DIpil Das

Introduction

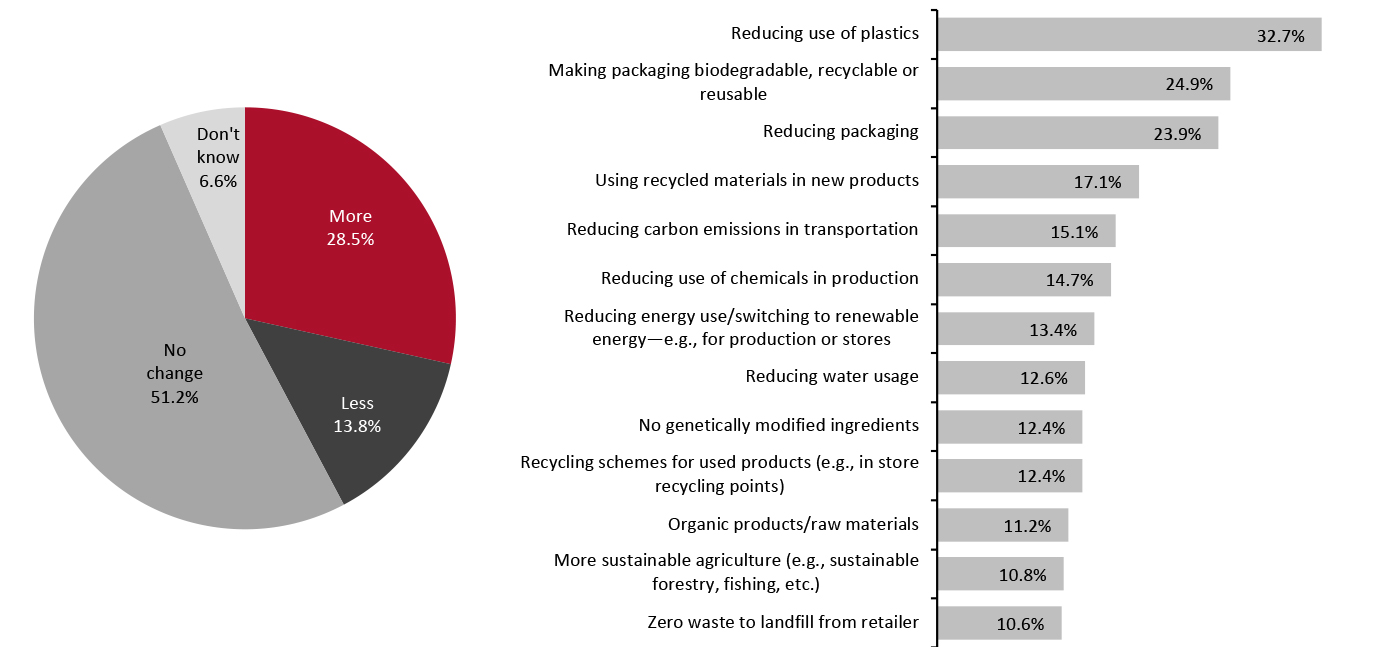

What’s the Story? Sustainability has been front-and-center in companies’ strategies in recent years, with the pandemic underscoring its importance for consumers and businesses alike. In the luxury sector, companies have been, or at least appear to be, more vocal about issues concerning sustainability, and have implemented strategies for the same. Coresight Research has identified sustainability as a key trend to watch in global retail in 2022 and beyond. In this report, we explore how luxury companies have approached sustainability and how they can best position themselves to meet consumer demand for increased environmental accountability, through the lens of our proprietary EnCORE framework for sustainability in retail. Why It Matters Consumers are increasingly concerned about aspects related to sustainability when they shop. In our US consumer survey from July 26, 2021, we asked respondents about their attitudes toward sustainability and how it affects their shopping behavior. Almost 30% of US consumers report that the pandemic has made sustainability more important for them when shopping, according to Coresight Research survey data. We asked consumers what they considered the most important types of sustainability measures for retailers to undertake—reducing plastic use and making packaging reusable, recyclable or biodegradable came out on top.Figure 1. All Respondents: Whether the Covid-19 Crisis Has Made Environmental Sustainability More or Less of a Factor to Them When Shopping (% of Respondents; Left) and Which Types of Environmental Sustainability They Consider To Be the Most Important for Retailers (% of Respondents; Right) [caption id="attachment_146308" align="aligncenter" width="701"]

Base: US respondents aged 18+

Base: US respondents aged 18+ Source: Coresight Research [/caption] We believe that sustainability principles are universal and that consumers around the world, including luxury consumers, feel similarly conscious of sustainability. Even after the pandemic subsides, we expect consumers to continue to place significant emphasis on the sustainability of their consumption choices.

