About Alibaba 2017 Investor Day

Fung Global Retail & Technology is attending Alibaba’s 2017 Investor Day at its headquarters in Hangzhou on June 8–9. Day 1 of the Investor Day focused on the following:

- CEO Daniel Zhang provided an overview of Alibaba’s ecosystem and its future strategy

- CFO Maggie Wu talked about the financial projections for the company

- CMO Chris Tung presented on Uni Marketing and how brands can leverage Alibaba’s platform to interact with consumers

- Taobao KOL Cherie provided a demonstration of live broadcasting

A Strategic Perspective on the Alibaba Economy

CEO Daniel Zhang presented an overview of Alibaba’s ecosystem and the company’s future strategy. Alibaba has been evolving rapidly since it was founded in 1999.Zhang highlighted that Taobao will remain an important platform within its core commerce segment—it has transformed from a marketplace to become a social commerce platform, allowing consumers to have fun exploring. The company has also moved into new areas such as digital entertainment and local services through investments in Koubei, a local commerce platform, and ele.me, an online food delivery platform.

He believes big data technology will be pivotal in driving synergies across all business units.

Source: Fung Global Retail & Technology

New Retail: Digitizing the Core Components of Retail Operations

Alibaba aims to digitize the different stages of the value chain, and has been experimenting with New Retail across different retail formats at its strategic partners such as Intime, Suning.com, Sanjiang and Bailian. Zhang regards Alipay, which provides digital payment solutions for offline retailers, as important, as it helps give consumers a seamless experience both online and offline, and is being integrated at physical retailers.

Source: Company data/Fung Global Retail &Technology

Transitions

Zhang highlighted the significant transitions that are ongoing:

- From making connections to transforming retail: Alibaba has shifted from merely connecting buyers and sellers to changing the way consumers transact, by integrating marketing, distribution, omnichannel and supply-chain functions through data technology.

- Cloud—from infrastructure as a service to application-enhanced cloud as a service: The function of AliCloud has evolved to support different functions such as retail, digital marketing, logistics, digital media, financial services, customer service, city brain and industry-tailored solutions.

- Digital media &entertainment—from commerce to entertainment: Alibabasees strong synergies between commerce and entertainment. It has been building its content-generation ecosystem and leveraging its media assets to transform commerce to make the shopping experience more enjoyable for consumers.

- Leveraging China’s advantage to meet global consumption demands: Alibaba aims to leverage its advantage in China to sell overseas through AliExpress, a cross-border direct-to-consumer export platform;Lazada for South-East Asian markets; and Tmall Global, which brings quality imports into China.

