albert Chan

What’s the Story?

Costly, inefficient and environmentally unsustainable, returns are a key issue that retailers and brands need to address as consumers continue to migrate online for a greater share of their overall purchases. The good news is that there are multiple opportunities through the product lifecycle to remedy/reduce returns, and there is a growing cohort of startups and innovators developing solutions to address the challenges that returns present for retailers.

In this report, we explore returns in retail, including causes, costs—financial and environmental—and solutions, with a focus on the US market. This report is sponsored by Newmine, a retail-tech innovator that is disrupting the returns management market.

Why It Matters

Retailers have generally regarded returns as simply a cost of doing business, with generous returns policies offering opportunities to attract and engage customers, enhance the consumer experience and increase loyalty. Furthermore, consumers may trade up when making a return (particularly if products were gifted to them), adding money to exchange unwanted products for a desired item.

However, high levels of returns give rise to significant challenges for retailers, as they eat into profitability on a product, store, channel and organizational level while simultaneously impeding strategic efforts related to environmental sustainability. These costs have been brought to the fore over the past year due to the pandemic-led surge in e-commerce and the usual bump in returns amid the holiday season. As shoppers are unable to touch or try on products when shopping online, e-commerce typically sees increased levels of returns. According to the NRF (National Retail Federation), the US returns rate for online purchases was 18.1% in 2020—much higher than the overall retail industry rate of 10.6% (totaling $428 billion). In addition, returns equated to a high proportion of total US retail sales during the holidays, at 13.3%, according to the NRF. Every January, retailers have to deal with holiday gift returns, which cause mayhem in stores as retailers transition to new seasonal merchandise and close out their books.

Offering free delivery and free returns services is a competitive advantage for retailers, but this strategy carries high costs, particularly in the current environment of heightened e-commerce. Furthermore, with increasing consumer awareness around sustainability, companies should instead look to reduce returns and thus improve their profit profile. There are many ways to do this, but brands and retailers must understand the core reasons behind returns across product categories in order to effectively address the root causes.

Retail Returns: In Detail

How Do Returns Impact the Environment?

Retail returns have an adverse impact on the environment across three key areas:

- Landfill—Each year in the US, around 5 billion pounds of returned goods end up in landfill, according to CBSNews.

- Carbon Emissions—The “2020 Impact Report” published by returns solutions provider Optoro states that an estimated 16 million metric tons of carbon dioxide were emitted from the transportation of returns in the US last year. The report also claims that e-commerce returns can produce 14% more landfill waste than brick-and-mortar returns, thanks to inefficiencies in traditional reverse logistics. Furthermore, according to Olive (a delivery consolidation service that bundles e-commerce orders into a single, weekly shipment delivered in a reusable “shipper”), 75% of e-commerce's carbon emissions come from single-use packaging and last-mile delivery—and when retailers offer doorstep pickup of returns, it creates a first-mile return journey that potentially doubles carbon emissions.

- Packaging and Plastic Waste—In 2019, Amazon alone generated 465 million pounds of plastic packaging, 22 million pounds of which ended up polluting freshwater and marine ecosystems, according to estimates by Oceana, an international advocacy group focused on ocean conservation. Oceana claims that this is equivalent to dumping a delivery van’s worth of plastic into our water ecosystems every 70 minutes. Amazon responded that Oceana miscalculated its impact, and that the actual plastic packaging generated is about one-quarter of Oceana’s estimate.

How Can Retailers Work Toward Sustainability in Returns?