Sustainability in Luxury: Coresight Research Analysis

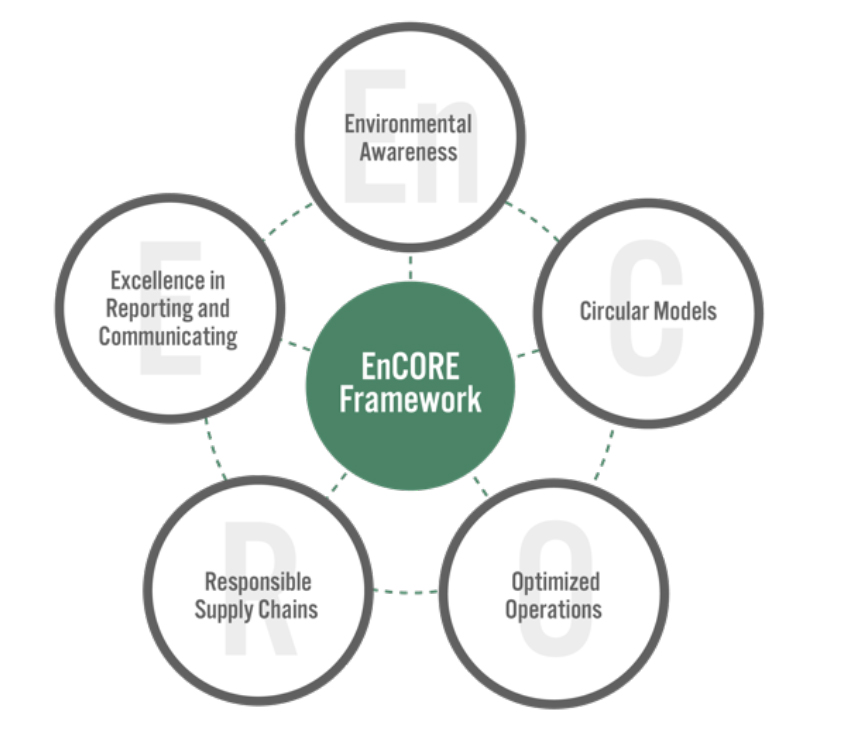

Coresight Research has developed the EnCORE framework for sustainability, which brands and retailers can leverage to develop their sustainability strategies.Figure 2. Coresight Research’s EnCORE Framework for Sustainability in Retail [caption id="attachment_146309" align="aligncenter" width="600"]

Source: Coresight Research[/caption]

1. Environmental Awareness

Environmental awareness is the foundation for creating a sustainability strategy, and it starts with reflecting on how the luxury industry impacts the environment.

Luxury brands and retailers must not only have an astute awareness of the environmental impacts of their own operations but also be aware of competitor and industry practices. Businesses should draw on the views of all stakeholders and understand what consumers want in terms of sustainability.

External research helps validate internal thinking and investigations, as well as providing businesses with a wider spectrum of ideas to help them gain competitive advantage. Luxury brands and retailers should leverage external sources to bring fresh ideas, knowledge and experience into their businesses. Three ways they can do this are:

Source: Coresight Research[/caption]

1. Environmental Awareness

Environmental awareness is the foundation for creating a sustainability strategy, and it starts with reflecting on how the luxury industry impacts the environment.

Luxury brands and retailers must not only have an astute awareness of the environmental impacts of their own operations but also be aware of competitor and industry practices. Businesses should draw on the views of all stakeholders and understand what consumers want in terms of sustainability.

External research helps validate internal thinking and investigations, as well as providing businesses with a wider spectrum of ideas to help them gain competitive advantage. Luxury brands and retailers should leverage external sources to bring fresh ideas, knowledge and experience into their businesses. Three ways they can do this are:

- Enlist specialist advisors and consultants to review existing practices, identify areas of improvement and risk mitigation, and provide input on formulating sustainability goals.

- Collaborate with environmentally focused nongovernmental organizations that could help provide insights into working with fewer or less harmful resources. Oeko-Tex, for example, is a group of 17 independent research and test institutes in Europe and Japan that are responsible for developing test methods and formulating standards for sustainable manufacturing. Textile manufacturers that adhere to Oeko-Tex’s standards receive a certification from the group.

- Partner with other brands and retailers to identify and implement sustainability best practices at scale.

