About Alibaba 2017 Investor Day

Fung Global Retail & Technology attended Alibaba’s 2017 Investor Day at its headquarters in Hangzhou on June 8–9. Day 2 of the Investor Day focused on the following:

- Executive Chairman Jack Ma expressed his long-term vision for Alibaba and the two major opportunities for the group: globalization and China’s consumption upgrade.

- Executive Vice Chairman Joe Tsai talked about post-M&A integration, value creation and interest alignment through minority investment as key to the group’s investment strategy.

- President of AliCloud Simon Hu gave an overview of the great strides that AliCloud has made since the decision to invest eight years ago. He believes AliCloud will be able to maintain rapid revenue growth through its domestic dominance and overseas expansion.

- Senior leaders of Ant Financial, Cainiao Network and Alibaba Digital Media & Entertainment Group shared their vision of how the business can leverage data to create value for customers and merchants globally.

Chairman’s Speech: “Born in China, Grow for the World”

Executive Chairman Jack Ma expressed his vision for Alibaba and the two major opportunities—globalization and China’s consumption upgrade—that he has been witnessing. He wants to focus not merely on the next quarter, rather on his long-term vision for the group—to become a truly global company providing solutions to world problems. He believes Alibaba can help globalization by making trade more inclusive, and e-commerce is the best way to solve that.

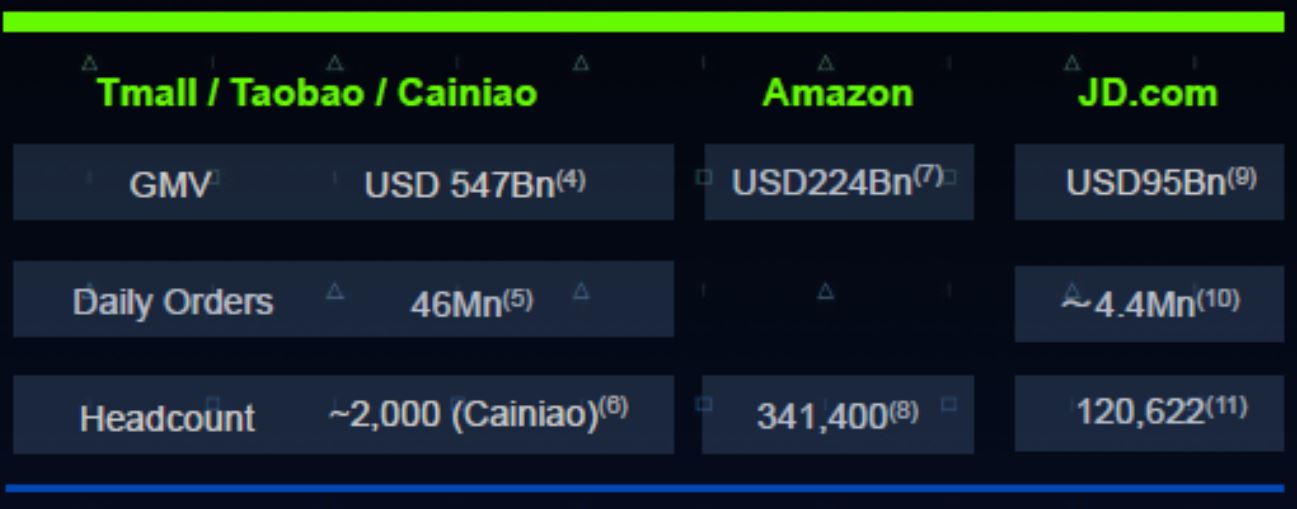

Ma expects Alibaba’s gross merchandise volume (GMV) to reach US$1 trillion by 2019, serve 2 billion customers—one-third of the world’s total population—by 2036, and support 10 million profitable businesses on its platform economy.

Source: Fung Global Retail & Technology

Opportunity 1: Making Globalization More Inclusive

Ma expects the new global economy to be based on the Internet. With e-commerce the best solution, he views globalization as a huge opportunity for Alibaba and expects its cross-border e-commerce platforms—Lazada and AliExpress—to grow rapidly. At Davos, China’s President Xi Jinping said China will import US$8 trillion in the next five years.

Alibaba is building a global network to leverage the network effect. By making the network available for all companies to join, Alibaba is making global trade more inclusive and leveling the playing field between large and small companies.

The eWTP (Electronic World Trade Platform) is a concept to create digital free-trade zones where small and medium-sized enterprises (SME) can tap into global trade via e-commerce. Malaysia was the first country to join in March 2017, and Alibaba is inviting more countries to join.

Opportunity 2: China’s Consumption Upgrade

Ma believes Alibaba is well positioned to benefit from the structural trends in China: 1) a growing middle class; and 2) the country’s shift from an investment- and export-led economy to one that is driven by domestic consumption. First, there are over 300 million middle-class consumers in China today, and this number is expected to increase to 500 million in the next five years. Second, he believes e-commerce will play a major role in China’s consumption upgrade, which is expected to drive import growth.

The Five “New”

Ma discussed the concept of the five “New,”which he believes will drive the Chinese economy in the future. See our report on the topic:

Deep Dive: New Retail―The Key To Unlocking Pent-Up Chinese Consumer Demand

- New Retail— refers to retailers’ shift from selling products to servicing consumers. See Deep Dive: Intime Retail—The Roadmap to New Retail with Alibaba

- New Manufacturing— refers to using cloud computing and IoT to solve China’s manufacturing upgrade

- New Financing— refers to the company’s vision to make financing more inclusive. Ma stated that instead of serving 20% of the companies (i.e., the largest ones) and making 80% of the profits like other big financial institutions, Alibaba will focus on serving the remaining 80% of the companies which have been underserved.

