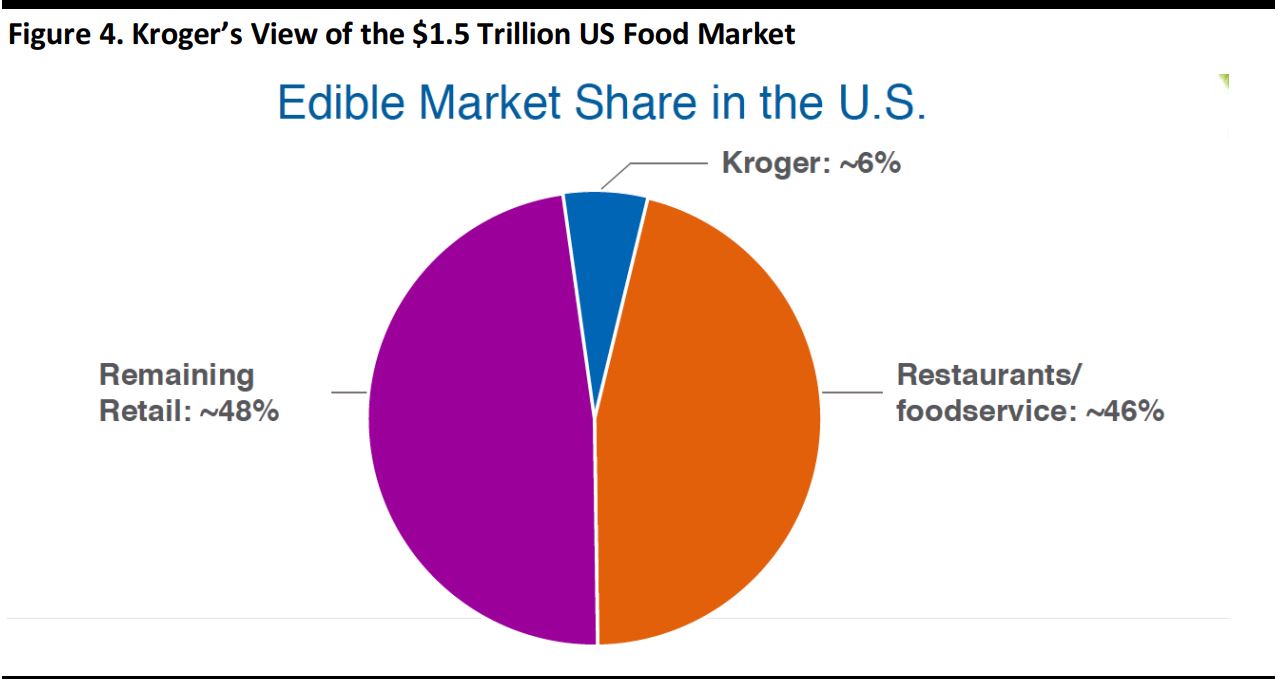

Summary

The FGRT team attended Kroger’s 2017 Investment Conference, held at the New York Stock Exchange on Wednesday, October 11.

