CFO Cathy Smith follow.

1. Target has embarked on a $7 billion-plus investment program to drive growth.

This investment aims to:

- Blend physical and digital stores.

- Reimagine Target stores.

- Open more new small-format stores.

- Create digital capabilities.

- Launch great brands.

Target challenged its employees by telling them that if they could end 2017 with positive comps, then they could wear jeans to work on weekends in 2018, and the employees delivered—comps were up 1.3% for the year.

2. The company ended 2017 on a financial high note.

Management summarized the fourth quarter and full year as follows:

- Strong traffic growth of 3.2% in the fourth quarter.

- Comp growth of 3.6% in the fourth quarter.

- Target gained market share in core categories.

- 2017 was the fourth consecutive year of more than 25% growth.

- More than 50% of digital volume was filled by stores.

- Adjusted EPS was $1.37 for the fourth quarter.

- Adjusted EPS was $4.71 for the full year.

Please click

here to read our full coverage of Target’s fourth-quarter results.

3. 2017 was about defining the plan; 2018 is about accelerating the plan to become “America’s easiest place to shop.”

In 2017, the company’s goals included:

- Laying out the strategic plan.

- Moving the organization in the right direction.

For 2018, the company’s goals include:

- Accelerating the plan.

- Leveraging the company’s greatest assets.

- Leaning into the company’s competitive strengths.

Target’s motto for 2018 is to become “America’s easiest place to shop.”

4. The company is focused on newness and innovation to improve the digital experience.

Target is exploring every current “technological buzzword,” including:

- Artificial intelligence.

- Computer graphics.

- Machine learning.

In terms of improving the digital experience, Target:

- Fulfilled two-thirds of digital orders in its stores this past holiday season.

- Offers an order pickup/returns/exchanges desk.

- Combined its Cartwheel and Target apps.

- Introduced a Target Wallet to expedite payment.