- New Technology— refers to solving customers’ problems with technology

- New Energy— refers to the use of data to fuel the future economy

Investments, Acquisitions and Capital Allocation

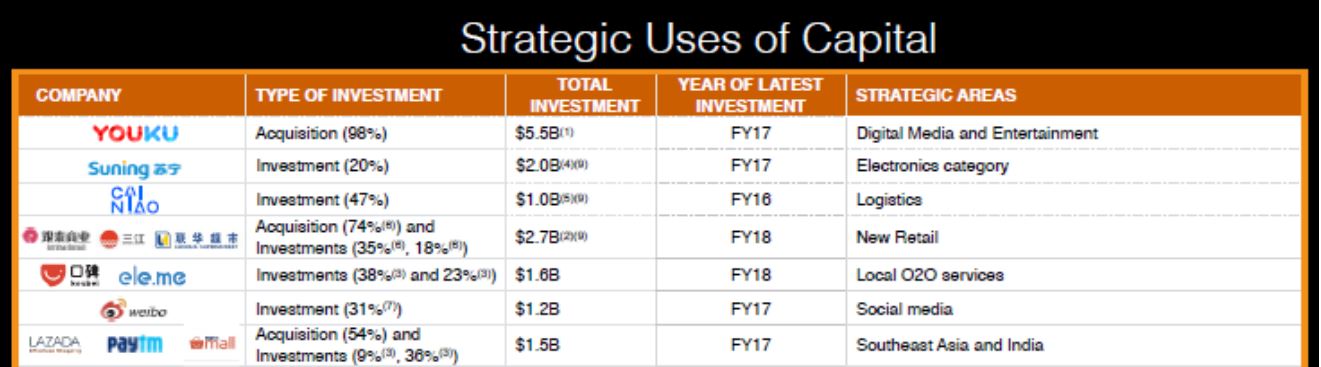

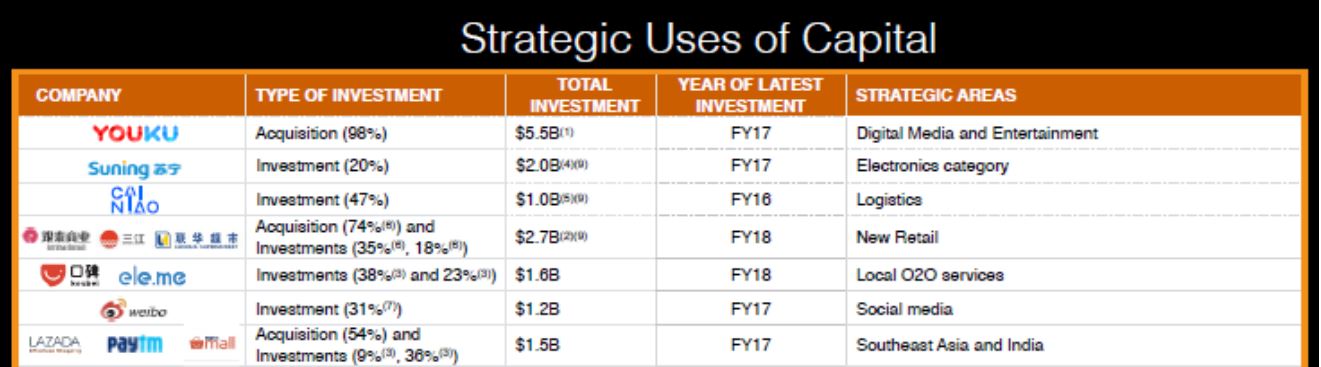

Executive Vice Chairman Joe Tsai started his presentation by reiterating the investment philosophy of Alibaba, which is to build long-term strategic value and drive synergies for the business.

- Integration is key to strategic M&A

- Prefer minority investments over controlling-stake acquisitions

Source: Fung Global Retail & Technology

Integration Is Key to Strategic M&A

He also emphasized the importance of planning for the eventual integration into the group, as investment outcomes are likely to be binary. Success or failure will depend mostly on people and innovation as they drive value creation. He gave the example of the group’s acquisition of UC Web in 2014. Yu Yongfu, the current Chairman of Alibaba Digital Media & Entertainment Group, came with the acquisition and was responsible for helping Alibaba integrate UC Web into the group.

Source: Company data

Prefer Minority Investments

Tsai also mentioned that Alibaba prefers to make minority investments over full acquisitions for three key reasons:

- Minority investments align the interests of the management team and assists in talent retention