Source: Kroger

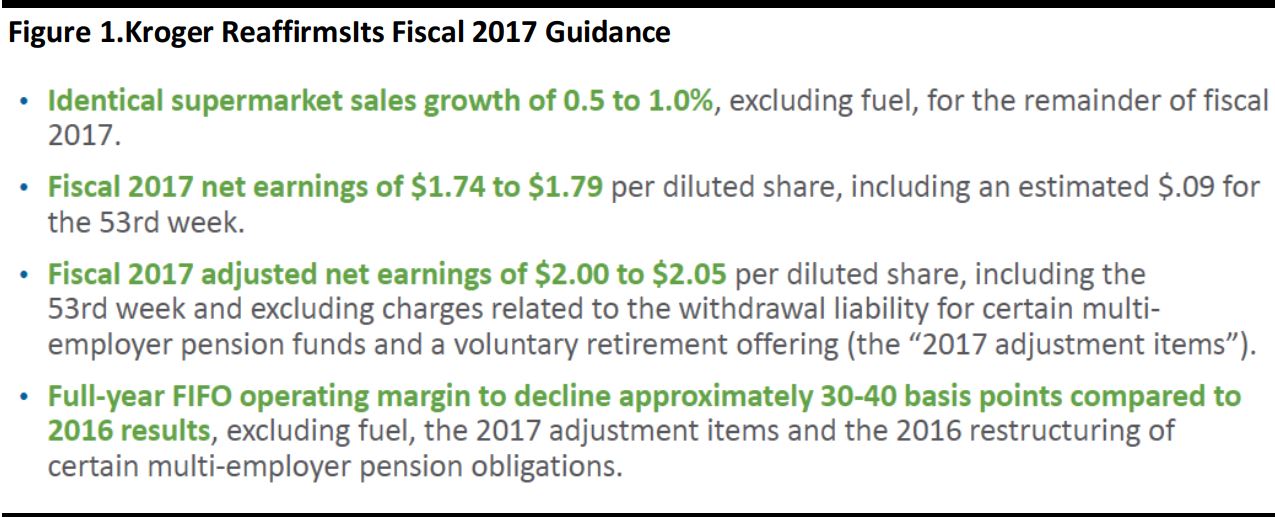

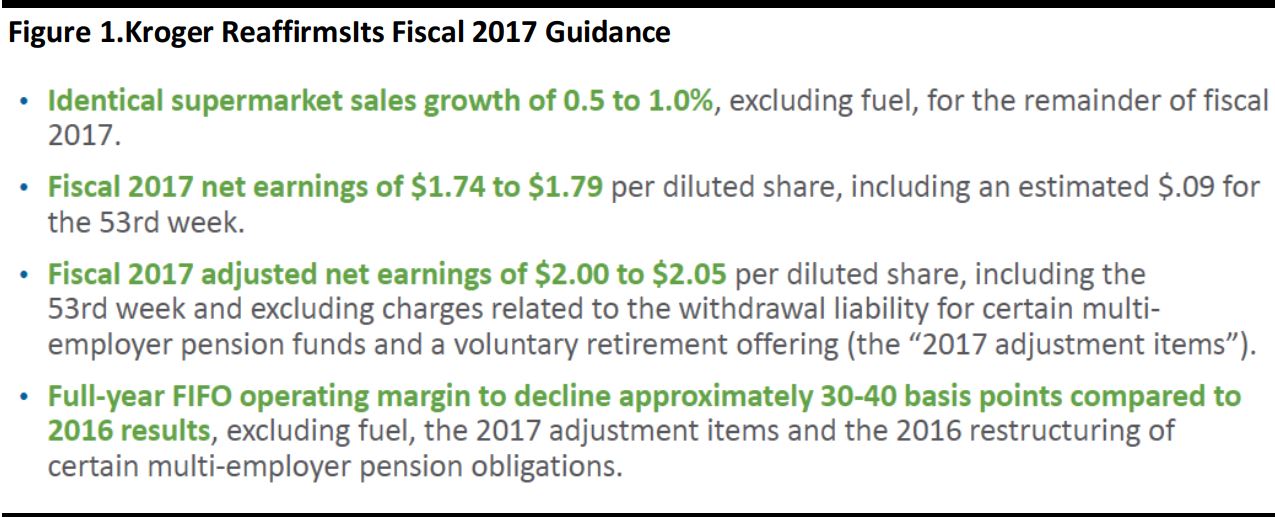

1) Kroger Reiterated Its Fiscal 2017 Guidance Despite the Summer Weather Disasters and Offered a Preliminary Look at Fiscal 2018

The company issued a press release reaffirming its guidance at the outset of the meeting—the company’s expectations were not affected by the summer weather disasters. Management also offered a rough look at fiscal 2018 guidance, which includes the following expectations:

- Fiscal 2018 EPS will be flat to slightly higher than the $1.74–$1.79 EPS that the company expects for fiscal 2017.

- Management sees no reason for EPS to be below $1.80 in fiscal 2018.

- Full-year 2018 same-store sales are expected to be higher than in the previous year.

- Capital expenditures are expected to be $3 billion.

2) The Company Is Seeking Strategic Alternatives for Its Convenience-Store Business

In the above mentioned press release, Kroger also announced that it intends to explore strategic alternatives for its convenience-store business in order to realize the maximum value of the business for shareholders. The business includes 784 convenience stores located in 18 states, as well as 68 franchise operations. The stores employ 11,000 associates and operate under the following banners: Turkey Hill Minit Market, Loaf ’N Jug, KwikShop, Tom Thumb and QuikStop. Neither supermarket fuel centers nor Turkey Hill Dairy will be included in this review. The business generated revenue of $1.4 billion and sold 1.2 billion gallons of fuel in 2016, and it has delivered 62 consecutive quarters of positive comps.

