DIpil Das

Introduction

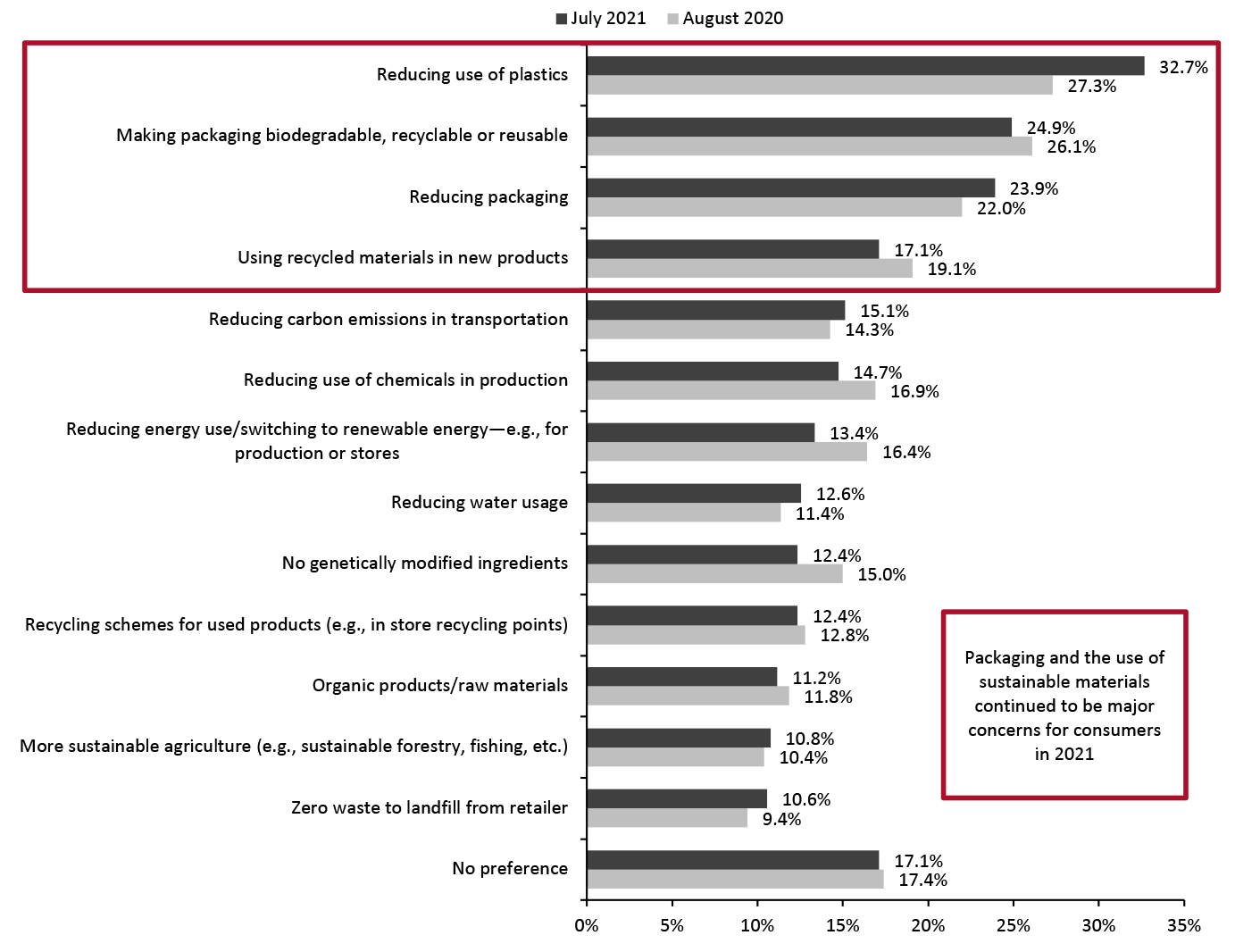

What’s the Story? Sustainability is becoming an even greater focus for organizations globally. We are ticking closer to the 2030 deadline for the 17 Sustainable Development Goals (SDGs) of the United Nations (UN). SDG #12, which focuses on responsible supply chains, and SDG #13, which looks at climate change, are in the spotlight for governments and companies alike. We identify multiple aspects of the supply chain that present opportunities for “greening”—i.e., implementing practices that are environmentally friendly. We examine these aspects through the lens of Coresight Research’s proprietary framework for environmental sustainability in retail, EnCORE. And discuss potential challenges and opportunities for retailers. Why It Matters Greening supply chains is a complex effort, not least because supply chains themselves are complex: In addition to the involvement of several parties—such as suppliers, agents, subcontractors, forwarders and shippers—supply chains have strict budgets and timelines to maintain, as well as stringent quality and compliance measures. Moreover, some of these aspects must be tailored to the specific sectors in which retailers operate, complicating the supply chain further for multicategory retailers. The Covid-19 pandemic has stressed the importance of agile and resilient supply chains across industries, with retailers facing unprecedented challenges, from costs related to unsold stock to manufacturer shutdowns to shipping bottlenecks. Many have been forced to rethink processes in order to remain cost effective while protecting themselves against global shocks. However, retailers should consider the tradeoff between costs and sustainability in the new strategies they look to implement. Investors are increasingly demanding that retailers focus on environmental, social and corporate governance (ESG) aspects and are transparent with their ESG goals and progress—and employees want to work for companies whose environmental and societal values align with their own. Consumers, too, continue to be conscious of the environmental impacts of their shopping decisions. In terms of types of sustainability practices that consumers consider the most important for retailers, reducing plastics takes the lead, according to findings from a Coresight Research survey of US consumers conducted on July 26, 2021. Our survey underscores that packaging is a major sustainability concern for consumers. Making packaging biodegradable, recyclable or reusable was ranked the second-most important sustainability action for retailers, followed by reducing packaging.Figure 1. Aspects of Sustainable/Eco-Friendly Consumption That Are Important to US Consumers [caption id="attachment_142982" align="aligncenter" width="701"]