- Alibaba is able to generate strategic synergies through equity relationships

- Alibaba can minimize capital or integration risk through a phased-in approach

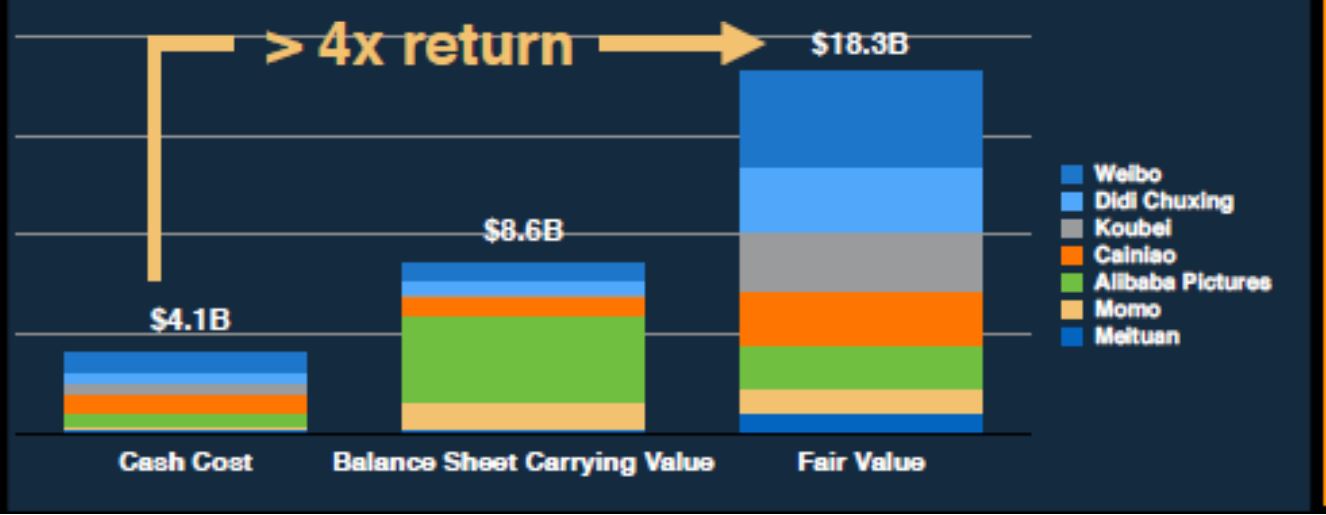

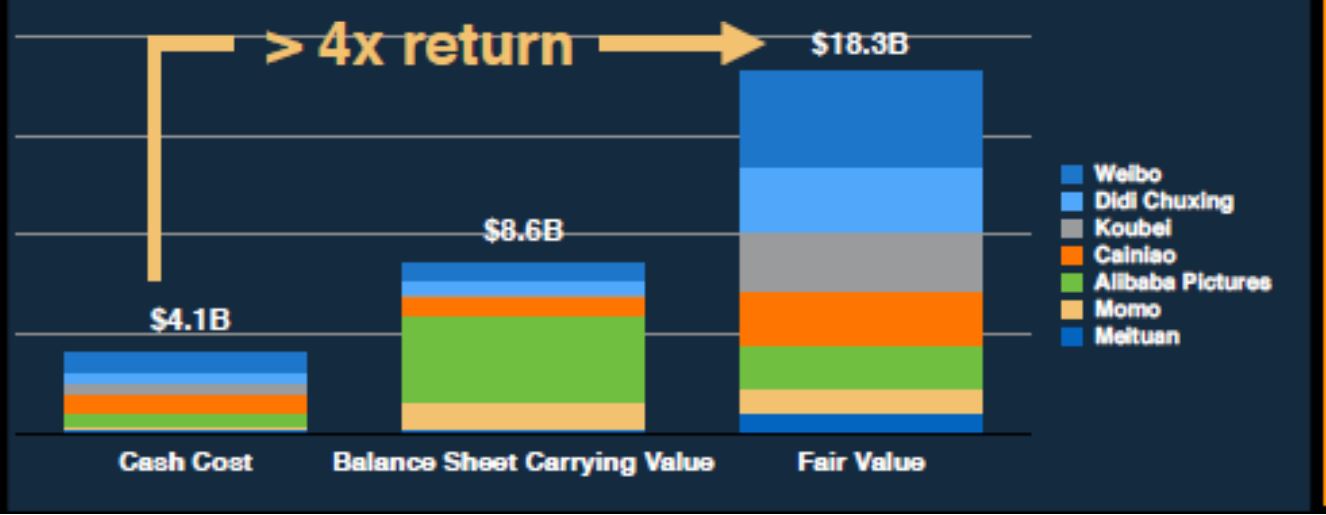

Tsai wrapped up his presentation by reviewing the group’s strategic investment track record and the value that has been created as a result. Strategic investments that have been made over the past two years totaled US$21billion. The large minority investments have yielded over a fourfold return.