Source: Kroger

3) Management Announced a Four-Part Plan for Creating Shareholder Value Whose Name, Restock Kroger, Is a Play on Words

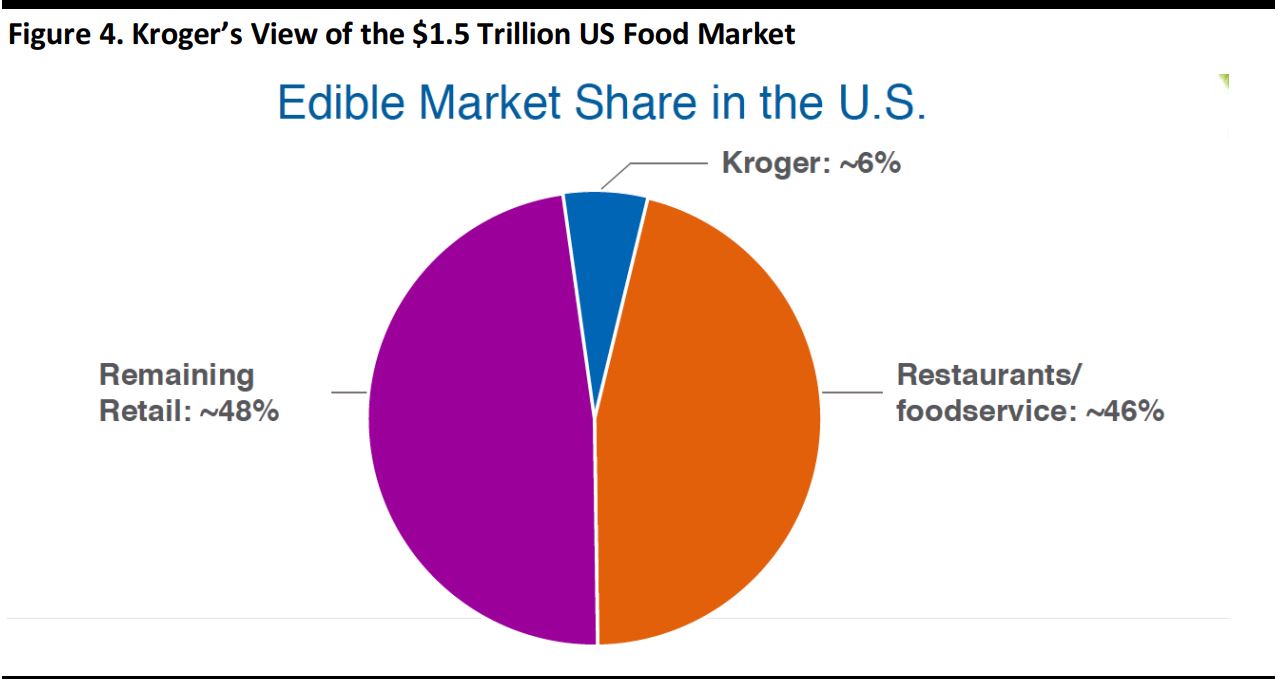

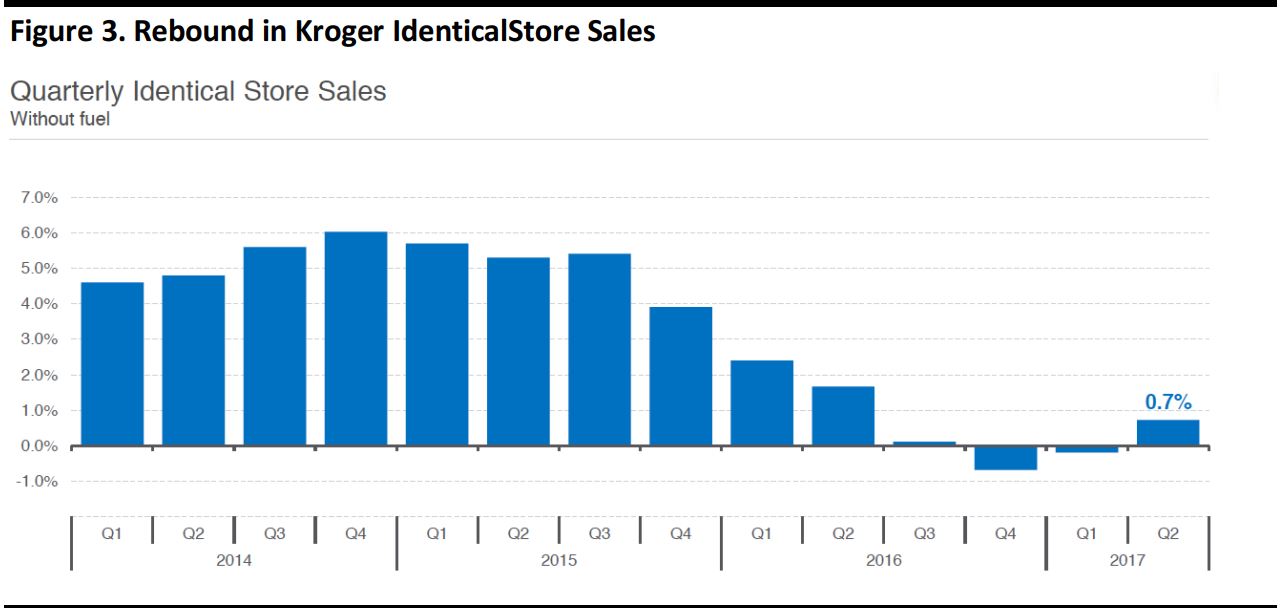

Management introduced a four-part plan called Restock Kroger that is based on redefining the grocery customer experience, partnering for customer value, developing talent and living its corporate values.The main thrust of the plan is to define the grocery experience using data and personalization, space optimization, brands, and smart pricing.

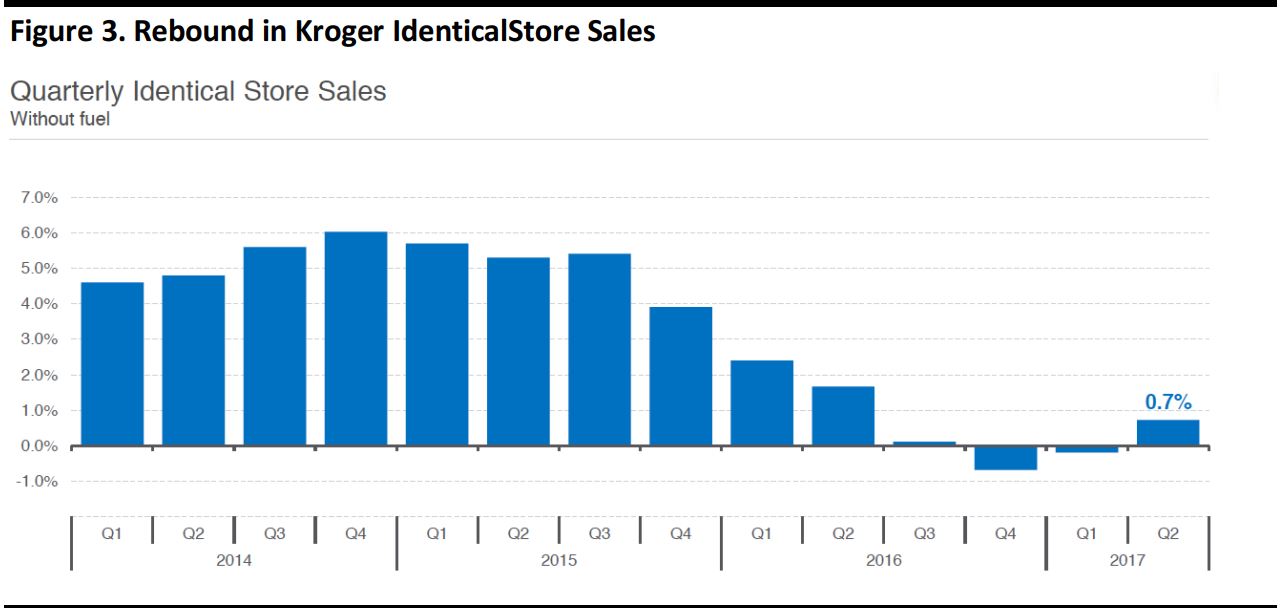

Management kicked off its remarks with the graph below, which shows a rebound in Kroger’s identical store sales. Management maintains that the company continued to gain share in dollar terms during three quarters of negative comps.

Source: Kroger

Source: Kroger

In the second quarter of 2017, spending per household increased by 1.8% overall and spending per loyal household increased by 3.6%. Spending per item increased by 1.1% in the quarter: an increase of 1.5% in product mix offset a 0.6% decrease in active retail, indicating that customers moved upmarket in terms of their purchases. Growth categories are illustrated in the graphic below.

Source: Kroger

4) Kroger Uses Data and Science to Develop a Personalized Experience for Each of Its Customers

Management commented that shopping is complicated, yet “personal” is the only one of the P’s that really matters (the traditional four P’s are price, product, place and promotion). Kroger uses data and science to cater to its customers’ core needs and create personalized experiences that drive loyalty.

The company also uses data to determine the product selection that serves all of its customers best and leads to personalized discovery, as shown in the graphic below.