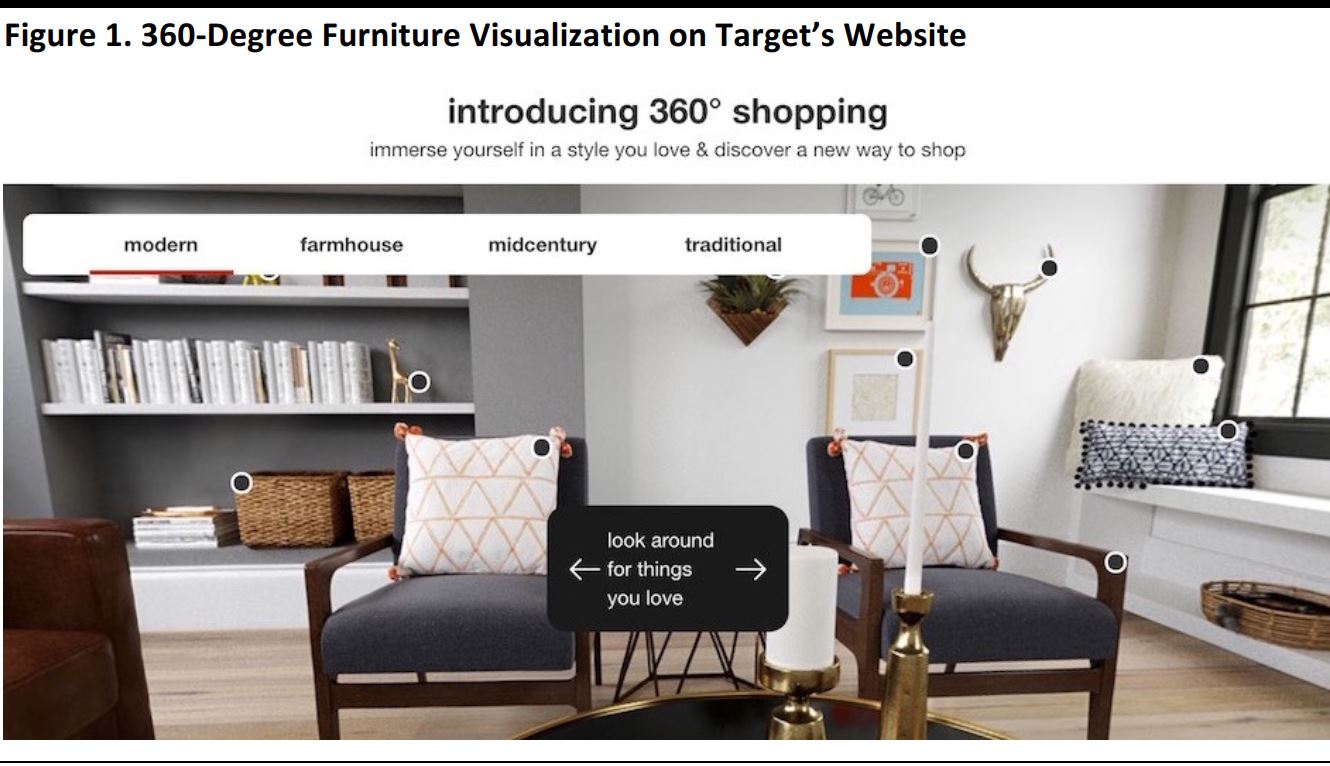

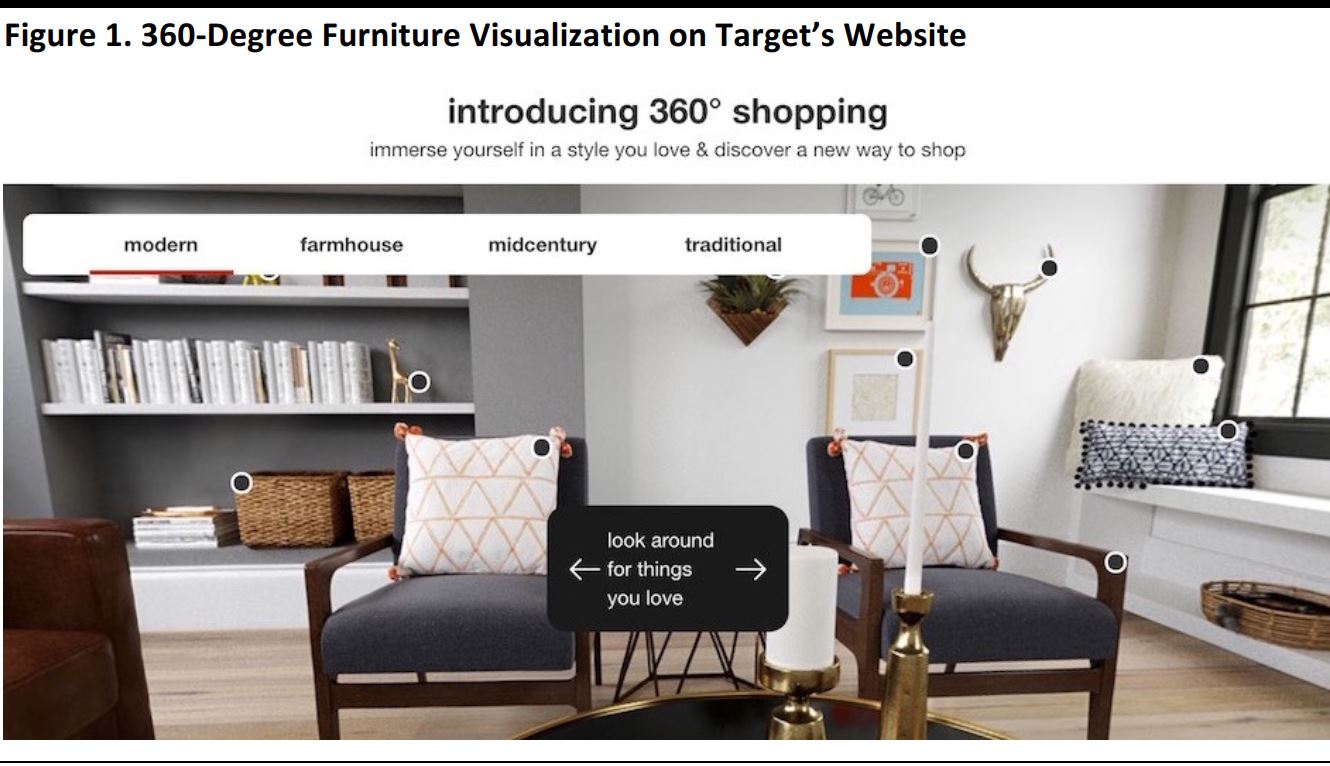

- Is enhancing the experience by adding a 360-degree visualization function, investing in augmented reality, elevating storytelling and extending its assortment.

Source: Target.com

5. Target is investing in its team through training, tools, advancement opportunities and pay raises.

Target is offering advancement opportunities and improved training to its sales associates, and providing them with better tools, such as handheld devices for use on the store floor.

Source: Target presentation

In addition, the company is raising the starting wage to $12 per hour for certain employees this spring, after having raised the rate to $11 per hour in October 2017 and with the goal of reaching $15 per hour in 2020. These wage increases have led to a 60% increase in applications to the company. Target seeks to become “the employer of choice” in its sector.

Source: Target presentation

Target is also staffing its stores with subject matter experts rather than with generalists.

6. The company plans to renovate and open more than 1,000 stores by 2020.

In reimagining its stores, Target is aiming for:

- Ease and inspiration.

- Style and essentials.

- Mass and specialty.