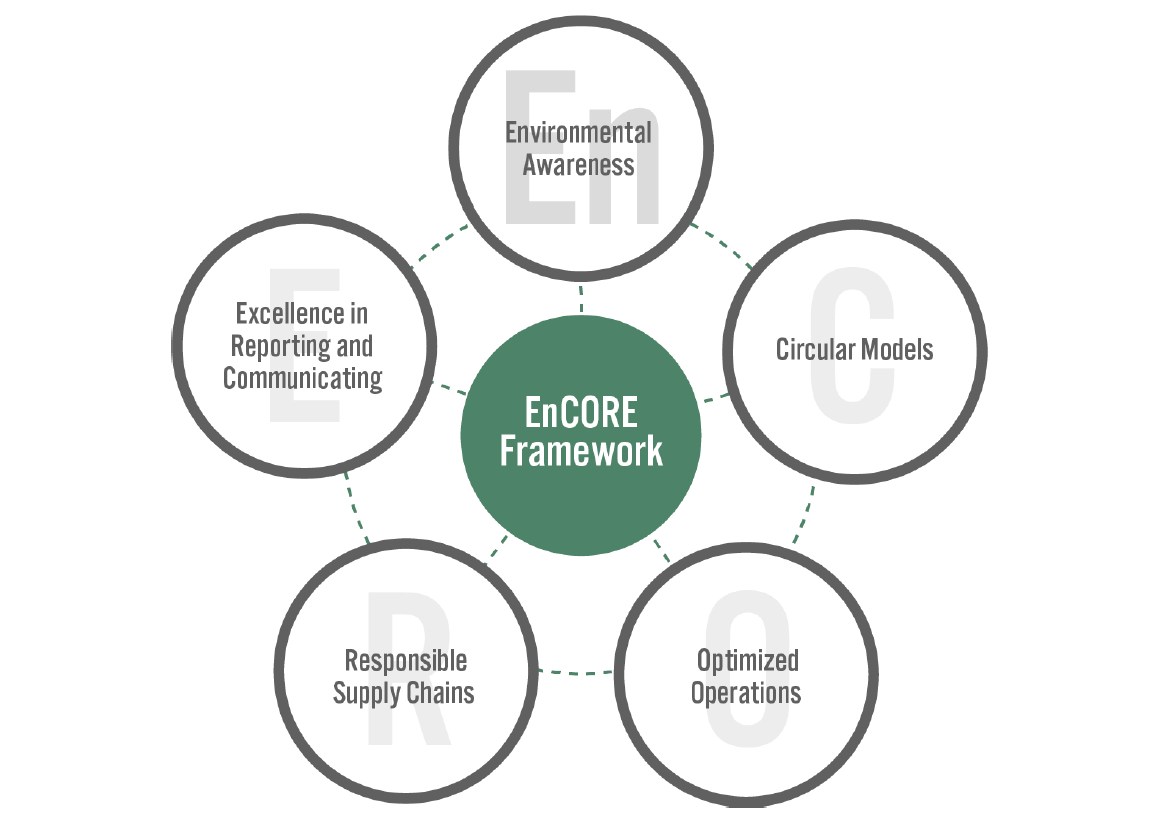

Coresight Research developed the EnCORE framework to help retailers and brands frame their approach to sustainability. The framework comprises five components (see Figure 1), providing a model through which retailers can begin to internalize a sustainability strategy, boosting profits and driving growth while realizing environmental benefits.

- For a more detailed discussion around the development of sustainability in retail and the five components of our EnCORE framework, read our free report: “The Time for Sustainability in Retail Is Now.”

Figure 1. Coresight Research’s EnCORE Framework for Sustainability in Retail

[caption id="attachment_125787" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