Respondents could select up to three options or “No preference”

Respondents could select up to three options or “No preference” Base: US Internet users aged 18+, surveyed in August 2020 and July 2021

Source: Coresight Research [/caption]

Greening Supply Chains: Coresight Research Analysis

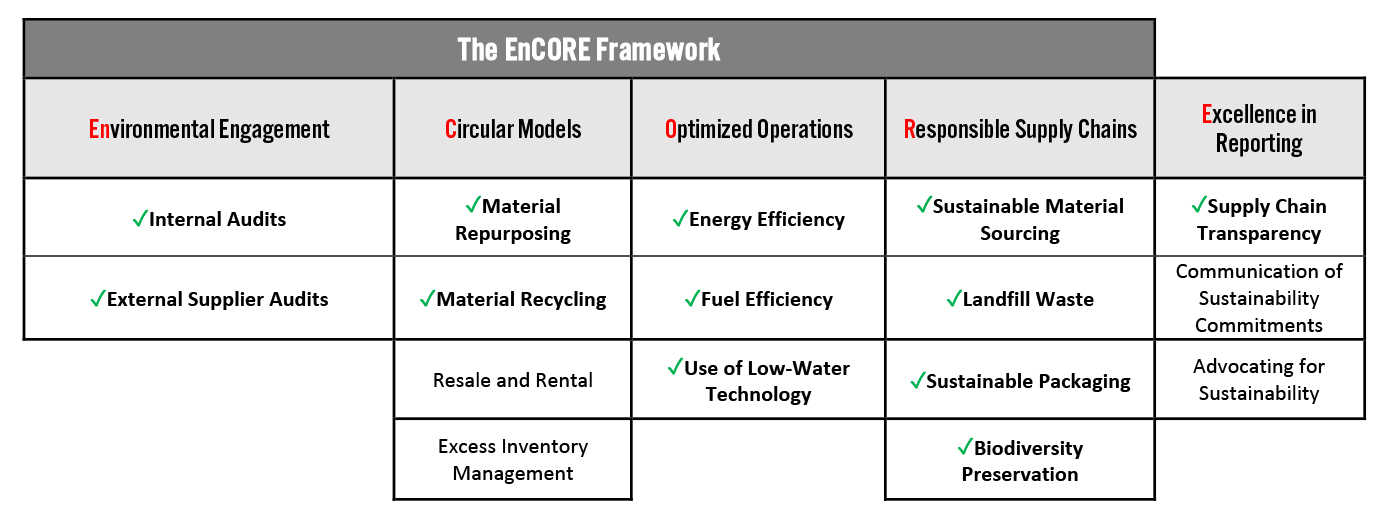

Coresight Research’s EnCORE framework comprises five components (see Figure 2), providing a model through which retailers can begin to internalize a sustainability strategy, boosting profits and driving growth while realizing environmental benefits.- For further discussion around the development of sustainability in retail and the five components of our EnCORE framework, read our free report, The Time for Sustainability in Retail Is Now.

Figure 2. Coresight Research’s EnCORE Framework for Sustainability in Retail [caption id="attachment_132363" align="aligncenter" width="580"]

Source: Coresight Research[/caption]

Elements under all five of the framework’s components are relevant to sustainability in sourcing (see bullets below and Figure 3). By implementing goals and actions that align with the highlighted elements, brands and retailers can reduce their impact on the environment—which should support them in attracting and retaining new customers and investors.

Source: Coresight Research[/caption]

Elements under all five of the framework’s components are relevant to sustainability in sourcing (see bullets below and Figure 3). By implementing goals and actions that align with the highlighted elements, brands and retailers can reduce their impact on the environment—which should support them in attracting and retaining new customers and investors.

- Environmental engagement—It is important to establish a strong sustainability strategy that begins at the top tier of organizations, beginning with internal audits. However, the responsibility of a brand’s or retailer’s environmental impact extends beyond their own footprint; external audits of first- and second-tier suppliers are essential in ensuring adherence to sustainable practices.

- Circular models—Better design at a product’s inception, the implementation of end-of-product-lifecycle programs and taking positive action to use alternative or repurposed materials would reduce waste and returns, and, in turn, reduce excess or unsold inventory.

- Optimized operations—Lower energy, water and fuel consumption at all levels of production will contribute to a greener supply chain.

- Responsible supply chains—A green supply chain strategy should consider sustainable material sourcing and packaging, reducing landfill waste and supporting biodiversity preservation.

- Excellence in reporting—Companies need to have enterprise-level aims that are communicated to internal and external stakeholders, and be transparent with all parties about accountability and progress.