Source: Fung Global Retail & Technology

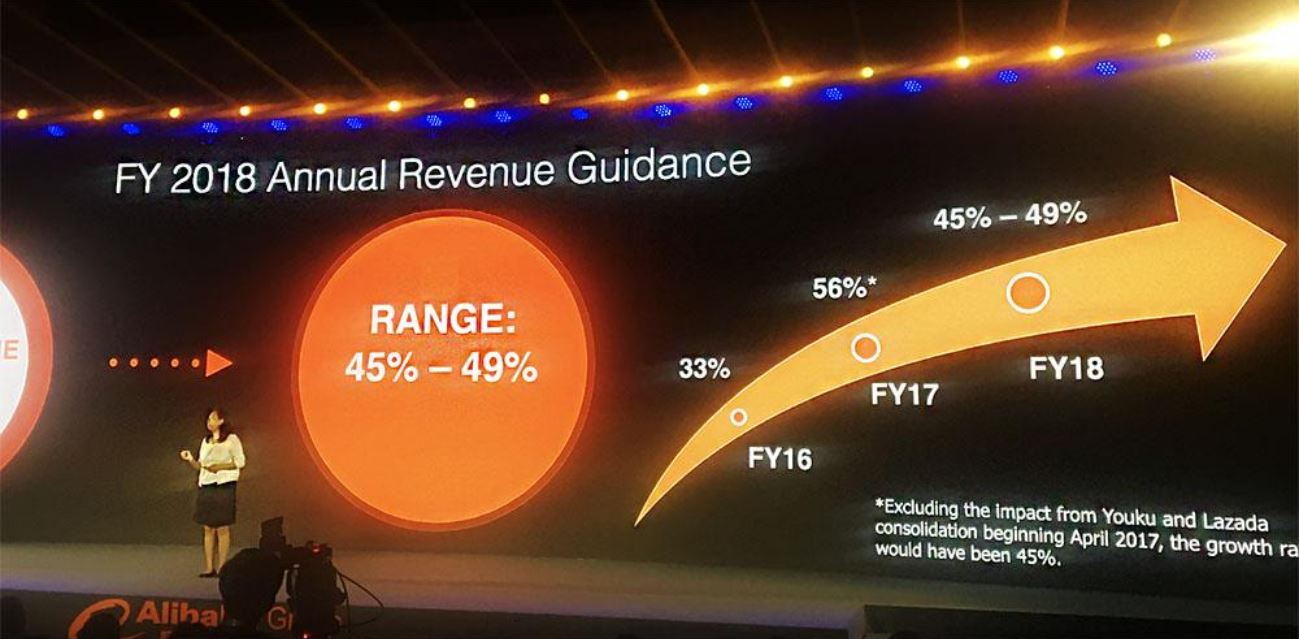

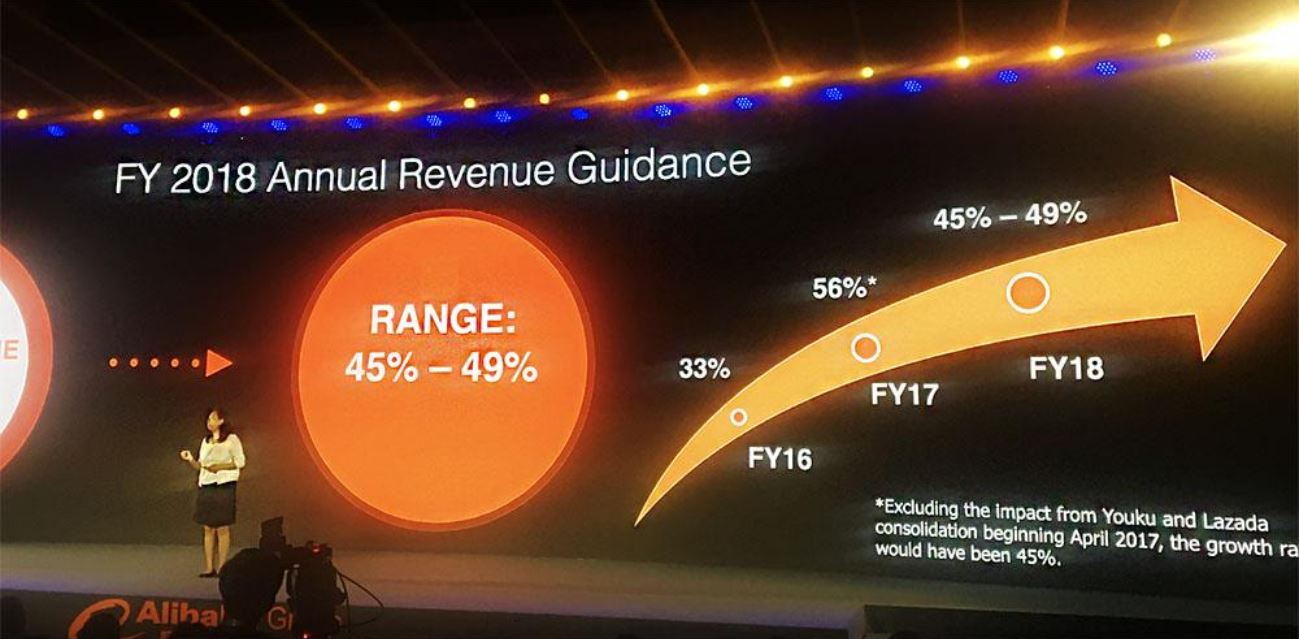

Financial Perspective and Revenue Guidance

CFO Maggie Wu began her presentation with a recap of Alibaba’s satisfactory financial performance since its IPO, supported by sustainable revenue and gross merchandise volume (GMV) growth, an improving mobile monetization rate and high growth in user and user engagement.Wu provided FY18 revenue guidance for a range of 45%–49% year over year.

Source: Fung Global Retail & Technology

Wu shared with the audience her thoughts on how a new business unit generally takes over seven years from initial incubation and gaining traction to generate sustainable cash flow.Currently, the core commerce division is cash-flow generative.She expects AliCloud and AliExpress to be next to reach that stage, followed by investments currently being incubated—i.e., New Retail, Uni Marketing, content, international expansion, etc.

Source: Fung Global Retail & Technology

Transform Marketing—How Brands Can Leverage the Alibaba Platform

CMO Chris Tung presented on Alibaba’s marketing capabilities, which provide brands with a full dimensional dataset from which to construct consumers’ lifestyles.In order to increase the effectiveness of marketing, Alibaba launched its Brand Databank, which helps brands build awareness, interest, purchases and loyalty among consumers by making data actionable and visible.Tung gave an example of how brands can leverage Alibaba’s platform to increase marketing efficiency:

Step 1—

Awareness: Brands can use Youku and Alimama.com to increase awareness among consumers

Step 2—

Interest: Brands can participate in shopping festivals such as Super Brand Day to make consumers more interested

Step 3—

Purchase: Juhuasuan, a group-buying site, can help convert consumers’ interest to purchase

Step 4—

Loyalty: The Brand Hub can transform customers who have purchased into loyal members

Source: Fung Global Retail & Technology

Content Drives Higher Conversion

The longer Chinese consumers stay on Alibaba platforms, the more they spend. The average customer placed 38 orders in the first year of registering on an Alibaba shopping site; four years later, they placed an average of 123 orders. The average spending per customer rose from around ¥3,000 in the first year to more than ¥12,000 in the fifth year.