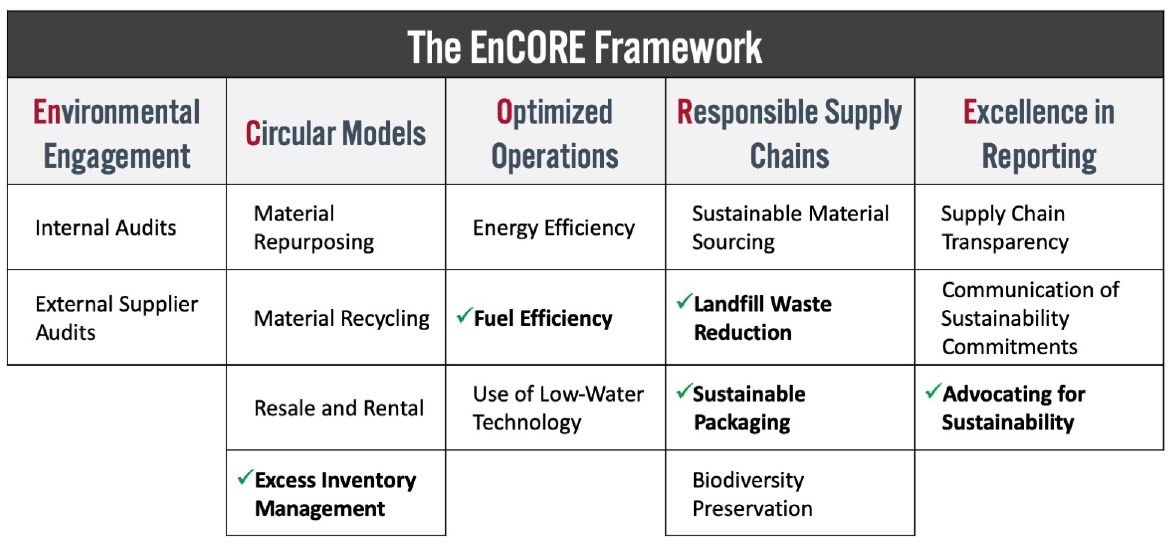

Elements under four of the framework’s components are particularly relevant to returns (see Figure 2). By implementing goals and actions that align with the highlighted elements, brands and retailers can lower their returns-related carbon footprint and thus reduce their impact on the environment—which should support them in attracting and retaining new customers and investors.

- Circular models—Better design at a product’s inception would reduce returns, positively impacting excess inventory.

- Optimized operations—Returns reduction leads to lower energy and fuel consumption.

- Responsible supply chains—Fewer returns would reduce the amount of waste sent to landfills, removing the need for extra packaging for returns by mail.

- Excellence in reporting—Retailers can advocate for sustainability in both the purchase and returns processes, appealing to environmentally conscious consumers.

Figure 2. The EnCORE Framework: Elements Related to Returns

[caption id="attachment_125788" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Implications for Returns Through The Entire Product Lifecycle

Implications for, and the hidden costs of, returns span the entire product lifecycle, from design to post purchase:

- Product ideation and creation—The wrong assumptions about the size of an opportunity and market validity, as well as inadequate quality control spanning the vendor base, raw materials and assembly, can lead to the overproduction of goods, which depletes natural resources with little or no economic return.

- Product transport—The speed of delivery from manufacturer to distribution center, retail point of sale or the consumer is a factor for retailers (in ensuring they have a seasonal assortment, for example) and shoppers (with demand for fast delivery increasing). Consumers may not need an item if it does not arrive within a specific timeframe, leading to an increased likelihood of returns. Products can also be damaged in transit, resulting in returns.

- Product at distribution center or retail location—Product may be lost or misplaced at distribution centers or in the retailer’s store. Product that is damaged on the selling floor, aged inventory and no longer fashionable/relevant products cannot be sold at full price. Issues with inaccurate product allocation are also relevant—with variations by geography, for instance.

- Post purchase—The customer experience of a return impacts future sales opportunities and can adversely impact the lifetime value of a customer. We discuss the top causes for returns in the next section.

Due to the lag between a purchase, decision to return, return and potentially restocking, we estimate that only 40–50% of returned merchandise can sell at full price, meaning that retailers’ profitability is eroded.

Inefficient supply chains jeopardize retailers’ ability to meet consumer demand and often lead to markdowns (impacting revenue) or disposal (impacting the environment). The issue of the carbon footprint associated with product transport is exacerbated not only by returns in general but by consumers buying products that they intend to return—ordering multiple items to select the right size or color, for example, before returning the rest.

Taking the full product lifecycle into account, reducing returns is a function of data-enhanced retail, as retailers can leverage data analytics to understand their customer and thus make better informed decisions on product manufacturing, shipment and pricing.