Figure 3. The EnCORE Framework: Elements Related to Sustainability in Sourcing [caption id="attachment_142968" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Greening Opportunities Through the Retail Supply Chain

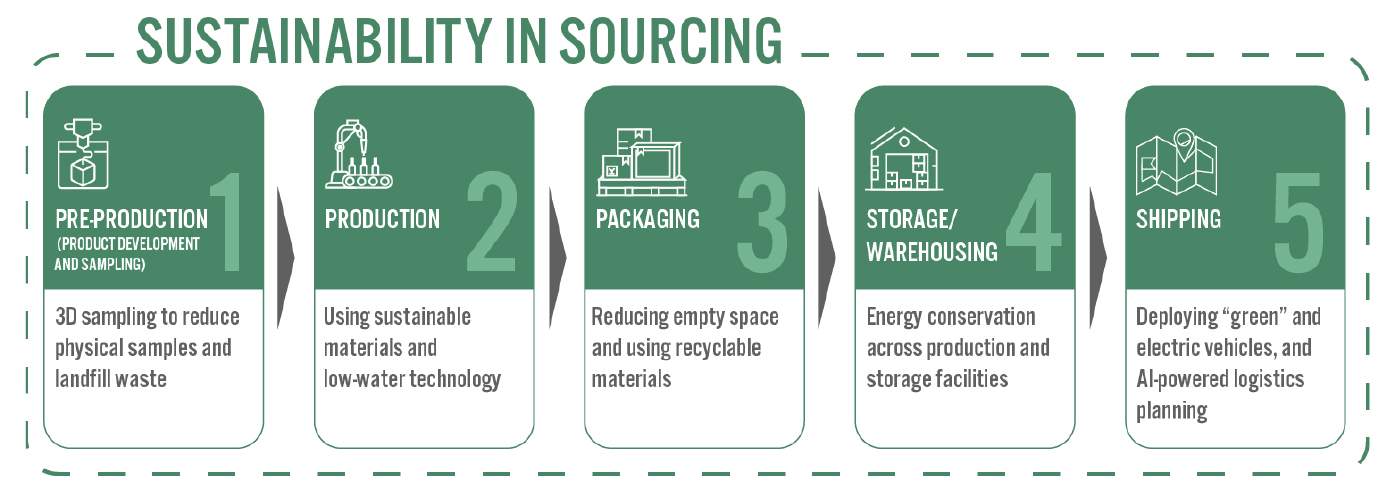

Aligning with the elements under the EnCORE framework, we present challenges and opportunities in greening across different stages of the supply chain, with contextual discussion for various retail sectors.

Source: Coresight Research[/caption]

Greening Opportunities Through the Retail Supply Chain

Aligning with the elements under the EnCORE framework, we present challenges and opportunities in greening across different stages of the supply chain, with contextual discussion for various retail sectors.

Figure 4. Sustainability in Sourcing: Greening Opportunities at Various Stages in the Retail Supply Chain [caption id="attachment_142969" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Pre-Production (Product Development and Sampling)

Challenge: Creating samples helps brands and retailers to understand a product’s viability and incorporate changes before bulk production. Product sampling remains predominantly offline, with brands and retailers continuing to rely heavily on physical samples. Manufacturers are often located in different countries to retailers, so product samples and prototypes are required to be shipped globally.

Source: Coresight Research[/caption]

Pre-Production (Product Development and Sampling)

Challenge: Creating samples helps brands and retailers to understand a product’s viability and incorporate changes before bulk production. Product sampling remains predominantly offline, with brands and retailers continuing to rely heavily on physical samples. Manufacturers are often located in different countries to retailers, so product samples and prototypes are required to be shipped globally.