Source: Company data

Source: Company data

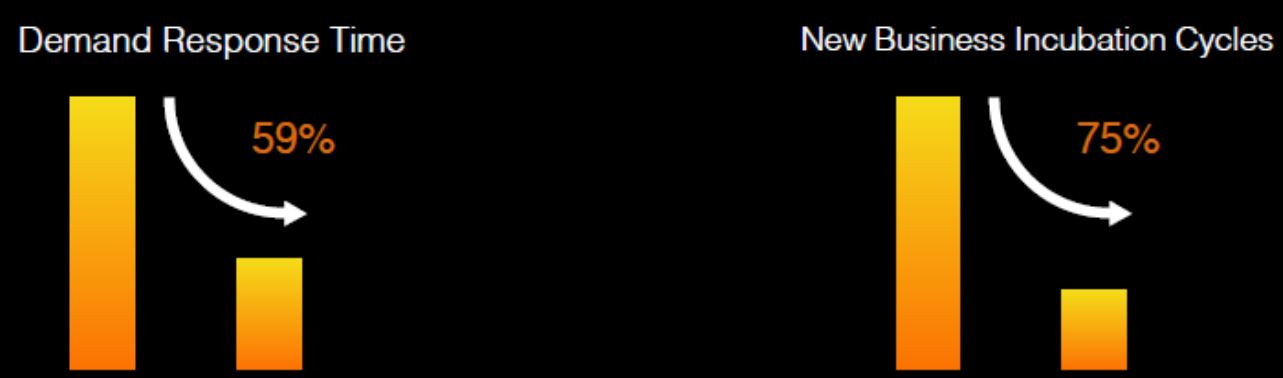

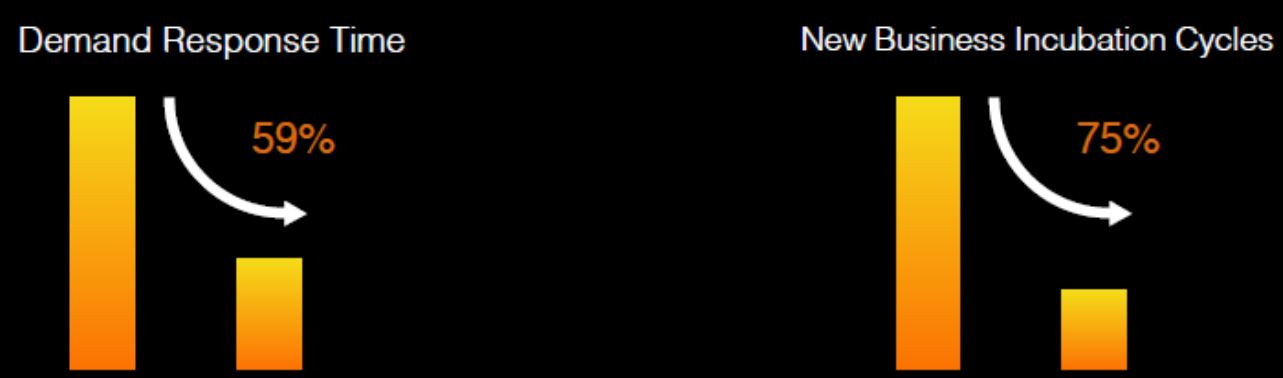

Technology – Infrastructure, AI and More

The core message of Alibaba CTO Jeff Zhang was that technology has been fundamental in driving growth in the Alibaba economy, and will continue to be the way forward. He stated that Alibaba’s technology prowess is manifest in the record-setting Singles’ Day, in which 175,000 transactions were handled every second at peak, and 657 million delivery orders were processed. The stable and efficient performance has accelerated business innovation. He used the business integration of the investment in Lazada as an example of using technology to innovate. Alibaba was able to rebuild Lazada’s seller platform and list over 10 million Taobao products on Lazada within three months.

Source:Company data

Zhang provided several examples of how Alibaba made technology available for merchants to enable them to do business.

- Personalization: Alibaba made ‘personalized’ technology available on its platforms, enabling merchants to target 507 million mobile MAUs through personalized recommendations and marketing.

- Big data: Alibaba runs 30 billion protective scans each day and uses biometric identification on users for risk management and security.

- AI-powered customer service: The “Store Concierge” chatbot is used by 100,000 merchants to handle millions of customer enquiries.

To prepare for the future, Alibaba has been focusing efforts on R&D in the following fields: deep learning, speech technology, voice-controlled intelligent platform, image and video technology, IoT cloud-based integration services and new retail infrastructure.