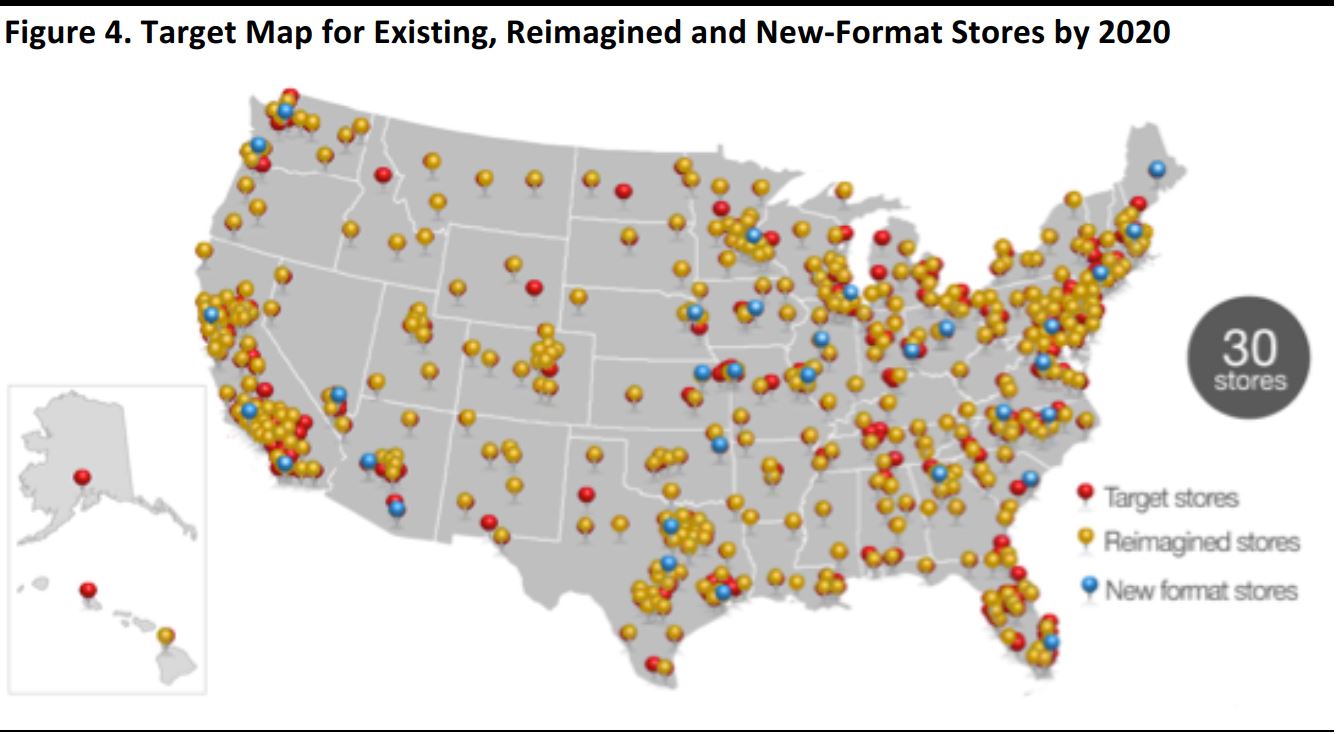

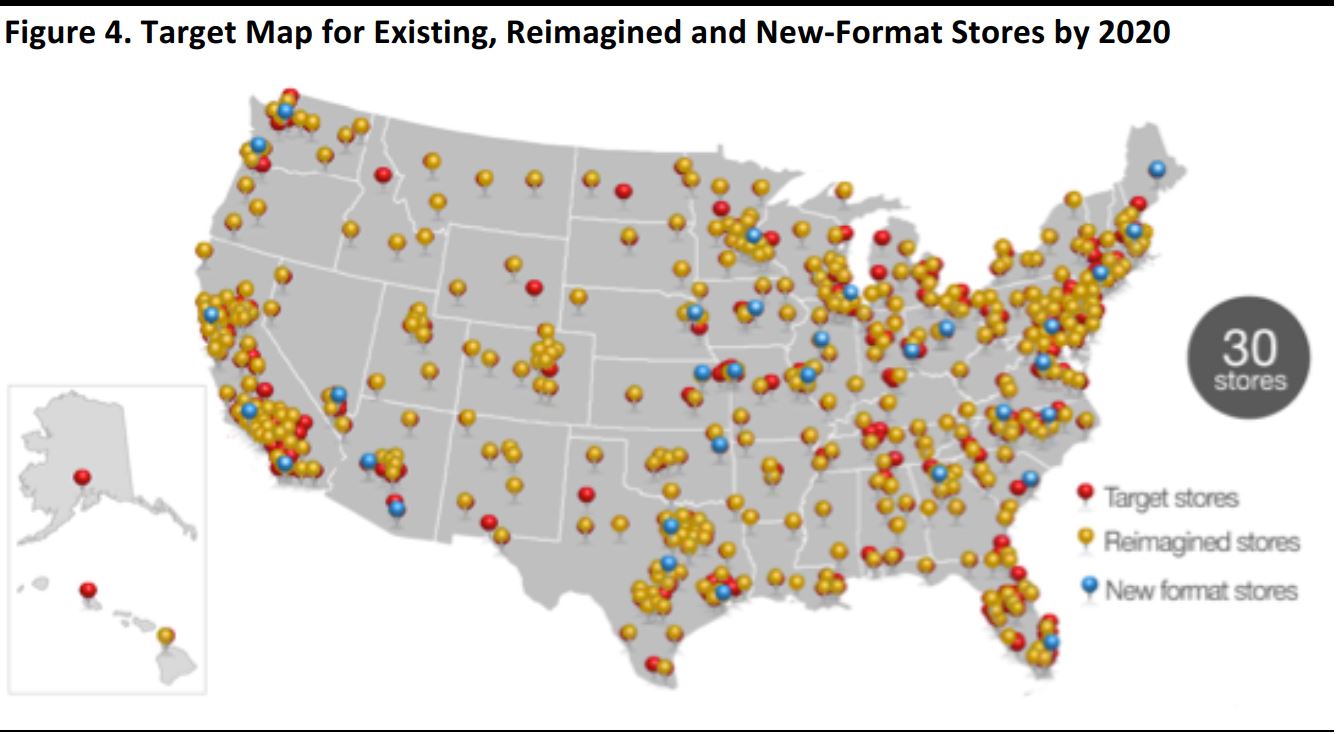

Target reimagined 110 stores in 2017 and plans to reimagine 325 stores in 2018, with a goal of renovating and opening more than 1,000 stores by 2020.

In addition, Target plans to open 30 new-format stores in 2018.