Source: Kroger

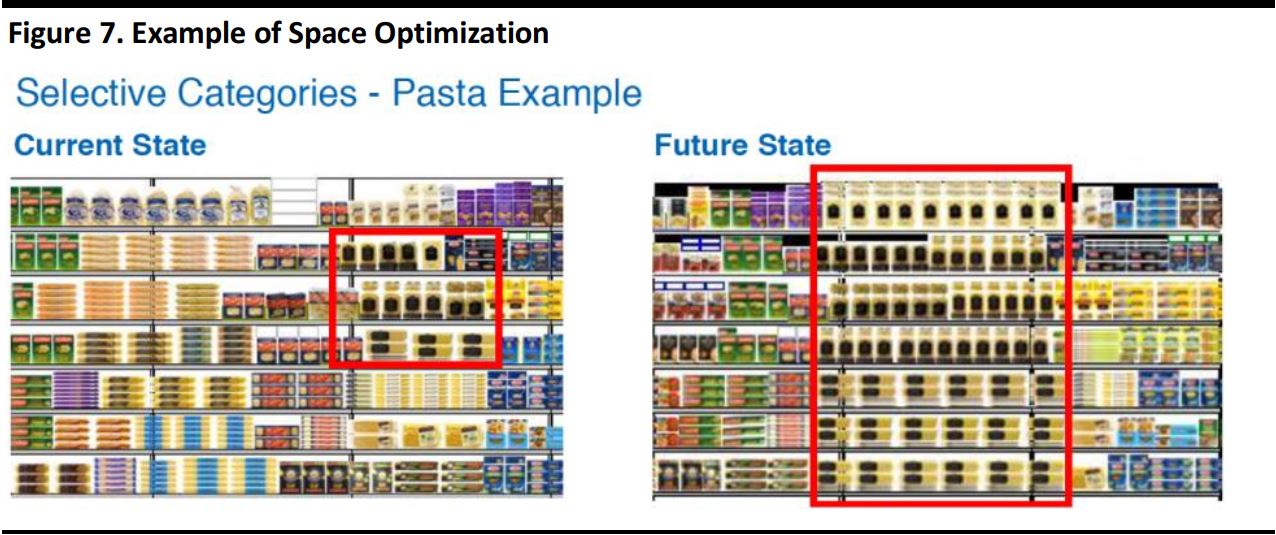

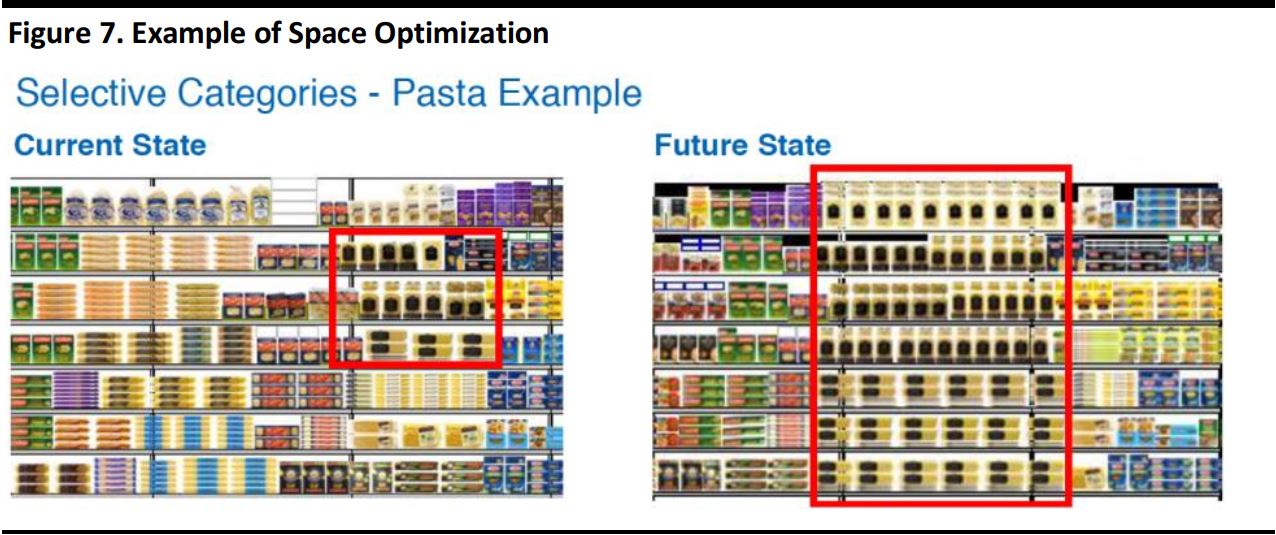

5) The Company Will Use Its Massive Data Analysis Capabilities to Optimize the Shelf and Floor Space in Every Store as Part of a Space Optimization Plan

Management announced that Kroger would begin using its data analysis capabilities to optimize the space in 20%–30% of its stores in fiscal 2018 and beyond, which could cause some minor headwinds to profitability. Kroger will allocate shelf space based on what its customers want, rather than based on pure profitability, as was the strategy previously.