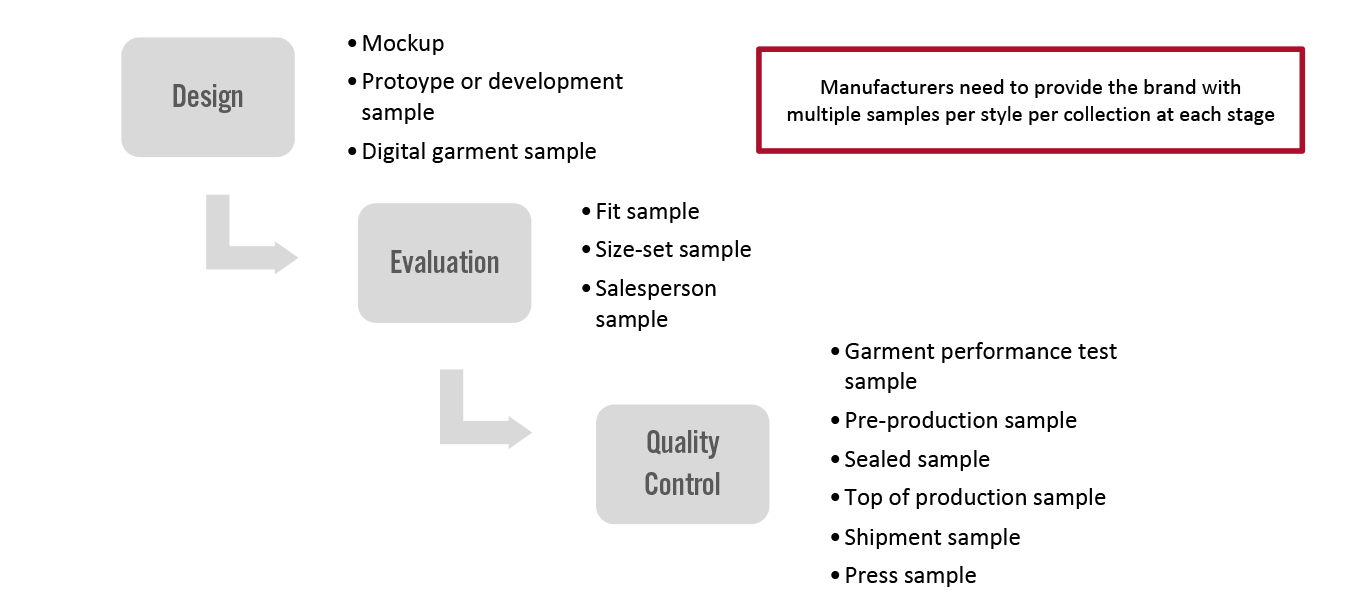

- In the apparel sector, there are 12 types of sampling that span the pre-production and production stages, according to fashion sample-making application Techpacker (see Figure 5). Multiple samples are typically created per style per collection, creating huge amounts of waste.

Figure 5. Sampling in Clothing Pre-Production [caption id="attachment_142970" align="aligncenter" width="700"]

Source: Techpacker[/caption]

Source: Techpacker[/caption]

- The pre-production stage in other markets, including furniture, nonfood CPG and processed food, involve the production of samples as part of product design and development.

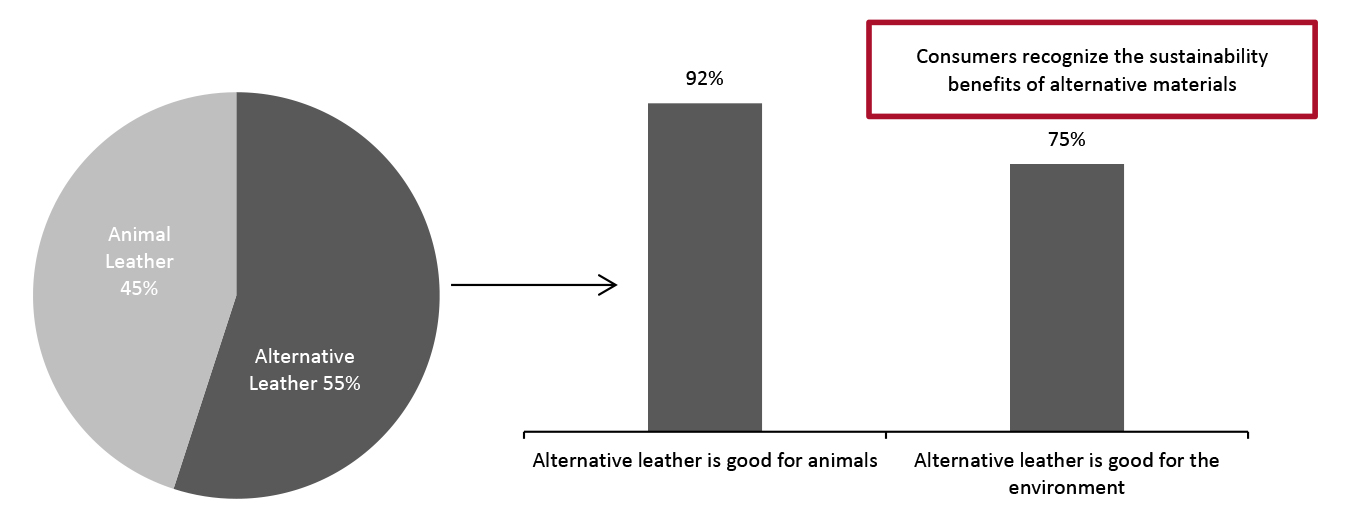

Figure 6. US Consumers’ Preference for Animal Leather Versus Alternative Leather (Left) and Top Reasons for Preference (Right) (% of Respondents) [caption id="attachment_142971" align="aligncenter" width="700"]

