DIpil Das

What’s the Story?

In our Supply Chain Briefing series, we examine key developments and challenges in the retail supply chain and their implications in the retail environment. In this report, we discuss three key issues: US labor shortages in transport and warehousing; how factory shutdowns in Vietnam are affecting the US apparel market; and the impact of a foam shortage on the furniture industry.Why It Matters

As supply chain issues persist, their impact compounds and pressures retailers’ budgets, resource allocation and margins. With the threat of Covid-19 still looming in various regions and consumer demand rising, retailers need to brace for a number of headwinds that could materially impact their costs over the next several months.Labor Scarcity, Factory Shutdowns and Foam Shortage: In Detail

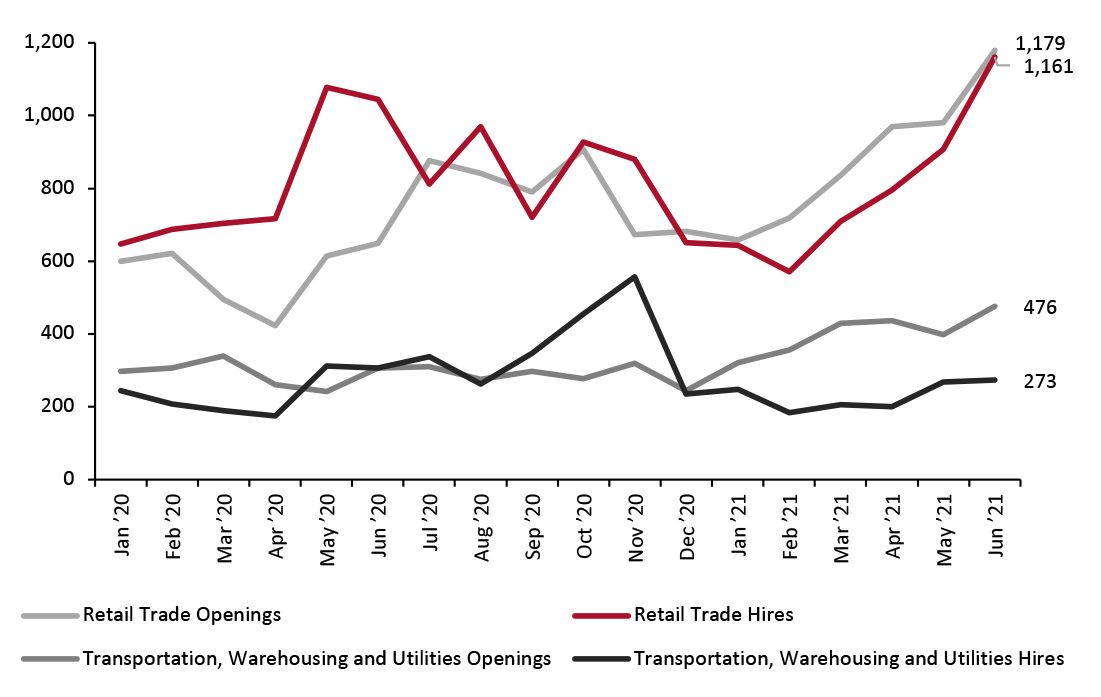

1. Labor Shortfall Widens in Transportation, Warehousing and Utilities As the US economy continues to open up, the availability of labor has not kept up with the pace of recovery in consumer demand and businesses. The latest data from the US Bureau of Labor Statistics (BLS) indicate that US job openings rose to 10.3 million in June 2021, up 6.6% month over month, while total hires increased by 5.2% to 7.7 million—indicating that 2.7 million jobs were open. Within retail, there was a deficit of 18,000 workers in June, and within transportation, warehousing and utilities, there was a difference of over 200,000 between openings available and people in jobs (as shown in Figure 1). Labor availability in the latter sector has been volatile in the past 18 months, with the shortfall widening significantly since December 2020.Figure 1. US: Openings and Hires in Retail Trade and Transportation, Warehousing and Utilities Sectors (Thousands) [caption id="attachment_131489" align="aligncenter" width="725"]

Source: BLS [/caption]

There could be several reasons for the labor shortfall across sectors, including the following:

Source: BLS [/caption]

There could be several reasons for the labor shortfall across sectors, including the following:

- Government stimulus checks and unemployment benefits may have provided enough cash for potential workers to sustain their expenses, meaning they do not see a need to return to work for the time being.

- Workers do not have the support they need to care for children and other family members. This issue may be resolved to an extent when children return to school in the fall.

- Workers may have relocated, no longer residing in areas where jobs are available.

- Workers may be concerned about contracting the coronavirus—an April 2021 survey by job search site FlexJobs2,100 US workers indicated that 58% would look for a new job if they could not work remotely. The biggest concern, indicated by 49% of respondents, was exposure to Covid-19, followed by lower work flexibility and less work-life balance.

- Ahold Delhaize: On its second-quarter earnings call held on August 11, 2021, grocery retail group Ahold Delhaize reported that it has managed to onboard 8,000 new employees at its Food Lion brand. The company stated that this has resulted in some additional wage costs, which it has factored into its full-year guidance. Management remarked that “there is a tight labor market… especially in transportation but also in the total supply chain.” The company expects that some of these pressures will ease after September, as potential workers may have used their stimulus checks and because their children may return to school.