Source: Target presentation

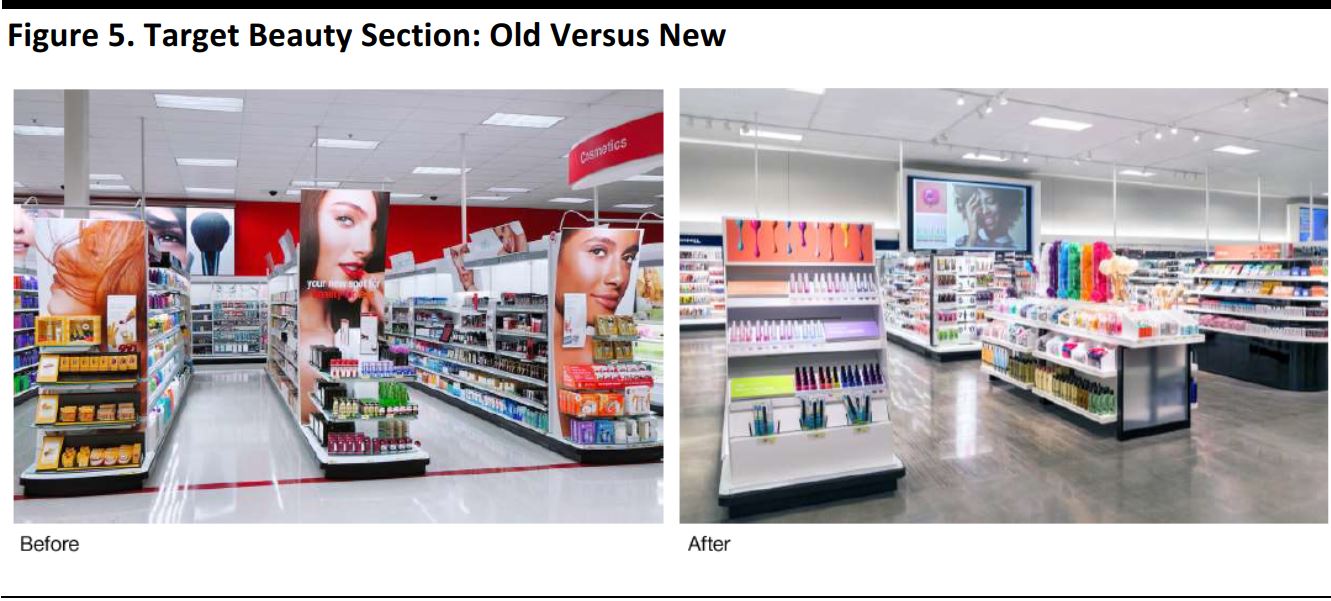

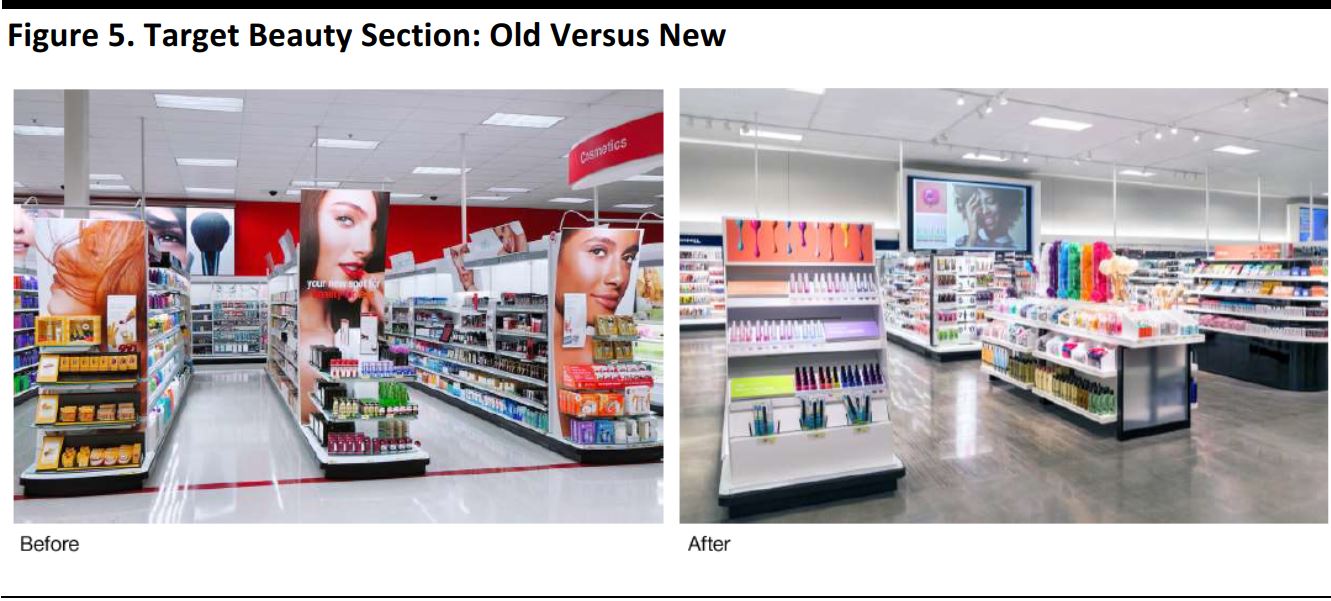

Target’s renovations involve the removal of old-fashioned merchandise displays in favor of modern and more accessible displays with better lighting, as illustrated below.