UniMarketing as a Tool to Manage Consumer Assets

Tung also provided a detailed explanation of UniMarketing, which he saw as a process of managing consumer assets with the following three characteristics:

- Universal touch points: Such as through the integration of membership systems

- United channels

- A unique relationship journey: To help manage the relationship between brands and consumers through the different stages of the consumer journey

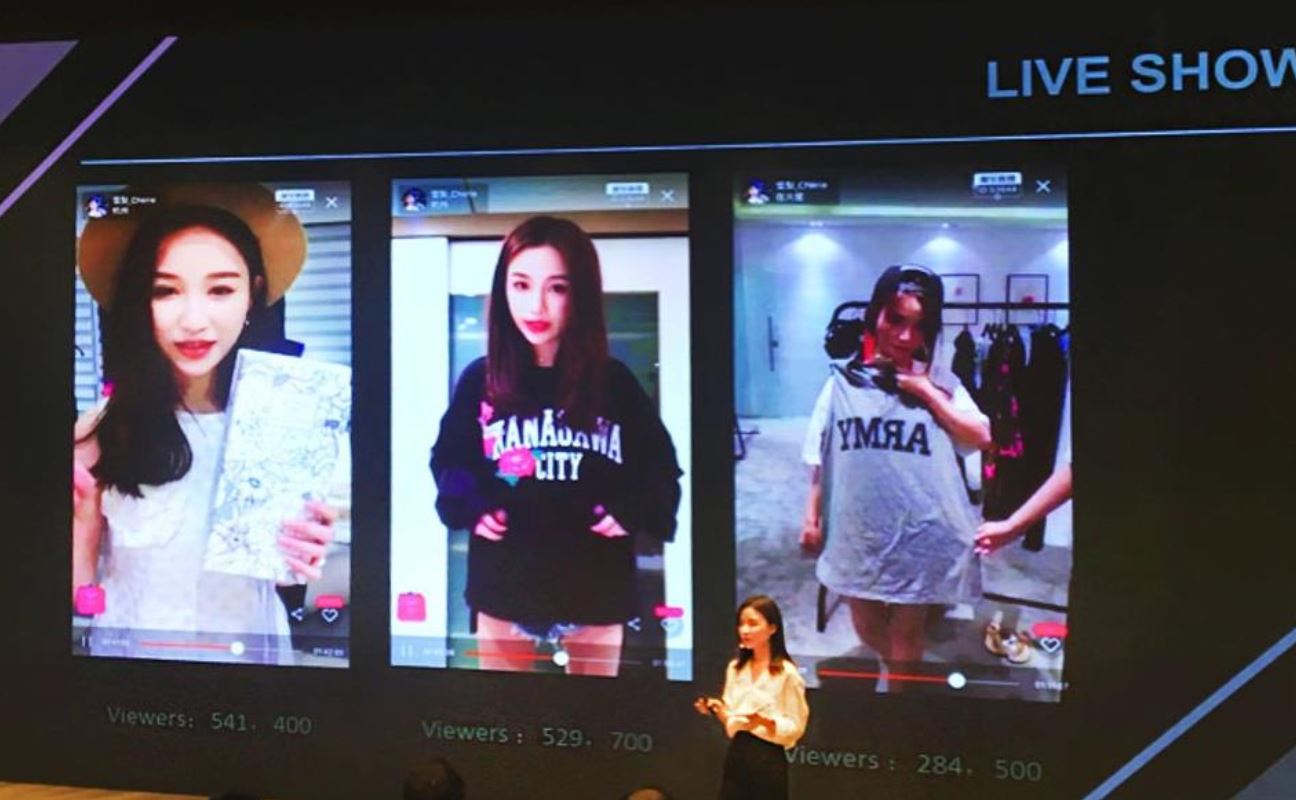

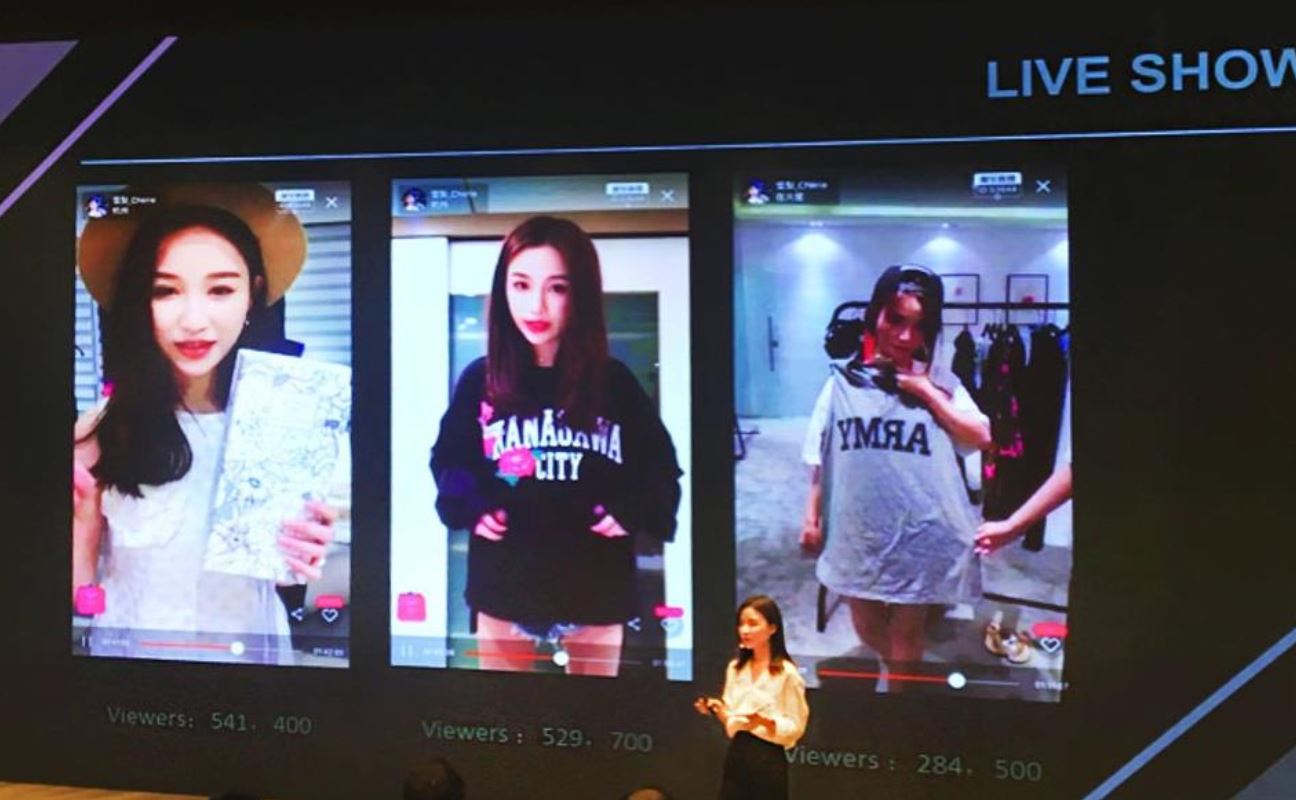

Live Demonstration of KOL

One of the leading KOLs on Taobao, Cherie,presented on the topic “The Rise and Breakthrough of the Internet Celebrity—The Economic Model under China’s E-Commerce Environment,” and talked about the advantages of using KOL to increase e-commerce traffic and conversion.She also gave a live demonstration.

Cherie began by sharing her view on the competitiveness and key advantages of the business model of e-commerce driven by KOLs.

- The traffic acquisition cost is lower: These costs are lower for e-commerce supported by KOLs, as they already have a fan base.

- The inventory cost is lower than physical retail: The KOL e-commerce model can use pre-sales to their advantage. KOLs have built trust with their fans who are willing to wait the 11–15 days lead time from pre-sales to delivery.

- KOL e-commerce has a lower trialing cost: Traditional retail models have limited knowledge about the potential market reaction to new product launches. KOLs can gain more color on the market reaction by first posting photos of products they plan to sell, and gauge consumers’ reactions, as indicated by the number of likes.

- Items sold by KOLs have high conversion rate: Over 10%.

Live demonstration of KOL

Cherie shared snapshots of her previous live streaming sessions and also gave a demonstration of live streaming. During the session, she introduced the fashion items that she was wearing and interacted with buyers to answer their queries on specific products.The number of likes from viewers totaled 500,000 during the 15-minute session, an indication of the popularity of her show.

Source: Fung Global Retail & Technology

Conclusion

The presentations about the future strategy and the core commerce segment left us convinced that Alibaba is on a solid, long-term growth trajectory. The Fung Global Retail& Technology team looks forward to reporting the highlights of Day 2 of 2017 Alibaba Investor Day, which includes keynote presentations from Executive Chairman Jack Ma and Executive Vice Chairman Joe Tsai, and the latest developments of AliCloud, the digital entertainment segment, Ant Financial and Cainiao Network.