Source: Kroger

6) Kroger Plans to Generate More Revenue from Its Private-Label Brands

Kroger’s private-label brands would rank #140 on the Fortune 500 list if they were a stand-alone company. In a brand equity study, Kroger’s private-label brands took two of the top three spots, as well as the seventh and eighth spots.

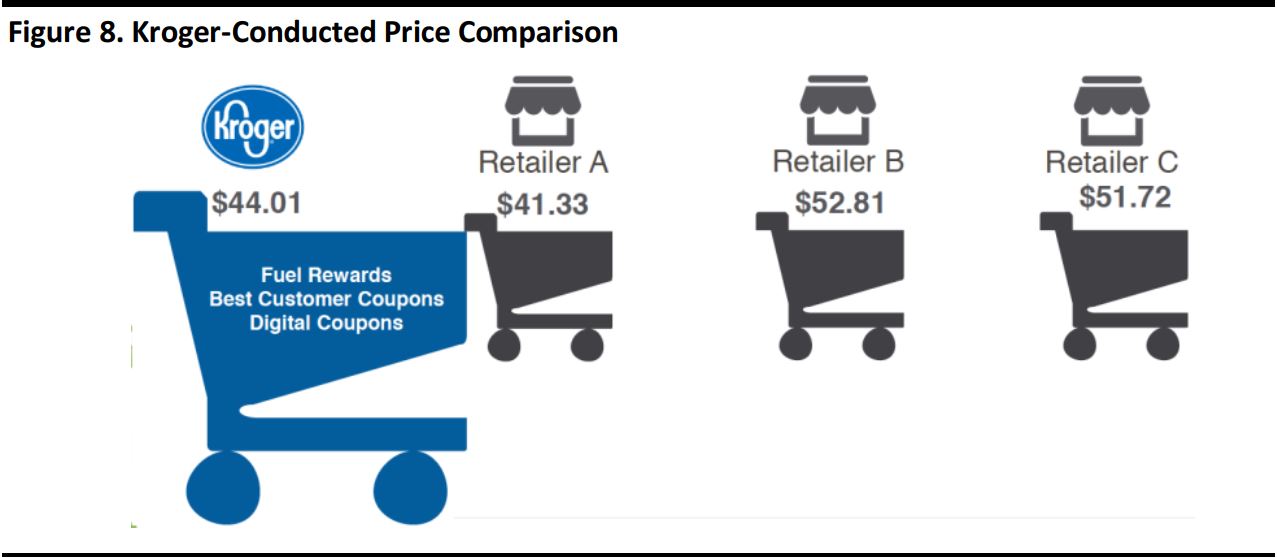

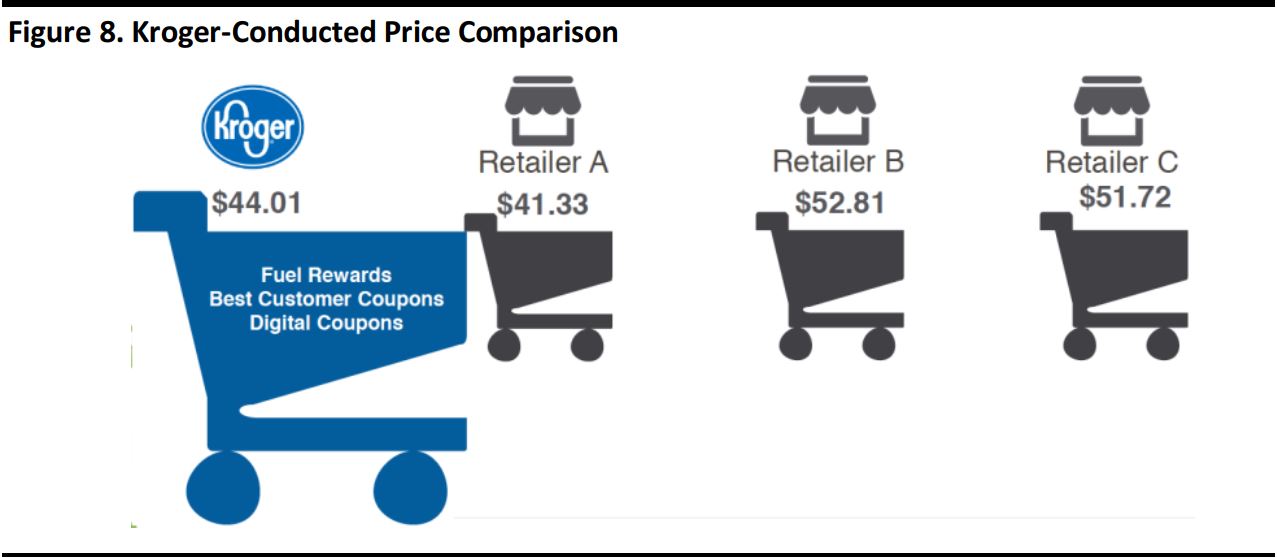

Kroger has invested $4 billion in lower prices and has resolved not to lose a customer because a price ranked second lowest in a price comparison performed by the company.