Source: Target presentation

7. Target offers a variety of pickup and delivery options, including Grand Junction, Drive Up and Shipt.

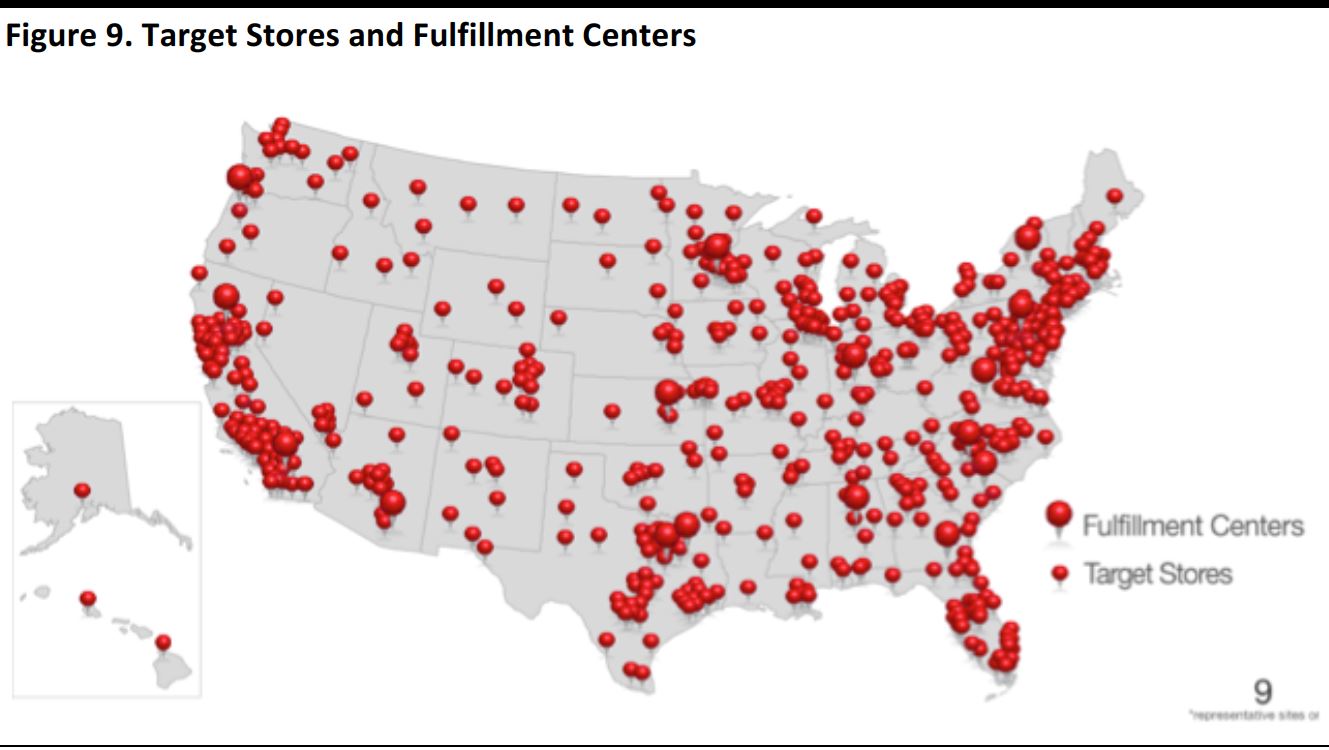

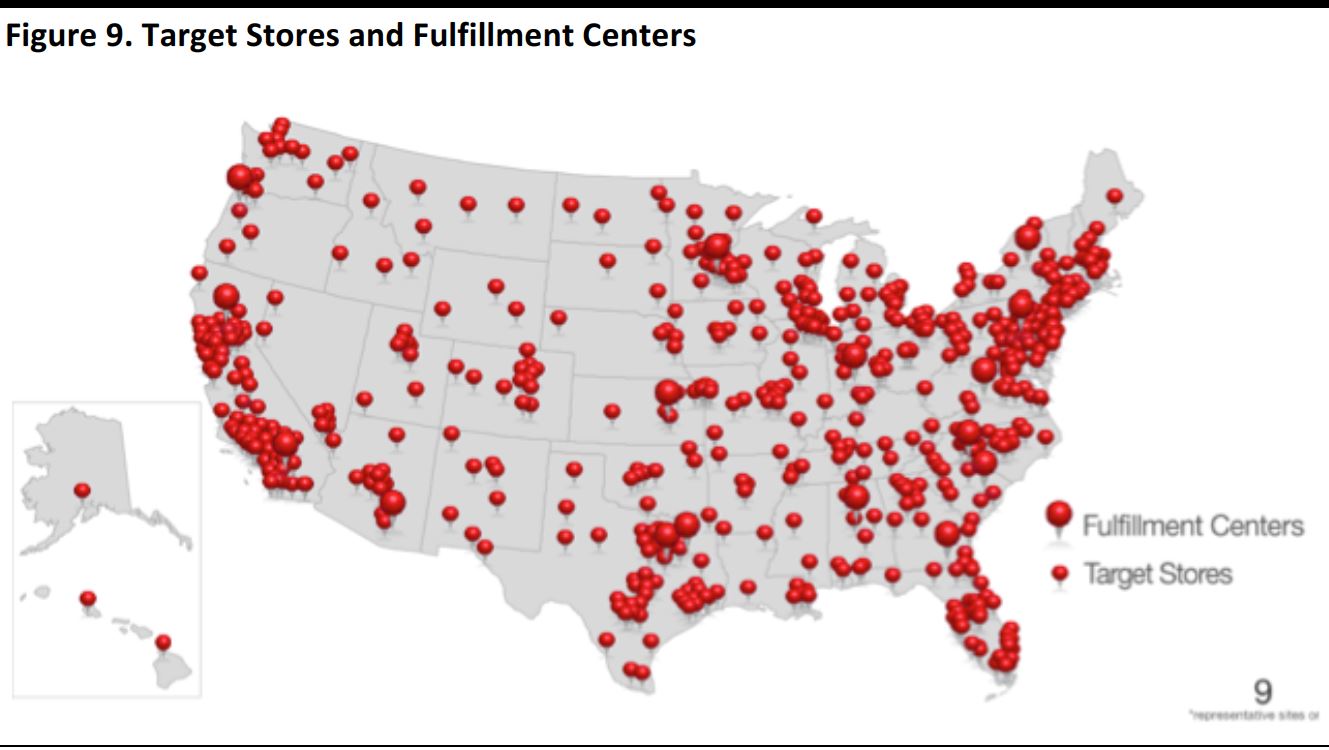

Target claims its stores are within 10minutes of every doorstep in the US, enabling rapid delivery.

Grand Junction

- Grand Junction offers a software platform that retailers, distributors and third-party logistics providers can use to manage local deliveries through a network of more than 700 carriers.

