DIpil Das

Introduction

What’s the Story? Our Supply Chain Briefing series examines the retail supply chain issues and their implications for the sector. In this report, we look at the impacts of the continued lockdowns in China, the growing threat of cyberattacks, recent retail supply chain acquisitions and reactions to the new FABRIC Act. Why It Matters The pandemic has put supply chain planning under greater scrutiny than ever before, and stakeholders need to remain on top of various factors causing disruptions as well as the means to mitigate their impacts. Supply chains are complex due to their interdependence and interconnectedness—just as they seemed to recover, ongoing lockdowns in China, rising inflation, geopolitical conflicts and other factors disrupt them further.China Lockdowns, Cyberattacks, Acquisitions and the FABRIC Act: Coresight Research Analysis

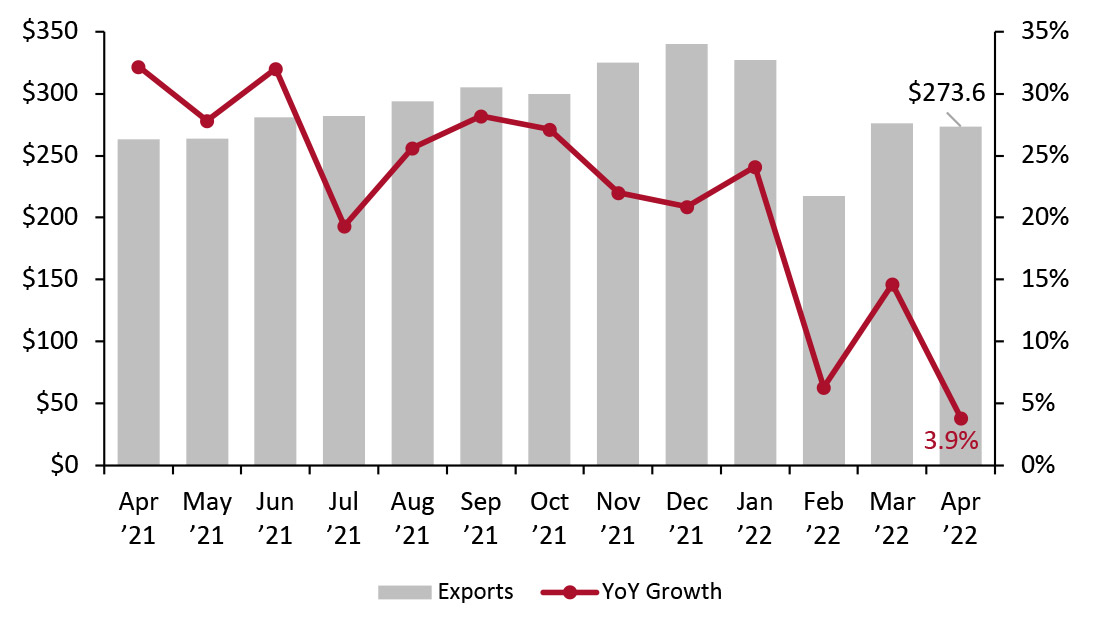

1. Lockdowns in China Persist, Upsetting Global Supply Chains China’s zero-tolerance Covid policy is testing the limits of businesses’ tolerance worldwide—and it could hasten companies’ plans to move their manufacturing out of China. We discussed other locked-down regions in China in our previous Supply Chain Briefing report. Since then, even more regions have been placed under restrictions. The most recent wave of lockdowns, which began in early March 2022, saw authorities close the commercial capital Shanghai, China’s most populous city, initially for a week. However, the lockdown lasted nearly two months, impacting numerous businesses and factories. On May 29, 2022, authorities announced that businesses would begin reopening on June 1, 2022, with schools and other facilities set to reopen in a phased manner through the month. On April 25, 2002, in Beijing—China’s political capital and second-largest city by GDP—municipal authorities began locking down neighborhoods suspected to be “outbreak sites.” By May 5, 2022, authorities had designated 518 as such in the city. Authorities in Beijing announced on May 29, 2022, that some major shopping centers would reopen immediately and some businesses, including gyms, libraries and museums would resume operations at half their usual capacity if no cases had been found in the prior seven days. The lockdowns have adversely impacted the productivity of various Chinese businesses—workers cannot get to factories to manufacture raw materials and goods, meaning they are not getting to subsequent factories, shipping ports, airports or trucks. As a result, China had its lowest export growth in 13 months: in April 2022, growth slowed to 3.9%, down from March’s 14.6%, according to data from the General Administration of Customs.Figure 1. China: Monthly Exports of Commodities (Left Axis; USD Bil.) and YoY Growth (Right Axis; %) [caption id="attachment_148523" align="aligncenter" width="700"]

Source: General Administration of Customs[/caption]

Scarred by the lessons of last year’s delays, we think that many retailers will pull forward inventory receipts if they have not already done so.

