albert Chan

What’s the Story?

Sustainability spans virtually every business and consumer touchpoint, but there are many misconceptions that lead to confusion among brands and retailers. In this report, we bust five myths about sustainability in retail to support discussions in the board room and at the C-suite level as brands and retailers embark on a sustainability strategy and communicate that strategy to their multiple stakeholders.

Why It Matters

Environmental sustainability is at the forefront of public policy debates through global initiatives such as the United Nations’ (UN’s) Sustainable Development Goals (SDGs) and the Paris Agreement. President Biden’s April 2021 pledge commits to eliminate America’s net carbon emissions by 2050, and China has vowed to become carbon neutral by 2060. The “2021 Deloitte Global Resilience Report” puts climate change and environmental sustainability as the top societal challenge over the next 10 years, based on findings from a survey of 2,260 CXOs across 21 countries.

There is therefore increased demand among consumers, governments and other stakeholders for businesses to take accountability for the environmental impacts of their operations and work toward implementing sustainable practices. Before brands and retailers can begin to do this, they must first break down the far-reaching concept of sustainability and identify the areas in which they can focus their efforts—but sifting through the misconceptions to fully understand the issues can be challenging.

Busting Five Myths in Retail: Coresight Research Analysis

1. Sustainability is too Vast for Businesses To Comprehend and AddressA simple Internet search for the definition of sustainability renders some 1.2 billion results, so it is no wonder that business do not know where to start, and it is difficult to comprehend at first glance how some definitions can translate into action.

The UN’s World Commission on Environment and Development is perhaps the most quoted on the definition of sustainable development as “development that meets the needs of the present without compromising the ability of future generations to meet their own needs.” This definition originated in 1987 with the “Brundtland Report,” which introduced sustainable development and how it could be achieved.

In recent years, sustainability has come to mean much more, and the term now tends to include areas such as environmental practices, social responsibility and even corporate governance (ESG). Consumers, employees and investors are demanding that the companies they buy from, work for and invest in increasingly take a triple-bottom line approach, measuring and improving their financial, social and environmental impacts—profits, people and planet—adding pressure for brands and retailers to make commitments to sustainability. Although it may seem overwhelming, the good news is that alongside burgeoning interest in sustainability comes increased efforts from leading organizations to support companies with their sustainability strategies.

The Global Reporting Initiative (GRI) is an international, independent standards organization that helps businesses understand sustainability reporting—the practice of companies disclosing the most significant economic, environmental and social impacts that arise from their corporate activities—and thereby be held accountable for their impacts and responsible for managing them.

Sustainability has implications for a company’s financial performance and long-term enterprise value, so investors have become increasingly interested in the topic. SASB Standards—which are maintained under the auspices of the Value Reporting Foundation, a global nonprofit organization—focus on the connection between businesses and investors, the financial impacts of sustainability and how sustainability issues can create or erode enterprise value.

