Staples to be Acquired by Sycamore Partners in a Leveraged Buyout Deal

Sycamore Partners will acquire US office supplies retailer Staples in a leveraged buyout deal for about $6.9 billion, or $10.25 per share. The offer represents a 12% premium to the share’s closing price on Tuesday. We expect the deal to provide leeway for the office-supply chain to better position its business amid persisting challenges. The office-supply chain has been suffering from three major headwinds in recent years:

- The digital transformation of workplaces has reduced the demand for office supplies such as printer paper and pens.

- Online competition, particularly from Amazon, has shrunk the market for office supplies sold in stores.

- There has been a shift in small businesses, Staples’ primary retail customers, to competitors such as Costco for better pricing.

Failure to Transform Amid Headwinds

In 2015, Staples offered to merge with Office Depot in a $6.3 billion deal to combine the two largest office-supply chains in the US. However, the transaction aroused antitrust regulators’ concerns and failed to obtain approval from the regulators.

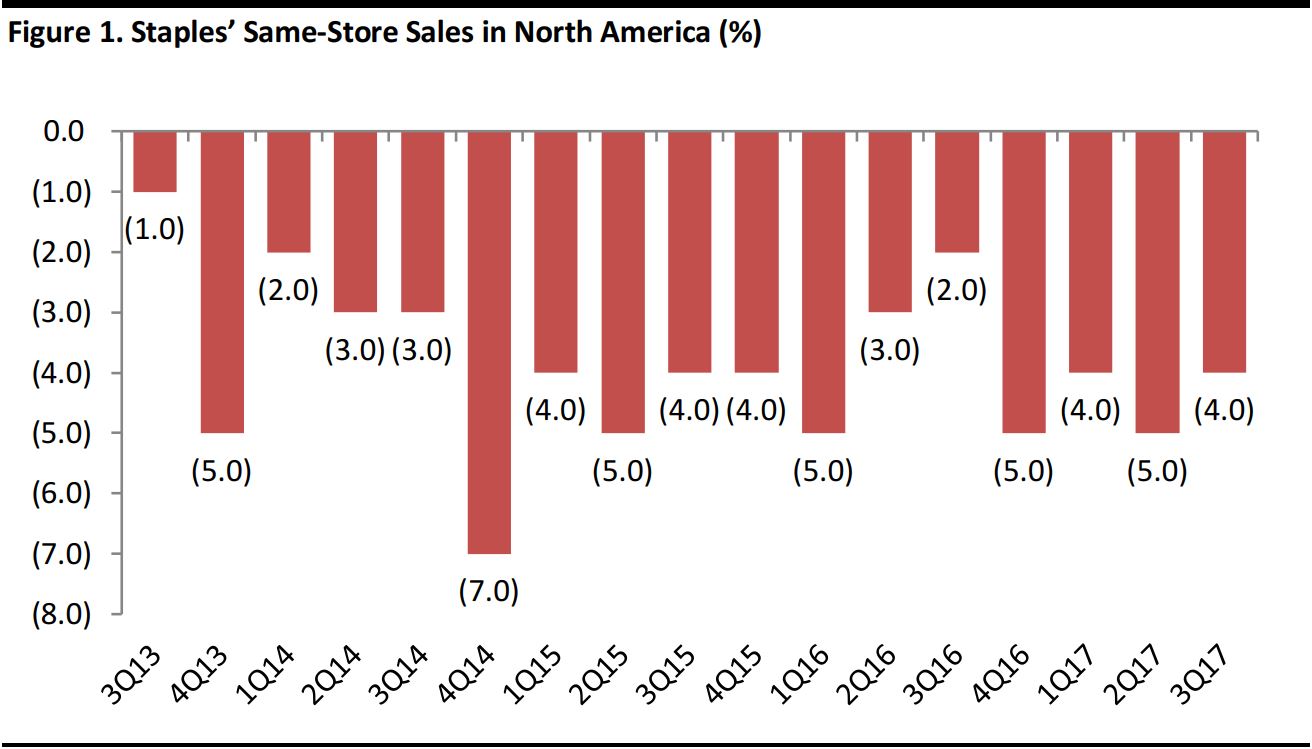

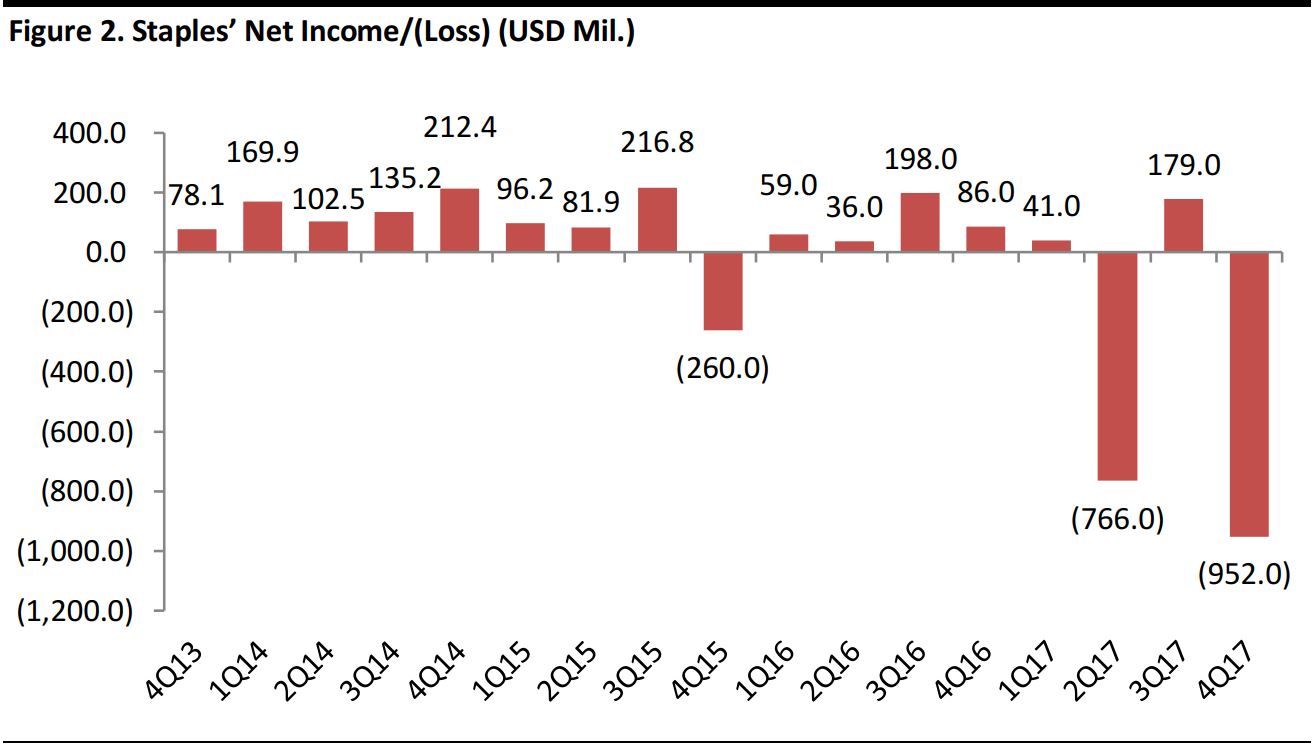

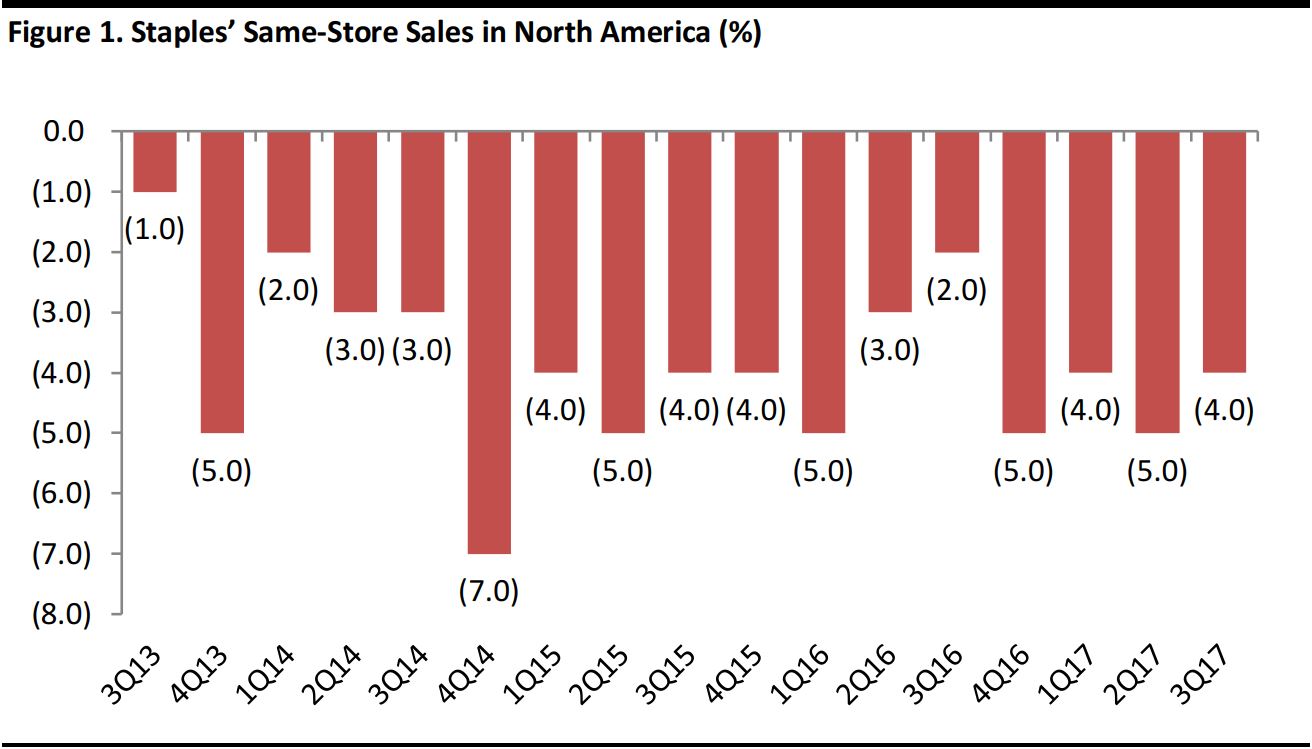

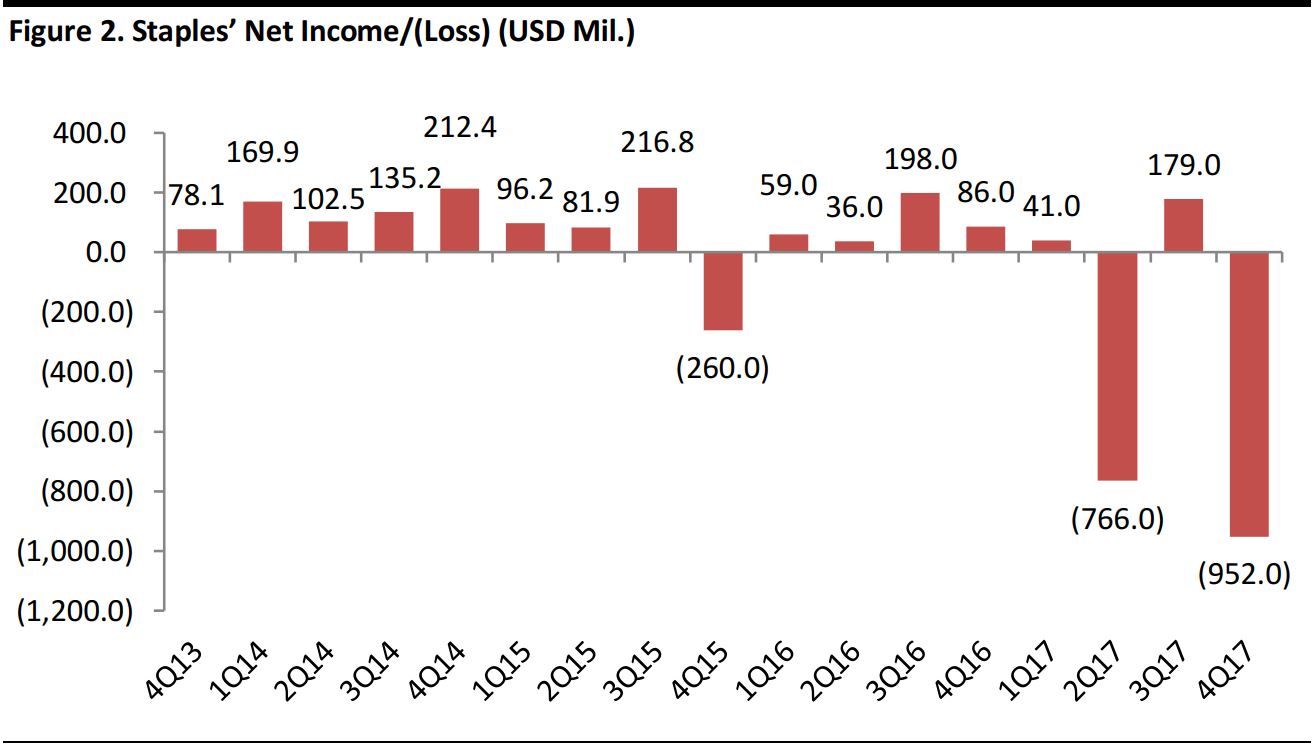

Staples then divested businesses outside of North America and took action to increase penetration with mid-market commercial customers. However, the actions failed to curb the decline in the company’s same-store sales or to improve the bottom line.

Source: Bloomberg

Source: Bloomberg

Leveraged Buyout Deal to Provide Leeway for Business Transformation

The leveraged buyout deal will allow the company more leeway to better position its business amid current headwinds. The demand for office supplies from corporations and the government, which account for more than 60% of Staples’ revenue, are less impacted by the secular declines experienced by the majority of retailers in the US. However, Staples will need to restructure its business to compete more effectively with the likes of Amazon and Costco, which the company’s management has identified as major competitors.

Under private ownership, Staples’ plans to focus on the mid- and high-end markets and to reduce its reliance on retail locations could improve the top and bottom line in the short to medium term. However, we anticipate that repositioning the business to enable sustainable long-term growth will be no easy feat. There are big questions to be answered around how Staples will compete more effectively against Amazon and Walmart, which are both making significant investments in omnichannel retail, as well as how the company will reposition its business to serve clients with office environments that are increasingly digital.