Source: General Administration of Customs[/caption]

Scarred by the lessons of last year’s delays, we think that many retailers will pull forward inventory receipts if they have not already done so.

- Dick’s Sporting Goods stated on its May 25, 2022, earnings call that it experienced supply chain challenges in the apparel category in the last quarter, but inventory “should get better” by the back-to-school season this quarter.

- Hanesbrands remarked on its May 5, 2022, earnings call for the first quarter of fiscal 2022 that it has already started to build its back-to-school inventory and that it will have 80% more stock on the floor this year compared to the last.

- Kohl’s stated on its May 19, 2022, earnings call that it is “positioned for a strong back-to-school season with a focus on timely key category availability.”

- Burberry—The luxury company stated that some 40% of its distribution in China is affected due to people not shopping during lockdowns and stores being shut or open reduced hours. This affected business in the fourth quarter of fiscal 2021 (ended April 2, 2022) and continues to affect business in the first quarter of fiscal 2022, according to an earnings call on May 18, 2022.

- Carter’s—During its April 29, 2022, earnings call, the baby clothes brand stated it sources less than 10% of its total unit volume from China, and its suppliers source a significant portion of its fabric and components from southern parts of China that are currently not under restriction. While Shanghai’s ports are not closed but congested, the company is using alternate ports to avoid delays and placing orders three to six weeks earlier than usual.

- Under Armour—While the company expects headwinds from lockdowns in China to impact its near-term progress, it expects the second half of fiscal 2023 to have positive momentum, according to its first-quarter earnings call on May 6, 2022. Under Armour is also canceling orders for the first half of fiscal 2023 due to lockdown-related capacity constraints and supply chain delays in China.

- VF Corporation—On its May 19, 2022, earnings call, the company stated that “China and the ongoing challenges of COVID has slowed a major opportunity for the brand,” in its fourth quarter of fiscal 2022 (ended April 2, 2022). The company said that it experienced declining high inflationary pressures and “delivery challenges across the supply chain” due to the restrictions in China.

- Walmart—On its May 17, 2022, earnings call, Walmart remarked that its “biggest international pressure point is related to the Covid-19 lockdowns in China, which created operational and financial pressure.” Walmart’s US gross margin was down 38 basis points in its first quarter of fiscal 2022 (ended April 30, 2022), with over three-quarters of the decrease driven by increased supply chain, fuel and e-commerce fulfillment costs. The company stated that, while there was some improvement early in the quarter, the Russia-Ukraine war and Covid-19 restrictions around the world, including in China, accelerated challenges.

Figure 2. Recent Cyberattacks within the Global Supply Chain [wpdatatable id=2024 table_view=regular]

Source: FreightWaves/Intek Freight Logistics/ZDNet 3. Shopify Acquires Deliverr E-commerce platform provider Shopify will acquire last-mile and fulfillment technology startup Deliverr for $2.1 billion. Deliverr has a network of warehouse, carrier and last-mile providers and offers two-day delivery services to sellers, online stores and e-commerce marketplaces. It accomplishes this by receiving and storing customers’ inventory and using algorithms for routing inventory based on demand and real-time fulfillment optimization. Deliverr’s acquisition will bolster Shopify’s portfolio and help it compete against Amazon, Walmart and other companies with the scale and capital to shore up their supply chain and last-mile offerings. This acquisition also signals an increasingly high-velocity sector and possibly further consolidation across various aspects of the supply chain. We outline other recent supply chain acquisitions in Figure 3.

Figure 3. US: Supply Chain Acquisitions Related to the Retail Sector [wpdatatable id=2025 table_view=regular]

Source: Company reports/Crunchbase 4. FABRIC Act: A Starting Point for Accelerating the Reshoring of Apparel Manufacturing to the US On May 13, 2022, US Senator Kirsten Gillibrand introduced the FABRIC Act, which would create new garment worker protections and incentives to fast-track local apparel manufacturing in the US, to the Senate. The bill features five pillars to “reweave” American garment manufacturing:

- Implementing minimum wage benchmarks, which would forbid piece-rate pay, and removing wage theft in US garment factories

- Holding brands and retailers more accountable to combat workplace violations

- Improving production transparency

- Using tax credits to incentivize reshoring

- Developing a $40 million domestic garment manufacturing grant program to revive the industry

What We Think

As global supply chains continue to experience turbulence, brands and retailers need to remain agile and responsive to disruptions. Pulling forward inventory and replanning logistical strategies—such as changing the sourcing mix or bolstering cybersecurity—during the off-season can better prepare businesses for future disruptions. Implications for Brands/Retailers- Brands and retailers should begin buying early to accommodate unforeseen delays, seek out local vendors and increase nearshore sourcing.

- Brands and retailers will seek vendors that can improve supply chain visibility and predict instances and impacts of anomalies to increase resilience and agility.