- In June 2021, Kering’s Gucci introduced three sneaker models made using a new material, called Demetra. Some 77% of Demetra is comprised of plant-based raw materials including wood pulp from responsibly managed forests and biobased polyurethane from renewable sources. The manufacturing process embraces sustainability by minimizing unusable parts of the materials and reducing waste from cutting. Material offcuts will be upcycled through an extension of the brand’s Gucci-Up upcycling program, which it introduced in 2018.

Gucci sneakers made from eco-conscious fabric Demetra

Gucci sneakers made from eco-conscious fabric Demetra Source: Gucci [/caption]

- LVMH outlined several practices in its 2020 Social and Environmental Responsibility Report, such as reusing precious raw materials and using alternative materials, that it will implement to ensure that it designs all products in an “environmentally friendly way” by 2030. By 2026, the group plans to avoid all use of plastic sourced from fossil fuels and by 2030, it plans to restore 5 million hectares of flora and fauna through regenerative agriculture. It also plans to introduce a program for sustainable innovations in luxury in 2023.

- Introduce upcycling programs where consumers can return their used and worn products for refurbishment or reuse in part or whole.

- Provide repair services for the brand’s products so consumers can get authentic parts for their products as well as after-sales services from the brand itself or authorized sources.

- Partner with rental and resale platforms so that consumers can access the brand’s secondhand products that have been authenticated by the brand themselves or from sources authorized by the brand. Brand owners could also resell their own secondhand products—by being more involved in the resale process, they can have greater control over their brand image and narrative, and recapture value that could otherwise be lost to other sellers.

- Resell unused textiles and materials to other brands and independent designers and buy unused materials from other brands and manufacturers where possible.

- Alexander McQueen has a platform named McQ for consumers to buy and sell the brand’s pre-owned products. McQ collections are designed by a group of designers handpicked by the Alexander McQueen team. Each item of clothing in the collection carries a near-field communication (NFC) chip which allows the garments to be tracked through blockchain technology and sold on its peer-to-peer platform, MYMCQ.

- Richemont-owned Chloé gained B Corp status (a certification awarded to companies that fulfill strict environmental and social impact criteria) in October 2021. The company has several initiatives in place to meet the certification standards, including using lower-impact materials for 90% of its needs, using only recycled wool by 2025 in wool collections, and using only recyclable paper by the end of 2022. It cut out the use of animal fur in its supply chains in 2018 and did the same for animal skins in 2019.

- Rethinking traditional marketing activities and replacing them with ideas that resonate with youthful, conscious shoppers who are open to engaging with products marketed as sustainable. Using social media influencers with strong, dedicated communities is likely to strike a closer chord with consumers than simply using known celebrities in media campaigns, as influencers tend to impart a greater sense of authenticity than distant megastars.

- Sourcing ethically and consciously manufactured or cultivated materials can be challenging. However, as companies optimize operations for sustainability, they will need to outline the costs they are willing to incur and develop guidelines for teams to budget accordingly. For example, sourcing a regular cotton T-shirt may cost $4 while a similar T-shirt made from organic cotton could cost $6 –$8. In these instances, when teams have oversight of the cost of sourcing sustainable items, they can identify other areas to achieve cost savings, for example, within packaging or transport.

- Sustainable sourcing and inventory control of goods not for resale (GNFR) is just as important as goods procured for sale. A Coresight Research survey of retail and CPG executives in February 2021 found that GNFR expenses account for between 11% and 20% of total costs; the share is likely to be similar within the luxury sector as well. Applying strict guidelines to GNFR cost management and leveraging data analytics to assess the sustainability impact of specific expenses can help luxury companies identify ways to streamline operations to reduce environmental impact.

- Since its launch in 2001, Stella McCartney has been committed to not using leather, feathers, fur or skin in its products. Over the last two decades, the brand has shifted to using organic cotton, recycled polyester, paper from sustainably certified wood, and LED bulbs and solar panels for its stores, among other initiatives. In 2017, it introduced its first garment made with silk alternative Microsilk, developed by Bolt Threads, an innovator enabling the luxury ecosystem. The brand has since used mushroom leather developed by the startup in various products.

Clothing made from a leather alternative developed by biotech sustainable material firm Bolt Threads

Clothing made from a leather alternative developed by biotech sustainable material firm Bolt Threads Source: Stella McCartney [/caption]

- Chanel has invested in or acquired clean manufacturing companies as part of its sustainability initiatives. In 2019, Chanel invested in two startups in the sustainable manufacturing sector—chemistry firm Evolved by Nature and cosmetics maker P2 Science. The luxury firm also has a stake in sustainable packaging company Sulapac, and since 2021, all Les Eaux De Chanel 125ml perfume bottles use caps made of a biobased material manufactured by Sulapac.