AliCloud—Strategies for Growth

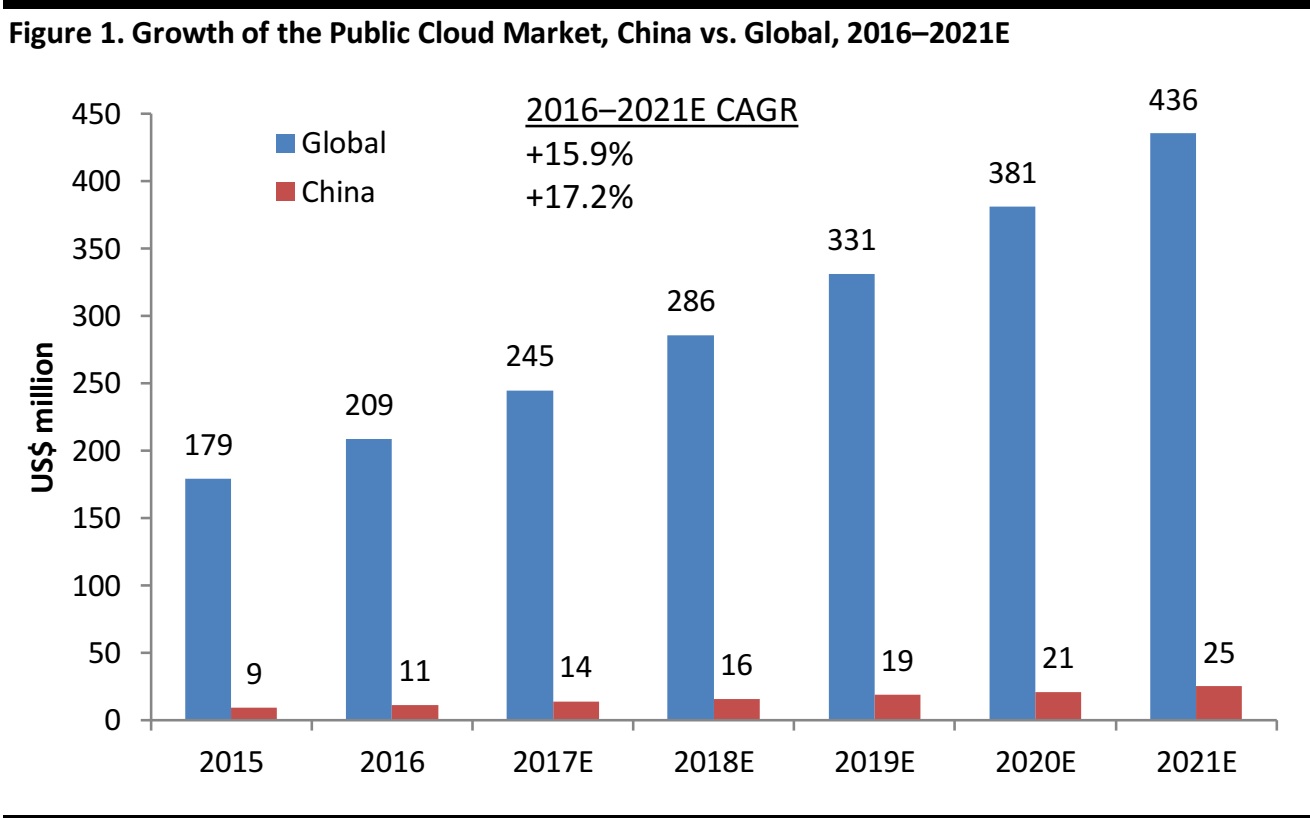

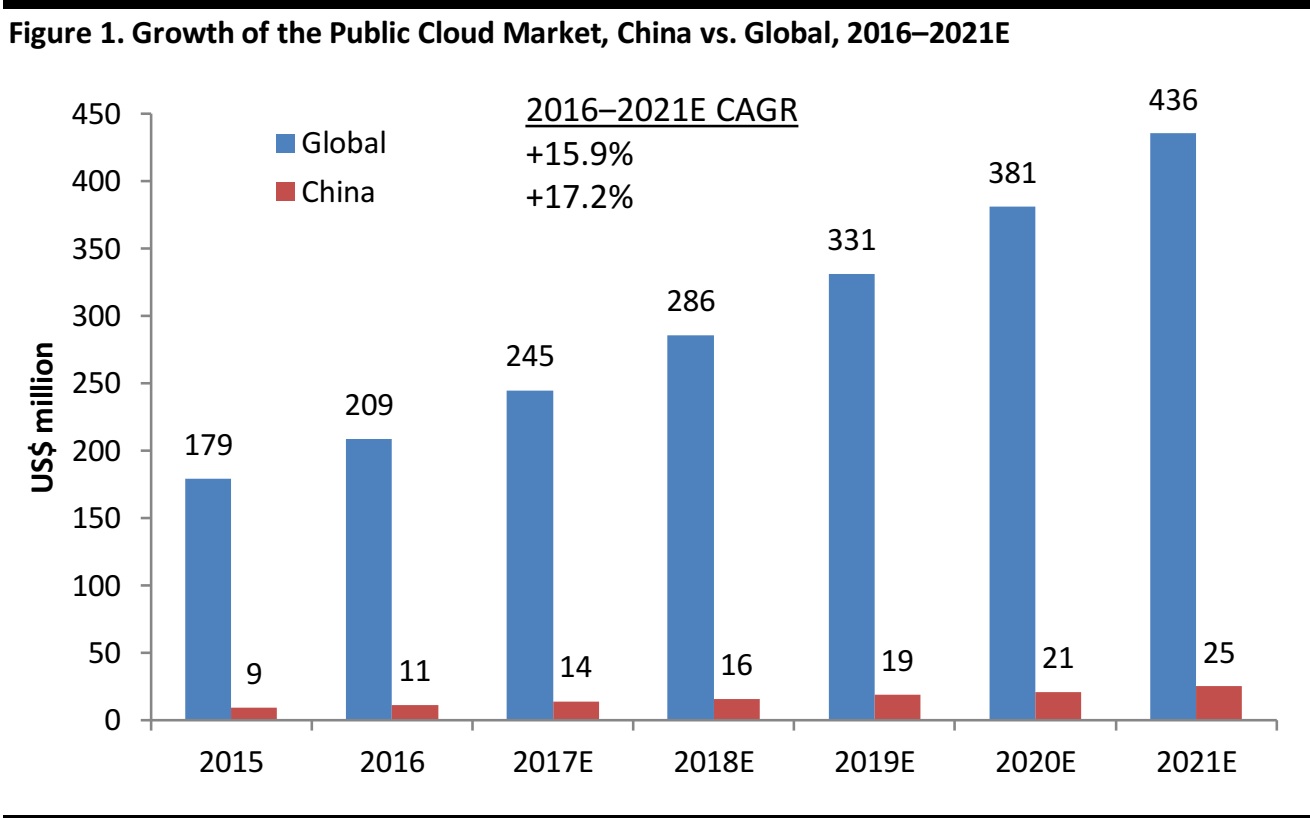

President of AliCloud Simon Hu shared his vision for AliCloud and the impressive strides that the business has made since Alibaba’s decision to invest eight years ago. Between fiscal year 2015 and 2017, AliCloud revenue increased at a two-year compounded annual growth rate (CAGR)of 115% to US$0.97 billion. He expects AliCloud, the leading cloud service provide in China,to continue its fast growth over the next 5–10 years as it expands globally.