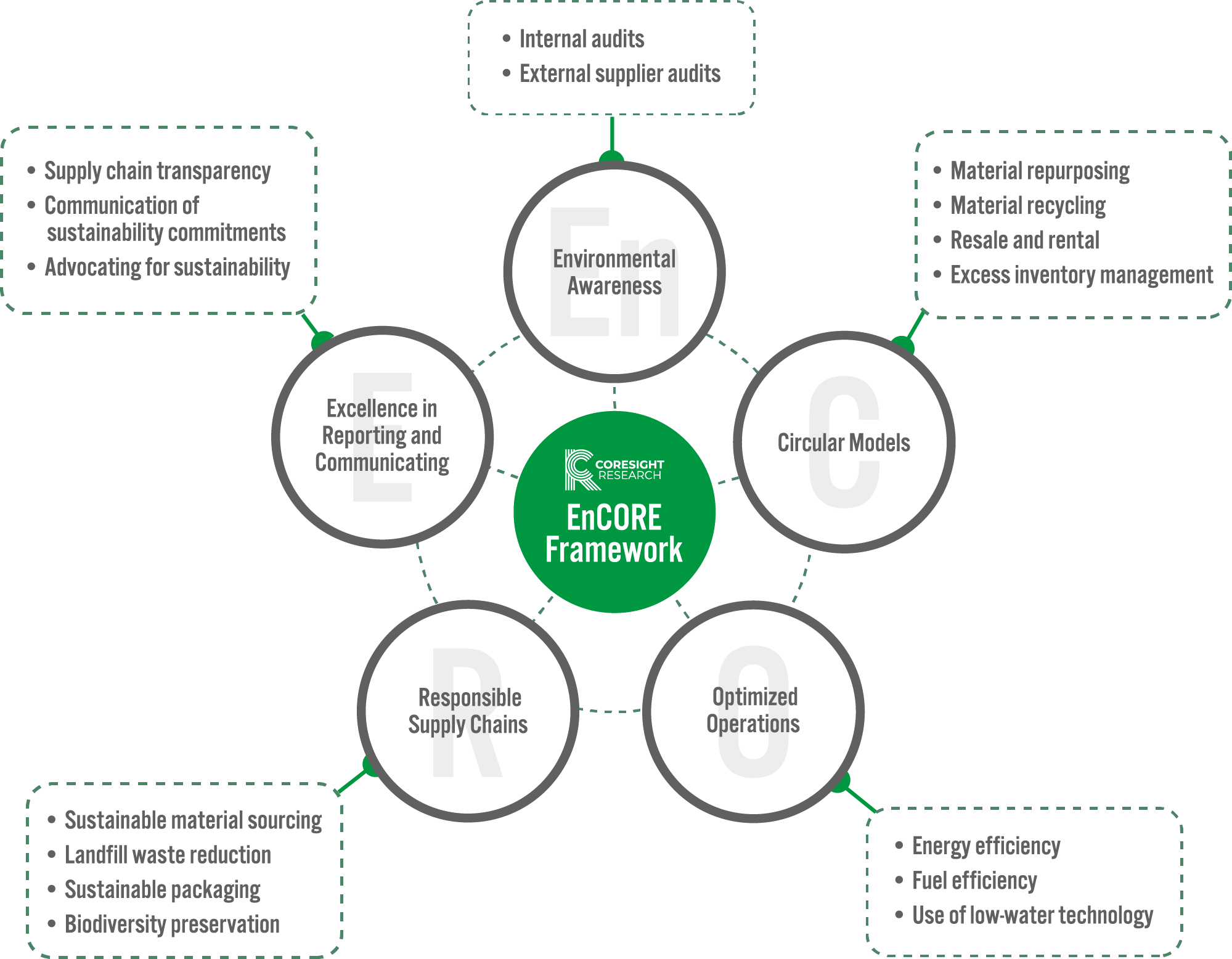

Coresight Research has identified sustainability as a key trend to watch in retail. Recognizing that navigating the sheer volume of issues that fall under the umbrella of sustainability is daunting, Coresight Research developed the EnCORE framework to help retailers and brands frame their approach to improving their environmental impact. The framework comprises five components—environmental engagement, circular models, optimized operations, responsible supply chains and excellence in reporting and communication—providing a model through which retailers can begin to internalize a sustainability strategy.

Figure 1. The EnCORE Framework [caption id="attachment_132437" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

2. Sustainability Does Not Positively Impact Profitability

Source: Coresight Research[/caption]

2. Sustainability Does Not Positively Impact Profitability

The focus on implementing sustainability strategies—and a challenge in doing so—is often on the capital required to make significant changes through the entire supply chain. However, Coresight Research believes that if companies are well informed about their environmental footprint, a little investment can go a long way when directed into the right areas. Furthermore, in addition to the environmental benefits, sustainable practices can generate real cost savings.

Typically, the first step in any sustainability program is to reduce consumption through efficiency measures. Reducing the energy necessary to operate facilities will result in real bottom-line savings, as will water conservation and waste reduction.

Packaging is another area where corporations can realize environmental and financial benefits at the same time—through less packaging, reusable and recyclable packaging and eliminating/reducing the use of plastics. This is particularly relevant in the current environment, as elevated levels of e-commerce amid the Covid-19 pandemic have led to increased demand for packaging materials: Demand remains higher than supply, so paper and cardboard manufacturers have increased selling prices.