Base: 519 US consumers aged 18–74

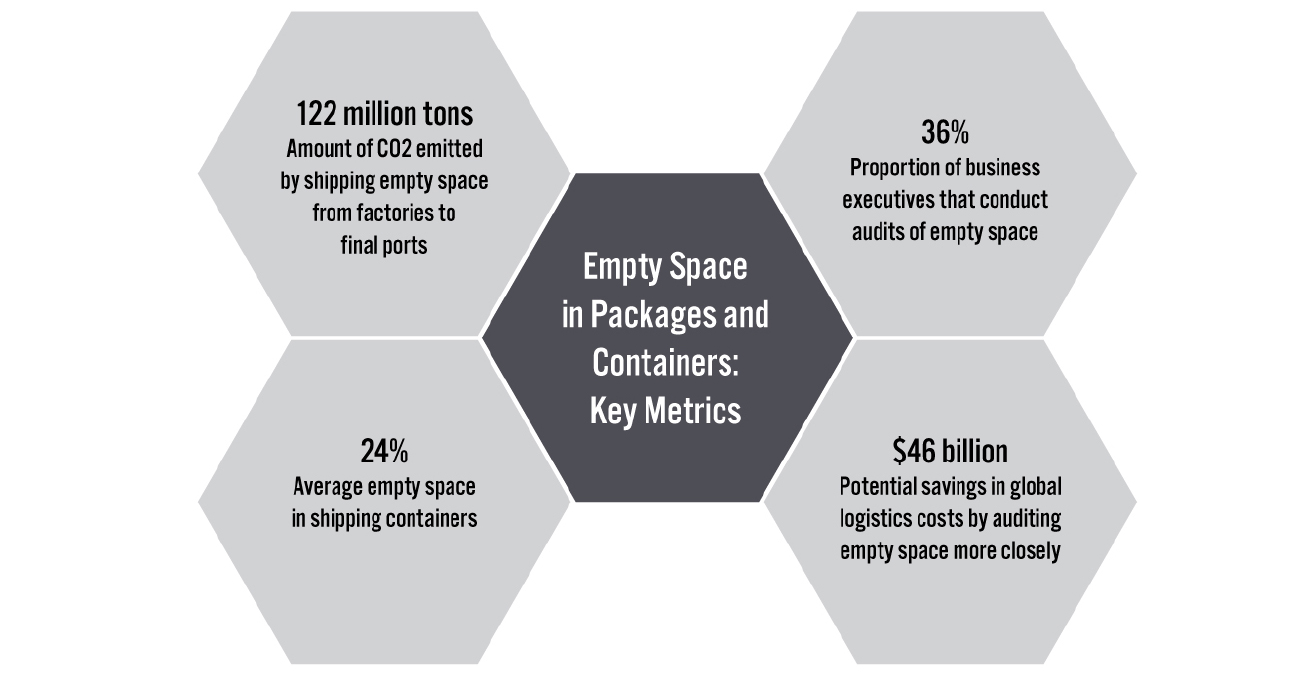

Base: 519 US consumers aged 18–74 Source: Materials Innovation Initiative [/caption] Packaging Challenge: Packaging has obvious negative impacts in the waste stream, and recent conversations have focused in particular around the detrimental impacts of plastic packaging on land and in oceans. Consumers and companies alike recognize there must be renewed urgency in driving down packaging waste. As highlighted by our consumer survey (Figure 1), packaging is a leading sustainability concern for consumers. Making packaging biodegradable, recyclable or reusable, and reducing packaging were two of the top three aspects of sustainability that US consumers consider most important for retailers, according to our August 2020 survey. Upstream, there are meaningfully negative impacts in terms of carbon footprint—not simply in the production of packaging but in shipping what often ends up being “empty space” halfway around the world. For retailers, this empty space equates to more shipping costs, as they pay to ship often-light but regularly space-wasting packaging from offshore production centers. According to a report from packaging firm DS Smith and Forbes Insights, some 24% of total shipping space is empty, on average, and about 122 million tons of carbon dioxide are emitted annually due to shipping empty space from manufacturers to the receiving ports. Inefficient packaging can also negatively impact brand perception among consumers. Research from DS Smith found that 93% of consumers have received packages with wasted space, and 73% have received packages that were twice the size or more needed for its contents. This has adversely impacted consumers’ impressions of the companies they ordered from, as 54% stated they would rethink ordering again from a firm that had too much space in its packaging. Greening Opportunities Brands can look to the “Responsible supply chains” component of the EnCORE framework to address this challenge. Brands will need to rethink their packaging designs to reduce empty space, and they can implement stricter audits for the use of space in packages—thus reducing carbon emissions associated with shipping as well as landfill waste. DS Smith estimates that reducing unnecessary space in packaging could result in $46 billion of global logistics costs annually. According to DS Smith and Forbes Insights, 93% of 370 global executives across retail and logistics have taken steps to lessen the environmental impact of packaging, but only 36% have conducted audits of empty space in shipping goods. Packaging audits are necessary not just for retailers to save costs and lessen their environmental impact but also to ensure that packaging does not negatively impact brand perception.

Figure 7. Empty Space in Packages and Containers: Key Metrics [caption id="attachment_142972" align="aligncenter" width="700"]

Source: DS Smith/Forbes Insights[/caption]

Brands and retailers should consider incorporating practical ways to reduce waste in packaging, such as through repurposing initiatives in which they take back product containers from consumers, or by encouraging customers to reuse packaging. This links closely with ensuring that the packaging material is sustainable, rather than using plastics: For example, some brands’ packaging is “paper that can be planted,” as it contains seeds, while others use recycled, recyclable or biodegradable materials.

While these solutions may not be suitable for all kinds of products (food, for example, needs specific packaging to maintain freshness and hygiene), brands and retailers across many sectors could experiment with alternative materials and innovations in packaging reuse to support sustainability.

Storage/Warehousing

Challenge: Production facilities, warehouses and retailers tend to consume tremendous amounts of energy for their day-to-day energy needs. Energy efficiency is critical for all supply chain parties to reduce the environmental impacts of their operations, and this is an important consideration in the warehousing of products. Until goods can be shipped, manufacturers need to store them securely, and considerations vary by sector—with some food items requiring temperature-controlled storage environments, for example.