Top Causes of Returns

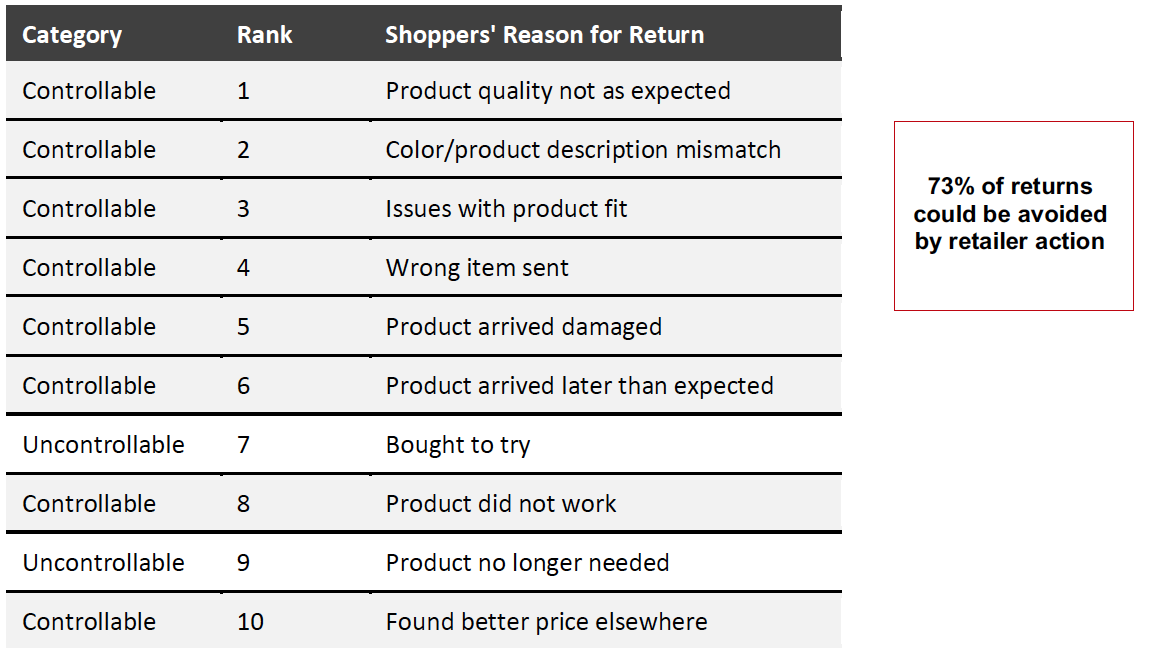

There are many factors that result in high returns rates. According to the “2021 State of the Industry Report: Retail Returns” by Incisiv (sponsored by Newmine), released on April 8, 2021, the top cause of returns is product quality, based on data from 2,500 omnichannel shoppers in the US.

Of the top 10 causes of retail returns (see Figure 3), Incisiv and Newmine’s report found that only two are uncontrollable for the retailer: “bought to try” and “no longer needed.” The other, controllable reasons present opportunities for retailers to reduce returns and thus improve sales, profits, and customer satisfaction and lifetime value.

According to Newmine, once an item is returned, it is handled by more than seven workers on average before it reaches its final destination—back on the selling floor, at an off-price retailer or in landfill—which is an unseen costly aspect to returns. Newmine estimates that the average annual returns rate in the US retail industry is 11.2%, and it could be reduced to 7.7%—representing $125 billion in sales not returned if retailers address the controllable reasons for returns.

Figure 3. Top Causes of Retail Returns

[caption id="attachment_125789" align="aligncenter" width="700"] Source: 2021 State of the Industry Report: Retail Returns, by Incisiv/Newmine[/caption]

Source: 2021 State of the Industry Report: Retail Returns, by Incisiv/Newmine[/caption]

Low-hanging fruit in terms of reducing returns is for retailers to stop encouraging people to buy more or buy multiples with the intent of returning, provide improved product information and educate the consumer regarding the environmental impact of returns. Sustainability is of increasing importance to consumers and providing and encouraging more sustainable return options as a way to reduce the environmental impact (and cost) of returns.

High Returns Rates in the Apparel Sector

Returns are prevalent in the apparel sector due to issues around the fit, color and quality of clothing, which have been recently exacerbated due to consumers having to make purchases online rather than in stores: According to the NRF, the rate of returns for online purchases in the apparel and footwear category in the US was 35–40% in 2020.