Heightened e-commerce is also impacting returns: Offering free delivery and free returns services is a competitive advantage for retailers, but this strategy carries high costs and is environmentally unsustainable—across packaging, landfill and carbon emissions. Due to the lag between a purchase, decision to return, return and potentially restocking, we estimate that only 40%–50% of returned merchandise can sell at full price, meaning that retailers’ profitability is eroded; reducing returns therefore presents huge opportunity to drive financial and environmental benefits. Retailers could also look to provide alternative returns options to reduce their carbon footprint—such as BORIS (buy online, return in-store) and central return drop-offs at convenient locations.

- For more on returns, read our separate Sustainability Insights report, The Hidden Costs of Retail Returns.

Overall, nonprofit organization ReFED estimates that 24% of all food in the US—54 million tons annually—is wasted. This has significant environmental impacts as the energy and water it took to grow, harvest, transport and package the food is wasted too. In addition, when food waste rots in landfill, it produces methane, a potent greenhouse gas. According to the World Wildlife Fund (WWF), about 6%–8% of all human-caused greenhouse gas emissions could be reduced if we stop wasting food; in the US alone, the “production of lost or wasted food generates the equivalent of 32.6 million cars’ worth of greenhouse gas emissions.”

Reducing food waste will therefore help the US address climate change. In 2015, the US Department of Agriculture and the Environmental Protection Agency (EPA) set the 2030 Food Loss and Waste Reduction Goal, which aims to reduce food loss and waste by 50% by 2030, aligning with the UN’s SDGs.

It is true that restaurants generate huge amounts of food waste: According to ReFED, US restaurants and foodservice businesses generate 12.7 million tons of surplus food each year, more than 80% of which goes to landfill or is incinerated as waste—and approximately 4%–10% of food purchased by restaurants is wasted before reaching the consumer.

However, ReFED states that US households are responsible for around 30 million tons of surplus food annually, dwarfing the amount the total surplus amount from restaurants. In addition, retailers generate 10.5 million tons of surplus food, of which nearly 35% goes to landfill or is incinerated as waste. As retailers connect farms, manufacturers and consumers, they have the opportunity to help reduce food waste through the entire supply chain.

4. Sustainability Considerations are the Same Across All ChannelsAlthough many sustainability issues are comparable across retail channels—for example, energy consumption, which is relevant to both physical stores and warehousing as well as e-commerce fulfillment centers—the key opportunities to make positive change in the supply chain varies by channel.

The last mile is a key factor in sustainability, in terms of packaging, transport and returns. Although physical retailers do not make deliveries, e-commerce can be more environmentally friendly than consumers making shopping trips to stores using their personal cars. According to the National Center for Sustainable Transportation, a 7% reduction in vehicle miles traveled was achieved when shoppers switched to online shopping in 2020, and there is potential for a further reduction of up to 80% if e-commerce becomes the dominant choice.

However, this benefit can only be realized with true operational efficiency—including trip consolidation and route optimization—as heavy trucks are more environmentally damaging than consumers’ cars. Retailers are increasingly promising faster and cheaper deliveries to gain share of online customers—which carries much higher consequences for the environmental impact of a brand or retailer, with increased carbon emissions from more delivery vehicles on the road and more miles being traveled (as trips are not consolidated). Online returns exacerbate this issue (which we discussed earlier).

In order to reduce their environmental impact, e-commerce players should focus on the last mile: Sustainability strategies should be driven by logistics to factor in a company’s carbon footprint—balancing the need to meet customer demand with environmentally friendly practices in deliveries and returns is key.

5. Fashion Shoppers Cannot Make Sustainable ChoicesFast fashion provides consumers with the ability to buy more clothes for less, but this has an environmental toll due to fast delivery services (see previous section) and textile waste. According to the EPA, nearly 9.1 million tons of clothing and footwear ended up in landfills in 2018 (latest data available)—up from 6.5 million tons in 2010. In 2018, textile waste (mainly discarded clothing and footwear, but also carpets, sheets, towels, and tires) accounted for 7.7% of all municipal solid waste in landfills. This represents a huge waste of the water, energy and raw materials used to produce the clothing. In addition, according to the World Economic Forum, fashion production is responsible for 10% of all carbon emissions.