- The company offers same-day delivery in Boston, Chicago, San Francisco and Washington, DC.

- The company has expanded delivery to all five boroughs of Manhattan.

Drive Up

Target is expanding its Drive Up collection service to nearly 1,000 locations in the continental US. The service uses geofencing technology to notify the store that the customer has entered the area.

Shipt

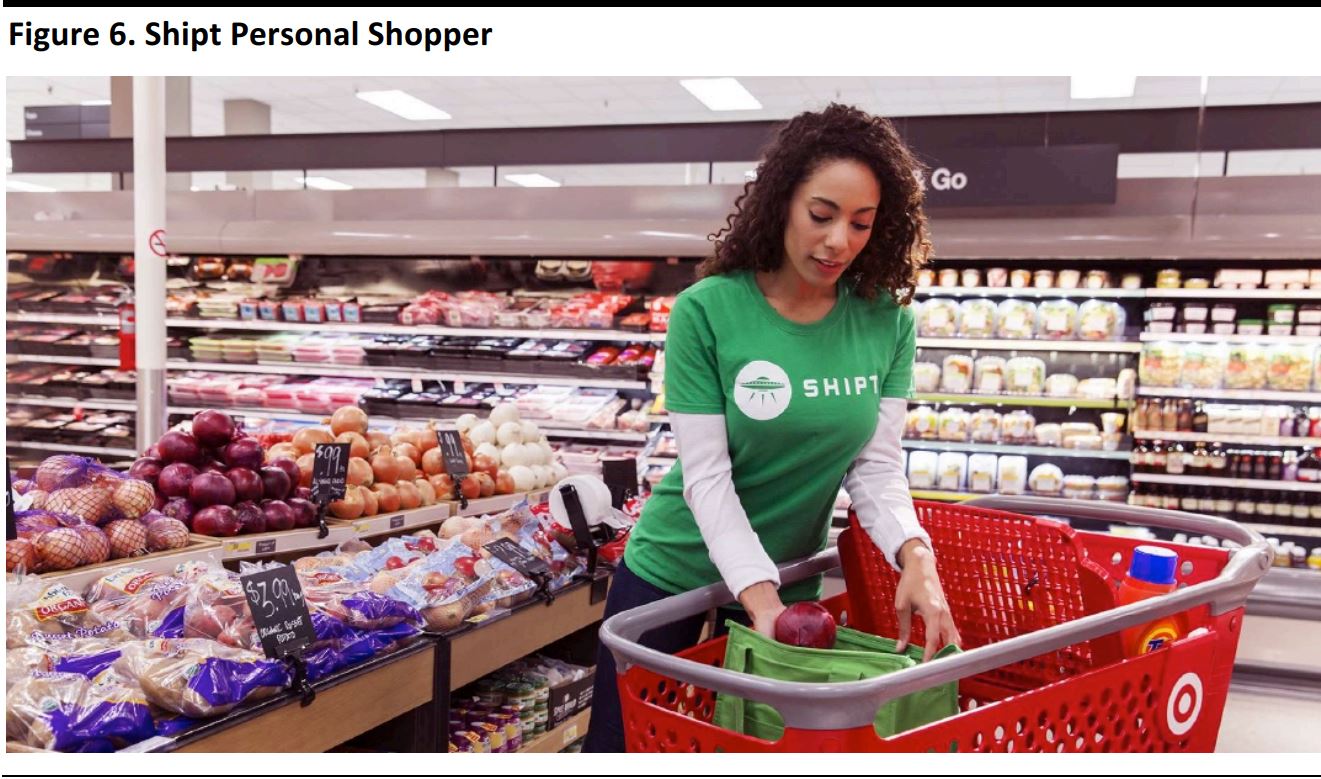

- Shipt uses personal shoppers to offer same-day delivery to customers in the Southeast and Twin Cities, with more cities to be added in April 2018.

- The platform creates a local shopping community and also serves HED, Publix, Meijer and Costco.

- Shipt offers 5,000 items across its assortment.

- Target aims to offer same-day shipping in every major market by the holidays this year.

Source: Target presentation

8. The company has completely updated its private-label brands in apparel, hinting that there are more to come this year.

In 2017, Target committed to launching 12 new brands in 18 months. Below is a selection of the new logos.

Source: Target presentation

9. Target has ambitious plans for 2018, including store remodels, new small-format stores, new brand launches, and improvement of fulfillment and management of team members.

Target has ambitious plans for 2018 in terms of stores, brands, fulfillment and staff.