Greening Opportunities

Brands and retailers can look to the “Environmental engagement”, “Optimized operations” and “Excellence in reporting” components of the EnCORE framework and should outline energy-conserving storage practices as part of their supplier code of conduct.

Many companies are working to actively reduce energy consumption and pollution, but this needs to be done at scale to observe a meaningful impact, which may require dedicated, incremental efforts. Companies need to have energy conservation at the heart of their strategy and build out policies around it.

There are several ways in which companies can reduce electricity use during manufacturing. Cloud computing consolidates computer tasks, and major computing centers should use solar power where possible. This can also cut down on carbon emissions. Manufacturers should also elect to schedule manufacturing at night when demand for electricity is lower, thus reducing the load on the central power grids and reaping the benefits of lower-cost night-time electricity.

Shipping and Distribution

Challenge: The distances between factories, warehouses, ports and destination markets have long been under scrutiny due to freight pollution. Recent diplomatic tensions between production-heavy China and a number of its import partners, as well as the impacts of the Covid-19 pandemic—have urged retailers to rethink and diversify sourcing locations.

Greening Opportunities

At a fundamental level, reshoring and nearshoring can help reduce freight pollution and cut transport times (and costs) from factory to port, port to port, and port to warehouse to store, while also reducing additional packaging required for long-haul transportation. However, there may be other cost advantages of manufacturing in specific countries further afield.

Retailers could consider sourcing a number of goods in the countries they sell, and to an extent, governments have mandated this for foreign brands in a country. For example, the Indian government has mandated that foreign brands selling in India need to source 30% of their goods domestically, and if they are already sourcing for their global needs in India, it can be offset against this limit. This has had an unlikely positive effect on greening the supply chain as brands that source in proximity to their consumer market save on time and costs spent on overseas transport.

Beyond reshoring and nearshoring, companies can look to the “Optimized operations” component and seek to achieve fuel efficiency by leveraging technologies. For example, “green” or electric vehicles are being adopted more widely across industries.

In addition, AI-powered logistics planning technologies can help identify optimal routes for transport and delivery, loads that carriers can take, the optimal combinations in size and weight distribution and the combination of parcels/packages to achieve the most efficient delivery routes. Of course, the applications need to be tailored to the specific mode of transport, to factor in type of terrain, traffic and weather conditions, for example.

Challenges in Implementing Sustainability Initiatives at the Supply Chain Level

Lack of Visibility into Supplier Infrastructure and Subcontractors

Retailers and brands may not always have full visibility into the suppliers’ procurement processes. While companies have better visibility over first-tier suppliers (those with which they have direct contact), they also have to manage more operational processes compared to having suppliers manage some aspects of procurement. Additionally, suppliers that are unable to complete all aspects of production within their facilities or are unable to produce all materials necessary for production internally, may subcontract to additional factories. Brands and retailers do not have direct contact with these second-tier suppliers.

Retailers and brands should establish policies for second-tier suppliers and have their first-tier suppliers ensure that all parties are adhering to them. Retailers and brands must undertake visits to and audits of second-tier suppliers to ensure adherence, or appoint agents to carry out these audits.

Varying Sustainability Standards Between Sectors

Raw materials manufacturers and processors are likely to face challenges in supplying materials to numerous industries. For example, aluminum sheet makers cater to food packaging firms, cookware and home appliance makers, automotive manufacturers and other sectors, and sustainability standards laid out by each sector and individual business may vary.

Raw materials manufacturers and suppliers should therefore look to adhere to the highest/strictest standards across the board to avoid losing out on the benefits of economies of scale—as long as those standards allow processes to meet the quality standards outlined by each sector. Organization-level policies need to include strategies to tackle such conflicts and the best practices to follow in the case of varying standards.

Conflicts Between Sustainability and Procurement Strategies

Sustainability and procurement tend to be performed by different teams at the category level within a single organization. These teams will work toward the ideal goals for their specific teams, which could lead to conflicting priorities. For example, a procurement team may work with a specific supplier to benefit from cost savings, but a sustainability team could advise against it if the supplier has a known history of disregarding sustainability practices.

Conflicts such as these emphasize the importance of establishing a strong sustainability strategy that begins at the top tier of organizations. Building on internal audits, plans should be put into place to address issues that may arise, and continuous updates regarding their status should be provided to relevant teams.

Organization-level strategies are typically broken down to function- and category-level goals for teams to work toward. Having policies or handbooks with sustainability at their center can help teams address conflict areas cohesively and achieve results collectively.

Pressure on Supply Chains Through Trade Disputes

Companies may need to revise their sourcing strategies to achieve cost efficiencies if trade disputes increase the burden on the supply chain, and sometimes, these revisions could result in less-green alternatives in parts of the organization.

If companies are left with no choice but to follow less-green alternatives for specific processes, they must look to offset that with new or additional processes. For example, if companies need to source from a new country further away than the original source country, they should look at ways to offset the carbon footprint of longer transport routes by reducing physical sampling, cutting out empty space in packaging and so on.

Policies at the Industry and Country Levels

Companies stand to benefit if they collaborate with others in their industry for sourcing and transportation. While sourcing at scale is cost-effective, it also helps cut down some processes at scale which could ultimately benefit the environment, such as fewer trucks used for transportation when brands consolidate shipments.

