DIpil Das

Introduction

What’s the Story? Our Supply Chain Briefing series examines issues in the retail chain and implications to the sector. In this report, we discuss the threat of Omicron to the stabilization of ocean freight rates. We also examine the impact of Typhoon Rai on global supply routes, as well as steps that Amazon is taking to build logistics capacity. Why It Matters Supply chains are complex, not least because of their dispersion across locations while remaining intricately connected across stages. The pandemic has brought supply chain planning and risk management to the fore—stakeholders and retailers were forced to explore numerous alternatives to circumvent the ensuing high costs, congestion and disruption. Omicron and lockdowns imposed due to the variant, such as China’s strict zero-Covid lockdowns, have upended the gradual recovery seen so far. Businesses must apply the lessons learned in 2021 and act with urgency to mitigate impending risks.Threats to Ocean Freight Rate Stabilization and Major South-Asian Ports: Coresight Research Analysis

- Ocean Freight Rates

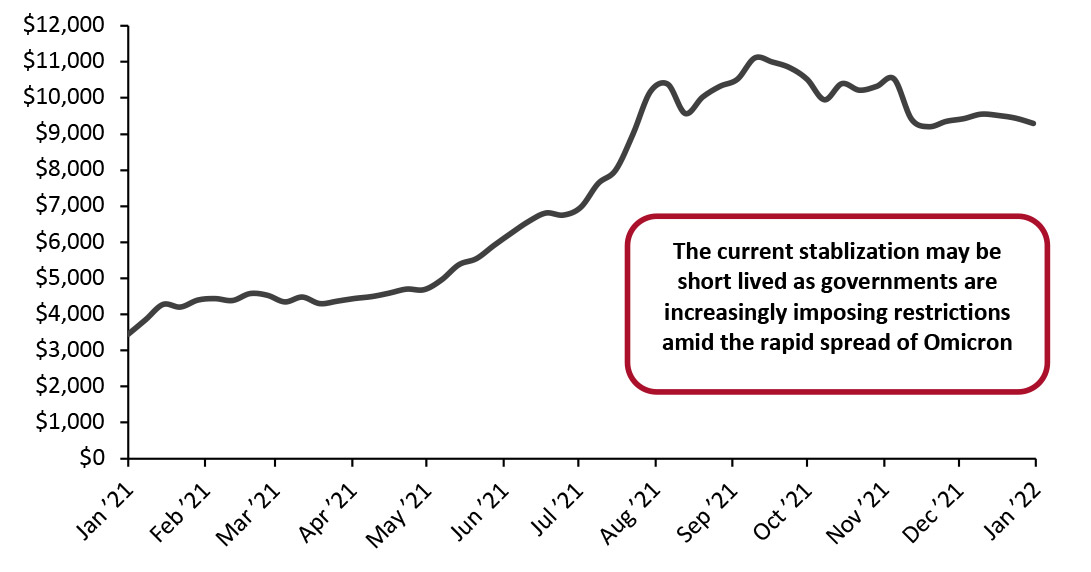

Figure 1. Global: Weekly Average Ocean Freight Container Prices [caption id="attachment_140762" align="aligncenter" width="700"]

Source: Freightos Baltic Index[/caption]

While this leveling of ocean freight rates may be an early sign of stabilization, businesses still need to be cautious of the potential volatility that the rapid spread of Omicron and any new variants present, especially in countries such as China, which operates a zero-tolerance policy toward Covid-19. Businesses should use the early-year lull in shipments to take advantage of lower prices, which may increase once demand for shipping rises at peak times later in the year.

Source: Freightos Baltic Index[/caption]

While this leveling of ocean freight rates may be an early sign of stabilization, businesses still need to be cautious of the potential volatility that the rapid spread of Omicron and any new variants present, especially in countries such as China, which operates a zero-tolerance policy toward Covid-19. Businesses should use the early-year lull in shipments to take advantage of lower prices, which may increase once demand for shipping rises at peak times later in the year.