Source: Kroger

7) The Company Is Living Its Corporate Values in Terms of Reducing Waste and Hunger

Kroger management mentioned the company’s goals of achieving zero company waste by 2020 and zero food waste by 2025 as well as its efforts in hunger relief.

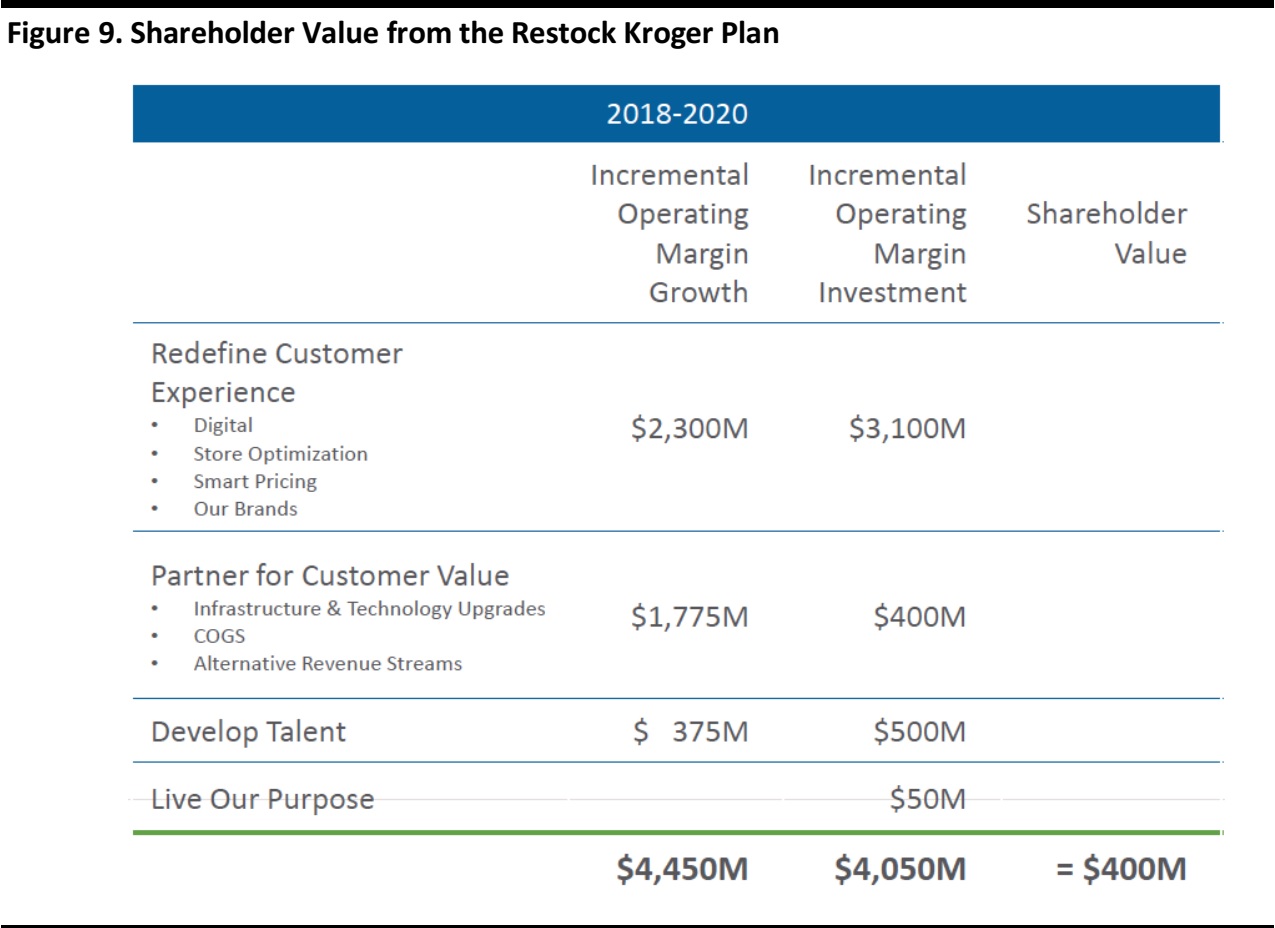

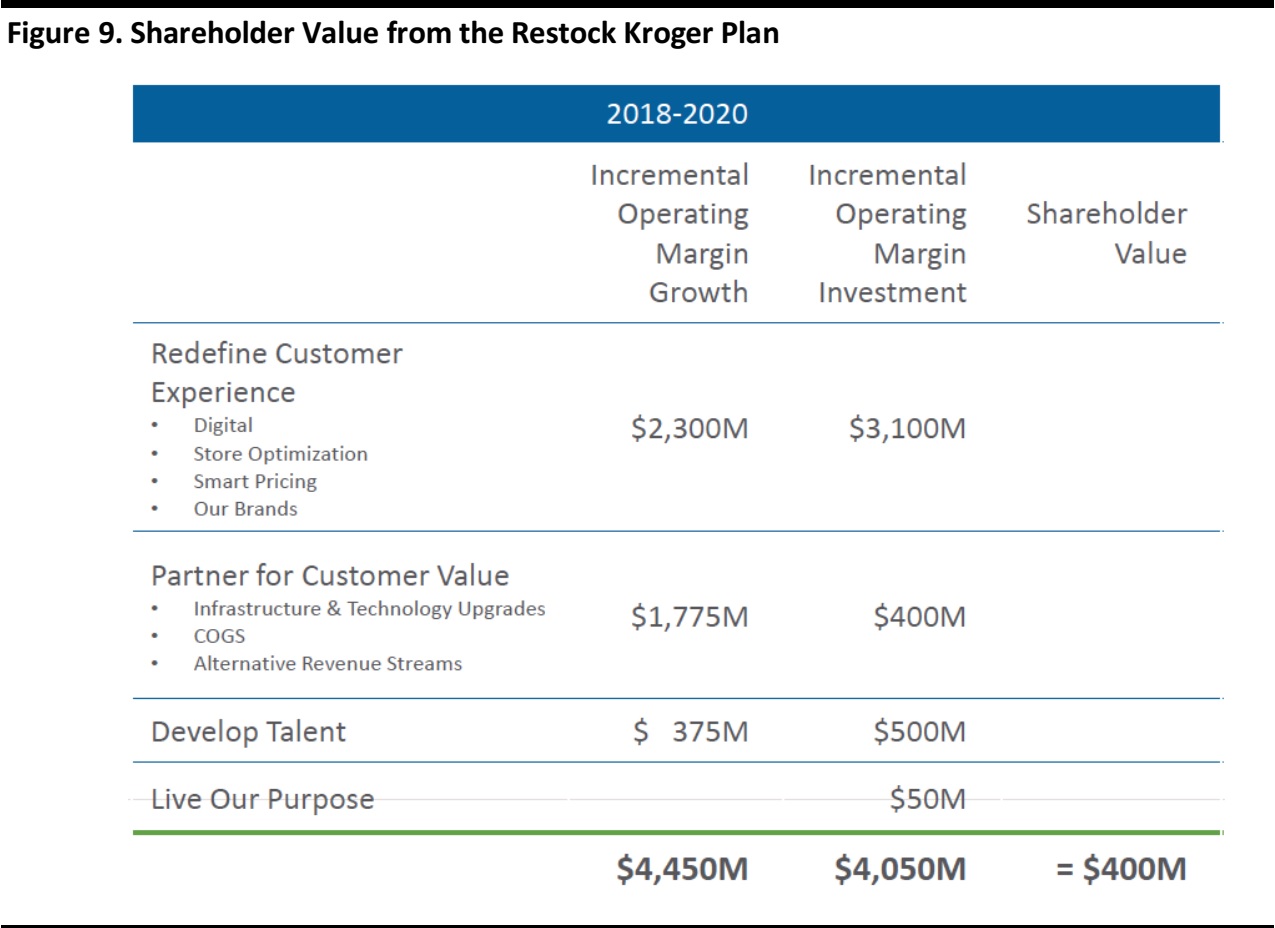

8) The Restock Kroger Plan Aims to Generate an Incremental $400 Million of Cash over Three Years that Could Be Returned to Shareholders

Management said that higher profits from partnering for customer value should more than offset net investments to improve the customer experience, develop talent and make donations to corporate causes, generating $400 million over a three-year period.This could increase EPS by about $0.27 over the period (based on $15 million of pretax savings representing $0.01 per share of EPS).

Source: Kroger