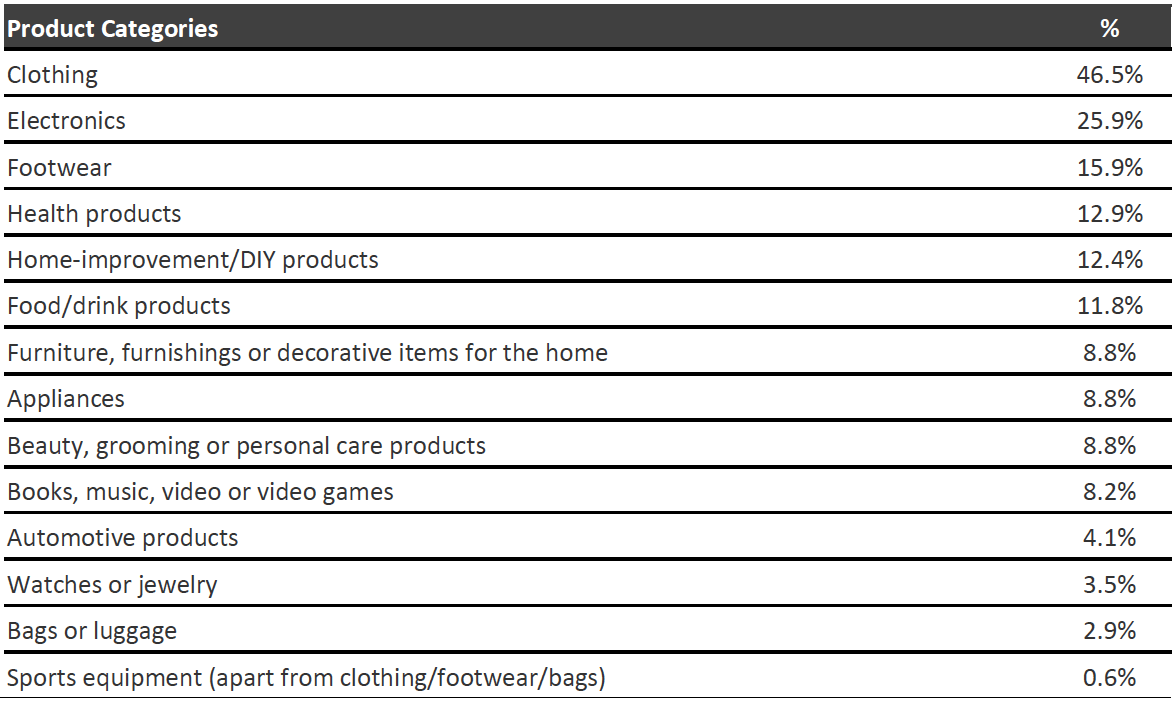

Coresight Research survey findings from March 2021 reveal that 42.4% of US consumers had returned unwanted products in the prior 12 months (since the outbreak of Covid-19 in the US). Clothing was the most returned category, with 46.5% of respondents who had made returns reporting that they returned such products—almost double the rate of returns for electronics (see Figure 1). This reflects the shift to online apparel shopping amid non-essential store closures during the Covid-19 pandemic, and the higher rates of returns associated with this category have likely been exacerbated by first-time online apparel shoppers.

In our survey, 38.8% of the respondents that returned products reported that they prefer to return online purchases in physical stores. This is encouraging for retailers, as it transfers the last-mile return trip cost to the consumer, while creating the opportunity for an in-store exchange (again saving the last-mile cost for the retailer) and add-on purchases.

Figure 4. Product Categories Returned by US Consumers in the Past 12 Months, as of March 2021 (% of Respondents That Reported Making a Return)

[caption id="attachment_125803" align="aligncenter" width="700"] Respondents could select more than one category

Respondents could select more than one categoryBase: 170 US Internet users aged 18+ who had made a return in the prior 12 months, surveyed in March 2021

Source: Coresight Research[/caption]

The Growing Role of Technology in Returns Reduction

There are many solution providers that are assisting retailers with customer returns experiences, reverse logistics and disposition/liquidation, all of which are reacting to the challenges presented by returns to make the handling of them less of a burden. Returns reduction is a newer solution category that focuses on proactively addressing the root cause of returns. Returns reduction efforts of the past have been hindered by a lack of comprehensive data that may be siloed throughout the organization. Getting the complete picture of the causes of returns requires the consolidation and analysis of massive amounts of structured and unstructured data. Advancements in AI, analytics and automation have allowed for new solutions to the age-old problem.