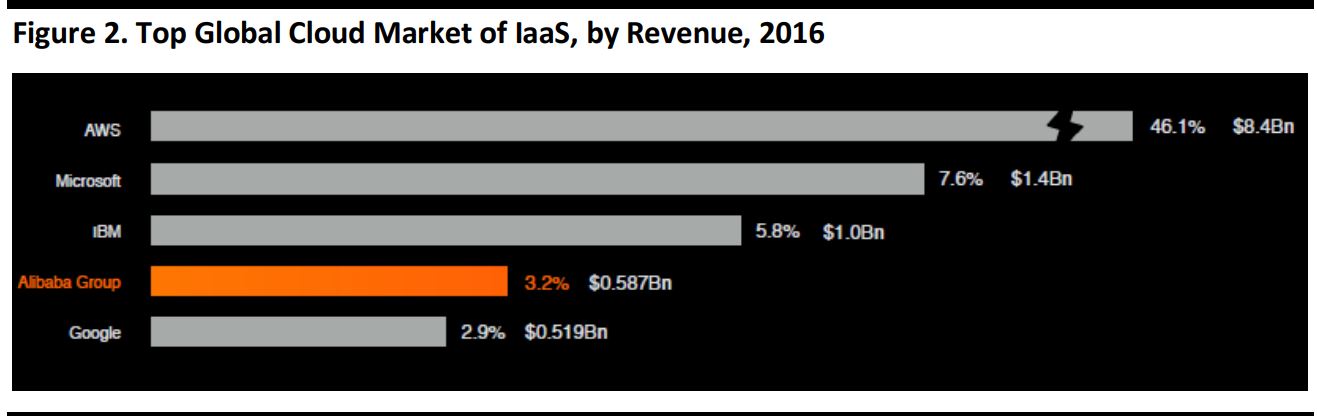

Source: Gartner

AliCloud—The Fastest-Growing Cloud Service Provider Globally

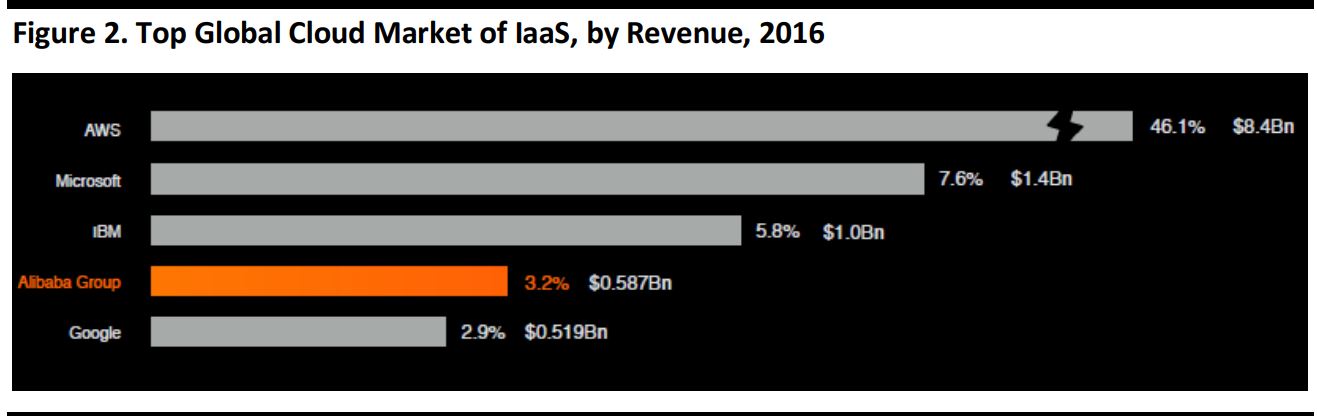

Hu believes AliCloud is well positioned to maintain its market-leading position in China, and amass further market share growth globally. AliCloudis currently the largest player in China’s IaaS market, with a 40.7% market share, equivalent to the aggregate market share of the next seven players. China’s public cloud market is expected to increase at a CAGR of 17.2% between 2016 and 2021, outpacing the 15.9% forecast for the global market, according to Gartner.

AliCloud has 15 data centers around the world, as of May 2017, and has 874,000 paying customers.

Source: Company data/IDC Tracker 2016H1/H2 Global Cloud Market of IaaS

As industries move to data technology from information technology, AliCloud aims to help enterprises use the data to deal with their challenges and create value. The four key areas include: business transformation, operation optimization, employee empowerment and user experience improvement. These enterprises span various industries, such as e-commerce, finance, manufacturing, retail, energy, multimedia, healthcare and agriculture.

Hu also talked about the competitive advantages of AliCloud, namely:

- Having data centers around the world

- Cloud offerings with the best value-for-money

- Heterogeneous computing which is able to use sources such as voice and graphics

- AI which connects data analysis with strategic decisions

- IoT which helps city planners and enterprises upgrade their business operations

- Cloud security—none of the users on AliCloud was affected by Wanna Cryas they had received a warning 28 days in advance, and the problem was fixed within nine hours

Hu introduced three of AliCloud’s applications. See

Takeaways from the Alibaba Computing Conference 2017 Part 2

- ET City Brain utilizes AliCloud’s AI technology and big data analytics capabilities to optimize city services and provide traffic predictions in real-time. In May 2017, AliCloud participated and broke the world record on machine learning on platform KITTI with an accuracy rate of 90.46% in vehicle detection. The goal is to use AI to make traffic smoother in Hangzhou and other cities.

- ET Industrial Brain uses AI technology to help industrial companies with centralized data management and real-time production monitoring to analyze and find solutions to weaknesses in the production process.AliCloud is cooperating with a number of enterprises including Xuzhou Construction Machinery Group (XCMG)

- ET Medical Brain is an AI-powered solution that aims to improve medical diagnosis and healthcare administration. AliCloud is cooperating with Zhejiang University to increase the accuracy of Thyroid Nodular Diagnosis. Using AI to assist diagnosis increases accuracy to 85% from doctors’ 60%–70%.

Hu described the profile of AliCloud’s customers—over one-third of China’s top 500 customers and about two-thirds of Chinese unicorn companies are its clients. He gave case studies of huge enterprises leveraging AliCloud to increase efficiency, such as China Unicom, the State Administration of Taxation, GCL Group and Geely which AliCloud is helping to improve its supply chain. Overseas customers include Schneider, Philips, Vodafone, Nestle and the Olympics Committee.

Future Outlook

AliCloud is the biggest cloud provider in China. It has shifted its sights to global expansion, which will put it in competition with AWS, the largest cloud provider globally. During the panel discussion, Hu mentioned that he expects the gap between AWS and AliCloud to narrow further. Two years ago, AWS was 30 times the size of AliCloud; the gap has since narrowed to 10 times.