- Amazon: During its earnings call on July 30, 2021, Amazon stated that it expects “wage pressure remaining for the immediate future” as it ramps up hiring for the holidays.

- CVS: On August 4, 2021, drugstore retailer CVS announced that it will increase its minimum wage to $15 per hour by July 2022, from its current $11, to maintain a competitive edge in the tight labor market. The company stated that it will also increase starting rates for its pharmacy technicians and call-center employees, who already earn more than $15 per hour. CVS expects to begin its wage increases in September this year and has allocated $600 million for the additional costs over the next three years.

- Wayfair: During its earnings call on August 5, 2021, furniture e-commerce retailer Wayfair stated that it is experiencing some pressure attracting transport workers more than fulfillment-center workers, but it has managed to access transport capacity when needed. The company reported that it raised the minimum wage to $15 per hour company-wide “some period of time ago” and so has not been particularly challenged in attracting talent.

- Adidas: Adidas has significant exposure to Vietnam. In its 2020 annual report, the company stated that by volume, it sources 49% of its footwear, 21% of its apparel and 11% of its accessories and gear from the country. On its second-quarter earnings calls held on August 5, 2021, the company stated that it is tackling the shutdowns in Vietnam by reallocating production to other regions, prioritizing key campaigns and product launches in its collection, and redeploying existing marketing inventory and stock.

- Under Armour: Under Armour sources about 30% of its assortment from Vietnam and has been severely impacted by the lockdowns. During its earnings call held on August 3, 2021, management stated that its “well-balanced sourcing platform” includes Europe, the Middle East, South America and Latin America in its network, placing it “maybe in a little bit better position than most.” The company also stated that it is continuing to rely less on sourcing facilities in Asia—implying that it is diversifying and nearshoring its sourcing to consumer markets.

- Intel: In March 2021, semiconductor giant Intel announced that it is investing around $20 billion to build two chip factories in the US. The company already has four facilities in the US, and the additional two will provide a US-based alternative to chip factories located in Asia.

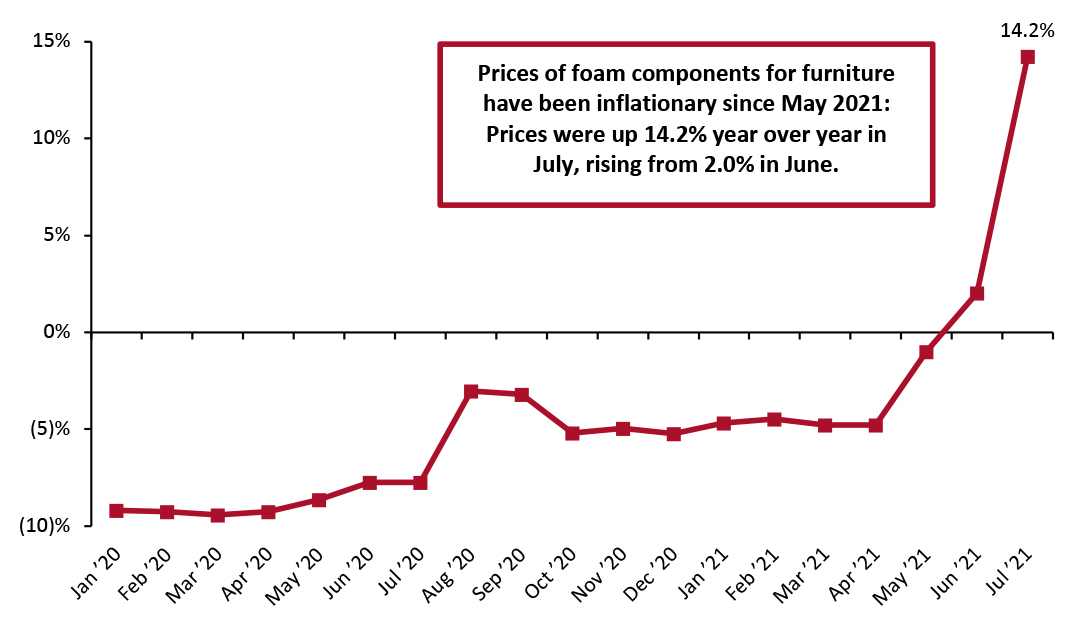

- Havertys Furniture: During its earnings call on July 28, 2021, major furniture retailer Havertys stated that “foam continues to be an issue for domestic vendors.” The company said that its import vendors do not have “foam issues.”

- Tempur Sealy: Mattress maker Tempur Sealy highlighted during its earnings call on July 29, 2021, that the foam shortage is mainly an issue of a deficit of chemicals, which it has ordered from overseas suppliers. While some are in transit and some are already in US ports, it is taking time to move them to foam manufacturing facilities considering other industry-wide logistics issues.

Figure 2. US Producer Price Index: Foam Components for Furniture [caption id="attachment_131490" align="aligncenter" width="725"]

Source: BLS [/caption]

Source: BLS [/caption]