Source: Target presentation

Fulfillment

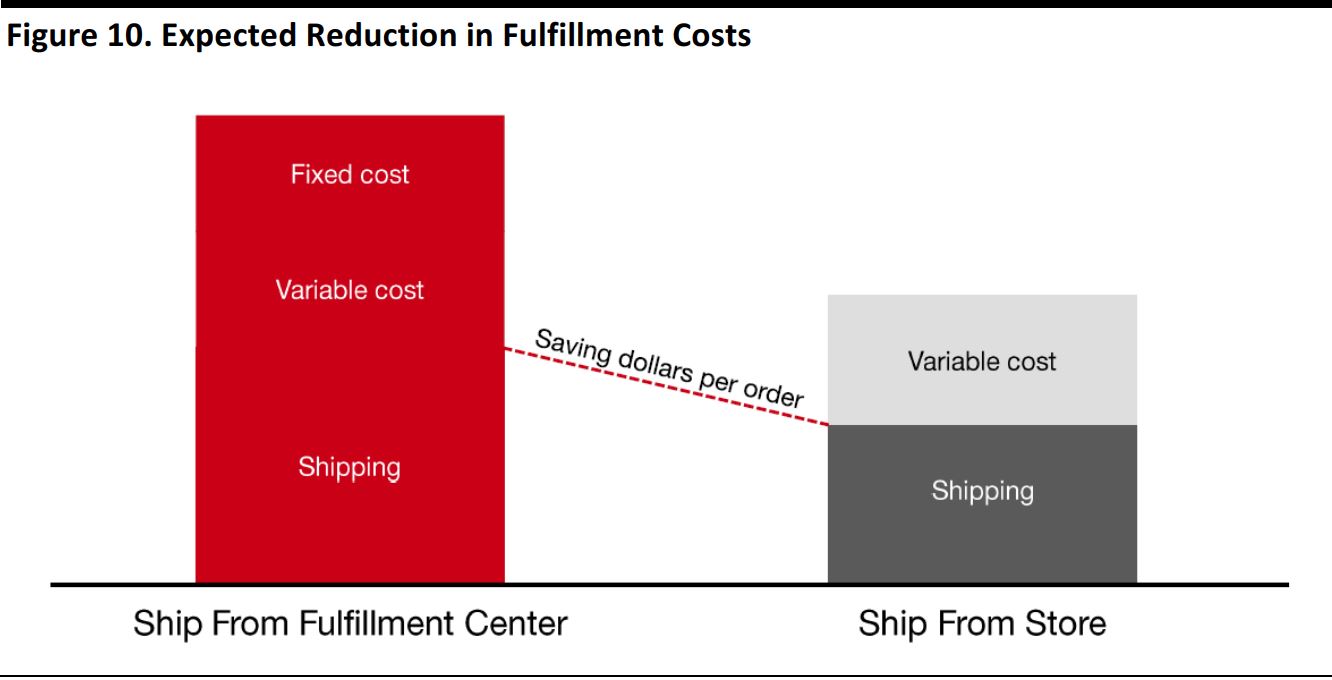

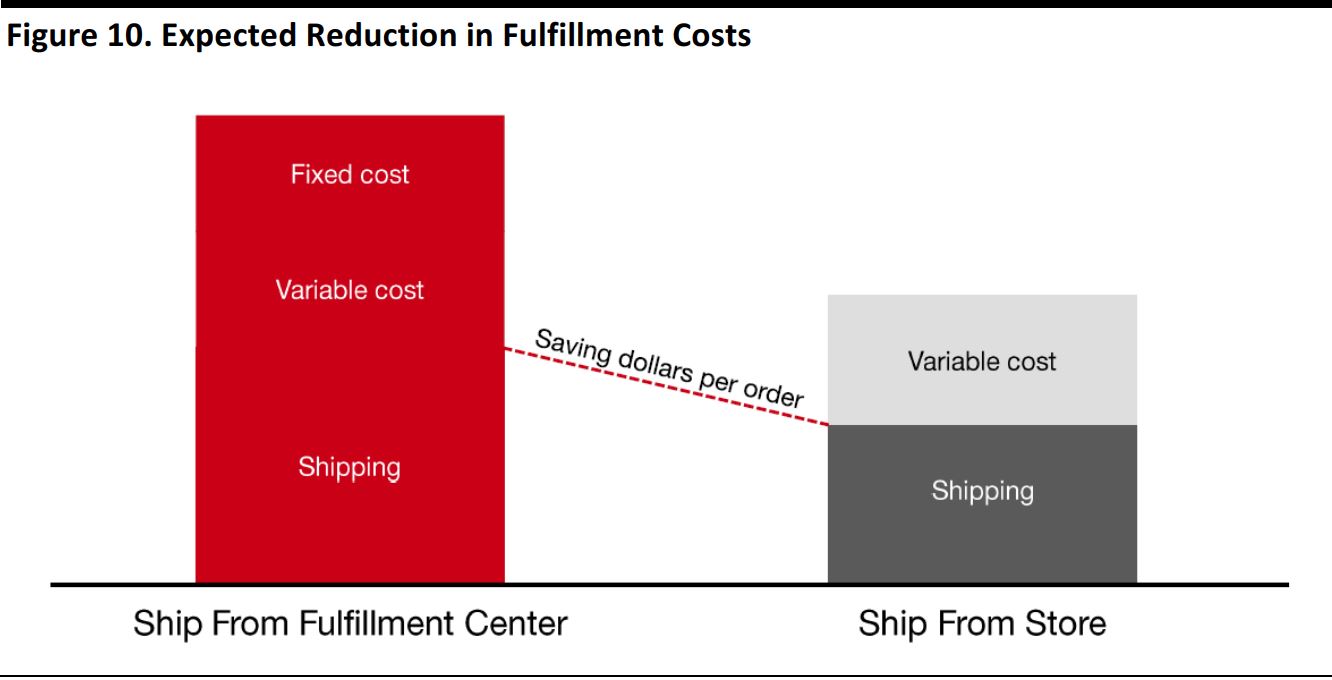

Target is committed to using its stores as shipping hubs and believes that “shipping from stores is faster and costs less.”

Source: Target presentation

Existing stores bring no additional fixed cost, and Target believes that its shipping costs are lower due to the proximity of its stores to most Americans’ homes.

Source: Target presentation

In addition, Target is engaging in supply-chain modernization, starting in the back rooms of stores. The program has enabled Target to cut backroom inventory by a third and out-of-stocks by half. Its supply-chain model expansion includes:

- An expansion in the Northeast US.

- Adding capability to more distribution centers.

- Scaling promising robotic solutions.

10. The company plans capital expenditures of $3.5 billion in 2018 to drive profitable growth and offer an outstanding return on invested capital.

To drive long-term profitable growth in 2019 and beyond, Target is investing $3.5 billion as follows:

- Tripling the number of store remodels.

- Opening 30 more small-format stores.