It is important that fashion shoppers make sustainable choices to reduce landfill and other waste—and many governments and organizations are mandating and facilitating change to this end. For example, the French Parliament approved an expansive climate bill in July 2021 that will introduce mandatory “carbon labels” for goods and services, including clothing and textiles, as part of an effort to inform consumers about the environmental impact of their purchasing decisions.

Retailers and brands have a responsibility to educate consumers and offer more sustainable apparel options—and resale and rental services are gaining traction among consumers. According to online consignment platform ThredUp, returning a singular item of clothing into the circular economy extends its life by an average of 2.2 years and reduces its carbon, waste and water footprints by 82%.

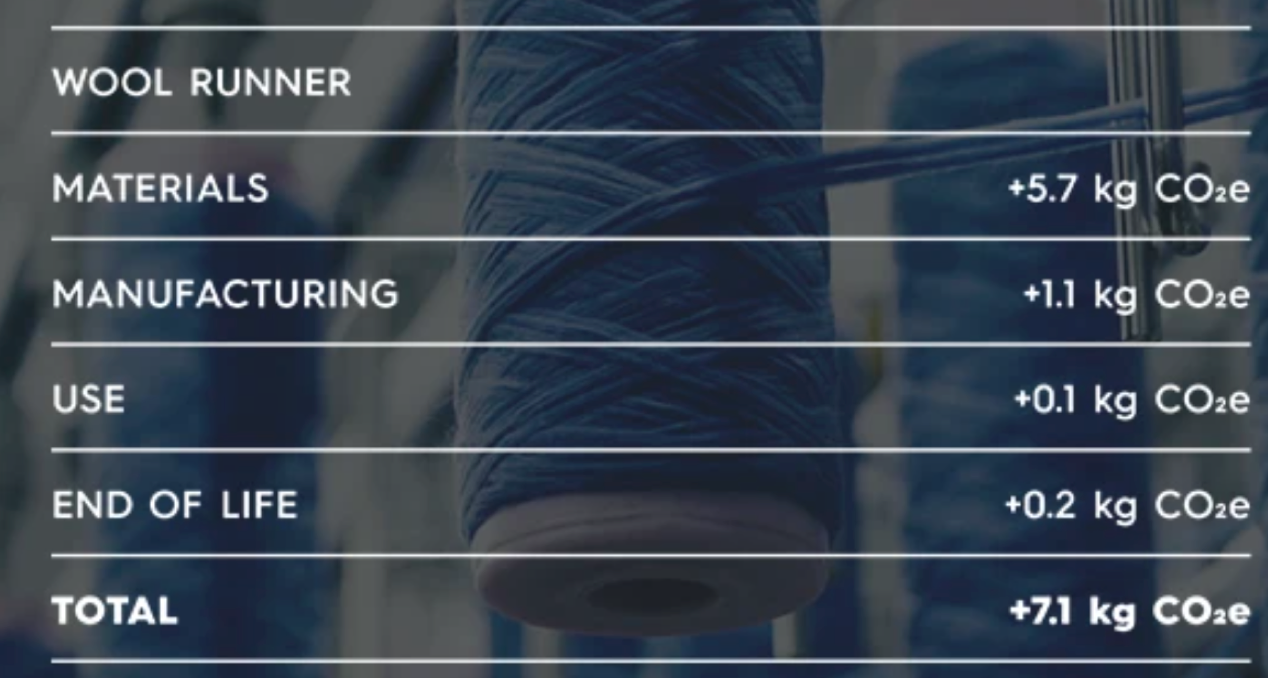

Some retailers are leading the way in making more sustainable choices in the production of clothing and footwear. Footwear brand and B Corporation Allbirds measures the carbon footprint of its products and shares this information with shoppers (see image below).

[caption id="attachment_132435" align="aligncenter" width="700"] Carbon footprint of the Allbirds Wool Runner shoes

Carbon footprint of the Allbirds Wool Runner shoesSource: Allbirds[/caption]