Meaningful change also comes from governments formulating legislation and defining targets for their country to achieve. For example, China has laid out clearly defined targets in its latest five-year plan to help green the country’s industrial landscape. For example, China aims to promote green development by increasing the forest coverage rate to 24.1% by 2025 (from 23.2% in 2020) and the ratio of days with good air quality in prefectural-level cities and above to 87.5% (from 87% in 2020).

China also seems to be ahead in innovating for the environment. The number of environment-related patents in China has grown by 60X between 1990 and 2014, compared to only 3X across the Organization of Economic Cooperation and Development (OECD) region, according to a 2018 OECD report.

Other countries could take a leaf from China’s book to establish measurable sustainability goals and policies that companies across industries need to collectively work on and for synergies to be formed between industries. Centrally planning some policies will help countries to drive participation between stakeholders across multiple industries, resulting in long-standing change as companies or single industries in isolation will have a smaller impact than the collective impact of many industries.

The Role of Technology in Sustainable Sourcing

A number of new technologies can help businesses better connect complex supply chains, improve transparency, gain insightful analysis and make decisions that positively impact operations and profits. We discuss some of these technologies below.

Source: DS Smith/Forbes Insights[/caption]

Brands and retailers should consider incorporating practical ways to reduce waste in packaging, such as through repurposing initiatives in which they take back product containers from consumers, or by encouraging customers to reuse packaging. This links closely with ensuring that the packaging material is sustainable, rather than using plastics: For example, some brands’ packaging is “paper that can be planted,” as it contains seeds, while others use recycled, recyclable or biodegradable materials.

While these solutions may not be suitable for all kinds of products (food, for example, needs specific packaging to maintain freshness and hygiene), brands and retailers across many sectors could experiment with alternative materials and innovations in packaging reuse to support sustainability.

Storage/Warehousing

Challenge: Production facilities, warehouses and retailers tend to consume tremendous amounts of energy for their day-to-day energy needs. Energy efficiency is critical for all supply chain parties to reduce the environmental impacts of their operations, and this is an important consideration in the warehousing of products. Until goods can be shipped, manufacturers need to store them securely, and considerations vary by sector—with some food items requiring temperature-controlled storage environments, for example.

Greening Opportunities

Brands and retailers can look to the “Environmental engagement”, “Optimized operations” and “Excellence in reporting” components of the EnCORE framework and should outline energy-conserving storage practices as part of their supplier code of conduct.

Many companies are working to actively reduce energy consumption and pollution, but this needs to be done at scale to observe a meaningful impact, which may require dedicated, incremental efforts. Companies need to have energy conservation at the heart of their strategy and build out policies around it.

There are several ways in which companies can reduce electricity use during manufacturing. Cloud computing consolidates computer tasks, and major computing centers should use solar power where possible. This can also cut down on carbon emissions. Manufacturers should also elect to schedule manufacturing at night when demand for electricity is lower, thus reducing the load on the central power grids and reaping the benefits of lower-cost night-time electricity.

Shipping and Distribution

Challenge: The distances between factories, warehouses, ports and destination markets have long been under scrutiny due to freight pollution. Recent diplomatic tensions between production-heavy China and a number of its import partners, as well as the impacts of the Covid-19 pandemic—have urged retailers to rethink and diversify sourcing locations.

Greening Opportunities

At a fundamental level, reshoring and nearshoring can help reduce freight pollution and cut transport times (and costs) from factory to port, port to port, and port to warehouse to store, while also reducing additional packaging required for long-haul transportation. However, there may be other cost advantages of manufacturing in specific countries further afield.

Retailers could consider sourcing a number of goods in the countries they sell, and to an extent, governments have mandated this for foreign brands in a country. For example, the Indian government has mandated that foreign brands selling in India need to source 30% of their goods domestically, and if they are already sourcing for their global needs in India, it can be offset against this limit. This has had an unlikely positive effect on greening the supply chain as brands that source in proximity to their consumer market save on time and costs spent on overseas transport.

Beyond reshoring and nearshoring, companies can look to the “Optimized operations” component and seek to achieve fuel efficiency by leveraging technologies. For example, “green” or electric vehicles are being adopted more widely across industries.

In addition, AI-powered logistics planning technologies can help identify optimal routes for transport and delivery, loads that carriers can take, the optimal combinations in size and weight distribution and the combination of parcels/packages to achieve the most efficient delivery routes. Of course, the applications need to be tailored to the specific mode of transport, to factor in type of terrain, traffic and weather conditions, for example.

Challenges in Implementing Sustainability Initiatives at the Supply Chain Level

Lack of Visibility into Supplier Infrastructure and Subcontractors

Retailers and brands may not always have full visibility into the suppliers’ procurement processes. While companies have better visibility over first-tier suppliers (those with which they have direct contact), they also have to manage more operational processes compared to having suppliers manage some aspects of procurement. Additionally, suppliers that are unable to complete all aspects of production within their facilities or are unable to produce all materials necessary for production internally, may subcontract to additional factories. Brands and retailers do not have direct contact with these second-tier suppliers.

Retailers and brands should establish policies for second-tier suppliers and have their first-tier suppliers ensure that all parties are adhering to them. Retailers and brands must undertake visits to and audits of second-tier suppliers to ensure adherence, or appoint agents to carry out these audits.