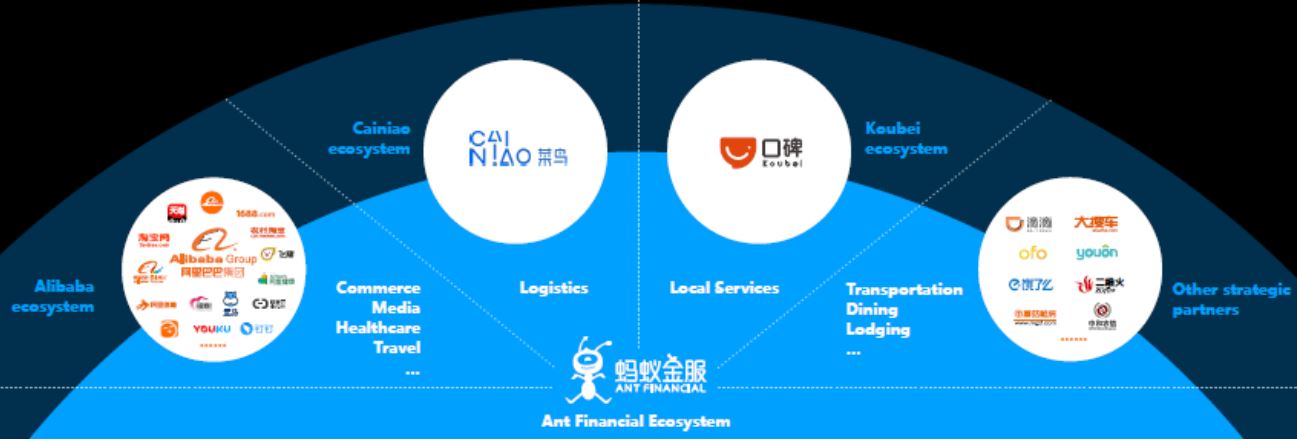

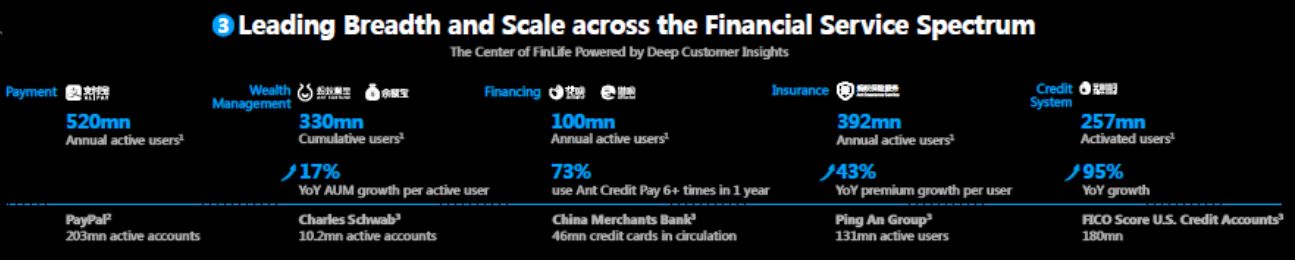

Ant Financial—Financial Services for Consumers and Small Businesses

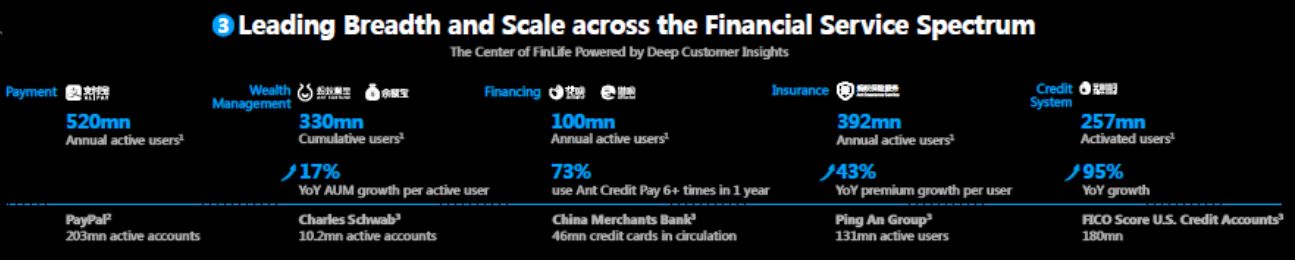

Ant Financial CEO Eric Jing shared his vision of Inclusive Finance and how Ant Financial—with its deep customer insights and unrivalled technology—can help address customers’ and merchants’ needs.

Vision of Ant Financial—Inclusive Finance

Jing started with a high-level overview of Ant Financial. He believes that finance should be transparent and inclusive. Jing built up the case for the need for inclusive finance by stating that approximately 30% of the adult population globally is unbanked, and approximately 80% of SMEs have no access to formal financial systems, according to the World Bank, 2014.

Ant Financial is able to offer financial solutions and access to financing to small businesses through its data insights, such as from Sesame Credit. As of the end of March 2017, 5.2 million small businesses were given access to unsecured lending and supply-chain finance cumulative loans reached ¥3.5 billion.