- Impact of Typhoon Rai on Global Trade

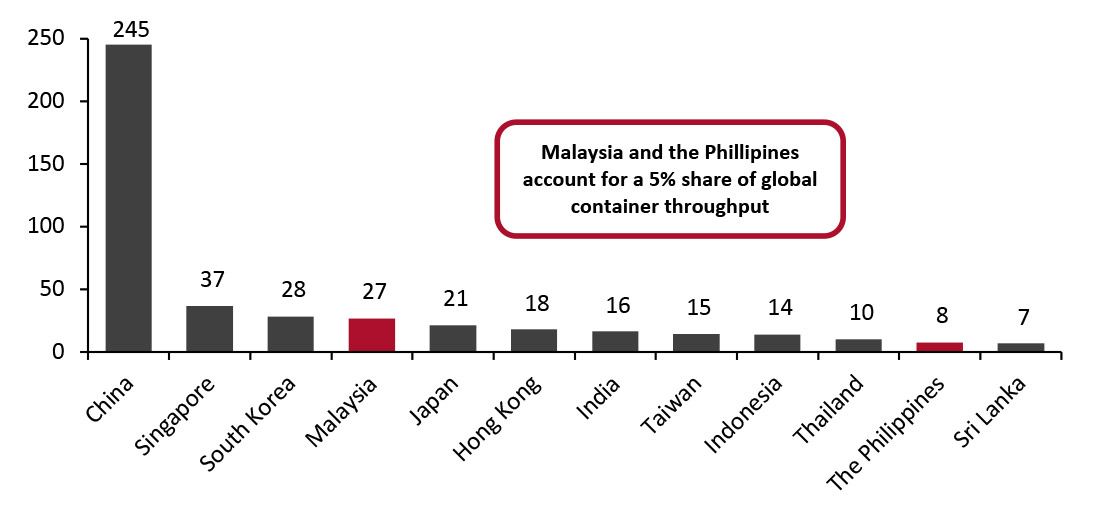

Figure 2. Top 12 South-Asian Countries, by Container Throughput (Mil., 2020) [caption id="attachment_140763" align="aligncenter" width="700"]

Source: UNCTAD[/caption]

Source: UNCTAD[/caption]

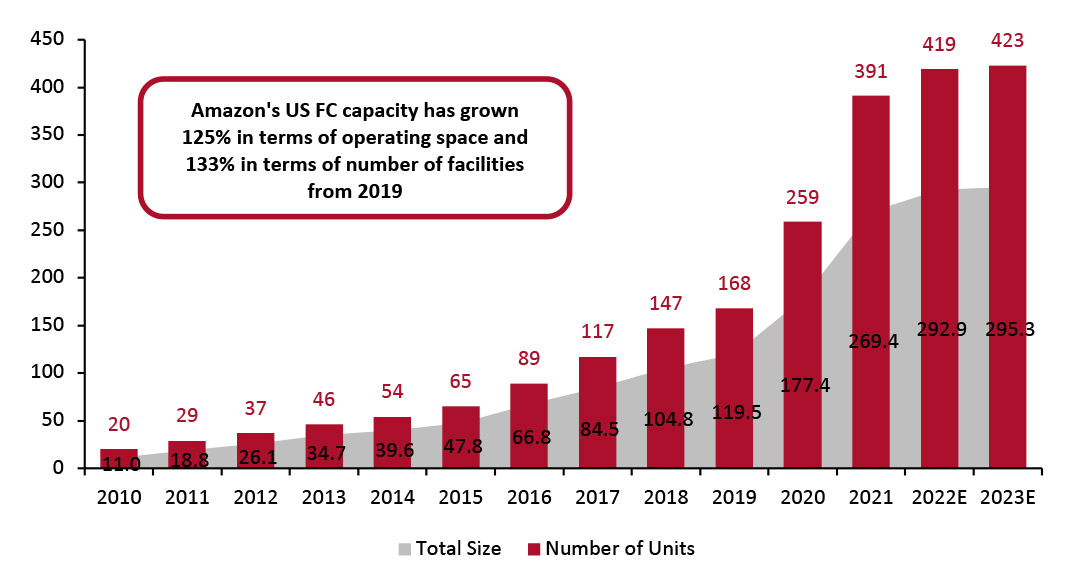

- Amazon Continues To Build Logistics Capacity in the US

Figure 3. Amazon US FCs: Total Size (Mil. Sq. Ft.) and Number [caption id="attachment_140764" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

This additional capacity has pitted Amazon squarely against US parcel delivery giants, surpassing FedEx’s parcel delivery numbers and putting it close on the heels of UPS, according to data from commerce technology company Pitney Bowes.

Amazon also announced the second-highest number of hires in the US during the holiday season last year compared to other major retailers. It increased its staff by 670,000 over 2020 and 2021, to bring the final total to about 1.4 million at the end of the year.

Source: Company reports/Coresight Research[/caption]

This additional capacity has pitted Amazon squarely against US parcel delivery giants, surpassing FedEx’s parcel delivery numbers and putting it close on the heels of UPS, according to data from commerce technology company Pitney Bowes.

Amazon also announced the second-highest number of hires in the US during the holiday season last year compared to other major retailers. It increased its staff by 670,000 over 2020 and 2021, to bring the final total to about 1.4 million at the end of the year.

What We Think

Some bottlenecks appeared to ease as we reached the end of the holiday period last year; however, the emergence of Omicron signals a prolonged recovery from existing disruption to global supply chains. Businesses that have not yet acted to overhaul their supply chain strategies must approach this with urgency to insulate themselves from further shocks. Implications for Brands/Retailers- US brands and retailers that are dependent on Asian supply bases for a significant portion of their production must rethink whether the cost efficiencies achieved are worth the risk of a long supply chain, and ultimately high shipping costs in times of freight disruptions.

- As companies continue to expand their logistics facilities to serve heightened online demand, real estate for warehouses, DCs, FCs and “dark stores”—facilities that look like stores but serve online orders located close to populous catchment areas—will be in demand.

- Brands and retailers looking to rapidly upgrade their operations must seek out technology vendors specializing in supply chain operations. While expanding or overhauling operations organically may be the first choice for many companies, leveraging third parties that already possess the technical know-how and tested and proved technologies will help firms prepare quickly and get ahead of impending disruption.