Varying Sustainability Standards Between Sectors

Raw materials manufacturers and processors are likely to face challenges in supplying materials to numerous industries. For example, aluminum sheet makers cater to food packaging firms, cookware and home appliance makers, automotive manufacturers and other sectors, and sustainability standards laid out by each sector and individual business may vary.

Raw materials manufacturers and suppliers should therefore look to adhere to the highest/strictest standards across the board to avoid losing out on the benefits of economies of scale—as long as those standards allow processes to meet the quality standards outlined by each sector. Organization-level policies need to include strategies to tackle such conflicts and the best practices to follow in the case of varying standards.

Conflicts Between Sustainability and Procurement Strategies

Sustainability and procurement tend to be performed by different teams at the category level within a single organization. These teams will work toward the ideal goals for their specific teams, which could lead to conflicting priorities. For example, a procurement team may work with a specific supplier to benefit from cost savings, but a sustainability team could advise against it if the supplier has a known history of disregarding sustainability practices.

Conflicts such as these emphasize the importance of establishing a strong sustainability strategy that begins at the top tier of organizations. Building on internal audits, plans should be put into place to address issues that may arise, and continuous updates regarding their status should be provided to relevant teams.

Organization-level strategies are typically broken down to function- and category-level goals for teams to work toward. Having policies or handbooks with sustainability at their center can help teams address conflict areas cohesively and achieve results collectively.

Pressure on Supply Chains Through Trade Disputes

Companies may need to revise their sourcing strategies to achieve cost efficiencies if trade disputes increase the burden on the supply chain, and sometimes, these revisions could result in less-green alternatives in parts of the organization.

If companies are left with no choice but to follow less-green alternatives for specific processes, they must look to offset that with new or additional processes. For example, if companies need to source from a new country further away than the original source country, they should look at ways to offset the carbon footprint of longer transport routes by reducing physical sampling, cutting out empty space in packaging and so on.

Policies at the Industry and Country Levels

Companies stand to benefit if they collaborate with others in their industry for sourcing and transportation. While sourcing at scale is cost-effective, it also helps cut down some processes at scale which could ultimately benefit the environment, such as fewer trucks used for transportation when brands consolidate shipments.

Meaningful change also comes from governments formulating legislation and defining targets for their country to achieve. For example, China has laid out clearly defined targets in its latest five-year plan to help green the country’s industrial landscape. For example, China aims to promote green development by increasing the forest coverage rate to 24.1% by 2025 (from 23.2% in 2020) and the ratio of days with good air quality in prefectural-level cities and above to 87.5% (from 87% in 2020).

China also seems to be ahead in innovating for the environment. The number of environment-related patents in China has grown by 60X between 1990 and 2014, compared to only 3X across the Organization of Economic Cooperation and Development (OECD) region, according to a 2018 OECD report.

Other countries could take a leaf from China’s book to establish measurable sustainability goals and policies that companies across industries need to collectively work on and for synergies to be formed between industries. Centrally planning some policies will help countries to drive participation between stakeholders across multiple industries, resulting in long-standing change as companies or single industries in isolation will have a smaller impact than the collective impact of many industries.

The Role of Technology in Sustainable Sourcing

A number of new technologies can help businesses better connect complex supply chains, improve transparency, gain insightful analysis and make decisions that positively impact operations and profits. We discuss some of these technologies below.

- For more on the modern, technology-powered supply chain, the benefits of supply chain visibility and leading software vendors in the space, read our separate report, Supply Chain Visibility: Beyond the Control Tower.

What We Think

Sustainability is emerging as a key focus to global organizations even as we approach the 2030 deadline for the 17 Sustainable Development Goals of the UN. Greening supply chains is complex as there are several facets that retailers need to consider, and a number of parties that are responsible for various processes that they need to involve. The pandemic has brought to the fore the vulnerabilities of supply chains across industries, and has prompted companies to rethink processes to insulate them to global shocks. As retailers are likely to overhaul many aspects of the supply chain, they should consider the tradeoff between costs and sustainability in the new strategies they are likely to implement. Moreover, investors are increasingly demanding that retailers focus on sustainability policies, and consumers are ever more conscious of their shopping behavior. Implications for Brands/Retailers- Organizations need to consider greening initiatives at every stage of sourcing and implement them incrementally. The Coresight Research EnCORE framework provides a model through which retailers can begin to do this.

- Sustainability should be integral to the overall business strategy of all brands and retailers. Companies need to have enterprise-level aims into which teams feed goals specific to their processes. Each team should communicate these goals to their reportees and external stakeholders, and establish singular points of contact for accountability and progress.

- As organizations work toward their sustainability goals, they should implement a continual process of evaluation whereby goalposts are adjusted in line with increased expectations on baseline standards as original goals are achieved.

- Companies should establish handbooks with procedures that can be rolled out company-wide and to their broader industry ecosystem to embed sustainable practices and enable compliance monitoring.

- Builders and operators of factories, warehouses, distribution centers and other commercial spaces should keep in mind future sustainability goals and look to implement environmentally friendly options from the time new facilities are being built, as retrofitting facilities at a later point could be an expensive activity.

- Retailers and manufacturers may be more likely to buy or lease spaces that already adhere to, or make provisions for, sustainable practices.