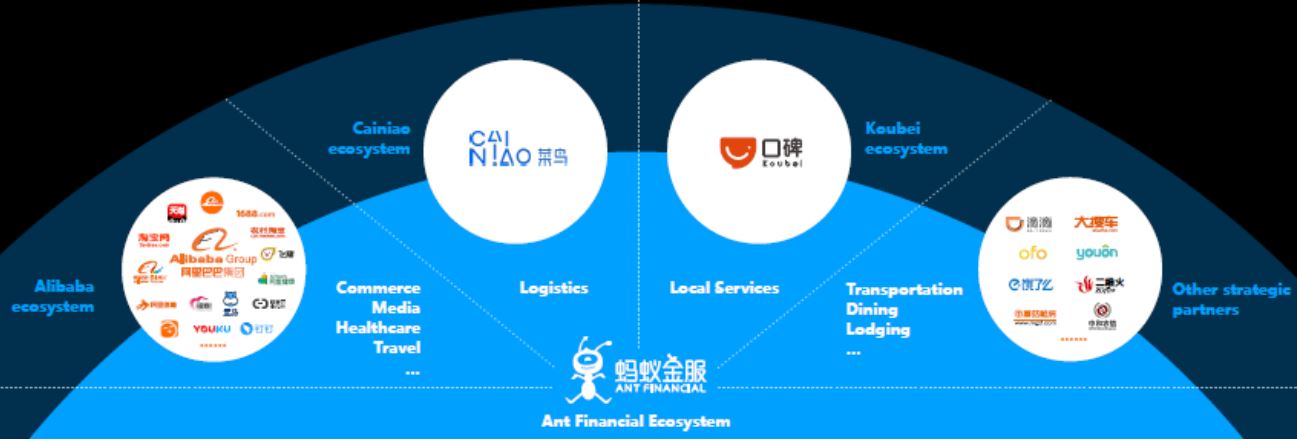

Ant Financial—An Integral Part of the Alibaba Economy

Jing described Ant Financial as the arteries of the Alibaba economy, by providing infrastructure, consumer insights and a payment platform to facilitate transactions. He gave examples of Ant Financial’s role in driving Alibaba’s strategy in New Retail and globalization. The number of offline payments has grown seven fold between March 2017 and 2016. Alipay allows offline merchants to digitalize payments, which works hand in hand with Alibaba’s global expansion by allowing consumers to buy globally. Ant Financial’s loyalty program also helps to derive more comprehensive consumer insights.

Source:Company data

Open Platform Model

Jing cited Ant Financial’s open platform model, which enables it to provide financial services which span the entire spectrum and increase value creation to consumers. On Alipay and Ant Fortune, there are over 100 asset-management companies and more than 2,600 fund products, as of May 31, 2017.

On its integrated financial services platform, approximately 430million users—or 8 in 10 Ant Financial users—use more than two categories of services.

Source:Company data

Note: 12 months ended March 31, 2017

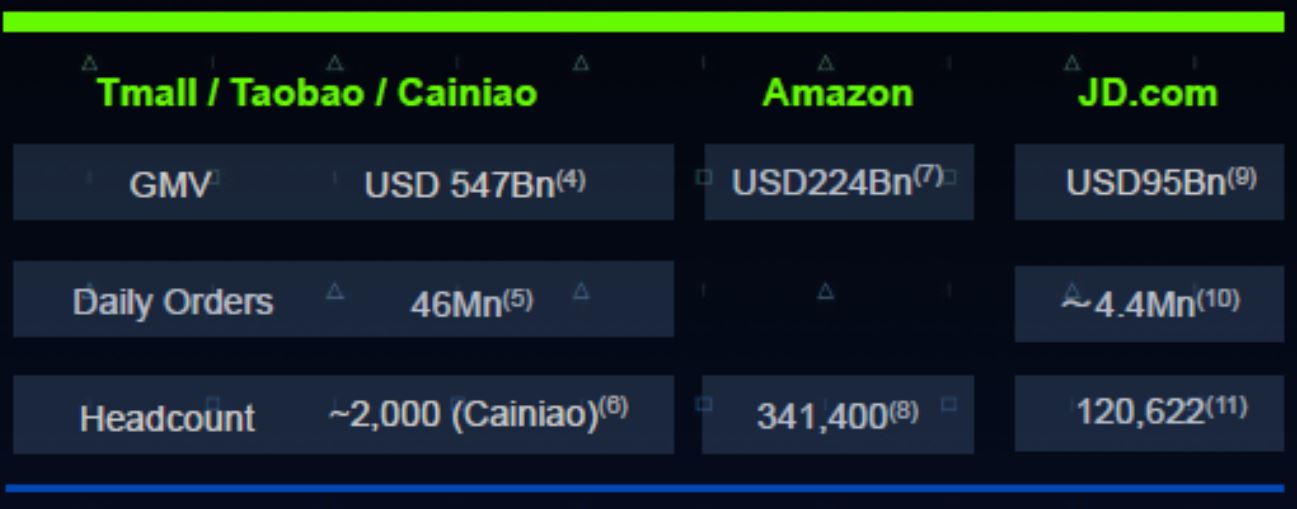

Cainiao Network—Scale, Efficiency and Consumer Experiences

President of Cainiao Wan Lin shared his vision for the open logistics platform of 15 logistics companies, and started his presentation by laying out the growth potential for China’s logistics industry. Compared to the US, China has a higher population density and a retail e-commerce GMV that is almost twice a large, as well as faster package volume growth. Yet, China’s logistics industry is faced with several challenges. Alibaba’s vision is to bridge the divide by helping partners connect their data through Cainiao Network.

- Lacks a unified data standard, making it difficult for companies to collaborate with each other

- Labor-intensive, last-mile delivery

Source:Company data

Through data technology, Alibaba aims to drive industry upgrade and collaboration among logistics partners.

Source:Company data

Note: As of the latest financial year

Future Opportunities for Cainiao Network

Wan outlined key future opportunities for Cainiao, which include:

- Building a unified intelligent logistics network in China, which would include rural areas

- Building a cross-border, global e-commerce logistics network

- Catering to emerging demand—China’s consumption upgrade and New Retail

From E-Commerce to Entertainment—A Synergistic View

Chairman and CEO of Alibaba Digital Media & Entertainment Group Yu Yongfu shared his vision to bridge e-commerce and entertainment in order to bring new users and data on Chinese consumers to the Alibaba ecosystem. As users shift from shopping to living in the Alibaba ecosystem, the platform seeks to maximize the value of creative properties by leveraging the multiple media assets across the group.

He expects Alibaba to generate multiple revenue streams through cross-platform monetization of TV dramas and movies by using IP on multiple platforms.

Source: Fung Global Retail & Technology

Overall, he believes Alibaba is well positioned to leverage on the relatively untapped growth potential of China’s digital entertainment industry, giving several examples of digital entertainment initiatives being undertaken:

- Youku’s original drama series: He gave an example of a series having 20-million viewers per episode, compared to just 3 million for Netflix’s popular House of Cards series.

- AliPicture’s production with Amblin Film: The movie “A Dog’s Purpose” grossed US$ 88 million in China, more than the US$64 million in the US.

- Damai, a live performance ticketing platform: According to Yongfu, Damai has a market share of approximately 70% in China, and he expects it to benefit from the growing China market.