Below, we outline three innovative startups that are solving for the retail returns problem:

3DLOOK is helping reduce returns and improve retail sustainability by accurately sizing individuals with its mobile body-scanning technologies. The 3DLOOK app measures the customer’s shape and size with just two photos. With AI and machine learning, 3DLOOK’s body-scanning lab captures over 100 data points from the human body to create lifelike 3D models.

3DLOOK is helping the fashion industry get closer to a sustainable future by enabling apparel manufacturers to reverse the fit process by customizing clothing to fit real people, thereby creating a new fashion business model that is better for business and better for the planet.

Newmine’s AI-powered Chief Return’s Officer mines a retailer’s data, identifies returns-reduction opportunities and presents improved feedback and corrective actions. By monitoring returns, identifying their root causes, collaborating across organizational silos and directing in-season action, Chief Returns Officer’s AI and automation can improve assortment planning, inventory positioning, supplier performance and marketing decisions. The solution also empowers retail employees because they are better informed with a comprehensive view of how products are performing, from inception to point of sale. In sum, returns decline, sales and profits increase, efficiencies are captured, and a virtuous business cycle is created.

Returnly focuses on eliminating the friction a consumer feels when opting to return unwanted merchandise as well as reducing the cost to the supply chain. The company’s solutions recover the value of returned inventory by ensuring that it is sent to the most profitable channel, while incurring the least amount of operational cost by leveraging data to drive decisions. Efficient returns routing can also reduce out-of-stock levels, which supports customer satisfaction.

What We Think

Returns are a comprehensive and costly problem for brands and retailers. Corrective action has to begin at product inception: By leveraging consumer data, brands and retailers can better align design merchandising and allocation with consumer demand. Manufacturing closer to season is another lever that can reduce returns as merchandise runs are based on more recent consumer insights. Improving merchandise quality while offering better product descriptions on websites are also strategies that can be used to reduce returns.

Keeping the big picture in mind, increasing consumer concerns around sustainability present retailers’ opportunities to educate their shoppers as to the adverse impact that repetitive returns have on the environment. Retailers could look to provide alternative returns options to reduce their environmental impact: Returnly, for example, suggests a “Green Returns” concept in which the return trip is eliminated when the return is not worth the postage or carbon footprint—customers are offered credit.

New retail tech startups are helping retailers uncover return data and opportunities to reduce returns and simultaneously increase sales, profits, efficiencies and customer satisfaction. It is imperative that retailers look to address the returns issue on multiple fronts as e-commerce growth continues to drive returns due to the inherent nature of online shopping.

Implications for Brands/Retailers

- Consumers care about returns policies and consider them prior to making a purchase. For reasons of retailers' cost and shoppers' satisfaction, it would be wiser to address the reasons shoppers return and eliminate those causes than to implement an onerous return policy that causes consumers to find alternative retailers for their needs.

- Retailers should identify the root causes of returns, as more than 70% of the top reasons for returns are controllable, according to Incisiv and Nemine. As such, these causes can be addressed and potentially eliminated by retailers, thereby reducing returns.

- Retailers should improve their strategic sustainability efforts and encourage and educate consumers to be sustainable too. Sustainable options such as BORIS (buy online, return in-store) and central return drop-offs at convenient locations reduce both costs and carbon emissions associated with returns. Retailers can provide shoppers with information about the carbon footprint of their alternative delivery services (i.e., varying speed of delivery), when consumers complete online checkout, thereby offering transparency into the environmental implications of their delivery choices and enabling shoppers to make more-informed decisions.

Implications for Real Estate Firms

- Shopping centers and malls can have centralized return kiosks that drive traffic to the center while reducing returns costs for their tenants.