- More responsible sourcing of raw materials and using relevant technologies, such as blockchain, to improve traceability from source to consumer.

- Supply chain mapping to ensure that principles and policies held by suppliers align with those of the company.

- Aligning fashion calendars with the “new normal” in social protocols dictated by the pandemic, such as creating seasonless or timeless clothing that consumers can wear any time of the year, and emphasizing a make-to-order/on-demand manufacturing strategy. While some consumers may still want the social aspects that fashion weeks present—of seeing and being seen at global fashion events—many consumers have come to realize the wasteful aspects of such limited-time events too. Luxury brands and retailers must be proactive in shaping more conscious consumption habits with the opportunities they provide to consumers.

- Richemont’s Cartier, LVMH and Prada announced the launch of the Aura blockchain consortium in April 2021. The companies claim that it is the first global blockchain in the luxury sector, and will provide consumers with additional traceability and transparency. Consumers can trace the journey of a product from conception to sale and be sure that they receive authentic goods and avoid goods sourced from undesirable locations. Consumers can also trace the journey of resold products.

- Large corporations such as Tapestry hold regular supplier summits and provide training and workshops so that suppliers are knowledgeable about business ethics and anti-corruption practices. In fiscal year 2021 (ended July 3, 2021), Tapestry asked suppliers representing 85% of its purchase volume for handbags and footwear to complete the Higg Facility Environmental Module—a self-assessment tool that standardizes how companies appraise and determine their annual sustainability and environmental performance. Tapestry also partnered with BSR HERproject in fiscal 2021, an organization that implements empowerment initiatives for women working at the factories producing the company’s products.

- After the pandemic broke out in 2020, Gucci steered away from the traditional fashion calendar and unveiled collections outside of the typical fashion timetable. In February 2021, Gucci returned to Milan Fashion Week, its first industry-organized event in two years. Similarly, Kering stablemates Balenciaga and Saint Laurent only showed up at Paris Fashion Week in September 2021, after avoiding live shows since the start of the pandemic. By exhibiting this flexibility in off-calendar shows, these brands are paving the way for more brands to experiment with their fashion timetables and explore more prudent sourcing.

- Stakeholder engagement includes internal stakeholders as well as external players. Engaging with staff helps management identify areas to implement sustainability strategies. Luxury companies will stand to benefit further if they collaborate with others in their industry to exchange ideas and innovative best practices to cement sustainability at the industry level.

- Employing a third-party auditor of sustainability practices will provide luxury companies with objective evaluations—internal audits can sometimes be biased toward the company. An external auditor will also evaluate the company against industry-based criteria and can help the company develop goals across governance, environmental impact and employee diversity and other areas.

- Rolex runs a site called Rolex.org that is dedicated to communicating about its environmental and social initiatives and sits separately to its commercial site. Content on Rolex.org is centered around its “Perpetual” theme and tagline, indicating to consumers that its sustainability initiatives and desire to ensure the continuity of the planet’s healthy environment are at the heart of its philosophy.

Rolex’s site for environmental and social initiatives.

Rolex’s site for environmental and social initiatives. Source: Rolex [/caption]

- Gucci’s Equilibrium site serves a similar purpose; indicating to consumers that the brand is dedicated to sustainability initiatives. The site publishes articles summarizing its social efforts as well as the company’s projects related to animal welfare, green energy, the circular economy and other environmental initiatives.

Gucci’s dedicated website for environmental and social initiatives

Gucci’s dedicated website for environmental and social initiatives Source: Gucci [/caption]

What We Think

Luxury brands should be forerunners in implementing meaningful change in the apparel and footwear industry. As consumers become increasingly knowledgeable and conscious about brands’ sustainability efforts, luxury brands can look to our EnCORE framework to devise sustainability strategies that resonate with their communities. Implications for Brands/Retailers- As luxury brands and companies overhaul their strategies to reduce their environmental impacts, they must be aware of the new sustainability aspirations as well as conscious habits that many consumers developed over the pandemic.

- While consumers desire luxury, they also want to feel good, or not feel guilty, that their consumption has come at a cost to the environment and society. Brands and retailers must keep this front of mind.

- Technology innovators that help increase transparency in the supply chain, improve communication and provide insights on improving responsibility will be in demand. Blockchain and artificial intelligence technology providers can make it easier to track materials and products thus helping brands and retailers to deliver on promises of greater traceability. Luxury groups must leverage blockchain technology to better map and monitor the movement of materials and products across the supply chain.