- Expanding digital fulfillment options.

- Shipping more orders from stores.

- Investing in its supply chain.

- Introducing more new brands.

- Balancing everyday prices and promotions.

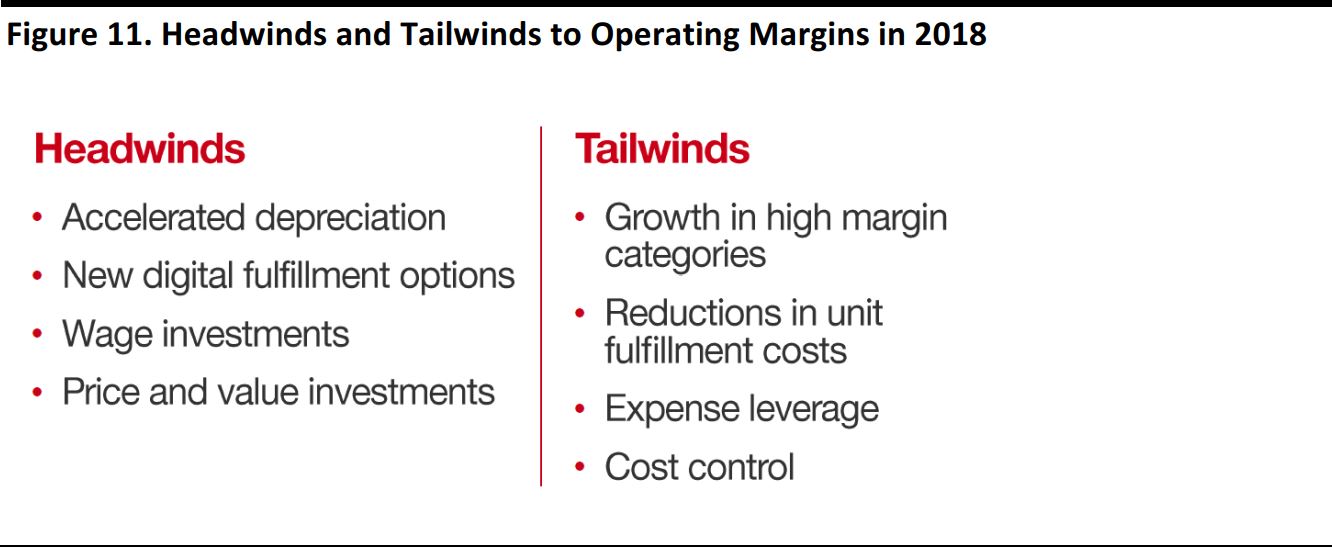

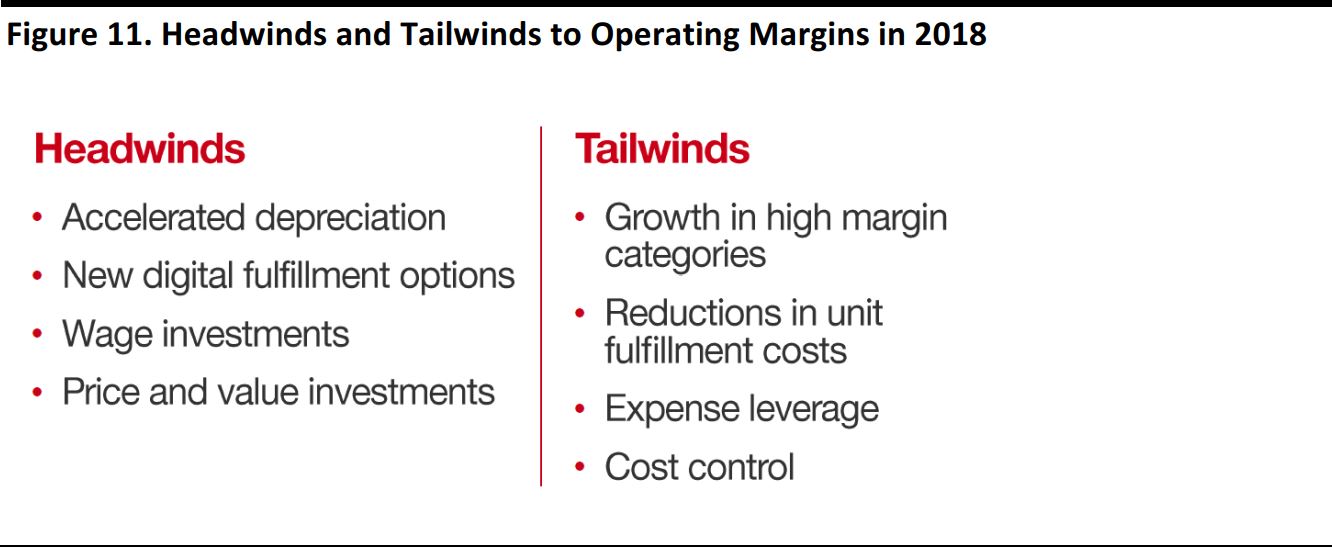

Margins in 2018 are expected to be affected by the headwinds and tailwinds listed below.

Source: Target presentation

Target’s financial guidance for 2018 is as follows:

- Low-single-digit comps.

- A 20-basis-point decrease in operating margin.

- Interest expense reduction of $60 million.

- GAAP and adjusted EPS of $5.15–$5.45.

For the first quarter, Target expects:

- Low-single-digit comps.

- A moderate increase in gross margin that will be offset by higher SG&A expense, leading to a decrease of 60–80 basis points in operating margin.

- GAAP and adjusted EPS of $1.25–$1.45.

Target achieved a 14% after-tax return on invested capital in 2017, and the company expects to achieve at least that return in 2018, although margins are expected to be a bit lower.